Figure 1:

Figure 2:

Figure 3:

Figure 4:

Figure 5:

Figure 6:

Figure 7:

Figure 8:

Figure 9:

Subject and research theme_

| Subject | Research theme |

|---|---|

| Primary school | Inquiry based learning (Blue et al. 2017) |

| Financial related practical activities (Moscarola and Kalwij 2018; Williams et al. 2020) | |

| Use of interactive and contextual media (Nagy 2023) | |

| Question with daily problems that are close to students (Santos et al. 2024; Yeo 2016) | |

| Secondary school | Mathematics tasks based on financial problems (Kenayathulla et al. 2024; Kusumawati et al. 2023; Kuzma et al. 2022; Mahmudi and Listiyani 2019; Rondillas and Buan 2019) |

| Introduction to financial terminology (Abylkassymova et al. 2020; Safronova et al. 2020) | |

| Numeracy skills reinforcement (Indefenso and Yazon 2020; Skagerlund et al. 2018; Sunderaraman et al. 2020) | |

| Project based learning (Sagita et al. 2023) | |

| Teacher | Use of technology (Hurtado et al. 2022) |

| Development of interdisciplinary content connecting mathematics, financial literacy, and social justice issues (Tanase and Lucey 2016) | |

| Task design using financial and mathematical literacy models (Batty et al. 2014; Ozkale and Aprea 2024; Ozkale and Erdogan 2020; Ozkale and Ozdemir 2020) | |

| Development of measurement tools for financial literacy levels (Özer and Ersoy 2022) | |

