Financial literacy has garnered significant attention in numerous nations due to its profound impact on individual well-being and the economic stability of countries. According to Bosshardt and Walstad (2018), financial literacy is described as a fundamental skill that ought to be possessed by all individuals, not exclusively those engaged in the financial field. The Organisation for Economic Co-operation and Development (OECD) conducted an assessment of financial literacy in various countries in June 2024, examining the correlation between financial literacy and students’ proficiencies in mathematics and reading. OECD (2024) highlights the importance of mastering key components essential for improving financial literacy, which consist of content (gaining the necessary knowledge and understanding of financial literacy across various domains), process (identifying and applying relevant concepts to comprehend, analyze, evaluate, and propose solutions), and context (understanding the circumstances in which financial knowledge, skills, and understanding are applied, ranging from personal to global contexts). Encouraging avenues for youth to bolster their financial literacy is vital, as educational achievement, income, and assets have been demonstrated to be closely intertwined with levels of financial literacy among adults (Lusardi and Mitchell 2014). As students embark on learning about financial matters and continuously enhance their attitudes and behaviors, their future financial capacities will expand (Batty et al. 2014).

The explication of financial literacy within the Financial Literacy Assessment Framework PISA 2022 (OECD 2023) posits that financial literacy entails the comprehension and awareness of financial principles and hazards, alongside the competencies and dispositions necessary to apply this comprehension and awareness to render effective judgments in diverse financial scenarios. These competencies are intended to enhance the financial well-being of both individuals and society while also promoting active participation in economic activities. As indicated by Remund (2010), the constituents of financial literacy encompass the knowledge, competencies, self-assurance, and impetus essential for proficient money management. Additionally, Wiedarti et al. (2018) has underscored that financial literacy stands as a pivotal skill requisite in the 21st century, entailing the capacity to grasp and implement conceptual facets of finance in day-to-day undertakings. Drawing upon these assertions, the scholar deduces that financial literacy denotes the capability of individuals to comprehend, govern, and apply knowledge pertaining to financial affairs in routine decision-making processes to enhance personal and communal financial well-being. Financial literacy embodies an awareness of financial principles and hazards, the proficiency to render effective financial judgments, and the ability to prudently manage financial assets, underscoring its significance in being instilled from the initial phases of formal education (Lusardi and Mitchell 2014). The significance of early financial literacy is buttressed by diverse research, demonstrating that a robust financial comprehension can assist individuals in making sound decisions, circumventing excessive debt, and attaining financial stability in the forthcoming years (Lusardi et al. 2010).

Financial literacy is a global concern, as evidenced by findings from the OECD’s 2024 Program for International Student Assessment (PISA). These challenges are observed in other developing nations, such as India (India 2020) and South Africa (Roberts et al. 2021), where financial literacy rates remain below 50 %. These disparities underscore the urgent need for effective financial education strategies that can be adapted across diverse cultural and economic contexts. Similar challenges are observed globally, even in high-performing countries with robust financial education systems. For instance, in Denmark, despite its high financial literacy rate of 71 % (Olujinmi 2023), vulnerable groups such as low-income families and immigrants face significant gaps due to limited access to resources and parental guidance (Lusardi and Messy 2023). Meanwhile, Australia and Finland have successfully integrated financial literacy into their national curricula, resulting in higher financial literacy rates among youth (OECD 2023). These comparisons highlight the importance of adopting best practices from high-performing countries while addressing context-specific challenges.

One of the growing concerns about financial literacy globally is the varying levels of skills possessed in different countries (OECD 2024). According to the Ansar et al. (2023), some countries have been successful in integrating financial education into their curriculums; however, other nations still struggle to improve the basic understanding of basic financial concepts for their people. The OECD PISA 2022 financial literacy assessment revealed striking disparities in financial literacy across the education systems involved in the study. For instance, high student rates of financial literacy were reported in Finland, Canada, and Australia, primarily because of their well-integrated educational systems and strong institutional support (OECD 2024). These countries have skillfully embedded financial concepts into their mathematics and economics curriculums; thus, from a young age, they have equipped their students with necessary skills in money management. Specifically, in Finland, financial literacy is integrated into the national curriculum through mathematics and social studies, with a focus on real-world applications such as budgeting and saving. While these nations have made significant progress, many developing countries continue to face challenges in implementing similar programs.

On the other hand, many developing countries and emerging economies continue to struggle with financial literacy, showing rates that fall well below the global average (Klapper et al. 2015). Recent reports reveal that many countries in Latin America, Southeast Asia, and certain regions of Africa struggle with financial literacy. This is often because they lack organized financial education programs (AFI 2021; UNCDF 2023) In many areas, schools don’t include financial literacy in their regular classes, which means students often struggle to make smart financial choices in the real world. In Southeast Asia, the rapid shift towards digital technology has greatly improved people’s access to financial services, which is why financial education has become more important than ever (AFI 2021; UNCDF 2023). For example, countries like Singapore and Malaysia have implemented government initiatives aimed at increasing financial literacy among young people. In contrast, nations such as Indonesia and the Philippines face significant challenges, particularly among lower-income populations who often lack essential financial knowledge. In the Philippines, government-led initiatives like the ‘Financial Education Program’ aim to improve financial literacy among students, but challenges remain in reaching rural and low-income populations.

The issues surrounding financial literacy are made even more challenging by the growing use of digital financial services (Lusardi and Oggero 2017). With the rise of online banking, mobile payment apps, and digital investment platforms, many young people are faced with complex financial decisions at an earlier age than ever before. Unfortunately, without proper financial education, they often struggle to evaluate financial risks and manage their money wisely (UNESCO et al. 2023). Research indicates that those lacking financial literacy are more prone to falling into debt, taking on high-risk investments, or becoming targets of financial scams (Lusardi and Oggero 2017). This highlights the critical need for comprehensive financial education programs that go beyond what is typically taught in schools.

To tackle these inequalities in education, we need a comprehensive strategy that incorporates updates to the curriculum, better training for teachers, and initiatives to raise public awareness (UNESCO et al. 2023). Educational leaders should consider successful strategies from around the world and adapt them for use in their respective systems. Incorporating financial literacy into math classes can equip students with the essential skills they need to navigate financial decisions confidently (OECD 2024). Additionally, collaborating with banks, government bodies, and digital finance platforms can create valuable hands-on experiences that enhance financial learning in practical settings (Ansar et al. 2023). Ultimately, improving financial literacy in various educational environments not only enables students to make wiser financial choices but also supports broader economic stability and enhances the overall well-being of society.

In many developing nations, financial literacy is still not fully integrated into mathematics education (Saini and Rosli 2021). This is a missed opportunity, as equipping students with the skills to manage personal finances and understand economic systems can significantly benefit their future. As digital financial services become increasingly common in our lives, mathematics education is essential in equipping students with important skills such as understanding interest rates, budgeting, and risk assessment. These skills are crucial for successfully navigating online banking and investment platforms. This shift towards digital finance highlights the importance of developing robust financial education programs that reach beyond the confines of traditional classroom settings. To effectively integrate financial literacy into mathematics education, it is vital to not only adjust the curriculum but also invest in targeted teacher training. This ensures that educators feel confident and capable in delivering financial concepts in a way that is engaging and relevant to students’ real-world experiences.

