COVID-19 originated in Wuhan, China in late 2019 and it quickly spread around the world. So far it is recognized to be the most impactful pandemic crisis on social customs, policy-making, and economic activities in the modern history of humankind. The World Bank announced that on the economic front, the economies of over 90% of countries in the world tightened, and the global economy lost 3% of its total output. This pandemic crisis has been noted to surpass the impact of World War I and II, the financial crisis of the 1930s, and the 2008 subprime financial crisis.

The insurance industry, both life insurance and general (property-casualty) insurance, was highly impacted by COVID-19. There are empirical studies on the relationship between COVID-19 and insurance markets, especially focused on changes in insurance premiums, insurance coverage and insurance demand (Babuna et al., 2020; Wang et al, 2020; Bundorf et al., 2021; Harris et al., 2021; Qian, 2021). Life insurance companies in the United States refrained from increasing premiums or eliminating policy options in response to changes in mortality risk. However, in response to COVID-19, premiums were raised for unhealthy older smokers and some policies offered to individuals aged 75 and above were removed from the market (Harris et al., 2021). In China, due to the limitation of insurance marketing channels and the suppression of household insurance demand, insurance industries were adversely affected by COVID-19 (Wang et al., 2020).

There is a lack of research on changes in insurance products and changes in insurance distribution and service channels due to COVID-19. In the past, especially in Asia, the most popular insurance distribution channel was face-to-face due to the characteristics of insurance products. However, during COVID-19, insurance companies had difficulties using face-to-face distribution channels, so they developed new types of digital insurance products. As social distancing increased due to COVID-19, untact (non-face-to-face) consumption behavior spread rapidly. Consumers who have become accustomed to digital trends are not expected to return to their past consumption methods.

This research aims to investigate the changes in insurance distribution, service channels and insurance products in Asia as a result of the COVID-19 pandemic. Our main point of focus will be the insurance sectors in Japan, South Korea, and China. Section II discusses the impact of COVID-19 on changes in consumer insurance demand and purchase behaviors. Section III documents changes in insurance distribution and service channels and insurance products. Section IV discusses implications and Section V concludes.

In many countries, including those that are the focus of this research, governments instituted extended emergency lock-downs to control the spread of COVID-19. These contributed heavily to the economic toll of the pandemic, creating adverse impacts on individual and family incomes through the restriction of economic activity, the insolvency of firms, and the occurrence of job losses. It also affected consumers’ purchasing behaviors and insurance demand, with potential implications for future market interactions.

In Japan, people refrained from traveling and going out, and were encouraged to do telework and online classes from April 7, 2020, when a state of emergency was declared, to May 25, 2020, when it was lifted. In the distribution industry, demand for hygiene products expanded and food sales increased, while demand for clothing, cosmetics, and other items related to going out decreased. The fraction of households purchasing products via Internet remained around 42–43% in 2019, increasing to 50.5% in 2020 (Hong, 2020). Thus, the use of online shopping increased and settled due to the spread of COVID-19. Using digital technology has the advantage of enabling more people to access services and information beyond geographical and time constraints.

In China, during the three stages of early COVID-19 prevention policies, the prominence of online activities reached the highest level in history. According to the China Economy Recovery Index released by Webank, the growth rates of telework and online education in 2020 were 537% and 169% and the growth rates of online gaming, online video, and online social activities were 124%, 63%, and 47%. The number of users of Tencent online meetings reached 10 million within two months of its launch (Zheng, 2022). Also, due to the impact of COVID-19, Chinese consumers are increasingly shifting towards contactless purchasing patterns and are placing greater emphasis on the safety and environmental health of products.

In South Korea, non-face-to-face consumption trends also changed after COVID-19, and related companies have emerged, such as those utilizing digital platforms in existing industries and expanding non-face-to-face services, and they have actively advanced the differentiation of non-face-to-face services in many commercial fields.

According to the 2020 PwC global consumer survey (PwC, 2020), changes in consumer behavior after COVID-19 are expected to lead to more fundamental changes. Online shopping, which had been growing rapidly even before COVID-19, is now expanding into the traditional offline bullish food and beverage sector, and therefore retailers are required to take a more efficient and integrated approach to online and offline strategies. Also, expectations for well-being and for health-conscious products and services will lead to more purchases, increasing consumers’ awareness of the future environment, and emerging as a new pattern in pursuit of healthy consumption. In other words, due to COVID-19, non-face-to-face consumption has begun to become routine compared to the past.