| Interactive learning strategies (Kozina and Metljak 2022) |

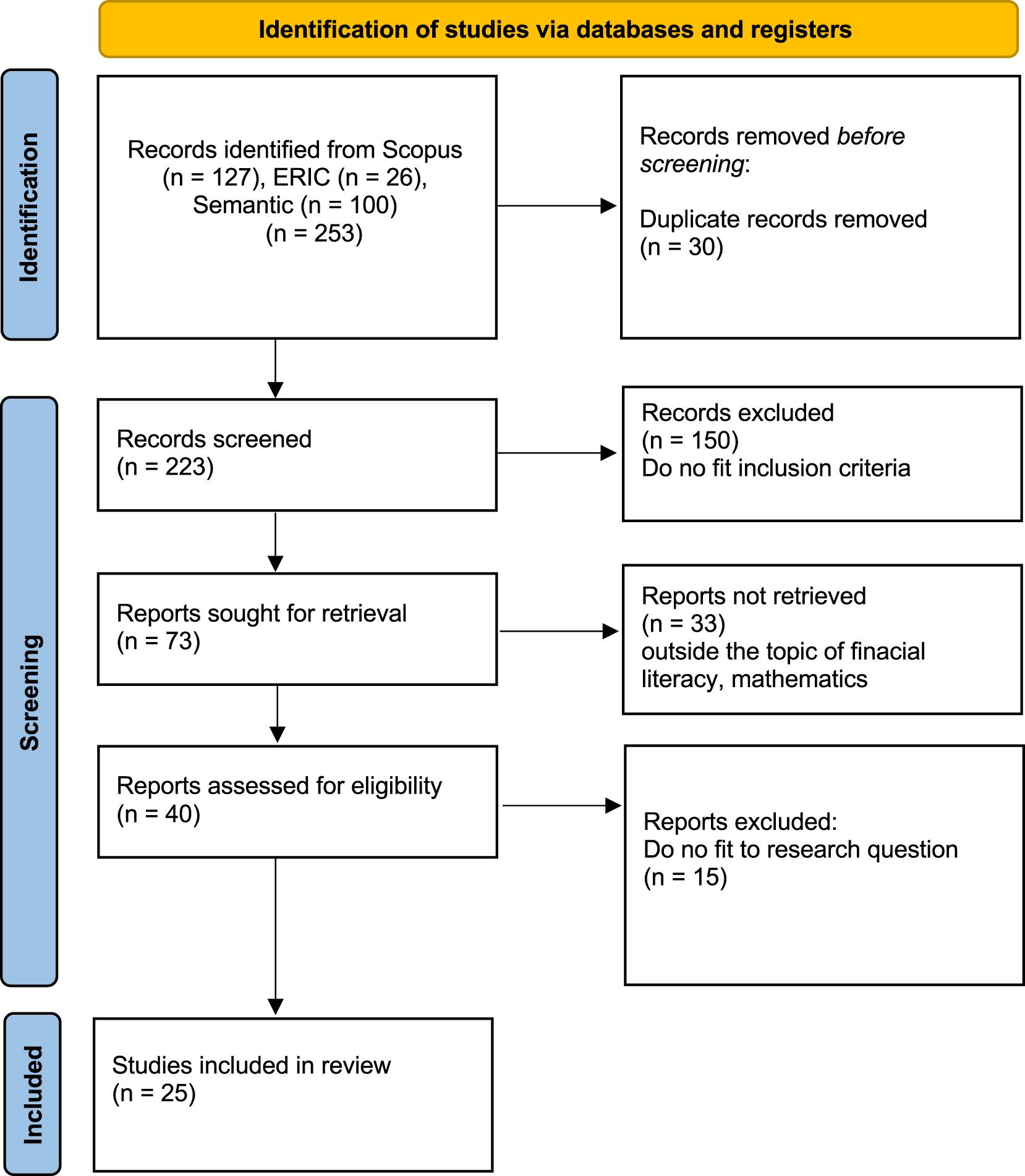

Inclusion and exclusion criteria_

| Inclusion | Exclusion |

|---|---|

| The article is written in English | The article is not written in English |

| The article is published as a journal, conference proceeding, or handbook | The article is published in a format other than journal, conference proceeding, and handbook |

| The article is in its final version or has undergone peer review | The article is not in its final version and has not undergone peer review |

| The content in article are contained improving financial literacy through mathematics learning and utilization of mathematics | The content in article are not contained improving financial literacy through mathematics learning and utilization of mathematics |

| The research subject is within the scope of elementary and secondary school communities (students and teachers) | The research subject is outside the scope of elementary and secondary school communities (students and teachers) |

Strategy and impact on improving financial literacy_

| Strategy | Activity | Impact in financial literacy process |

|---|---|---|

| Learning model | Through Project-Based Learning (PjBL), students can develop financial projects, such as creating budget plans for daily activities or conducting simple investment simulations (Sagita et al. 2023) | Apply financial knowledge and understanding |

| Through inquiry-based learning, students work in groups to analyze and construct mathematical justifications related to open-ended financial decision-making problems, such as determining the best investment product based on the given data (Blue et al. 2017) | Analyze financial information and situations, | |

| Integration of financial literacy into mathematics tasks | Mathematical problems presented to students should include financial content that is relevant to their immediate environment (Safronova et al. 2020) | Identify financial information |