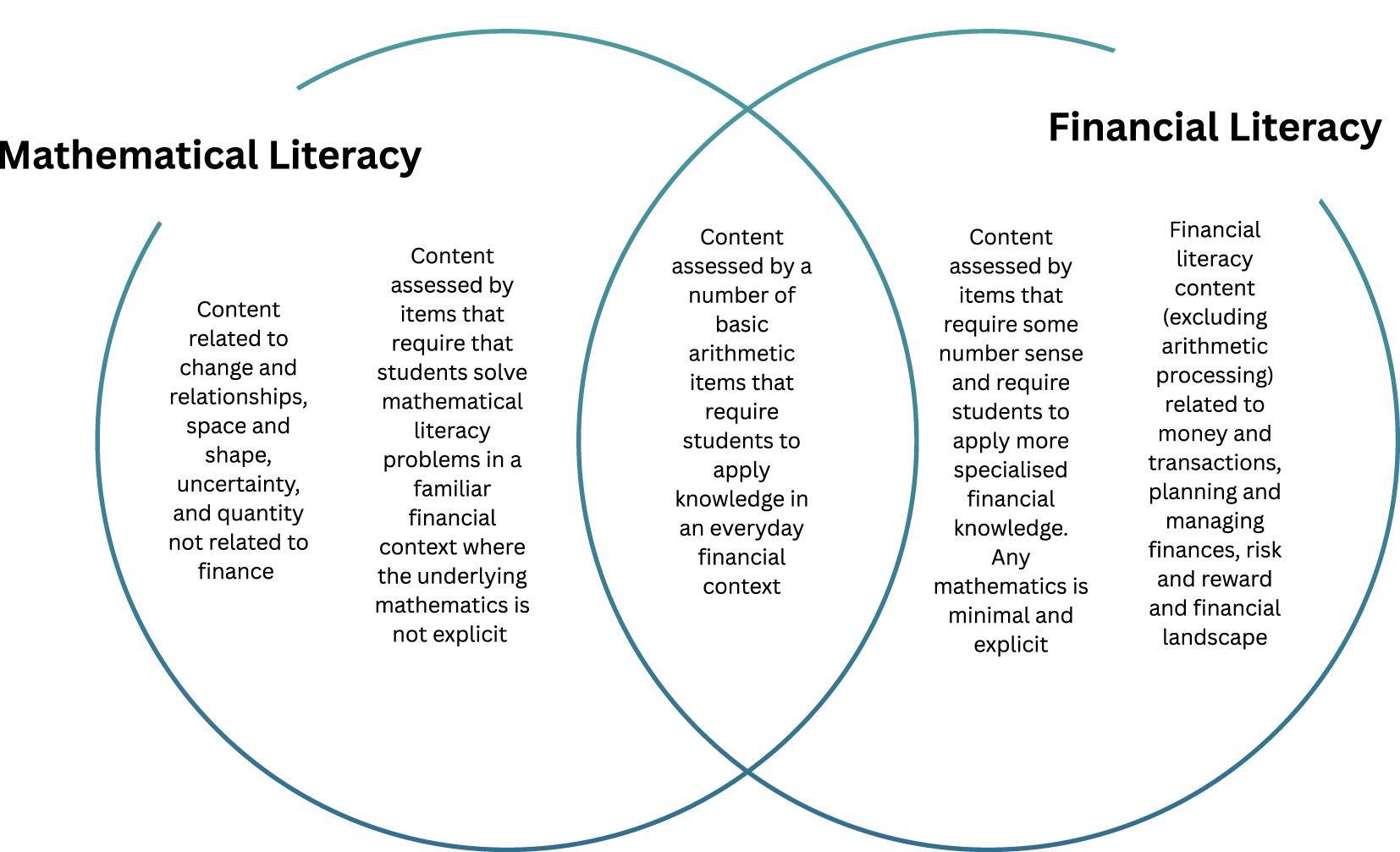

Mathematics, as a core subject introduced at the elementary level, plays a critical role in developing children’s financial literacy skills (Medvedieva et al. 2022; Saini and Rosli 2021). The incorporation of financial principles in mathematics instruction can facilitate students in comprehending and applying these principles in practical and meaningful situations (Sherraden et al. 2010). Consequently, mathematics emerges as a critical instrument in the endeavor to enhance financial literacy. The strong association between mathematical aptitude and financial literacy is supported by a correlation coefficient of 0.87 (OECD 2024). Figure 1 below illustrates the connection between components of financial literacy content and mathematical proficiency, as evaluated in the PISA examination.

Relationship between financial literacy and mathematics (OECD 2024).

The Venn diagram depicted in Figure 1 illustrates the correlation between mathematical literacy and financial literacy. This correlation is portrayed within the intersecting area, which covers fundamental arithmetic operations necessitating the application of knowledge in various financial scenarios. The overlapping region of these domains underscores the significance of integrating mathematics and financial education to provide students with essential competencies for handling day-to-day financial matters and comprehending the pragmatic uses of mathematics. A recent study by Sagita et al. (2023) suggests that project-based learning, incorporating mathematical and financial concepts across content, context, and process dimensions, can enhance financial literacy. Evidence from research carried out in different nations shows that this strategy can enhance students’ comprehension of financial management and cultivate more favorable attitudes towards financial planning (Blue et al. 2017; Ozkale and Aprea 2024).

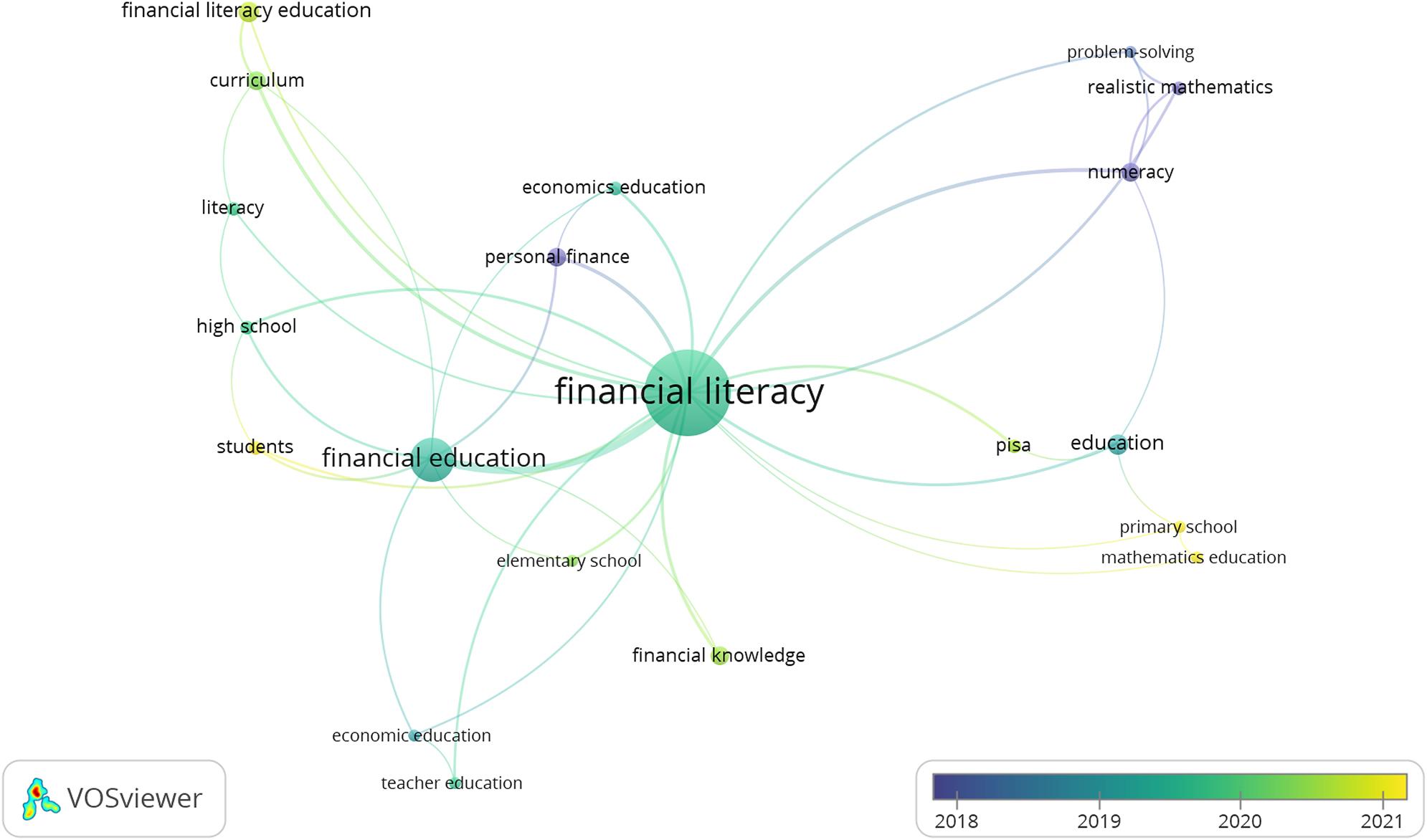

Overall, this study analyzed prior research trends by investigating topics related to financial literacy and examining the progression of financial literacy research over the past few decades. This was accomplished using VOSviewer software, specifically utilizing the Overlay Visualization feature, as depicted in Figure 2. VOSviewer was used to analyze annual trends based on keywords (Jeong and Koo 2016). The data source used in this visualization consists of 127 articles from Scopus-indexed journals with the keywords “financial AND literacy AND in AND mathematics” and “financial AND literacy AND in AND mathematics AND school.”

Mapping of research trends over time.

