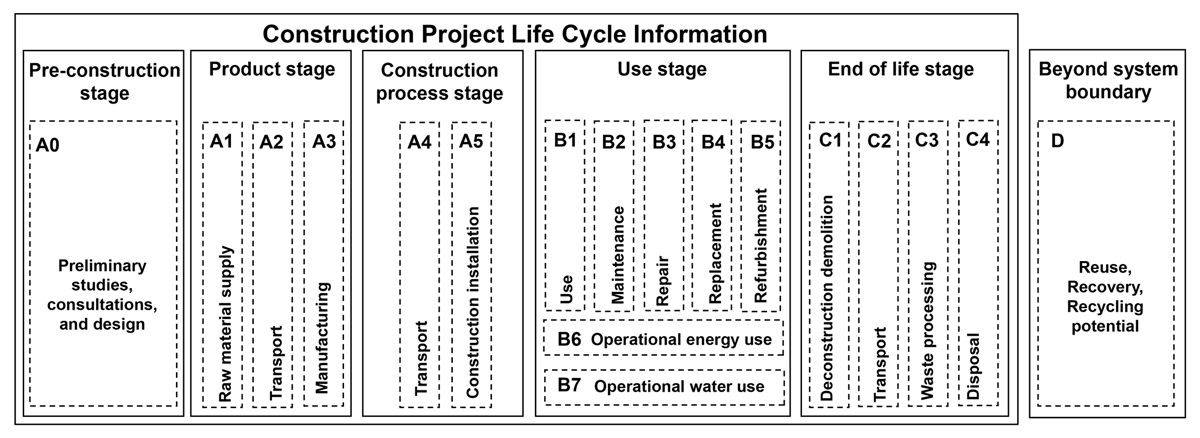

Figure 1

Building project life-cycle stages. Source: Crawford, Stephan, & Prideaux (2019), based on EN 15978:2011 and EN 15643-5:2017.