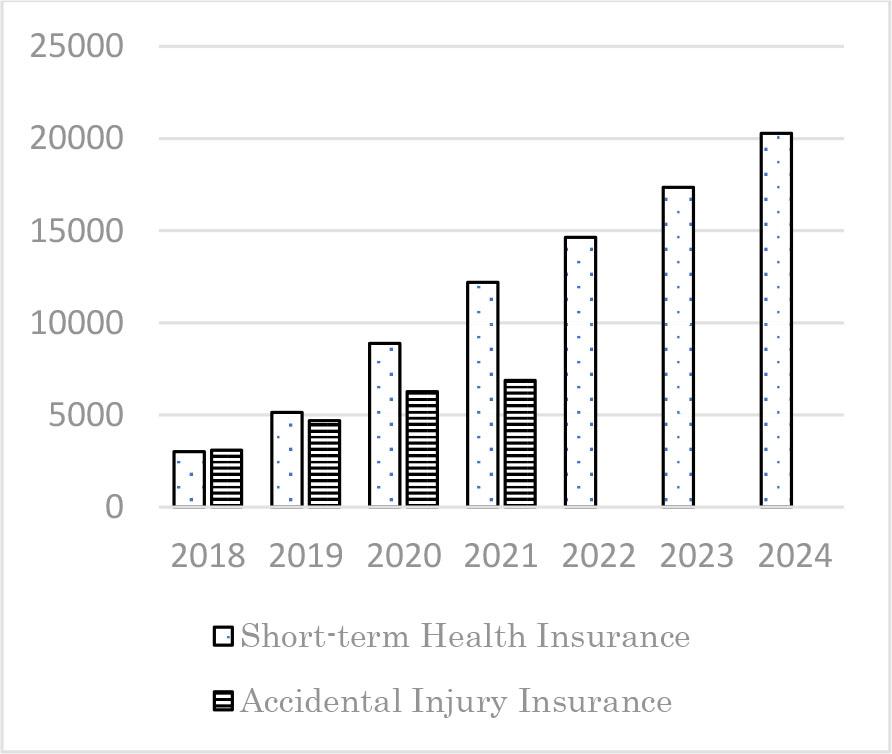

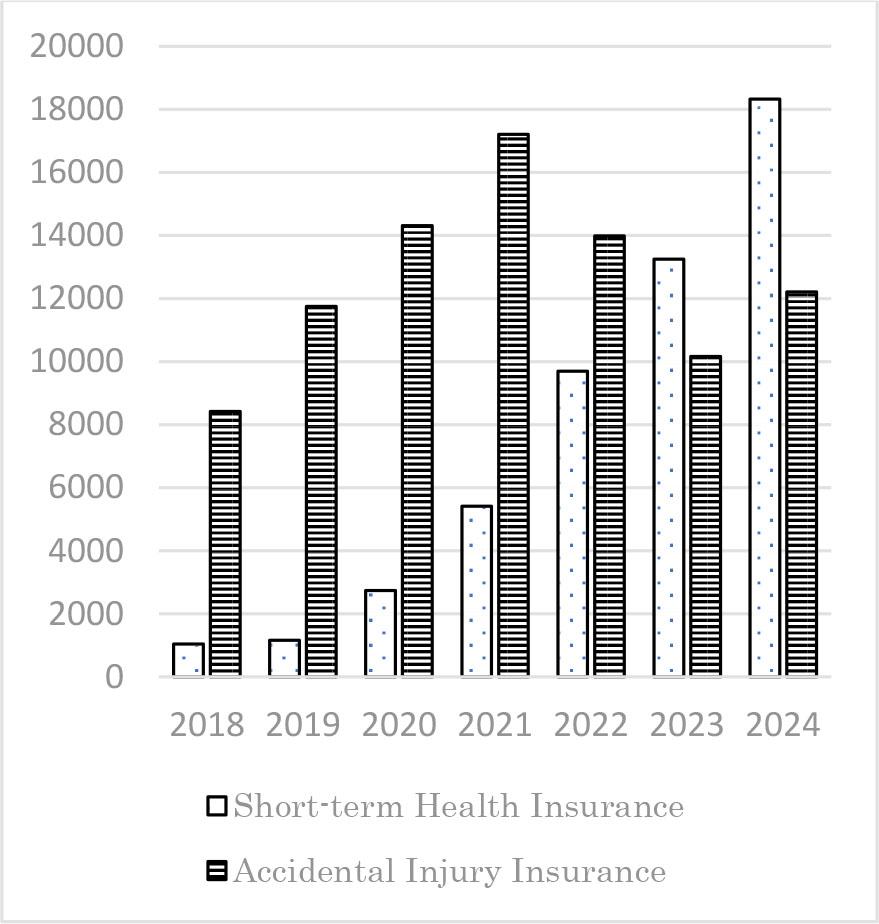

The demand for health insurance and accidental injury insurance related to COVID-19 increased dramatically in China during the period 2019 to 2024. According to Figures 1 and 2, China Pacific Insurance Company’s (CPIC) short-term health insurance increased by about four times from 2019 to 2024, and accidental injury insurance correspondingly doubled. Ping An Group’s short-term health care insurance premium income increased from 1.162 billion RMB in 2019 to 18.328 billion RMB in 2024, depicting a tremendous accelerating period, meanwhile, accidental injury insurance premium income increased from 11.75 billion RMB in 2019 to 17.20 billion RMB in 2021. And Ping An’s Annual Results Report also denotes a decrease in the accidental injury insurance premium income from the year 2022 since the impact of Covid-19 get controlled. CPIC announced a policy to compensate for 25% of the insurance payout stipulated in the insurance contract as a special provision for critical illness insurance for seriously ill patients with COVID-19 and it can be applied to 16 different long-term illness insurance products.

CPIC’s Total Premiums for Short-term Health Insurance and Accidental Injury Insurance in China (Million RMB)

Source: Yearbook of China’s Insurance 2019-2022. CPIC Annual Report 2022–2024.

Pin An’s Total Premiums for Short-term Health Insurance and Accidental Injury Insurance in China (Million RMB)

Source: Yearbook of China’s Insurance 2019-2022. Pin An Annual Results Report 2022–2024.

Ping An Insurance Group added a COVID-19 special provision to 32 disease insurance products; hence, the insured can receive up to 500,000 RMB in insurance money if the insured already has a severe level of illness and got COVID-19.