Figure 2 presents the research trends on the topic of financial literacy, highlighting their development over the years. Starting from the blue indicator (approximately in 2018), scientific publications tended to focus on the fundamentals of financial literacy and economic education. Then, in the green indicator (around 2019–2020), there was a broader development in scientific publications on financial literacy topics, integrating it with curricula and emphasizing primary and secondary education. The most recent developments are shown by the yellow indicator, which highlights more specific topics such as PISA assessments and realistic mathematics education. This reflects the evolving complexity of financial literacy research, which is increasingly integrating with various aspects of education, particularly as this study discusses its application in mathematics education.

The urgency of financial literacy is quite complex and cannot be addressed by a single skill alone, unlike mathematical literacy, which can be solved with mathematical ability. Therefore, it is essential to reference various studies from different countries that have tried to enhance financial literacy through mathematics instruction in primary and secondary schools (Fianto et al. 2017). This approach proves to be highly effective, as it provides a valuable guide for educators in designing strategies that account for the increasingly complex and evolving trends in financial literacy research.

In a previous systematic literature review on financial literacy conducted by Saini and Rosli (2021), factors influencing students’ financial literacy and practical methods for enhancing financial literacy were identified. These methods include inquiry-based mathematics, technology simulations, interactive modules, simulation games, workshops, and school camps. The novelty of this study lies in presenting strategies for integrating financial literacy contexts into the framework of mathematical tasks, as well as exploring the role of teachers and the challenges in developing students’ financial literacy skills within mathematics instruction.

This study will explore the subsequent inquiries:

-

1.

What are the effective strategies for integrating financial literacy into mathematics instruction?

-

2.

How does the role of teachers contribute to enhancing students’ financial literacy skills in mathematics instruction?

-

3.

What are the challenges in improving students’ financial literacy skills in mathematics instruction?

Therefore, this study aims to identify and analyze effective strategies for integrating financial literacy into mathematics instruction to enhance students’ understanding and financial skills. Additionally, it describes the role of teachers in supporting and improving students’ financial literacy through pedagogical approaches. Furthermore, this study seeks to identify and analyze the various challenges and obstacles encountered in efforts to enhance students’ financial literacy in mathematics instruction and to provide strategic recommendations for overcoming these challenges.

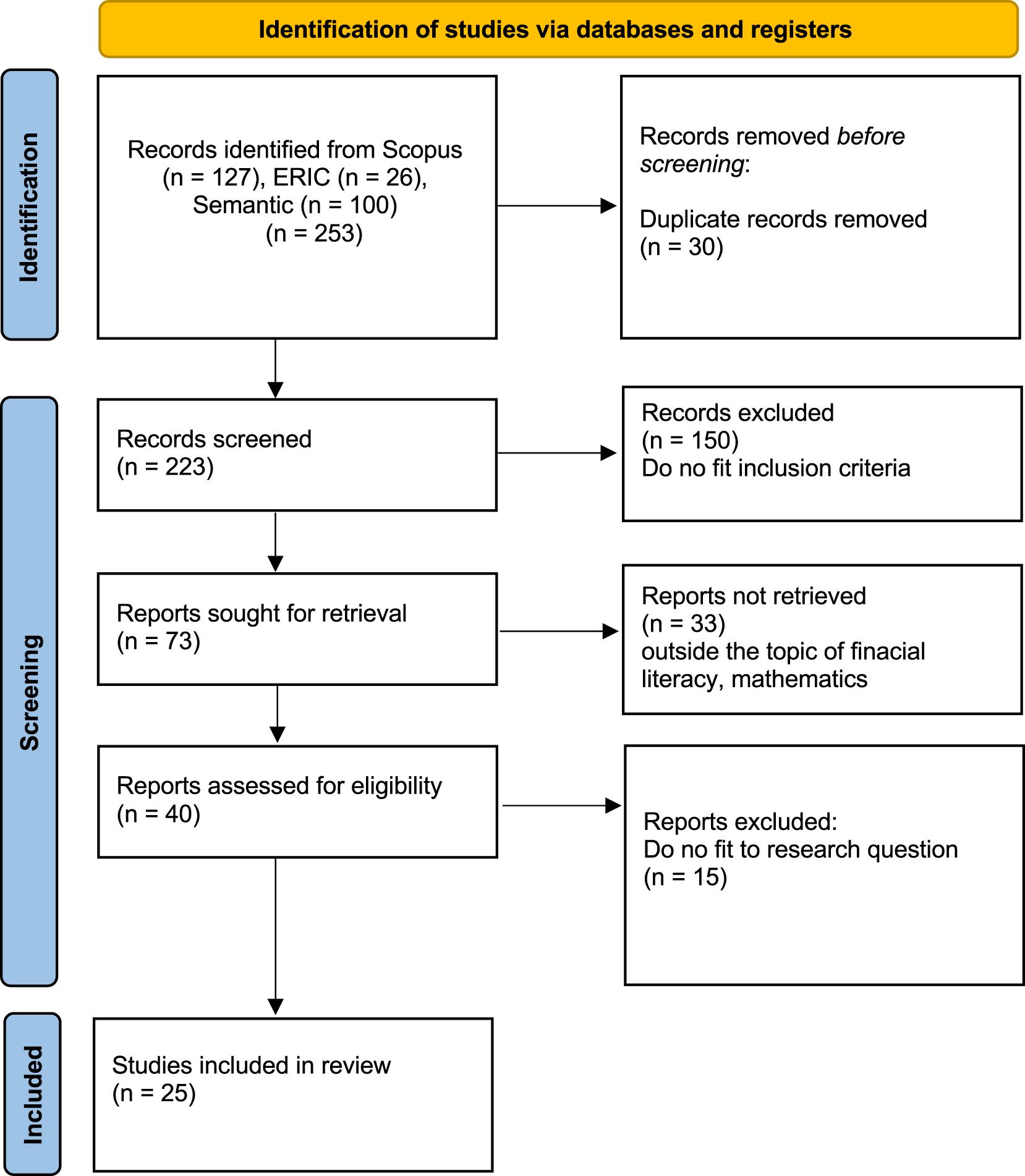

This research employs a qualitative approach. This section delineates the methodology utilized for examining recent studies on mathematics instruction in primary schools with the goal of enhancing financial literacy, spanning the timeframe from 2014 to 2024. The choice of the 2014–2024 period was made by the researcher to alleviate potential biases stemming from transient fluctuations or short-term occurrences, thus ensuring a more diverse dataset. The concept of “financial literacy” garnered attention in global research subsequent to its debut in the 2012 PISA evaluation (OECD 2013). The approach adopted by the author is the Systematic Literature Review (SLR). SLR is a technique employed to identify, choose, and evaluate pertinent research, in addition to systematically and explicitly gathering and analyzing research outcomes (Juandi 2021). The decision to employ the SLR approach stems from its ability to offer researchers several advantages when conducting future studies based on conclusions drawn from previous publications (Kitchenham et al. 2009). To enhance the quality and reproducibility of the review process, PRISMA has established a standardized methodology, which includes a checklist of best practices (Conde et al. 2020).

This study utilized the PRISMA (Preferred Reporting Items for Systematic Reviews and Meta-Analyses) framework to guide the data selection process. The stages of the systematic literature review (SLR) following the PRISMA approach, which include identification, screening, eligibility, and inclusion, are presented in Figure 3. The authors sourced data from a total of 253 articles, consisting of 127 articles from Scopus, 26 articles from ERIC, and 100 articles from Semantic Scholar, using the keywords “financial AND literacy AND in AND mathematics” and “financial AND literacy AND in AND mathematics AND school.” The search across these three different databases resulted in 30 duplicate articles, which were subsequently excluded from the review.

PRISMA procedure.

The next stage involves the screening of 223 articles. This screening process is crucial to ensure that the studies selected for the systematic literature review are truly relevant and of high quality so that the findings of the review can be trusted and relied upon (Liberati et al. 2009; Moher et al. 2009). The screening stage consists of two activities: the first involves screening abstracts and titles based on inclusion and exclusion criteria and assessing their alignment with the chosen topic. This is consistent with Liberati et al. (2009) who suggest that screening titles and abstracts is a quick way to exclude irrelevant studies before full-text review. The researchers provided guidelines for inclusion and exclusion criteria, as presented in Table 1.