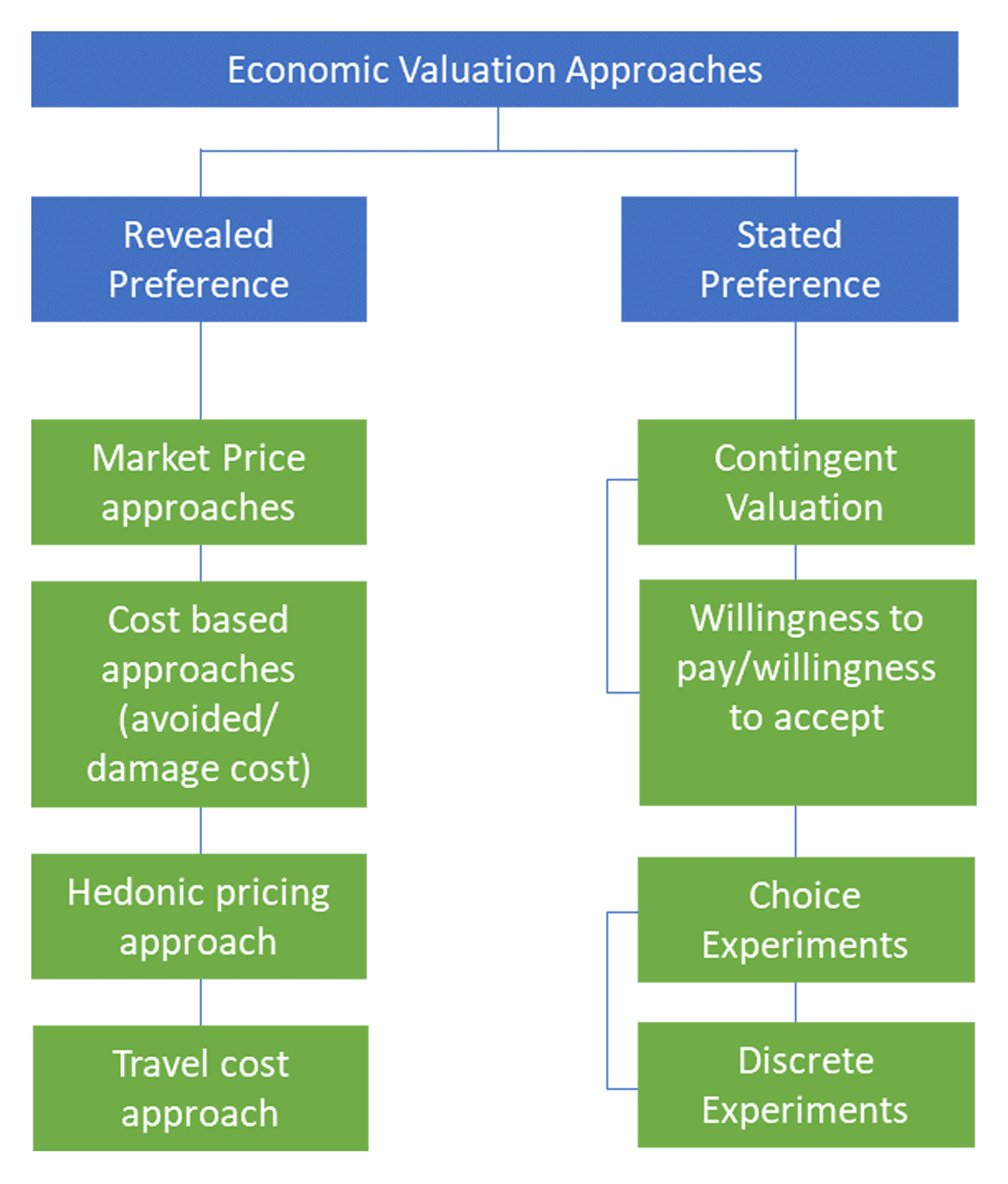

Figure 2

Economic valuation approaches.

Table 1

Advantages and disadvantages of economic valuation approaches.

| Approach | Advantage | Disadvantage |

|---|---|---|

| Market price approach | Market data available and robust. Uses standard, accepted economic techniques | Value of emissions might not represent the social cost of climate change. Limited to market goods and services |

| Cost-based approach | Good for assessing the outcomes of mitigation options to inform related policy decisions | Lack of transparency when it comes to the use of integrated assessment models. There are different assumptions and has a ‘black box’ nature |

| Hedonic pricing approach | Versatile and can be adapted to consider several possible interactions between market goods and environmental quality | Relatively complex to implement and interpret, requiring a high degree of statistical expertise |

| Travel cost approach | Based on actual behaviour, and therefore more reliable than methods based on the hypothetical behaviour of the respondents | Limited in its scope of application because it requires user participation. Cannot be used to measure non-use values |

| Contingent valuation | Can capture all use and non-use values. The use of surveys enables an estimation of hypothetical changes and their impact before they have taken place | Potential bias in response. Hypothetical market (not observed behaviour); resource intensive |

| Choice experiments | Use of surveys enables the collection of relevant socioeconomic and attitudinal data on the respondents that could be relevant for understanding the variables influencing social preferences and choices | Complex questionnaire development and data analysis. Budget and time demands are high |

