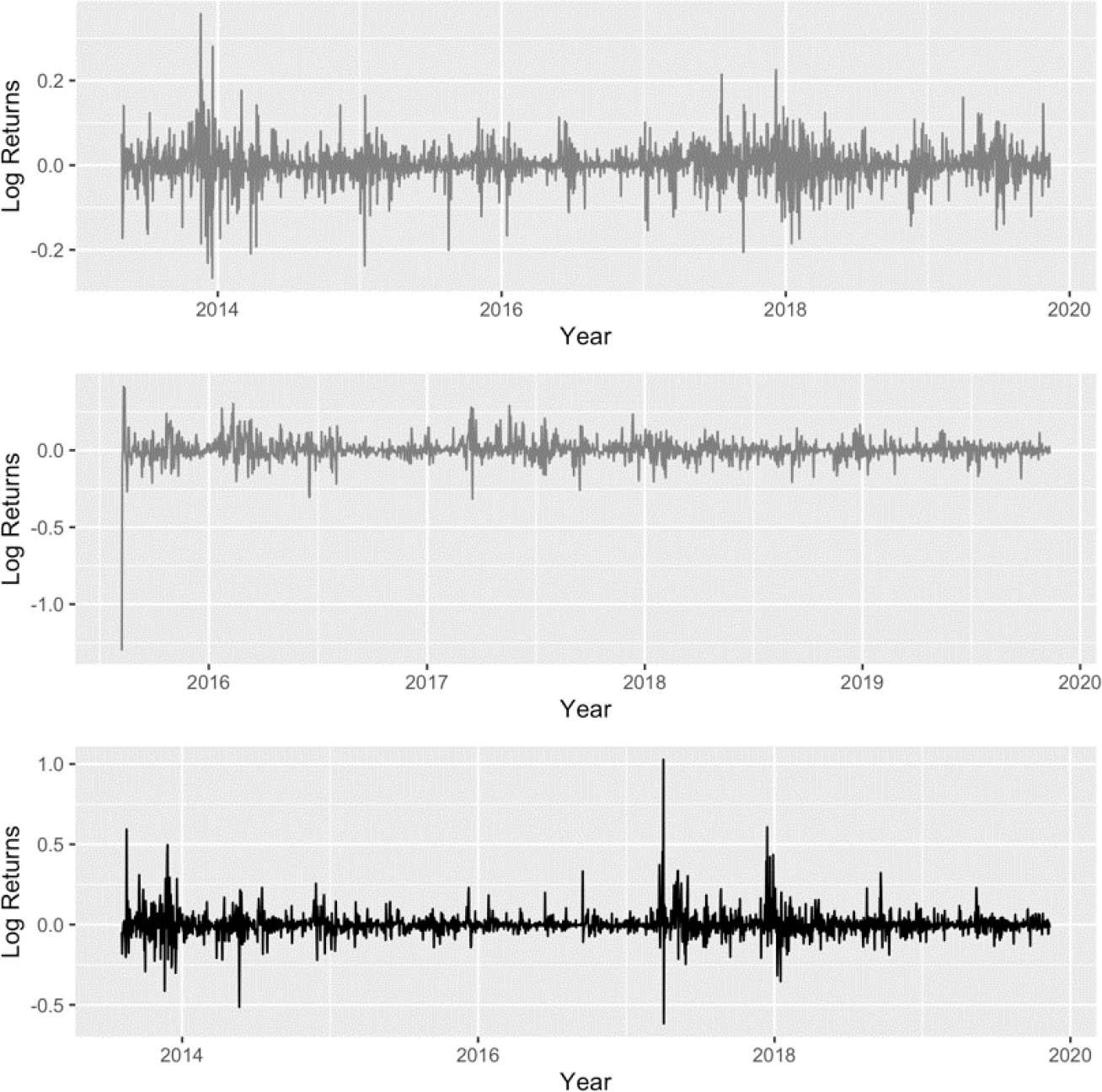

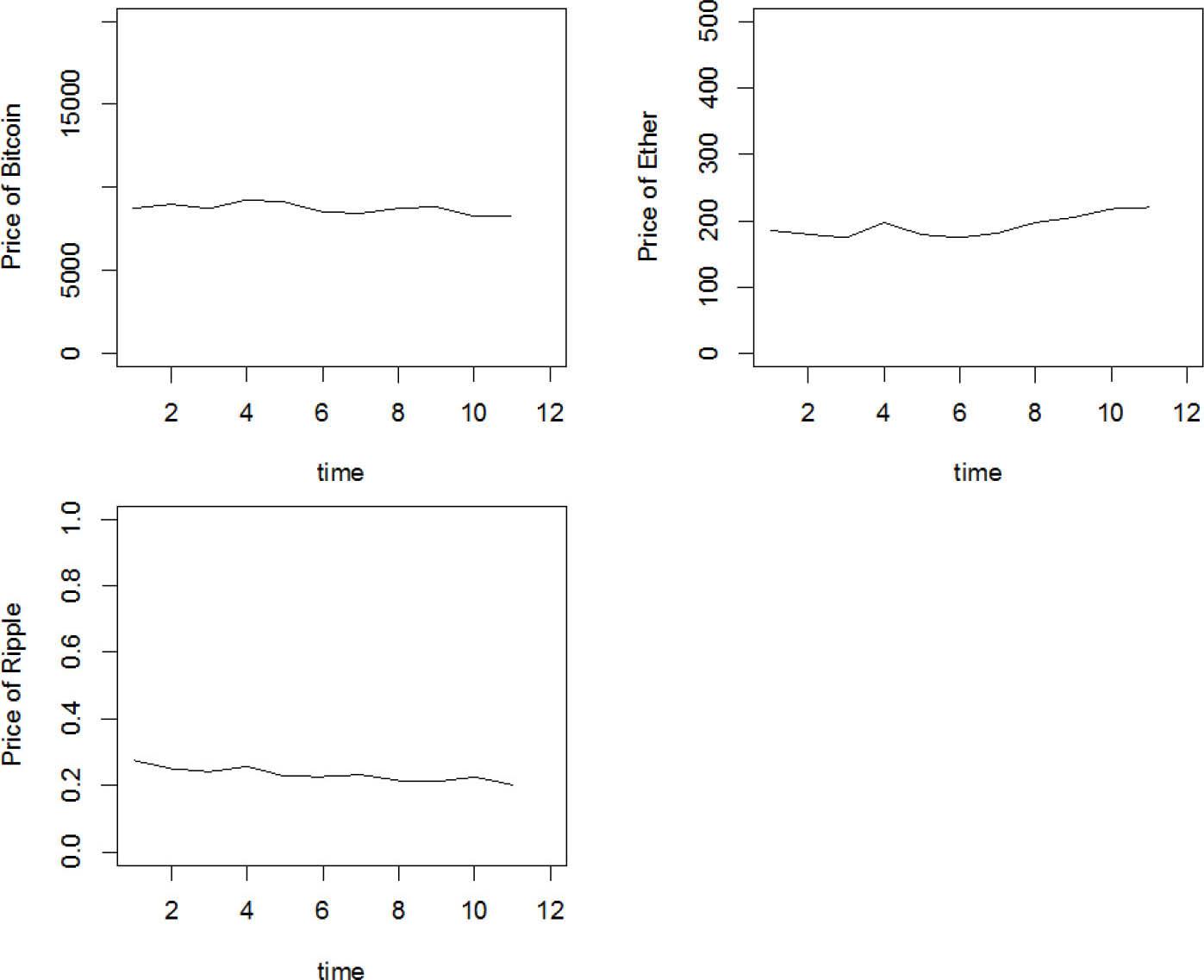

Figure 1

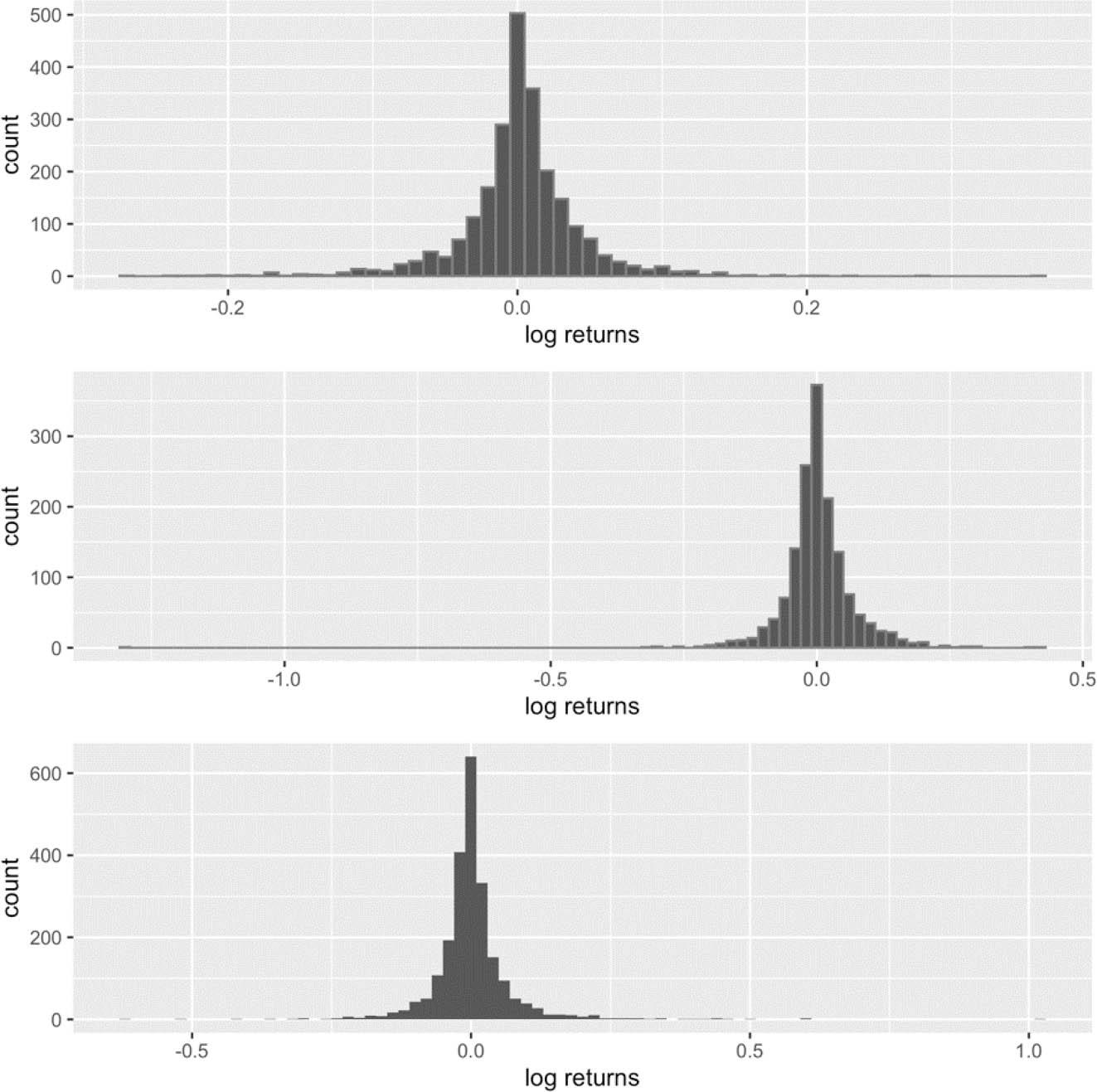

Figure 2

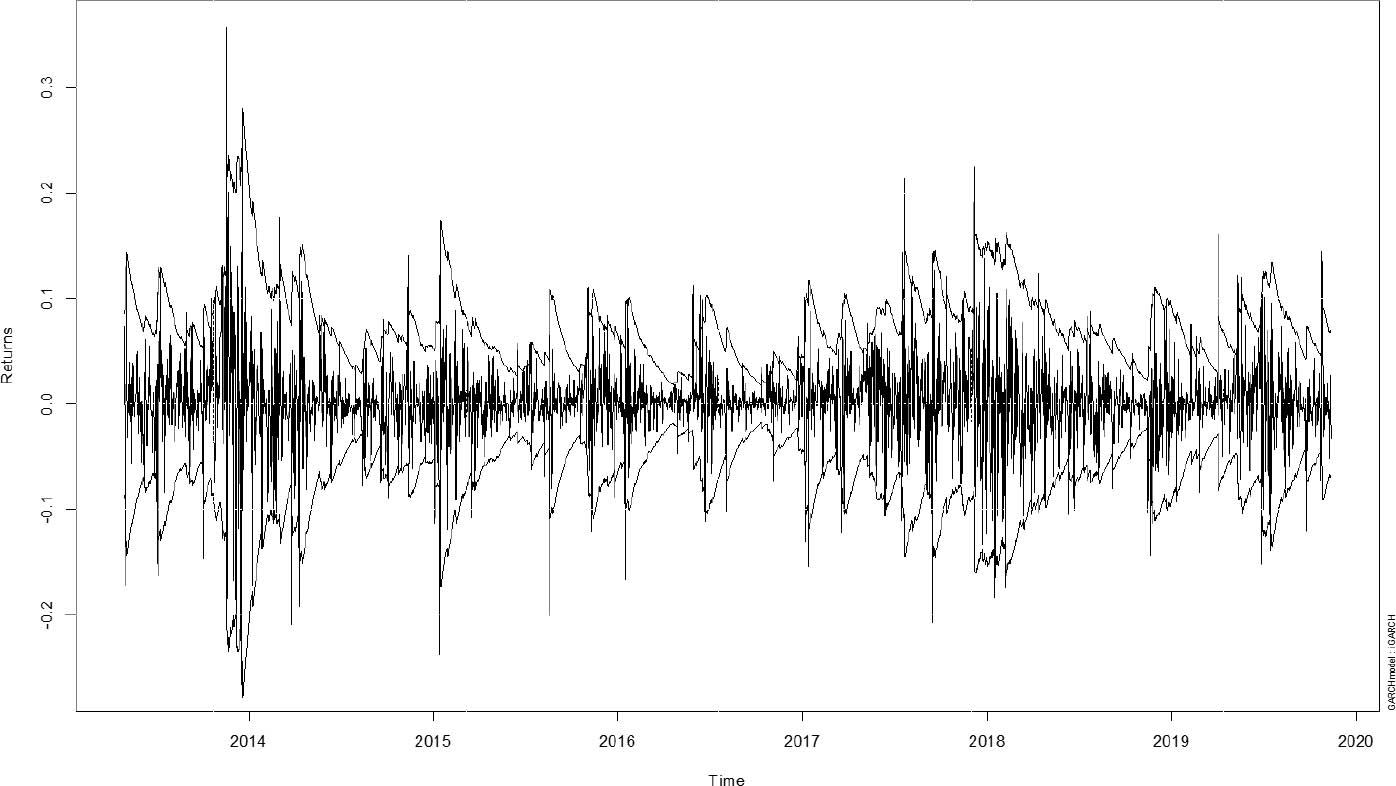

Figure 3

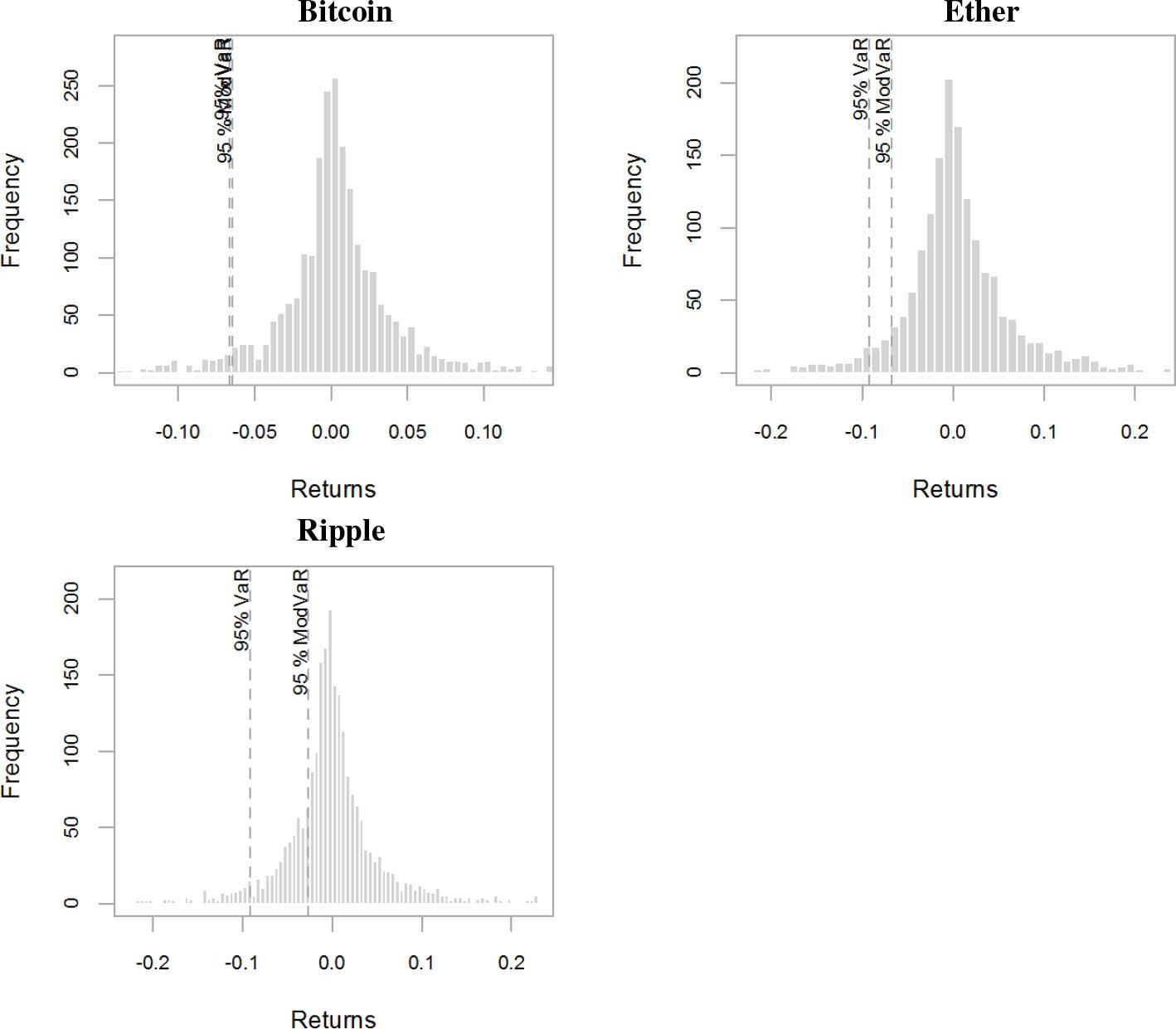

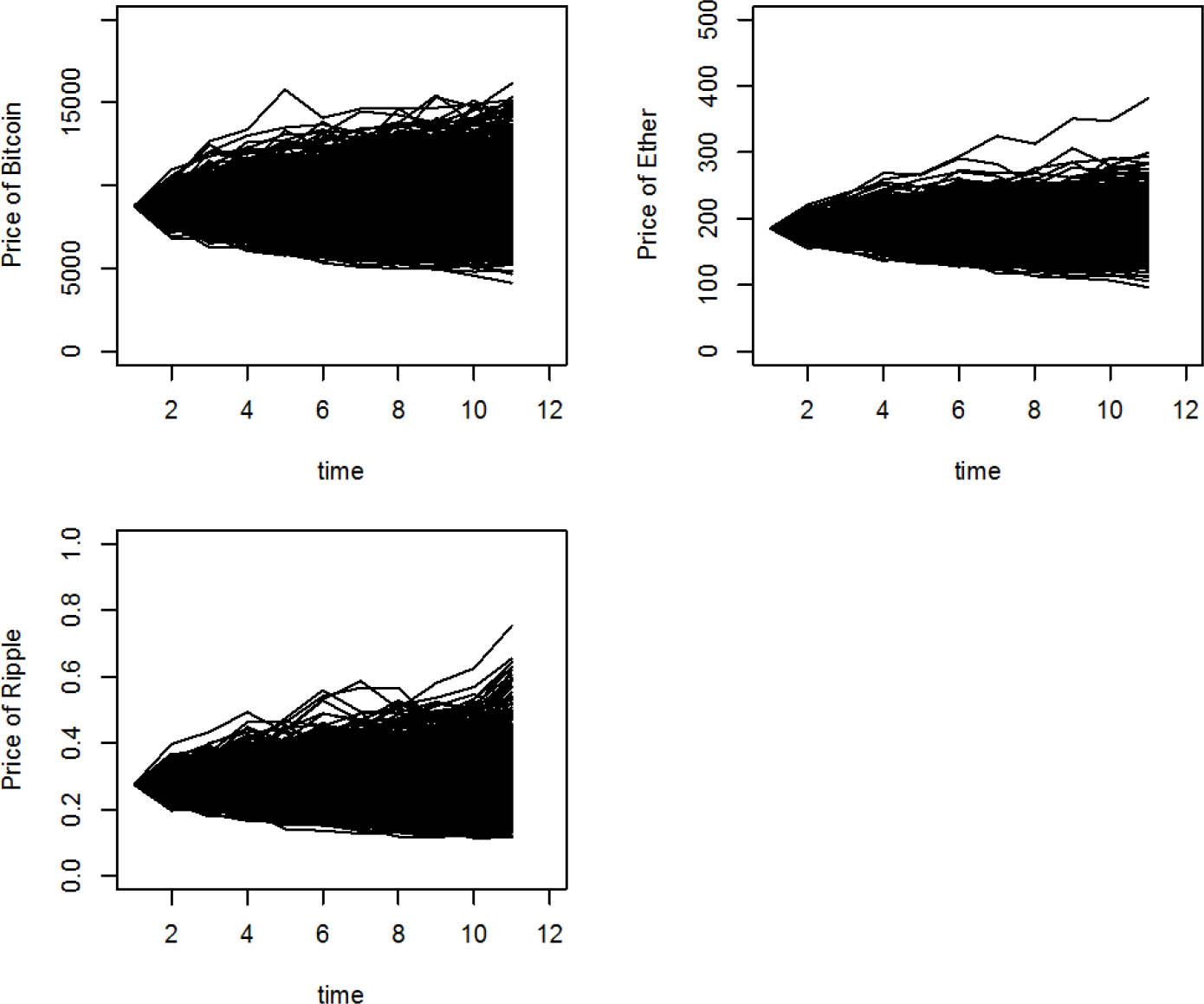

Figure 4

Figure 5

Figure 6

Basic statistics