Inclusion and exclusion criteria.

| Inclusion | Exclusion |

|---|---|

| The article is written in English | The article is not written in English |

| The article is published as a journal, conference proceeding, or handbook | The article is published in a format other than journal, conference proceeding, and handbook |

| The article is in its final version or has undergone peer review | The article is not in its final version and has not undergone peer review |

| The content in article are contained improving financial literacy through mathematics learning and utilization of mathematics | The content in article are not contained improving financial literacy through mathematics learning and utilization of mathematics |

| The research subject is within the scope of elementary and secondary school communities (students and teachers) | The research subject is outside the scope of elementary and secondary school communities (students and teachers) |

During the screening phase, the application of specific inclusion and exclusion criteria led to the identification of 73 articles that fulfilled the inclusion criteria. Subsequent refinement was undertaken to evaluate the pertinence of the topic, with a particular emphasis on the integration of financial literacy within the context of mathematics instruction in educational institutions, resulting in the identification of 40 articles. The subsequent stage entailed a comprehensive examination of these 40 articles to determine their alignment with the research inquiries posited. This stage is crucial in ensuring that solely pertinent research studies are encompassed within the analysis (Higgins et al. 2023). Among the 40 articles scrutinized, only 25 were deemed relevant, featuring research questions that are germane to the present study.

Based on the 25 selected articles, a diverse range of information was identified. The earliest article was published in 2015, and there has been a consistent increase in publications each year since. The diversity of research subjects has expanded, covering topics from elementary education to higher education levels.

In addition to reviewing research trends, the researcher also examines the distribution of research subjects. The analysis of the distribution of research subjects is expected to be useful in understanding the diversity of topics studied, thus offering a more holistic perspective on the topic under investigation (Gentles et al. 2016); identifying gaps in the current literature and guiding future research towards underrepresented topics (Pigott and Polanin 2019); and facilitating the application of findings by a broader range of stakeholders (Paez 2017). In this study, the research subjects include targets for elementary school-age students, high school-age students, and for educators.

Based on Table 2, the development of exercises for primary and secondary school children should follow a scaffolded approach. In the initial stages, problems ought to focus on fundamental skills such as recognizing small monetary values, demonstrating basic counting abilities, and adding small sums using currency (Yeo 2016). To enhance kinesthetic learning, students should be engaged in simple, finance-related activities like counting money, making change, and recording sales (Williams et al. 2020). This classroom practice should be supplemented by parental involvement, such as discussing everyday financial matters at home (Moscarola and Kalwij 2018). For primary school students, mathematics instruction must be engaging and tailored to their comprehension level by incorporating familiar financial activities (Nagy 2023). The use of instructional models like Inquiry-Based Learning (Blue et al. 2017) and Project-Based Learning (PjBL) (Sagita et al. 2023) is designed to help students integrate learned concepts with real-world scenarios. At the secondary level, instruction progresses to equipping students with an introduction to financial terminology (Abylkassymova et al. 2020; Safronova et al. 2020) and the reinforcement of numeracy skills (Indefenso and Yazon 2020). These competencies are essential for understanding problems and strengthening computational abilities when performing mathematical tasks within a financial context (Kenayathulla et al. 2024; Kusumawati et al. 2023; Kuzma et al. 2022; Mahmudi and Listiyani 2019; Rondillas and Buan 2019).

Subject and research theme.

| Subject | Research theme |

|---|---|

| Primary school | Inquiry based learning (Blue et al. 2017) |

| Financial related practical activities (Moscarola and Kalwij 2018; Williams et al. 2020) | |

| Use of interactive and contextual media (Nagy 2023) | |

| Question with daily problems that are close to students (Santos et al. 2024; Yeo 2016) | |

| Secondary school | Mathematics tasks based on financial problems (Kenayathulla et al. 2024; Kusumawati et al. 2023; Kuzma et al. 2022; Mahmudi and Listiyani 2019; Rondillas and Buan 2019) |

| Introduction to financial terminology (Abylkassymova et al. 2020; Safronova et al. 2020) | |

| Numeracy skills reinforcement (Indefenso and Yazon 2020; Skagerlund et al. 2018; Sunderaraman et al. 2020) | |

| Project based learning (Sagita et al. 2023) | |

| Teacher | Use of technology (Hurtado et al. 2022) |

| Development of interdisciplinary content connecting mathematics, financial literacy, and social justice issues (Tanase and Lucey 2016) | |

| Task design using financial and mathematical literacy models (Batty et al. 2014; Ozkale and Aprea 2024; Ozkale and Erdogan 2020; Ozkale and Ozdemir 2020) | |

| Development of measurement tools for financial literacy levels (Özer and Ersoy 2022) | |

| Interactive learning strategies (Kozina and Metljak 2022) |

As educators, teachers should integrate financial contexts into mathematics instruction (Tanase and Lucey 2016) and design student tasks as problems integrated with financial activities (Ozkale and Erdogan 2020). Instruction should foster an interactive atmosphere (Kozina and Metljak 2022) and employ approaches that utilize technologies such as spreadsheets (Hurtado et al. 2022). Critically, it is also essential to conduct assessments to measure students’ understanding of financial literacy by developing appropriate evaluation instruments (Özer and Ersoy 2022).

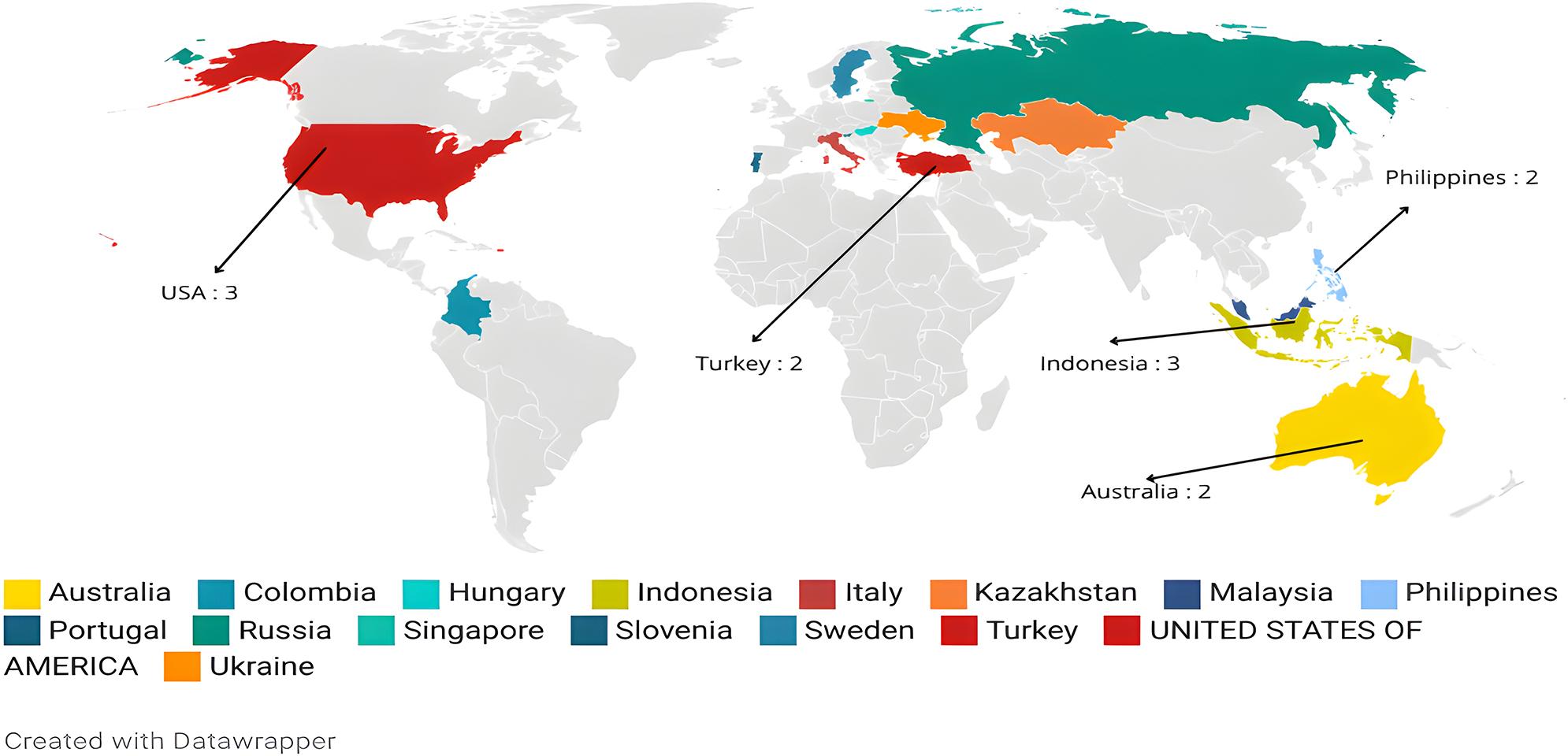

Figure 4 depicts the distribution of nations that have made contributions to the study of financial literacy in the context of mathematics instruction. Based on Figure 4, it is evident that related research has been predominantly conducted in America, Asia, and Europe, with the United States and Indonesia being the countries with the highest number of studies. However, there remains a gap, particularly in Africa, where no research representation is observed.