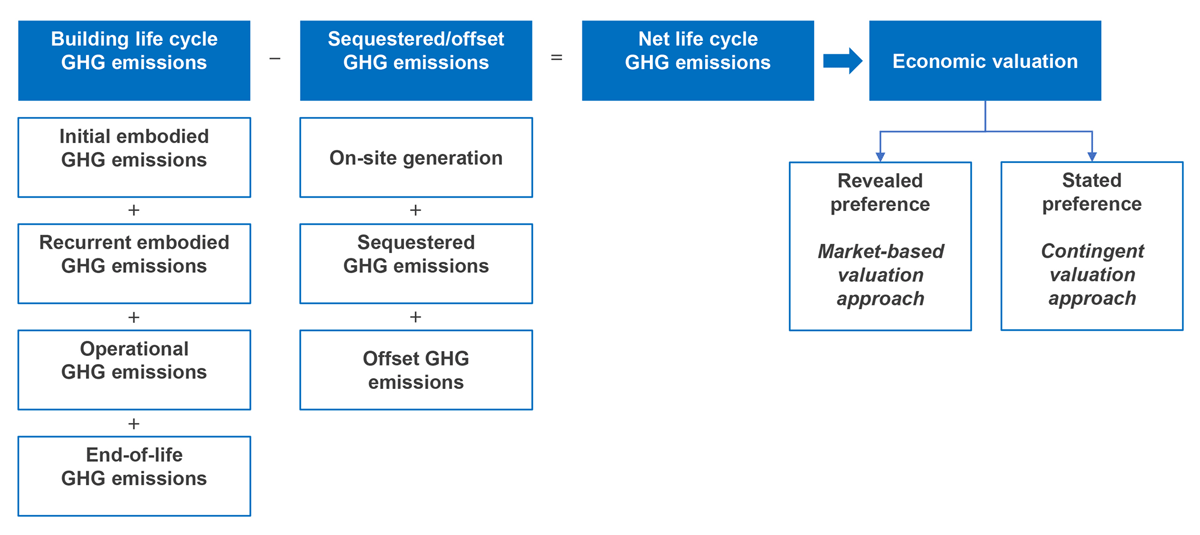

Figure 3

Key elements of the conceptual approach.

Table 2

Characteristics of the case study building.

| Building item | Detail | Building item | Detail |

|---|---|---|---|

| Gross floor area (m2) | 230 | External wall material | Brick veneer with 90 mm timber frame |

| Ceiling height (m) | 2.4 | Roof material | Concrete tile with timber truss |

| Number of bedrooms | 4 | Window material | Single glazed with aluminium frame |

| Length × width (m) | 19.7 × 14.8 | Floor material | Concrete waffle pod slab |

| Heating | 3-star gas-ducted heating unit | Insulation | Wall: R2 Glasswool batt; ceiling: R4 Glasswool batt |

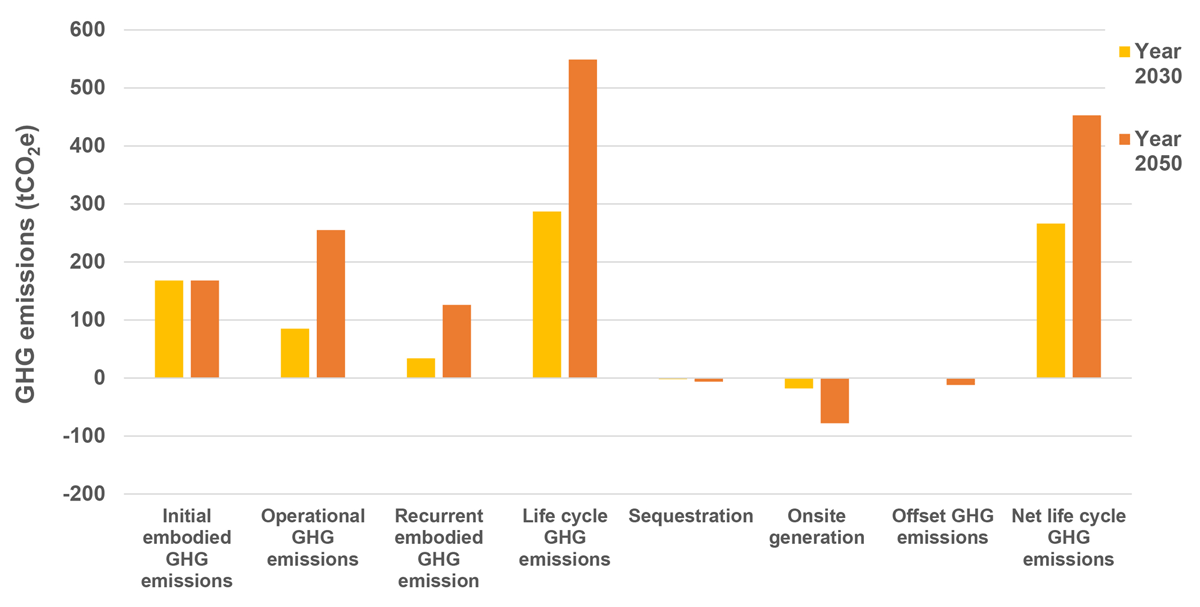

Figure 4

Total life-cycle greenhouse gas (GHG) emissions for case study building to 2030 and 2050.