Insurance companies in Japan, China and South Korea introduce new products in response to the social changes and changes in insurance demand caused by COVID-19. The shift toward digital insurance was also enhanced by COVID-19 and insurance distribution channels have changed.

Insurance companies made new efforts to respond quickly and flexibly to claims handling and other needs due to the restrictions and infection concerns associated with COVID-19. For example, to avoid face-to-face contact with policyholders, insurance applications, consultations, and confirmation of policy contents are shifting to online and telephone-based services. Insurance companies themselves are also enhancing online insurance application acceptance and provision of quotes.

The increased risk of infection due to COVID-19 led to an increase in telephone and online procedures for soliciting insurance policies, medical examinations, and insurance contract renewals, which used to be done mainly in person. Many life insurance companies stopped imprinting their seals on policies and stepped up their efforts to provide online insurance subscription and consultation services. This allows customers to get consultations, buy insurance, and make an insurance claim over the phone.

In Japan, Sony Life Insurance enhanced its online insurance application and enrollment processes, as well as premium payments, due to the impact of COVID-19. In addition, to avoid customer contact, the sending and receiving of insurance policies was transitioned online, and the online insurance consultation service was also expanded so customers can now get a consultation and resolve questions about insurance comfortably at home. Sumitomo life insurance launched “Paypay Hoken” which allows customers to pay premiums and complete enrollment procedures using the Paypay application. “Paypay Hoken” offers a variety of insurance plans, including cancer insurance, medical insurance, and death benefits, with premiums set in a reasonable price range.

In addition, life insurance companies expanded the use of automated policy purchase machines that allow customers to buy insurance and confirm insurance policy details on their own, hence customers can complete insurance-related procedures at their convenience and insurers can respond flexibly to customer needs. For example, Mitsui Sumitomo Aioi life insurance has started to sell cancer insurance at 7-Eleven, the largest convenience store chain in Japan, since July 2020. Previously, insurers sold some general insurance products such as auto insurance, bicycle insurance, and leisure insurance before COVID-19 at convenience stores, but they started to sell life insurance at convenience stores after COVID-19. Life insurance is generally purchased through consultation with a sales representative, but afterCOVID-19 contact with customers in person became difficult so non-face-to-face insurance contracts through convenience stores were instituted. After entering the basic information required for an insurance contract through the customer’s mobile and computer, customers can visit 7-Eleven to apply for insurance products, complete payment at the cashier, and purchase insurance.

In Japan, in the case of automobile insurance, online quotes and contracts are increasing to prevent the spread of COVID-19. In addition, an increasing number of insurance companies are considering customer needs, such as launching new plans that offer discounts on insurance premiums according to the decrease in vehicle usage. For example, SOMPO Holdings introduced “SOMPO Rakuraku Online Automobile Insurance”, which allows customers to purchase insurance from the comfort of their own home, with online procedures from quotation to contract. Furthermore, in the area of fire insurance as well, the requirement to stay in one’s own home has promoted online quoting and contracting, lowering the threshold for purchasing insurance, while fire insurance products tend to be revised more frequently than in the past.

In China, sales of large pension insurance and savings-type insurance products in life insurance have been traditionally conducted through face-to-face distribution, but since COVID-19 life insurers have been actively pursuing online sales and setting up online insurance claim systems. For instance, China Life and Ping An developed their own apps and used online videos and online casts to conduct internal education for employees, recruit sales staff, and open channels for payment of insurance claims. Huatai Insurance and Taikang Life Insurance have begun to promote data collection and insurance sales through third-party Internet platforms.

In China, in the past 85% of general insurance transactions were conducted mainly via insurance agencies and managers, but this sales pattern has changed significantly since COVID-19 (Zheng, 2022). Some general insurance companies are using Tencent’s WeChat SNS platform and apps developed in-house to introduce insurance products and perform support tasks such as confirming the number of insurance claims. Other examples of changes in insurance sales are the People’s Insurance Company of China (PICC) and Ping An. PICC has used GPS and drones to provide insurance contracts with high levels of customer satisfaction for agricultural insurance and Ping An made its “Ping An Doctor” app to promote the sale of short-term medical insurance and accidental injury insurance products.