Distribution of research subjects.

This suggests an opportunity to expand studies in underrepresented regions to achieve a more comprehensive perspective. This aligns with the statement by South Africa (Roberts et al. 2021), which is currently developing the integration of financial literacy into mathematics education. This highlights the significance of financial literacy in educational frameworks on a global scale. The variety of participating nations introduces a diverse array of viewpoints and methodologies to the research on financial literacy, thereby enhancing the conclusions and suggestions for integration within mathematics instruction.

Effective implementation of financial literacy education for elementary and secondary school students can be achieved by integrating it into existing subject curricula. Teaching financial literacy should be integrated consistently and continuously within mathematics instruction rather than being treated as a skill taught in a short period (Yeo 2016). These strategies include the implementation of instructional models that accommodate financial literacy, the integration of financial literacy into mathematics tasks and problems, curriculum modification, the use of instructional media, teacher training, and curricular activities.

The strategy of providing a positive and collaborative learning environment, utilizing language that encourages active participation and critical thinking, is effectively presented through an appropriate instructional model (Blue et al. 2017). In addition to designing the syntax of the lesson plan, an essential component is the use of diagnostic tools to help measure students’ progress in understanding financial literacy and to evaluate the effectiveness of the instruction, allowing for the adjustment of teaching methods to meet students’ needs (Nagy 2023). Özer and Ersoy (2022) developed a valid financial literacy scale instrument for assessing elementary students’ financial literacy levels, focusing on the factors of Planned, Saving, and Extravagant in their questionnaire. Consequently, there is a need for references to appropriate instructional models and their implementation in the classroom.

Supported by the syntax of the Project Based Learning (PjBL) model, the integration of financial literacy into the mathematics curriculum effectively engages students in projects related to real-life situations and the everyday challenges they face, particularly in areas such as financial planning, money management, and investment (Sagita et al. 2023). Furthermore, Sagita et al. (2023) highlighted the positive impact of employing the PjBL method, which includes enhancing students’ motivation to learn, as they feel more involved and find the material more relevant.

Based on Figure 5, the syntax of Project-Based Learning (PjBL) in financial literacy instruction within mathematics classrooms consists of three main stages: initial material, project work, and evaluation (Sagita et al. 2023). These stages are designed to develop students’ financial planning skills. This increased engagement subsequently leads to a better understanding and application of financial knowledge in their daily lives.

Syntax activity of PjBL method (Sagita et al. 2023).

In addition to the PjBL (Project-Based Learning) model (Blue et al. 2017), an instructional approach was designed by implementing an inquiry-based learning model, which has demonstrated through investigative activities aimed at considering financial decision-making from both individual and group perspectives. Inquiry-based learning in mathematics serves as an exploration-driven approach that encourages students to solve ill-structured problems using mathematical evidence and collaborative group discussions to determine the best answers and provide evidence to support their reasoning (Blue et al. 2017). This approach fosters positive emotional connections with mathematics, promoting a greater willingness to engage in decision-making through problem-solving an attribute aligned with a growth mindset. The learning model that employs a student-centered approach to problem-solving is believed to enhance students’ critical thinking skills in financial management classes (Sugeng and Suryani 2020).

Fianto et al. (2017) further explains that the integration of financial literacy education should emphasize practical applications, which can be incorporated into subjects like mathematics and social sciences. Moreover, long-term learning can be effectively implemented through carefully designed assignments by mathematics teachers (Yeo 2016). Mathematics instruction, when integrated with financial literacy, can be delivered through assignments addressing topics such as financial decision-making and money management (Batty et al. 2014).

The concept of financial literacy in children necessitates careful consideration of their developmental stages in comprehending financial matters (Blue et al. 2017; Ozkale and Aprea 2024). The mathematical problems presented to students should include financial content that is relevant to their immediate environment (Safronova et al. 2020). Therefore, it is essential to develop strategies for teaching financial literacy to children by considering the characteristics of the learners. At the elementary school level, children begin to understand money and basic concepts such as payment and shopping, factors that influence the price of goods and services, the ability to compare prices with the quality of different objects, and the distinction between needs and wants, which are fundamental aspects of financial literacy (Ozkale and Aprea 2024). At the secondary school level, financial literacy includes topics relevant to the financial activities of high school students, such as money and transactions, spending, saving, investing, credit management, and the development of financial awareness. Material introduced at an early age and reinforced at higher levels can enhance students’ understanding (Nagy 2023).

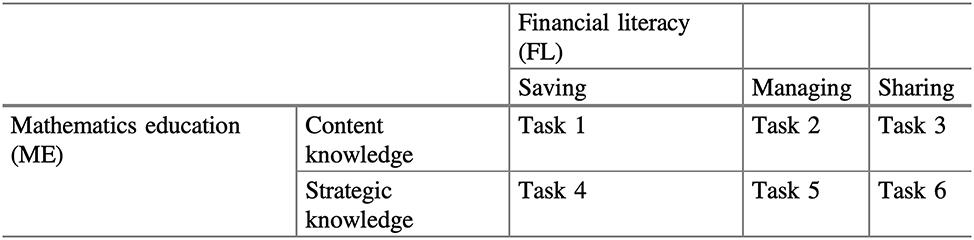

The practice of assigning tasks to students is an integral part of school education. Yeo (2016) developed the “Mathematics Education × Financial Literacy” or “ME x FL” matrix, which serves as a tool for teachers to integrate financial literacy components into mathematics instruction. This matrix supports the development of activities that facilitate the integration of financial literacy into the mathematics curriculum, as illustrated in Figure 6.

Matrix model ME × FL (Yeo 2016).

The “ME × FL” matrix in Figure 6 illustrates the combination of components in mathematics instruction, including content knowledge (technical and procedural mathematical skills related to the use of mathematical algorithms) and strategic knowledge (general strategies and approaches in problem-solving, such as reasoning, discovery, prediction, and symbol comprehension). In contrast, the elements of financial literacy encompass the ability to save, manage, and share money (Yeo 2016). An example assignment referenced by Santos et al. (2024) involves problem posing and problem-solving within the context of financial education and consumer education topics in a supermarket case study, which includes mathematical operations, mastery of decimal numbers, and the application of various mathematical skills, particularly problem posing, problem-solving, connection, reasoning, representation, and communication (Santos et al. 2024). Financial literacy-based mathematics instruction is aimed at mastering the elements of content, process, and context in both financial literacy and mathematical literacy. Ozkale and Erdogan (2020) developed the IMMFL (Interaction Model of Mathematical and Financial Literacies) as a model to explore the integration of financial literacy into mathematics instruction.

The development of the IMMFL model, as depicted in Figure 7, integrates components of financial literacy based on the PISA framework’s content, processes, and financial context with elements of mathematical literacy, as outlined in the PISA framework, including content, processes, and mathematical context (Ozkale and Erdogan 2020). Furthermore, the mathematical task framework is presented by dissecting the financial literacy context into four areas: income, investment and savings, expenditure, and financial management and planning. These areas necessitate the use of mathematical process skills in task completion, including problem-solving, modeling, manipulation and estimation, reflection and knowledge transfer, as well as the use of technology and communication (Ozkale and Erdogan 2020).