| Bitcoin | Ether | Ripple | |

|---|---|---|---|

| Minimum | −0.266198 | −1.302106 | −0.616273 |

| Maximum | 0.357451 | 0.412337 | 1.027356 |

| 1st Quartile | −0.012615 | −0.024548 | −0.022698 |

| 3rd Quartile | 0.018402 | 0.0284860 | 0.020083 |

| Mean | 0.001750 | 0.002700 | 0.001679 |

| Median | 0.001883 | −0.000802 | −0.002762 |

| Sum | 4.178293 | 4.204154 | 3.845187 |

| Variance | 0.001848 | 0.005229 | 0.005384 |

| Stdev | 0.042991 | 0.072313 | 0.073372 |

| Skewness | −0.162197 | −3.412472 | 2.057162 |

| Kurtosis | 7.637610 | 70.186393 | 29.374596 |

VaR computed using GARCH model

|

| VaRt+1 | VaRt+10 | |

|---|---|---|---|

| Bitcoin | 0.03340 | $ 54.015 | $ 175.33 |

| Ether | 0.04028 | $ 66.314 | $ 257.69 |

| Ripple | 0.03958 | $ 68.740 | $ 336.26 |

Volatility and VaR forecast based on EWMA model

|

|

| VaRt+1 | VaRt+10 | |

|---|---|---|---|---|

| Bitcoin | 0.03351 | 0.03358 | $ 55.41 | $ 175.21 |

| Ether | 0.02972 | 0.02925 | $ 48.26 | $ 152.62 |

| Ripple | 0.03503 | 0.03489 | $ 57.57 | $ 182.05 |

Optimal parameters based on standard GARCH modelling

| mu | alpha0 | alpha1 | beta1 | |

|---|---|---|---|---|

| Bitcoin | 0.001095* | 0.000073*** | 0.143602*** | 0.824987*** |

| Ether | 0.000148 | 0.000407*** | 0.194669*** | 0.704177*** |

| Ripple | −0.003432*** | 0.000417*** | 0.397415*** | 0.594709*** |

Historical VaR

| Digital asset | Historical VaR |

|---|---|

| Bitcoin | $ 66.16 |

| Ether | $ 92.81 |

| Ripple | $ 91.88 |

Monte Carlo VaR

| VaRt+1 | VaRt+10 | |

|---|---|---|

| Bitcoin | $ 124.079 | $ 342.515 |

| Ether | $ 88.355 | $ 291.802 |

| Ripple | $ 160.696 | $ 490.118 |