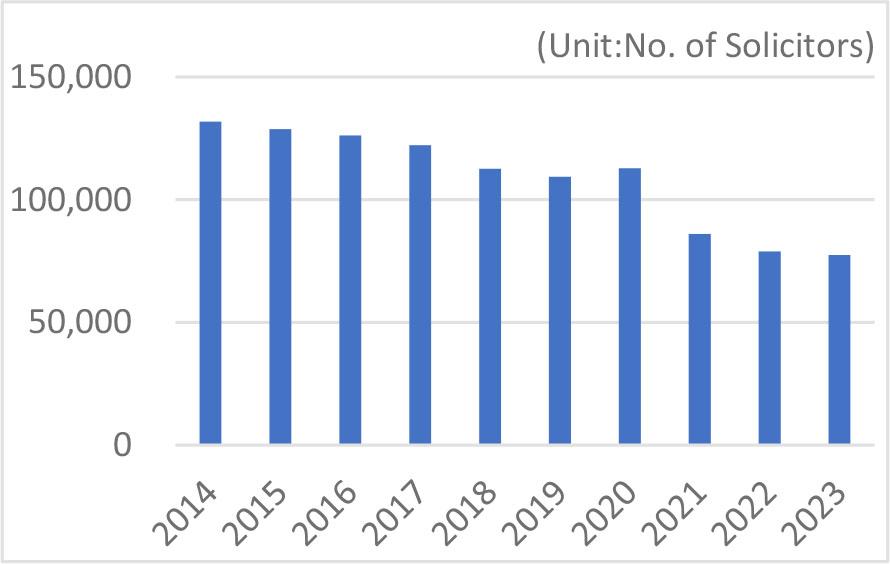

In South Korea, although the majority of life insurance policies is still sold through face-to-face distribution channels, the trend is toward non-face-to-face distribution channels. Compared to the past, non-face-to-face sales have become more representative and the COVID-19 pandemic appears to have hastened the trend (Figure 3). Non-face-to-face distribution channels will be revitalized in the near future, and insurance comparison and recommendation services via online websites or apps are attracting attention. In fact, given that the advancement of digital sales channels has become an irreversible trend, the industry is particularly interested in changing the workforce structure of life insurance companies. To that effect, it expects to be able to launch non-face-to-face distribution channel solutions for complex whole life insurance within a few years.

Status of Solicitors of Life Insurance Companies in South Korea (Year-end basis)

Source: KLIA (Korea Life Insurance Association), www.klia.or.kr/

In South Korea, as the financial environment has changed after COVID-19, non-life insurers are also strengthening their non-face-to-face distribution channels. The share of premiums of non-face-to-face channels was 5.2% in Q3 2019 and 6.7% in Q3 2021. It’s increasing every year. Since the COVID-19 pandemic, the number of new polies of face-to-face sales by non-life insurers has been stagnant since 2019, showing from 58.75 million in 2019 to 58.18 million in 2021. However, the proportion of non-face-to-face sales is increasing from 31% in 2019 to 34.3% in 2021. The reason is that mainly products with simple and standardized product structures for the CM (cyber market) channel which consumers actively seek out and sign up for.

New products introduced in response to COVID-19 include enhanced hospitalization benefits, coverage for hospitalizations resulting from COVID-19, and online health management and medical consultation services. In Japan, insurance providers are discontinuing certain products and introducing new ones in response to the financial challenges associated with covering presumed hospitalization caused by COVID-19.

First, in October 2020, AXA life Japan launched two new products – AXA Infectious Disease Hospitalization Insurance and AXA Infectious Disease Leave Insurance – which cover risks such as hospitalization and absence from work due to COVID-19 infection. The AXA Infectious Disease Leave Insurance covers a certain period of salary if an employee is unable to work due to self-isolation or medical treatment caused by an infectious disease. Specifically, it covers absence from work due to designated infectious diseases, such as new coronavirus infection. AXA Infectious Disease Hospitalization Insurance is an insurance policy that reduces the financial burden during hospitalization if it becomes necessary due to a designated infectious disease.

Sumitomo Life’s Paypay Hoken added “Influenza Sympathy Money Insurance”, which pays a certain amount of sympathy money depending on the length of hospitalization and medical treatment in the event of an influenza-related illness. For example, if a patient is hospitalized for three days, the policy pays 10,000 yen. This insurance can be used to cover sudden medical and living expenses in case of unexpected hospitalization or medical treatment due to influenza.

AIG general insurance in Japan launched a “Specified Insurance Product for New COVID-19 Infectious Disease” which can be added to AIG Japan’s accident insurance products and includes COVID-19 infections as an illness covered by insurance claims. It has the advantage that if an insured person requires hospitalization and treatment due to infection with a new type of coronavirus, the policy will pay claims in addition to regular personal accident insurance.

Second, SOMPO Japan Nipponkoa Insurance launched a “COVID-19 Solatium” insurance product on May 25, 2020. This is not a policy that includes hospitalization costs for a certain period, salary protection, or death benefits in the event of a new type of coronavirus infection, but rather a solatium that is paid to those with minor illnesses that do not require hospitalization or those who self-isolate. However, due to the number of people infected with COVID-19 being much higher than expected, the insurance company suspended sales of this policy as of March 31, 2021. In April 2021, SOMPO also launched a new product called “JAL New COVID-19 Special Insurance” which covers hospitalization, treatment, and tests for COVID-19, so it is expected to be in demand by people who are concerned about the risk of infection when traveling abroad.

Third, Tokio Marine & Nichido Fire Insurance launched a “Telework Disaster Insurance” in October 2020 which covers telework and telecommuting. It provides medical and hospitalization costs in the event of accidents or injuries to people working at home, as well as income compensation in the event they are unable to work. As telecommuting has increased, the risk of accidents and injuries at home is also increasing, so interest in this product seems to be expanding.

In China, PICC launched three new infectious disease insurance products after COVID-19: Employer Liability Insurance Plus Infectious Disease Liability Insurance, School Liability Insurance Plus Infectious Disease Insurance, and Freight Forwarder Liability Insurance Plus Infectious Disease Insurance. “Employer Liability Insurance Plus Infectious Disease Liability Insurance” is included in small and micro-enterprise guardian insurance, which is sold in combination with basic property insurance and business interruption insurance. “Small and Micro-Enterprise Guardian Insurance” are limited products for companies that have under 15 employees, and they can choose one from three levels of insurance coverage. If an employee is confirmed to be infected with the COVID-19 at the insured company’s office and, as a result, the business is interrupted and incurs losses due to COVID-19, the insurance company will compensate for the damage.