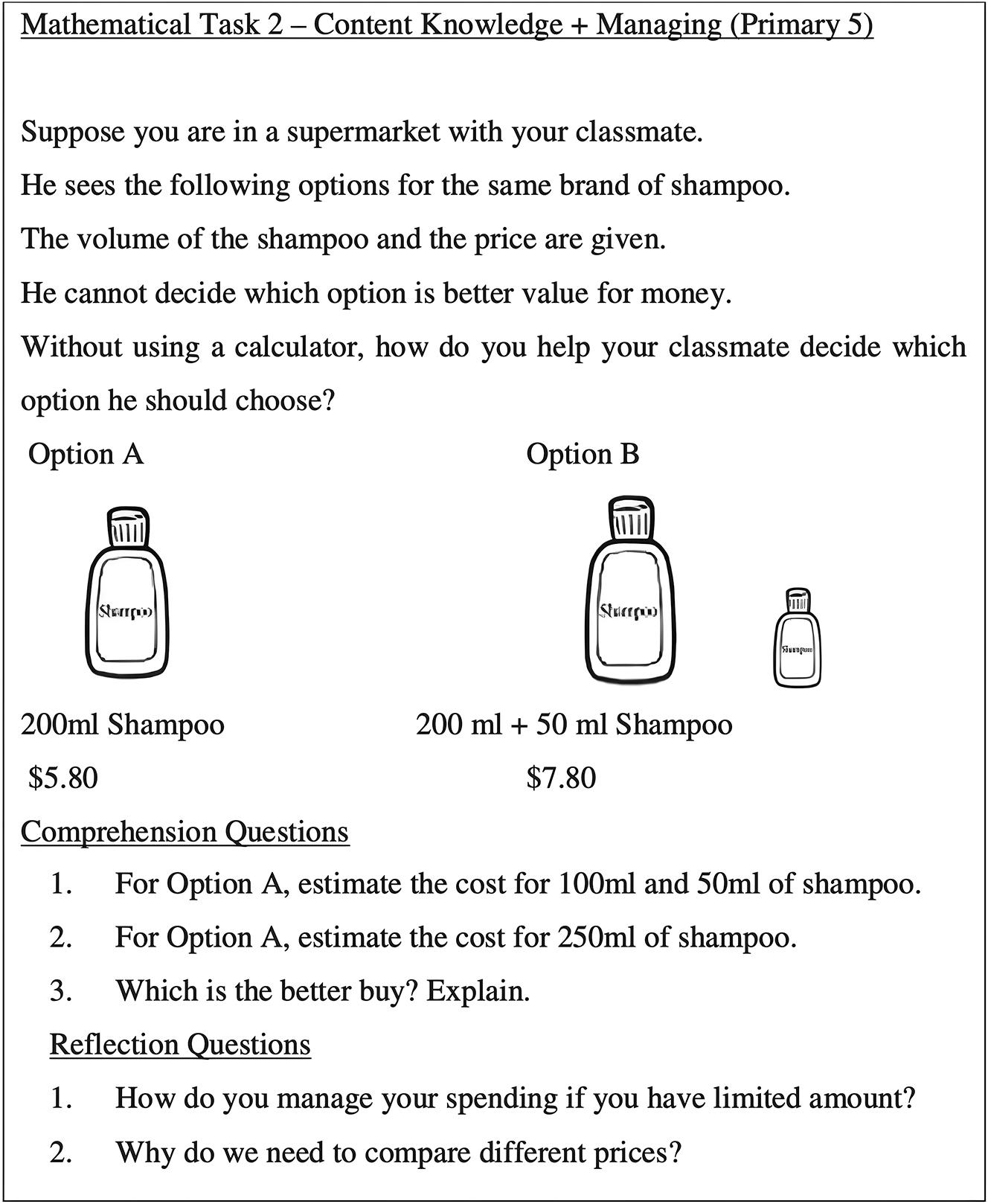

IMMFL model (Ozkale and Erdogan 2020).

The following is an example of a task applied in mathematics learning in Figure 7 (Yeo 2016). The task in Figure 8 exemplifies the integration of mathematics in developing financial literacy skills. Through calculations, comparisons, and estimations, students learn to make rational financial decisions. Additionally, psychological factors like perceived value and cognitive biases are at play, but the application of mathematical reasoning helps counter these influences, fostering better financial decision-making abilities in students. Teachers can use contextual examples starting from the simplest and most relatable activities for students, then gradually develop the context in accordance with current issues or trends in contemporary demands. Everyone must adopt proper financial behavior in order to balance income and expenses effectively. Financial decision-making can be developed among individuals through the enhancement of financial literacy, particularly when they are involved in planning life events, household budgeting, purchasing a home, and retirement (Atkinson and Messy 2012).

Examples of math problems with mathematics content knowledge and context managing (Yeo 2016).

Another crucial element in designing assignments for students is the implementation of a tiered approach. Research conducted by Ozkale and Aprea (2024) utilizes a spiral approach that progressively strengthens students’ understanding, guiding them from simpler concepts to more complex ones while ensuring continuous reinforcement and repetition of key concepts (Ozkale and Aprea 2024). The spiral approach in structuring activities is applied in three ways: first, by designing lessons that transition from easier to more difficult tasks; second, by building new material upon previous learning; and third, by revisiting previously learned concepts with new learning experiences (Ozkale and Aprea 2024). In addition to the spiral approach, a tiered structure of assignments is also evident in the research by Abylkassymova et al. (2020), which follows Bloom’s Taxonomy stages. This research categorizes assignments into three levels: Level A, which encompasses foundational knowledge and skills for everyday activities; Level B, which focuses on knowledge and skills for reinforcing economic topics; and Level C, which targets knowledge and skills for direct application in professional activities. This approach aims to meet the diverse learning needs and goals of students, accommodating their varying abilities, talents, and requirements.

Several countries have developed curricula focused on financial literacy, indicating the crucial role of financial literacy in education. Consequently, the OECD has included financial literacy as one of the key indicators of students’ literacy skills (OECD 2024). The curriculum plays a vital role in setting learning objectives, providing a framework, and integrating knowledge and skills. Efforts to support the enhancement of financial literacy through curriculum design involve the integration of financial literacy content into mathematics instruction (Blue et al. 2017; Ozkale and Aprea 2024; Sagita et al. 2023) and the provision of resources and practical programs (Batty et al. 2014; Moscarola and Kalwij 2018). One example from Australia illustrates that elementary school students are expected to connect mathematical concepts to real-world problems, including those related to purchasing, with and without digital technology (Blue et al. 2017).

Curriculum serves as the foundation for determining key educational components, such as grades, instructional hours, content acquisition, the number of units and topics, and project features like work plans, design processes, and expert opinions. Ozkale and Aprea (2024) developed a spiral approach to task distribution within the curriculum, which is divided across elementary and secondary school levels, with a focus on the following topics: in grades 1–4, mathematics topics that can support financial literacy include currency recognition, data management, number operations and fractions, and measurement; in grades 5–8, relevant topics include fraction operations; factors, multiples, and exponents; decimals and rational numbers; percentages; sets; algebra; data management and analysis; ratios; measurement; and probability. Financial literacy is widely regarded as an essential component of educational curricula in many countries. This integration aims to equip students with the fundamental financial skills necessary for making informed decisions in the future.

Financial literacy requires a strong understanding of numbers, percentages, and calculation procedures, which supports the interpretation that numeracy is a crucial factor in financial literacy (Skagerlund et al. 2018). Numeracy is defined as the ability to process basic numerical concepts, quantitative estimation, probability, and ratios (Skagerlund et al. 2018). Furthermore, the role of personal attitudes should be nurtured by educators. Sunderaraman et al. (2020) highlight the need for mental arithmetic, math achievement, and numerical reasoning to master financial skills in mathematics instruction. The relationship between numeracy and financial literacy is evidenced by research conducted by Indefenso and Yazon (2020), which reveals a significant positive correlation between numeracy and financial literacy, as well as the importance of problem-solving skills in financial literacy.

As time progresses, educators must recognize the evolving needs in education, which necessitates the implementation of specific strategies in the learning process. Financial literacy-based mathematics instruction serves as a crucial tool in sustainable education to develop future human resources (Yeo 2016). Support of instructional media is expected to enhance student participation and motivation in a given learning topic. A learning approach that incorporates elements of sound, text, graphics, and animation can provide a more effective educational experience (Nagy 2023). Instructional media in financial education has become a critical component in the development of elementary school students (Kuzma et al. 2022).

The use of instructional media was demonstrated in a study conducted by Rondillas and Buan (2019), which introduced an interactive module integrating financial literacy, complemented by clear instructions and a representation of fraction-based materials, fostering an effective and easily followable learning process for students to solve their own problems. Additionally, students can utilize technology such as Excel by applying mathematical reasoning and learned concepts to facilitate the resolution of both routine and non-routine financial problems (Hurtado et al. 2022). In the context of using instructional media at the elementary school level, the key to engaging children’s interest lies in employing interactive presentations, which are anticipated to help children understand fundamental financial concepts and processes with economic-financial-accounting appropriate to the students’ age (Nagy 2023). This is further supported by Wang (2023) study, which suggests that educational media capable of presenting financial simulation are an effective teaching strategy, significantly enhancing students’ learning outcomes and motivation in financial education.