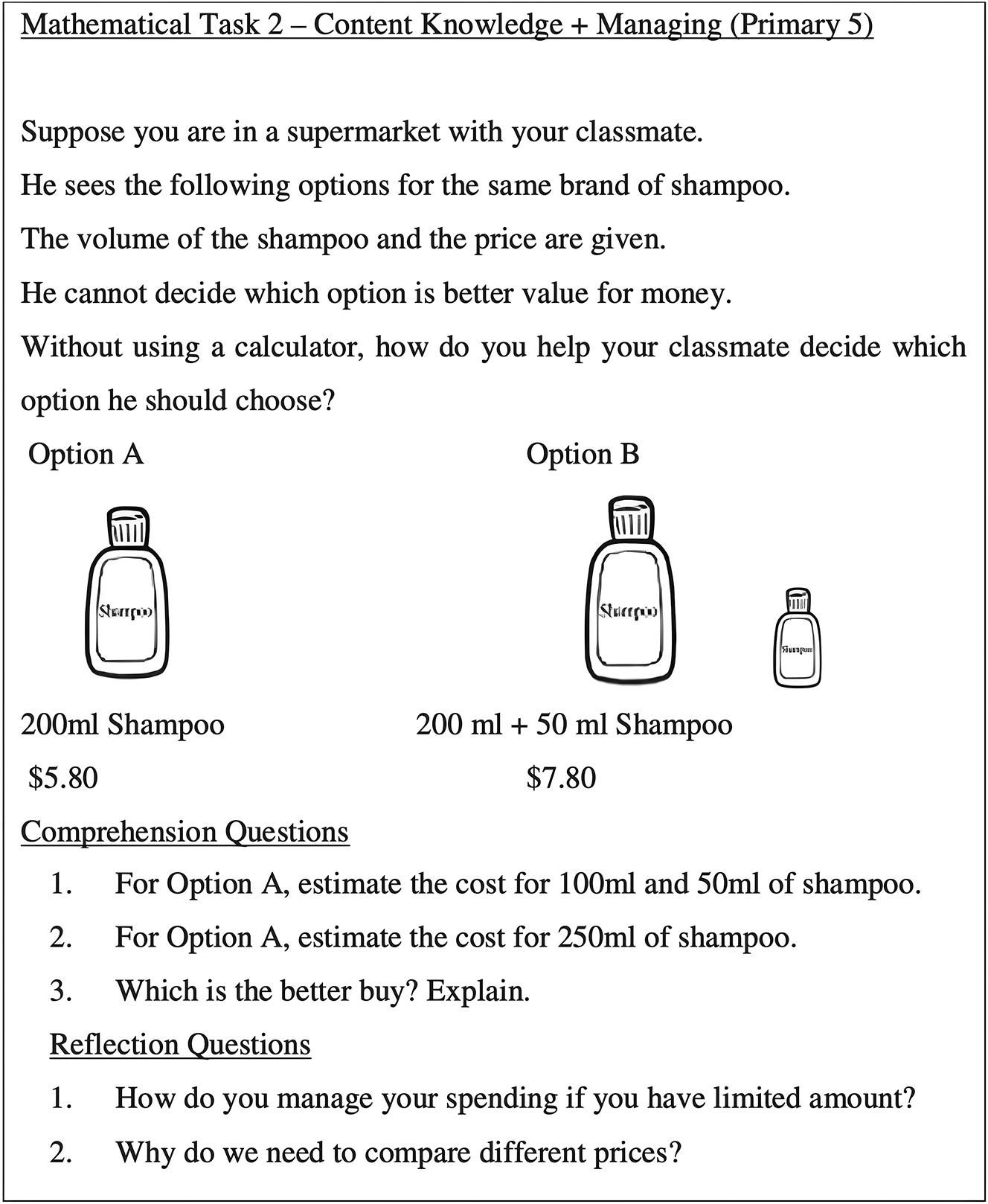

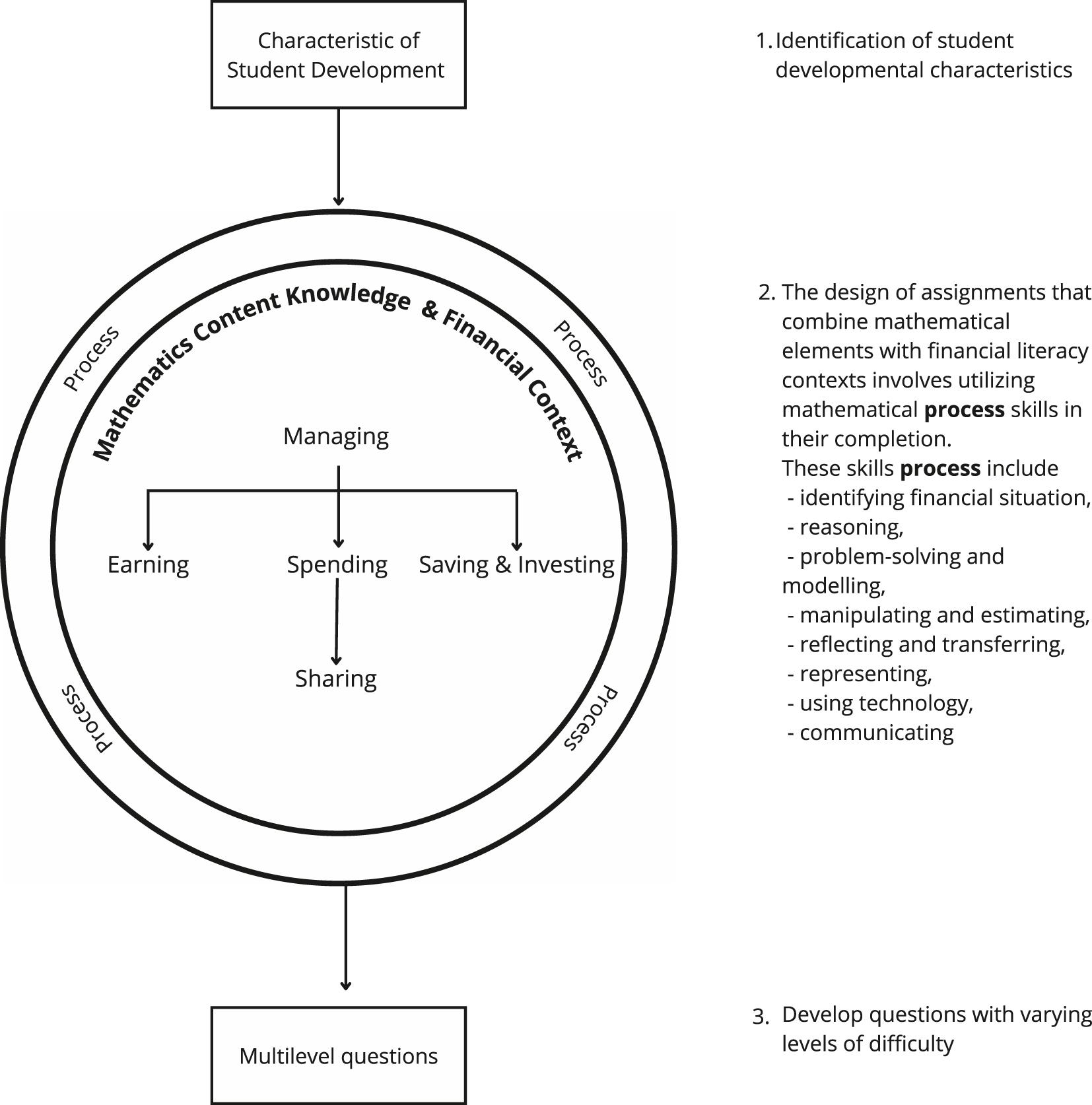

| The development of tasks utilizes the “ME X FL” and “IMFFL” task frameworks by integrating elements of content, process, and context in both financial literacy and mathematical literacy (Ozkale and Erdogan 2020; Yeo 2016) | Analyze financial information and situations, | |

| Curriculum modification | Efforts to support the enhancement of financial literacy through curriculum design involve the integration of financial literacy content into mathematics instruction (Blue et al. 2017; Ozkale and Aprea 2024; Sagita et al. 2023) and the provision of resources and practical programs (Batty et al. 2014; Moscarola and Kalwij 2018) | Analyze financial information and situations, |

| Instructional media | Use of interactive modules that integrate financial literacy with clear instructions and fraction-based material representations enables students to understand financial concepts through visual illustrations and simple simulations (Rondillas and Buan 2019) | Identify financial information |

| Utilization of Excel applications for solving financial problems, such as budget management, transaction reporting, and investment simulations, enhances students’ ability to apply mathematical concepts in financial decision-making (Hurtado et al. 2022) | Analyze financial information and situations | |

| The use of interactive presentation tools and financial simulations tailored to students’ developmental levels can enhance motivation and facilitate the understanding of fundamental economic concepts, such as money management, savings, and the value of goods and services (Nagy 2023) | Identify financial information | |

| Teacher training | Improving resources is through teacher training in financial literacy (Indefenso and Yazon 2020; Kozina and Metljak 2022; Tanase and Lucey 2016) | Identify financial information |

| Curricular activities | Case study learning in mathematics instruction (Williams et al. 2020) | Apply financial knowledge and understanding, |