In South Korea, insurance companies are gaining attention and responding by launching a variety of online mini-insurance products at affordable premiums that cover the illnesses and injuries that consumers need. The mini-insurance market is formed by online insurance and general insurance companies, and life insurers have entered it since COVID-19. Mini insurance is always a specific coverage with a narrow range of products, and the trend of mini-insurance leveraging digital platforms aimed at Gen MZ (Millennials and Generation Z) is expected to continue. Also, online mini-insurance is a cancer insurance product that is optimized for the needs of a single household and focuses on medical and long-term care costs and can be purchased through non-face-to-face online channels. Through insurance DIY, which allows consumers to choose from a specific coverage range based on family history and lifestyle, the barrier to insurance enrollment for 20s and 30s households was relaxed with reasonable premiums. With the revision of the Enforcement Order of the Insurance Business Act, the small-amount and short-term insurance business was introduced, and related markets are expected to be revitalized in the future.

In South Korea, general insurance companies have introduced special products to help pay for treatment during quarantine due to infectious diseases, and recently launched a “Vaccine Insurance” to cover side effects caused by increased COVID-19 vaccinations. According to the South Korea general insurance industry, Hyundai Marine & Fire Insurance, Samsung Fire & Marine Insurance, DB Insurance, and KB Insurance are selling “Vaccine Insurance” and “Vaccine Side-Effect Insurance” as a rider of health insurance or of main contracts (Table 3). This does not cover muscle pain, headaches, and blood clots, which have been reported as side effects of the vaccine but is a rider for anaphylactic diagnosis that applies only if a severe allergic reaction is diagnosed.

COVID-19 seems to have had the effect of speeding up changes in the insurance industry – both in terms of new product introductions and advances in digital distribution and servicing. These changes have potential benefits for consumers and the insurance industry but also may introduce some new problems.

In general, financial products are traded based on trust as invisible contract products. In particular, the insurance industry is based on trust that insurance will be paid in the event of an accident in the future in return for insurance premiums (Courbage & Nicolas, 2020).

Nippon Life Insurance announced that it will introduce an exemption period for medical and other insurance policies from April 2023. If a person is hospitalized because of infection with the new coronavirus within 14 days of the start of coverage, he or she will not be covered. This is in response to the moral hazard risk of people who have subjective symptoms such as fever but do not reveal the fact that they are infected and apply for benefits.

Third, Dai-ichi smart small-amount and short-term insurance announced that since July 11 in 2022 they have stopped underwriting an insurance product that provides a lump-sum benefit of 100,000 yen if a person is diagnosed with a new type of coronavirus or other infection. They began offering this insurance from April 2021, and the premiums fluctuate according to the status of infection, such that the initial premium was 980 yen but the 2022 premium was 3,330 yen. Claims were particularly high for benefits due to deemed hospitalization and if the insurance policy includes coverage for hospitalization benefits, such as 10,000 yen per day for hospitalization, insurance benefits would be paid if a person received medical treatment for COVID-19. However, as the number of people infected with COVID-19 has been increasing dramatically, Dai-ichi has had difficulty maintaining this product.

Lastly, with the rapid spread of the infection after July 2022, not only Dai-ichi smart-amount and short-term insurance, but also other insurers’ payments to patients with documented hospitalization increased sharply. Against this backdrop, on September 9, 2022, Nippon Life Insurance, Dai-ichi Life Insurance, Meiji Yasuda Life Insurance, and Sumitomo Life Insurance, the biggest life insurers in Japan, announced that they would review their hospitalization benefits paid to those infected with the new coronavirus, starting with those diagnosed on or after September 26, 2022. Specifically, these insurers announced they will not pay hospitalization benefits to a person infected by a virus that is not equivalent to the new type of coronavirus, even if they receive overnight or home treatment.

Among the three countries, Japan has developed a product that guarantees income while unable to work due to COVID-19 infection. However, due to the rapid increase in patients, sales of COVID-19 compensation insurance products were also suspended. China has developed a product that pays insurance money to asymptomatic people infected with COVID-19, but in reality there are many cases where insurance money is not paid, causing complaints from financial consumers. South Korea has developed an insurance product that covers anaphylactic shock, a side effect of the COVID-19 vaccine, and various mini-insurance products aimed at targeting the MZ generation.

In China, Internet insurance companies and insurance agency platforms had sold various insurance products related to COVID-19 before December 2022. These products promised that when the insured were confirmed to be infected with COVID-19, even though they were asymptomatic, they could get insurance money ranging from 10% to 30% of the total amount of insurance. However, the actual rate of payment of insurance money was extremely low and the claim process was complicated and many consumers complained. Consequently, as China entered the fourth stage of its epidemic prevention policy, the sale of COVID-19 insurance products on the Internet has temporarily ceased.

The main problems for financial consumers in South Korea related to COVID-19 are a) the prevalence of several types of unlawful private finance targeting the public experiencing economic hardships due to the protracted COVID-19 crisis, and b) non-face-to-face financial services and related problems for economically alienated elderly people are increasing (Lim, 2021).