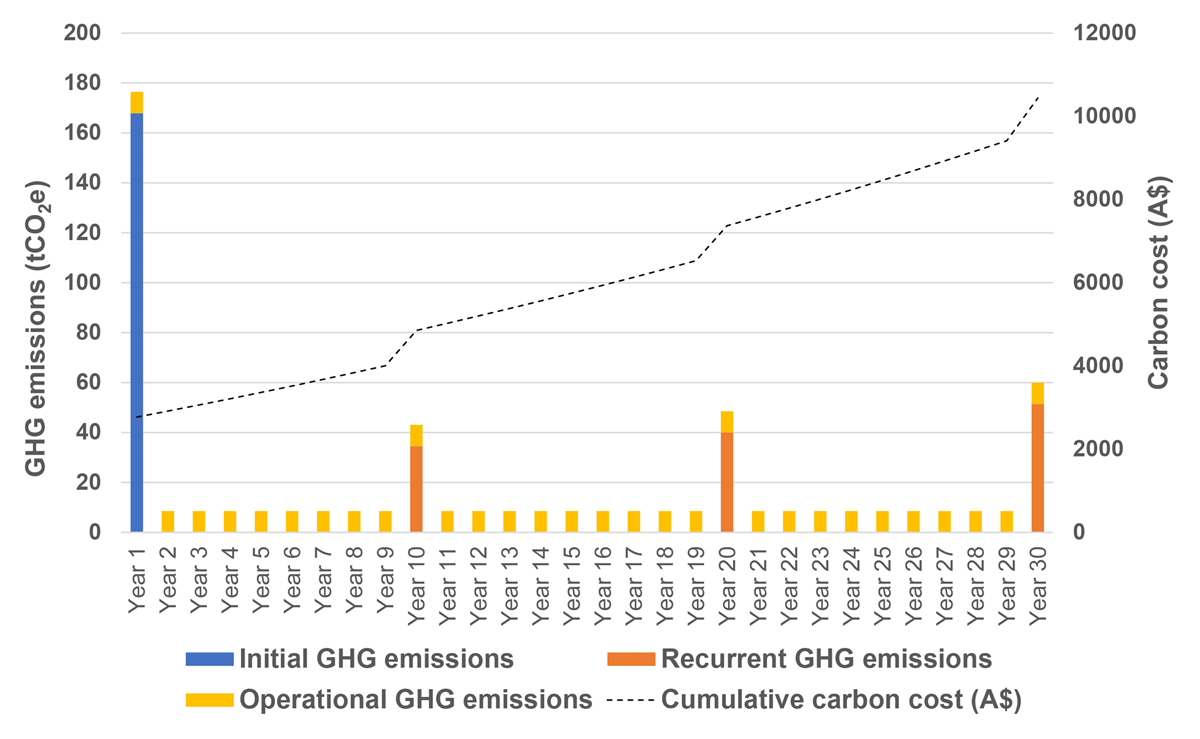

Figure 5

Cumulative carbon cost of case study dwelling.

Table 3

Economic assessment of the life-cycle greenhouse gas (GHG) emission costs for the case study building using the capitalisation approach.

| Description | Method | 2030(10 years) | 2050(30 years) |

|---|---|---|---|

| Capitalised value of GHG emission costs: GHGCV | Annual net GHG emissions multiplied by the carbon price capitalised, plus initial and recurrent embodied GHG emissions multiplied by the carbon price | A$5854 | A$6767 |

| Annualised capitalised costs: GHGCpa | Total costs over a period are then annualised to provide an annual payment amount (2% discount rate) | A$652 | A$302 |

Table 4

Economic assessment of the life-cycle greenhouse gas (GHG) emission costs for a case study building using a cash flow approach.

| Description | Cashflow treatment | 2030(10 years) | 2050(30 years) |

|---|---|---|---|

| PV of life-cycle GHG emissions: GHGCPV | PV of cashflows (GHG emissions × carbon price) | A$4652 | A$7860 |

| Annualised PV of life-cycle GHG emissions: GHGCcfpa | Annualised cost over the time period—discounted | A$518 | A$351 |

[i] Note: PV = present value.