The development of strategies to enhance financial literacy skills must consider the quality of resources, as well as the facilities and infrastructure used. One approach to improving resources is through teacher training in financial literacy (Indefenso and Yazon 2020; Kozina and Metljak 2022; Tanase and Lucey 2016). Schools and stakeholders need to collaborate in providing various training sessions for teachers to help maintain students’ numeracy, problem-solving abilities, and financial literacy (Indefenso and Yazon 2020). Tanase and Lucey (2016) also emphasize the importance of teacher education programs in increasing pre-service teachers’ understanding of the interdisciplinary links between mathematics, financial literacy, and social issues. For educators to deliver high-quality financial education, it is crucial that teachers have access to training opportunities that encompass both subject content and instructional methodologies (Kozina and Metljak 2022).

Integrating financial literacy into mathematics instruction is a growing global trend aimed at equipping students with essential life skills. Beyond theoretical knowledge, this approach fosters social attitudes such as saving, giving, and sharing, which are crucial for financial well-being. For instance, in the United Kingdom, the Money and Pensions Service (MaPS) (n.d.) has implemented programs that integrate financial education into the mathematics curriculum, utilizing real-life scenarios like budgeting and saving. Similarly, Singapore’s Ministry of Education (2022) has introduced financial literacy concepts into primary school curricula, teaching basic concepts such as differentiating between needs and wants, spending within means, and the value of thrift and accumulating savings. These global initiatives demonstrate the potential of integrating financial literacy into mathematics education to prepare students for future financial challenges.

The implementation of financial literacy is widely recognized as essential, leading several countries to develop learning programs that provide practical and contextual financial literacy education to students. This can be applied through case study learning in mathematics instruction. As researched by Williams et al. (2020), the school garden market program effectively prepares students for simulated economic activities by engaging them in money transactions, understanding debt, comparing costs, calculating percentages, and making financial decisions involving mathematical operations. Furthermore, informal education also influences formal education in strengthening the financial literacy of elementary school students, for example, through the use of pocket money (Moscarola and Kalwij 2018).

The discussion on the role of teachers aims to provide educators with insights into practical steps that can be implemented to integrate financial literacy into mathematics lessons in ways that are engaging and relevant to real-world situations. By gaining a deep understanding of the critical importance of educators in introducing financial literacy, policymakers in the field of education are expected to make more informed decisions to enhance curriculum frameworks and improve teacher performance. The role of educators is a key determinant in the quality of learning outcomes.

Classroom activities that emphasize collaboration, promote the integration of social and mathematical concepts, and encourage students to reflect on the broader consequences of financial decisions for others can effectively contribute to enhancing financial literacy (Blue et al. 2017). Educators need to carefully prepare lesson plans using various targeted teaching methods and topics. For elementary school teachers, it is recommended to use methods such as demonstrations, game-based learning, and experiential learning, while secondary school teachers are advised to employ discussion activities, explanations, and the application of frequently used teaching methods (Kozina and Metljak 2022). This aligns with Nagy (2023) research, which suggests that teachers should be given the flexibility to link financial literacy topics with existing curricular content and use interactive and contextual teaching methods (Tanase and Lucey 2016). Emphasize that educators should cultivate attitudes that foster students’ critical thinking in financial management to motivate social responsibility. As a solution for preparing well-structured lessons, educators are recommended to design learning activities based on authentic problems and encourage students’ critical thinking through active, ICT-integrated learning approaches (Kozina and Metljak 2022).

From the perspective of financial literacy, educators can expand students’ understanding of consumer mathematics, including savings, investments, credit, debt, financial management, insurance, and taxation (Kenayathulla et al. 2024). Mathematics instruction holds a strategic role in integrating the development of financial literacy (Mahmudi and Listiyani 2019). Students with sound financial knowledge are more likely to exhibit positive financial attitudes.

The development of financial literacy skills still faces several obstacles and challenges in enhancing the quality of both educators and educational institutions. It is necessary for teachers to have a comprehensive understanding of financial terminology to implement it effectively in mathematics instruction (Sagita et al. 2025). A significant challenge lies in the fact that the majority of pre-service teachers have a narrow or moderate conception of how to integrate financial topics into mathematics instruction (Tanase and Lucey 2016). Additionally, collaboration with external parties, such as community financial institutions or practitioners, is needed to support practical financial references in classroom teaching (Kuzma et al. 2022).

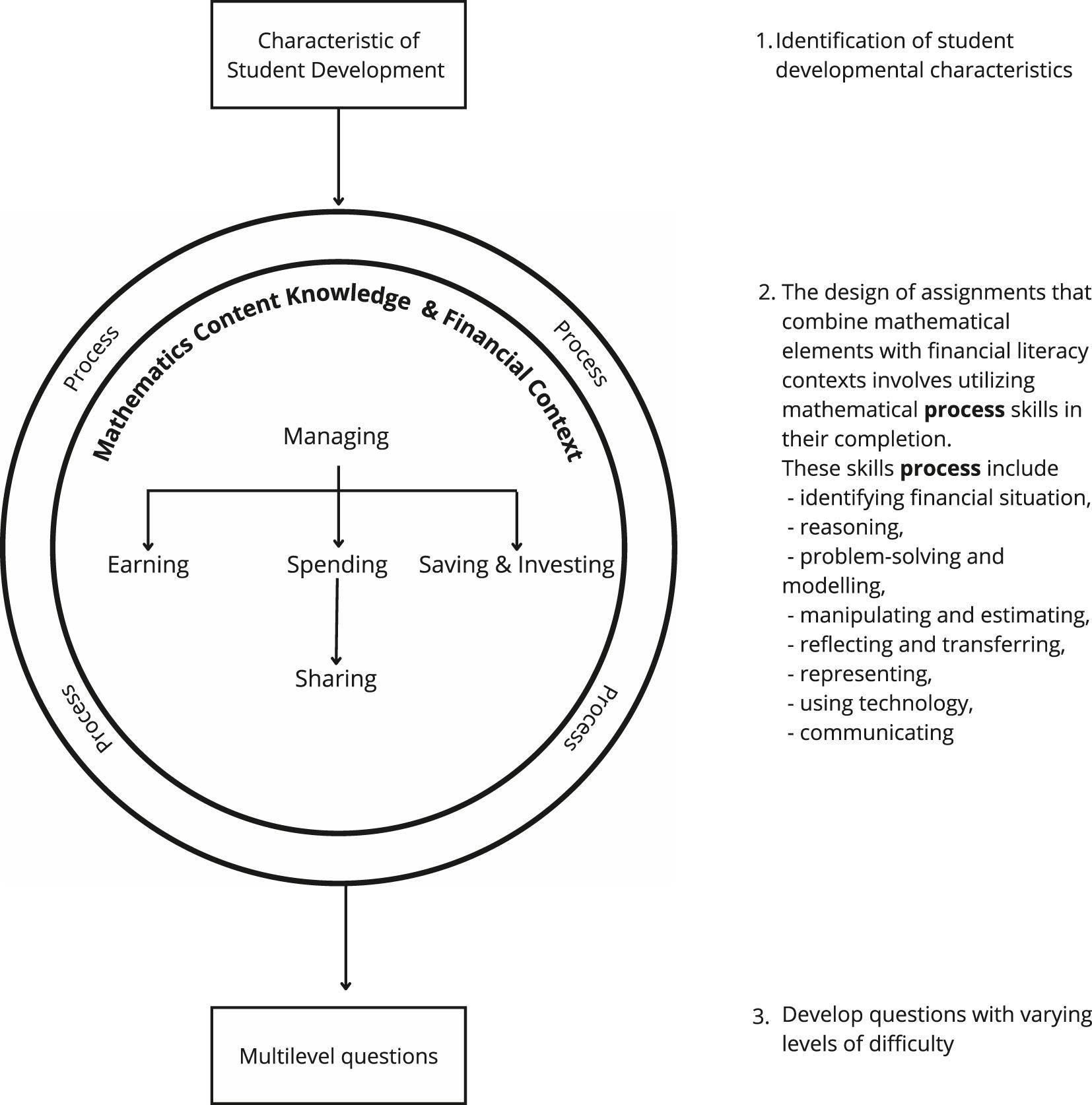

Learning tasks should be designed to translate theory into practical skills and facilitate student adaptation to real-world contexts (Longman et al. 2024). Consequently, an algorithm is required for designing financial literacy-based mathematics tasks. The development of financial literacy-based mathematics tasks necessitates a clear methodological framework. Accordingly, Figure 9 outlines a proposed set of guidelines for constructing these tasks. These guidelines are synthesized from the foundational literature analyzed within this research, representing a consolidation of best practices identified in the selected papers.