However, there are concerns that untact technology will accelerate the polarization of digital information among the so-called ‘digitally illiterate’ elderly and rural residents. The digital divide under COVID-19 refers to the disparity between people and regions with low digital skills due to the increased use of online information and services. The biggest impact of the digital divide caused by COVID-19 on insurance policyholders is that the elderly and those with low IT literacy may find it difficult to purchase insurance policies digitally because they are unfamiliar with the online process, despite the fact that the penetration of Internet usage among Japan, China, and South Korea has accelerated during the COVID-19 era.

Due to the characteristics of the insurance industry this digital divide is making it more difficult for the insurance industry to provide services to those who do not have access to an Internet environment, meanwhile, the insurance industry is also processing digitalization.

Along with the digitalization in insurance industries, the increase in online insurance applications and billing procedures has made it more difficult for those who are not digitally skilled to access insurance information. It is also noted that the elderly in rural areas have limited access to insurance information and services due to the lack of Internet access. On the other hand, those with greater digital skills can compare and examine insurance products online more easily, allowing them to make better insurance choices. The digital divide in Japan is pronounced by region, city, age, and income.

According to the Ministry of Internal Affairs and Communications in Japan, the ratio of whole individuals (over 6 years old) who had used the Internet in the last 10 year was 79.5% in 2012 and 84.9% in 2022. When looking at the Internet usage experience in the last 10 years by age group (Figure 4), in 2012 the lowest figure was 25.7% for those aged 80 or older, and the highest figure was 97.2% for those aged 13 to 29. Additionally, in 2022, the lowest figure was 33.2% for those aged 80 or older, and the highest figure was 98.6% for those aged 20 to 29.

Internet Usage Experience in the Last 10 Year by Age Group in Japan

Source: Ministry of Internal Affairs and Communications of Japan

Although the differences in percentages have decreased compared to 10 years ago and the penetration ratio of those aged 65 or above has increased by 2022, the digital divide is still large due to the disparity caused by digital literacy. In 2012, the gap in Internet usage experience between individuals in their 20s, 30s, and 40s and those aged 70 or above was more than twice as large. The Internet usage experience of individuals aged 60 and over has shown a substantial growth by 2022, as compared to 10 years before. Nevertheless, a significant gap remains between individuals in their 70s and above and those belonging to lower age groups.

Another example of the impact on Japanese insurance consumers caused by the digital divide is as follows. First, in 2020, Tokio Marine & Nichido Fire Insurance began offering QR codes that allow policy contents to be checked on a smartphone or computer for some insurance products, because of the time it often takes for insurance policies to arrive in the post. But in cases where QR codes are not available or there are other circumstances, the company also supports the mailing of insurance policies in a conventional way. Second, in January 2021, SOMPO Holdings also launched an “App Quote” service that allows customers to easily perform “Auto Insurance Quotes”’ on their smartphones, a procedure that previously had to be done in stores. However, this service requires a smartphone, making the service unavailable to those who do not have access to one.

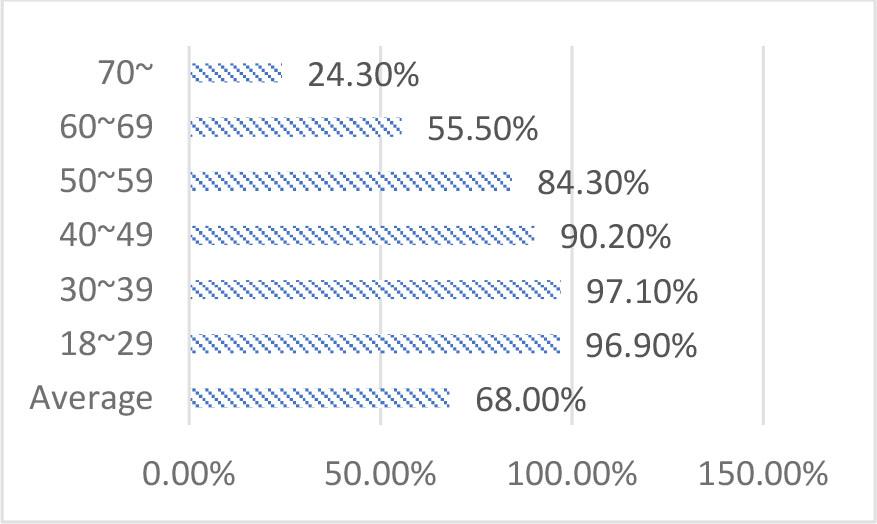

According to a report published by the Japan Research Institute in 2022 (Figure 5), the percentage of the usage of smartphones and tablets among people aged above 60 is much lower than that aged below 60. And only 24.3% of the people aged above 70 use smartphones or tablets often which reveals the disparity caused by digital literacy.

Percentage who Use Smartphones and Tablets Often, by Age Group

Source: Japan Research Institute, 2022, “The Current Status of the Digital Divide Problem for the Elderly, and Suggested Directions for Future Efforts by Local Governments”

According to the 2021 statistical report on the development of China released by the China Internet Network Information Center, the Internet penetration rate in China reached 76.4% by the end of 2023, with a total of 1078.5 million users. Due to COVID-19, the Internet penetration of China expanded to be 20% higher in the year 2022 than it was in 2018.

