Figure 1

Figure 2

Figure 3

Figure 4

Figure 5

Figure 6

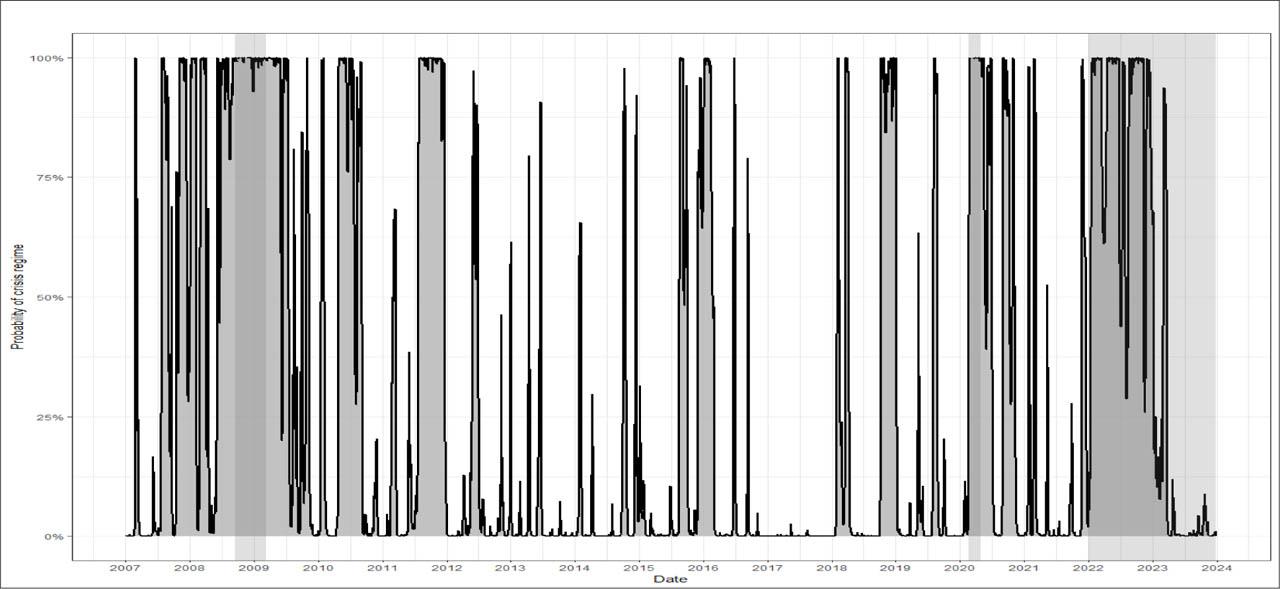

Annual regime statistics for SPY

| Year | Average crisis regime probability (%) | % Days in crisis regime |

|---|---|---|

| 2007 | 30.9 | 28.0 |

| 2008 | 75.3 | 76.3 |

| 2009 | 61.1 | 59.9 |

| 2010 | 38.5 | 37.3 |

| 2011 | 46.3 | 44.0 |

| 2012 | 9.8 | 9.6 |

| 2013 | 4.8 | 3.6 |

| 2014 | 9.2 | 7.9 |

| 2015 | 18.8 | 19.8 |

| 2016 | 17.9 | 17.9 |

| 2017 | 0.1 | 0.0 |

| 2018 | 31.8 | 30.7 |

| 2019 | 10.5 | 8.7 |

| 2020 | 50.0 | 49.0 |

| 2021 | 13.8 | 13.1 |

| 2022 | 84.7 | 86.9 |

| 2023 | 9.1 | 6.8 |

Transition probability matrix

| S&P 500 (SPY) regimes | ||

| Regime 1 (Bull) | Regime 2 (Crisis) | |

| Regime 1 (Bull) | 0.9558 | 0.0191 |

| Regime 2 (Crisis) | 0.0442 | 0.9809 |

| 20Y+ Treasury (TLT) regimes | ||

| Regime 1 (Bull) | Regime 2 (Crisis) | |

| Regime 1 (Bull) | 0.9922 | 0.0134 |

| Regime 2 (Crisis) | 0.0078 | 0.9866 |

Estimated regime characteristics for SPY and TLT daily returns

| Asset | Regime | Return | Volatility | Persistence | Duration (days) |

|---|---|---|---|---|---|

| SPY | Regime 1 | −0.131 | 2.063 | 0.956 | 22.64 |

| Regime 2 | 0.108 | 0.670 | 0.981 | 52.36 | |

| TLT | Regime 1 | 0.026 | 0.693 | 0.992 | 127.87 |

| Regime 2 | −0.006 | 1.304 | 0.987 | 74.6 |