Algorithm for designing mathematics assignments based on financial literacy.

Based on Figure 9, the researcher illustrates the algorithm for designing mathematics tasks embedded with financial literacy by involving the interplay between student characteristics, mathematical content knowledge, financial contexts, and tiered questioning within the learning process. The first aspect to consider is the student characteristics, particularly age, which is positioned at the top of the diagram. This placement indicates that students’ age influences the instructional approaches employed (Blue et al. 2017; Ozkale and Aprea 2024). The task framework is then developed by combining elements of mathematical content with financial contexts, including skills in managing areas such as earning, spending, sharing, saving and investing (Ozkale and Erdogan 2020; Yeo 2016). The outer circle encompasses a range of essential mathematical process skills required for task completion. These skills include identifying financial situations, reasoning, problem-solving and modeling, manipulating and estimating, reflecting and transferring knowledge, representing information, utilizing technology, and effective communication (Ozkale and Erdogan 2020). To meet the diverse learning needs and goals of students, tiered questions are developed, taking into account their abilities, talents, and needs. These questions are designed to assess students’ understanding within a financial context through the application of their mathematical knowledge (Abylkassymova et al. 2020; Ozkale and Aprea 2024). Thus, this framework is designed to assist teachers in constructing targeted and meaningful mathematics tasks that are integrated with a financial literacy context.

The main focus of this research is to explore how the integration of mathematical concepts and financial literacy can be effectively implemented in teaching. The effectiveness of integrating financial literacy into mathematics instruction is demonstrated by the fulfillment of the process aspects in financial literacy, which reflect students’ ability to recognize and apply relevant concepts, understand, analyze, reason, evaluate, and propose solutions. In PISA financial literacy, four process categories have been defined, without a specific hierarchical order: identifying financial information, analyzing financial information and situations, evaluating financial issues, and applying financial knowledge and understanding (OECD 2024). Table 3 presents a summary of the relationship between integration strategies and the fulfillment of aspects of the financial literacy process.

Strategy and impact on improving financial literacy.

| Strategy | Activity | Impact in financial literacy process |

|---|---|---|

| Learning model | Through Project-Based Learning (PjBL), students can develop financial projects, such as creating budget plans for daily activities or conducting simple investment simulations (Sagita et al. 2023) | Apply financial knowledge and understanding |

| Through inquiry-based learning, students work in groups to analyze and construct mathematical justifications related to open-ended financial decision-making problems, such as determining the best investment product based on the given data (Blue et al. 2017) | Analyze financial information and situations, | |

| Integration of financial literacy into mathematics tasks | Mathematical problems presented to students should include financial content that is relevant to their immediate environment (Safronova et al. 2020) | Identify financial information |

| The development of tasks utilizes the “ME X FL” and “IMFFL” task frameworks by integrating elements of content, process, and context in both financial literacy and mathematical literacy (Ozkale and Erdogan 2020; Yeo 2016) | Analyze financial information and situations, | |

| Curriculum modification | Efforts to support the enhancement of financial literacy through curriculum design involve the integration of financial literacy content into mathematics instruction (Blue et al. 2017; Ozkale and Aprea 2024; Sagita et al. 2023) and the provision of resources and practical programs (Batty et al. 2014; Moscarola and Kalwij 2018) | Analyze financial information and situations, |

| Instructional media | Use of interactive modules that integrate financial literacy with clear instructions and fraction-based material representations enables students to understand financial concepts through visual illustrations and simple simulations (Rondillas and Buan 2019) | Identify financial information |

| Utilization of Excel applications for solving financial problems, such as budget management, transaction reporting, and investment simulations, enhances students’ ability to apply mathematical concepts in financial decision-making (Hurtado et al. 2022) | Analyze financial information and situations | |

| The use of interactive presentation tools and financial simulations tailored to students’ developmental levels can enhance motivation and facilitate the understanding of fundamental economic concepts, such as money management, savings, and the value of goods and services (Nagy 2023) | Identify financial information | |

| Teacher training | Improving resources is through teacher training in financial literacy (Indefenso and Yazon 2020; Kozina and Metljak 2022; Tanase and Lucey 2016) | Identify financial information |

| Curricular activities | Case study learning in mathematics instruction (Williams et al. 2020) | Apply financial knowledge and understanding, |

The implementation outlined in Table 3 is expected to address the challenges faced by educators and educational institutions in integrating financial literacy into mathematics instruction. Equally important is the active involvement of educators in supporting students throughout the learning process. Furthermore, educators are required to understand students’ psychology to implement instructional strategies that enhance financial literacy learning effectively. One of the factors influencing financial literacy, in addition to the use of mathematics, is the psychological factor (Mihno 2021). Individuals with financial awareness are able to control their emotions, which allows them to manage their finances better and invest their money wisely (Lowe et al. 2018). On the other hand, a lack of financial literacy can lead to unwise choices of financial products, poor debt management, and inadequate saving behaviors (Yong and Tan 2017). Psychological factors can be accommodated in the application of tasks in mathematics education.

Enhancing financial literacy skills encourages individuals to manage finances better and make informed financial choices using mathematics (Martin et al. 2021). Additionally, financial literacy education has been proven effective in reducing risky behaviors among students (Wann 2017). Furthermore, the benefits of financial literacy in primary school students can increase their motivation to save and help eliminate the sandwich generation chain in this generation (Suhana et al. 2021). Therefore, it is hoped that financial literacy will become a powerful tool in raising awareness among teenagers to prevent them from falling into the trap of illegal online loans.

This systematic literature review has certain limitations in the scope of the databases used. Some strategies for improving financial literacy that are published in journals not indexed in the selected databases may not be covered in this article. Future research could explore the role of parents and technology in enhancing students’ financial literacy skills. It is anticipated that such research will address broader challenges and opportunities in financial literacy education and contribute more significantly to the financial well-being of younger generations.

This study underscores the importance of enhancing financial literacy through mathematics instruction from an early school age. This effort is particularly crucial in preparing for the coming years when the entire Generation Z will enter the productive age group, with the expectation that they will contribute to economic growth and improve societal welfare.

Through the Project-Based Learning (PjBL) and Inquiry-Based Learning models, students engage with mathematical problems integrated with financial literacy contexts. The curriculum design adjustments involve integrating financial literacy content into mathematics instruction and providing relevant resources and practical programs. Additionally, students benefit from various instructional media, including interactive modules with visual illustrations and simple simulations, Microsoft Excel, interactive presentation tools, and financial simulations. Furthermore, curricular activities, such as case study learning in mathematics instruction, enhance students’ understanding and application of financial literacy concepts.

Equally important is the role of teachers, which becomes a key factor in preparing lesson plans tailored to the diverse characteristics of students. Teaching methods delivered by teachers should be interactive and contextual to create a learning environment that encourages active student engagement. Additionally, teachers need to foster critical attitudes in students regarding financial management and integrate information and communication technology (ICT) into the teaching approach.

Achieving the goal of improving financial literacy through mathematics education is not without its challenges. One of the main challenges in teaching financial literacy is the need for teacher training in integrating and deepening financial literacy and raising teacher awareness of the interdisciplinary relationship between mathematics and financial literacy. Furthermore, educators need to instill social values in students, and collaboration with external parties or practitioners is also a key part of the successful integration of financial literacy-based mathematics education in schools. Therefore, the aforementioned alternatives are expected to gain public attention and support the strategic missions and programs of the government in creating a society with a high financial literacy index.

The strategies have the potential to transform financial education not only in Indonesia but also globally. Countries facing similar challenges, such as India, and South Africa, can adapt these strategies to their unique contexts. Furthermore, the success of financial literacy programs in countries like Australia, Finland, and Singapore provides valuable lessons for policymakers and educators worldwide. By fostering international collaboration and sharing best practices, we can collectively address the global financial literacy gap and equip future generations with the skills needed to navigate an increasingly complex financial landscape. Financial literacy serves as a powerful tool to raise awareness among teenagers, helping them avoid falling into the trap of illegal online loans. Thus, strengthening financial literacy among students from an early age is crucial in equipping the younger generation with the knowledge needed to make wise financial decisions in the future.