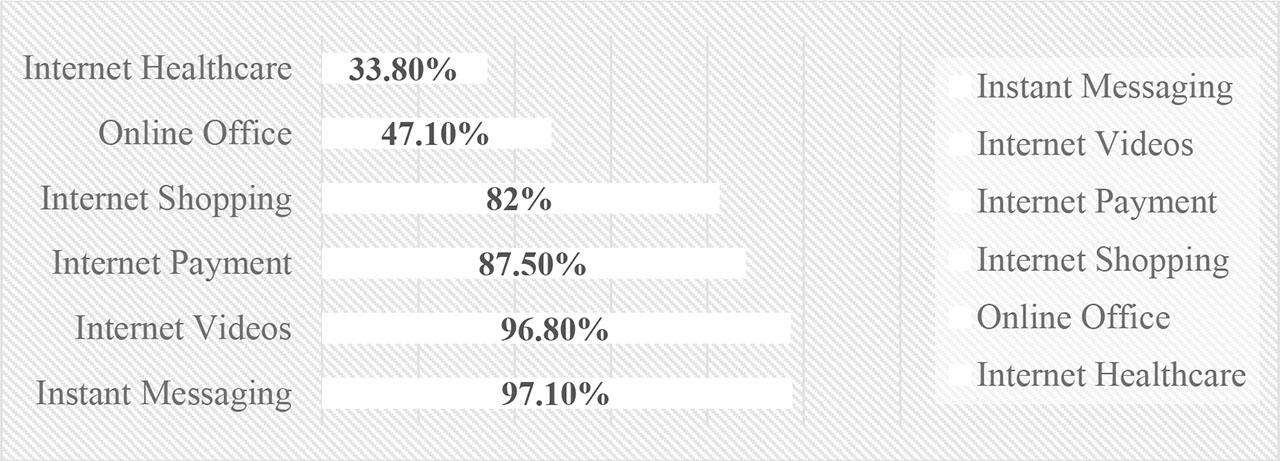

Unlike the situation in Japan, China’s Internet users who use smartphones to access the Internet account for 99.8% of the overall Internet users. However, the degree of digital penetration among companies and individuals and their grasp of Internet technology have revealed a digital divide against the backdrop of the pandemic. If we check the utilization rate of the various Internet applications (Figure 6), we find that usage of applications needing high Internet literacy – such as Internet Healthcare (33.80%) and Online Office (47.10%) – is much lower than usage of other applications. From the perspective of the public, due to the impact of the pandemic and strict epidemic prevention policies, people will inevitably have to get used to living their lives through the Internet.

Utilization Rate of Various Internet Applications

Source: CNNIC (August, 2023)

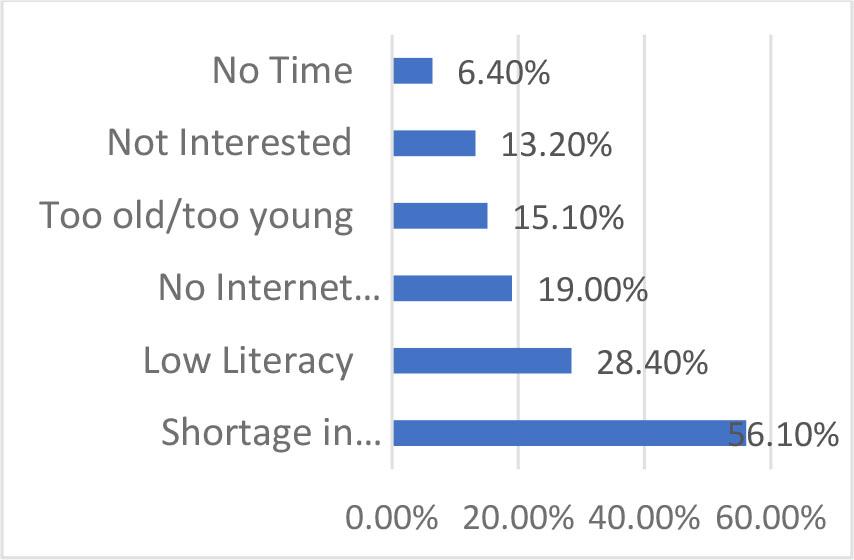

According to the data from the “China Internet Development Statistics Report” released by CNNIC in August 2023 (Figure 7), 56.10% of people in the group that does not use the Internet are unable to do so due to a lack of understanding of computer and Internet technology. This poses a challenge for people with low Internet skills, especially the elderly. For these people, not only is it difficult to purchase insurance through the Internet, but it may also be difficult to process insurance claims if they are involved in an accident.

Reasons for not using the Internet

Source: CNNIC (August, 2023)

For example, CPIC and Zhong An Insurance have introduced video damage appraisal apps and processes for car insurance due to the impact of policies such as area closures caused by the pandemic. Normally, policyholders with relevant knowledge of digital technology can smoothly process their insurance claims through their own app operation, but elderly people unfamiliar with smartphones or online video operations may not be able to cope. Therefore, insurance companies need to make efforts to promote the necessary digital technology and develop user-friendly methods with simple processing procedures that are easy for people with low digital skills.

The South Korea National Information Society Agency (NIA) stated in its 2021 digital divide survey that the information gap between generations and between classes appears to be a digital divide. The digital divide, which will further widen following COVID-19, will manifest itself in the elderly and may cause severe damage to consumption activities such as financial products (Choi, 2020).

According to the ministry of science and ICT, the ratio of whole individuals (above 3 years old) who accessed the Internet in the last 1 month was 78.4% in 2012 and 93% in 2022. When examining Internet usage in the last one year by age group (Figure 8), in 2012, the lowest figure was 9.7% for those aged over 70 years old, and the highest figure was 99.9% for those aged 10 to 29. In 2022, individuals over the age of 70 had the lowest percentage at 54.7%, while those aged 30 to 39 had the greatest percentage at 99.9%. There has been a notable rise in the percentage of individuals aged 40 and over who have gained experience in using the Internet in 2022 as compared to 2012. Specifically, the percentage of individuals in their 60s who utilized the Internet was 40% in 2012, but it saw a more than twofold increase to surpass 90% in 2022. In addition, individuals aged 70 or above had a significant and rapid increase in proportion, surging by nearly fivefold from a mere 10% to exceeding 50%. As of 2022, it has been established that there is a significant gap in Internet usage between individuals aged 70 or older and those in their 10s to 30s, with the former group seeing nearly double the difference. In other words, while the percentage of senior citizens using the Internet has risen in comparison to a decade ago, there is a significant gap in digital access between different age groups.

Internet Usage Experience in the Past Month by Age Group in South Korea

Source: Ministry of Internal Affairs and Communications of South Korea

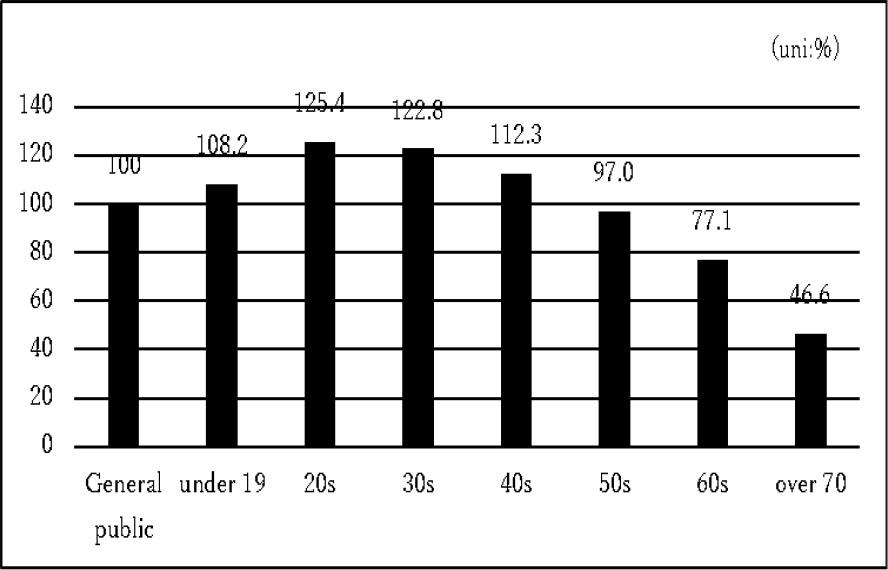

In South Korea, the difference in digital information ability levels between younger people and the elderly is about 2–3 times (Figure 9). As a policy for the protection of elderly consumers, financial companies have provisions for elderly financial consumer protection in the financial consumer protection model standards, and a government-led financial consumer education plan is being prepared. As COVID-19 increases the digital divide, it is necessary to strengthen policies for the elderly, such as the establishment of special organizations, financial education, and guidelines on financial companies.

Digital Information Ability Level by Age in South Korea

Source: National Information Society Agency of South Korea (2021)

COVID-19 created unparalleled disruptions across every segment of society in the world and the uncertainty it caused has affected the insurance industry and the behavior of financial consumers.

Responses in all three countries show product changes such as the development of new special products that cover damages caused by COVID-19, the addition of rider of insurance related to COVID-19 coverage to existing health and life insurance products, and coverage of hospitalization costs due to COVID-19. As consumer interest in medical and income loss insurance increased due to the influence of COVID-19, counseling, and subscription to related insurance products increased and products were also diversified. In the initial stages of COVID-19, insurance companies experienced decreasing sales and reduced capacity. In the future, infectious disease risks are expected to recur and lead to losses, so the insurance industry needs to work on the development of insurance products that cover infectious disease risks.

With respect to changes in insurance distribution channels, it is clear that the era of untact insurance has opened. Insurance companies in Japan, China, and South Korea are seeking non-face-to-face distribution channels in various ways, including the use of mobile apps, and are using non-face-to-face distribution channels in areas such as insurance subscriptions, insurance claims, insurance premium payments, and consulting. In addition, insurance companies in three countries have been strengthening the capabilities of non-face-to-face distribution channels through continuous expansion of digital investment in the internal business. Among the three countries, Japan is the only country that sells insurance products at convenience stores. Mitsui Sumitomo Insurance and Aioi Life Insurance sell auto insurance, leisure insurance, bicycle insurance, and cancer insurance in Japan’s largest convenience store chain, 7-Eleven. Financial consumers can purchase that insurance using unmanned devices in convenience stores and pay insurance premiums at the checkout counter. Compared to South Korean insurance companies, Japan and China seem to be more active in internal business investments, such as conducting online training for internal employees to strengthen non-face-to-face distribution channels, providing smartphones to all employees to support sales activities, and hiring additional employees.

By speeding the transition to digital insurance, COVID-19 increased the importance of the digital divide between the young and the elderly. The elderly and those with low Internet literacy may find it difficult to purchase insurance policies digitally because they are unfamiliar with the online process. The emergence of digital business models with the rise of Insurtech and Big Tech since COVID-19, and the aging of the population and emergence of the MZ generation as digital natives have expanded the need for new service delivery beyond traditional concepts.