The ability of local government units (LGUs) to generate revenue, referred to as revenue potential, is dependent on various factors. Among the most important ones are population size, age structure of the population, level of development and economic structure of the LGU, level of infrastructure development, condition and type of properties, and local tax policy [Malinowska-Misiąg, 2020].

It should be highlighted that the determinants of the revenue potential of LGUs can vary depending on the country and region (due to their specificity, such as natural resource wealth). The indicated main factors influencing the analyzed revenue potential are complex and interact with each other; therefore, assessing it, as well as its conditions, requires considering multiple aspects and analyzing local conditions.

As observed, the revenue potential of LGUs is influenced by the size and structure of the residents of a given unit. It is the residents who largely determine the size of the tax base of that unit. And although the literature on this subject increasingly addresses the topics of depopulation and population aging, their impact on the revenue potential of LGUs is rarely analyzed. These processes, especially population aging, are typically considered in the context of the pension and social security systems, labor market and workforce constraints, healthcare and social services, economic growth and consumption patterns, and public finance balance [Rouzet et al., 2019].

The analyzed demographic phenomena evoke and will generate challenges for the future functioning of LGUs in terms of funding their activities and ensuring access to public goods and services. This issue is worth addressing as depopulation and population aging occur in significantly diverse spatial patterns. The greatest variation exists in Poland among the smallest (basic) LGUs – units, which simultaneously have the broadest range of public tasks to fulfill and public revenues to manage, and are the only ones in Poland with limited taxation authority over specific sources of revenue. Hence, they will be the subject of this study. The research will focus on demographic phenomena occurring in Poland and their spatial variations, with the aim of determining their impact on the size of revenues, especially those most influenced by population aging – namely, revenue from personal income tax (PIT) and property tax. These indicated revenue sources are significant fiscal revenues for LGUs.

The paper attempts to address the following research questions:

What is the extent of spatial differentiation in the aging process of the population in Poland, considering LGUs?

Does population aging affect selected categories of LGUs revenue?

What could be the consequences of population aging for the revenue potential of LGUs in the near future?

Answering the research questions formulated in this manner required the utilization of methods typical for social sciences, including empirical research methods, particularly observation, comparison, and measurement. The analyzed demographic phenomena were described using data provided by Statistics Poland. Determination of the effect of population age on the size of chosen categories of LGUs revenue was made using the correspondence analysis, which is a statistical method for summarizing tables and analyzing the relationship between two or more categorical variables. Thanks to this multivariate technique it was possible to make visualization of this relationship in two-dimensional space in the form of the so-called perceptual map.

Data from the Local Data Bank, which is the largest database in Poland on the economy, society, and the environment was used for the purpose of our analysis. The analysis covered all municipalities in Poland (with a focus on cities with county rights) in 2011 and 2021, the years in which the national population and housing census was conducted in Poland.

The problem of aging is crucial and concerns everyone in developing and developed countries. Thus, it is a subject of extensive research in many disciplines [Fernandez-Carro, 2012]. In the studies conducted so far, the issue of population aging is often addressed as a socioeconomic problem, and much less frequently as a development opportunity (silver economy). The conducted analyses usually pertain to the national level, and somewhat less to the regional or local levels. Many of these studies focus on relatively narrow topics such as housing, transportation, the labor market, or the activation of elderly individuals [Wąsowicz and Kula, 2016]. Considerable attention in the literature is also devoted to the connections between demographic changes and public finances [Sanz and Velázquez, 2007]. However, these debates are mainly conducted in the context of rising social security, health care, or declining tax revenues and are considered from the perspective of central budgets expenditure [Disney, 2007]. Increasingly, researchers are also addressing the issue of rising budget expenditures, including at the local level, in the context of meeting the growing needs of the elderly population [Kopańska, 2023]. A matter that often receives little attention is the demographic changes that impact on the budgets of lower levels of public management. As various authors demonstrate, for instance, Lee and Edwards [2001] for the United States or Seitz [2007] for Germany, changes in the age structure and number of the population have varying effects on the finances of different levels of public administration. The analyses indicate that population aging can result in vertical fiscal imbalances at different levels of governance, which necessitates the distribution of revenues among various levels of public management adjusted to demographic changes.

In the literature, it is extremely rare to find works directly addressing the limitations of territorial self-government unit revenues due to the aging of individual populations. In recent foreign studies, public revenues and expenditures have begun to be categorized according to their susceptibility to demographic changes, contributing to the classification of countries into those with low, average, and high susceptibility, without detailed categorization of these revenues [Colin and Brys, 2019]. The authors of these studies acknowledge that units whose revenues primarily rely on their own sources, mainly taxation, are most susceptible to demographic changes, while those reliant on transfer sources are least susceptible. Colin and Brys [2019] emphasize that conducting analyses concerning the impact of population aging on the financial situation of LGUs requires an assessment of how sensitive local revenues and expenditures are to these changes. They point out that both direct and indirect influences can be distinguished regarding both revenues and LGU expenditures. Direct impact pertains to revenue categories linked to the age structure of the population. Indirect impact, on the other hand, relates to changes resulting from population aging occurring within the local economy, leading to alterations in specific revenue categories such as property tax (as a result of reduced economic activity). Direct impact is easier to diagnose and implement remedial solutions for (through introducing changes in unit financing systems), whereas indirect impact is more challenging to identify. Hence, recognizing the indirect influence and understanding its source is particularly crucial when planning changes in financial systems at the local level [Colin and Brys, 2019].

In the literature, emphasis is being placed on the consequences of demographic changes for LGUs, with a primary focus on the significant decline in revenues of specific categories most dependent on the age structure of residents. Various researchers highlight the relationship between the size of revenues obtained by LGUs, primarily from direct taxes, in systems where these units have a share in such revenues [Maj-Waśniowska and Jedynak, 2020]. The individuals contributing most to local budgets through these taxes are typically those who are employed. Hence, the decrease in their number due to population aging translates into lower tax revenue from these sources. Pensions and allowances are generally lower than salaries, resulting in lower tax revenue from the former than the latter [Colin and Brys, 2019]. In Poland, LGUs receive a significant share of income tax revenues from individuals living in their territory. In the case of municipalities, it is almost 40% of this revenue, which, when this revenue falls, limits the revenue potential of individual units.

Other authors also note that depending on the adopted property taxation system (based on area or value), population aging may have a greater or lesser impact on limiting the size of LGU revenue from property tax. According to these authors, as the population ages, there might be a reduction in the number of individuals using commercial properties, leading to a decrease in property tax revenue. In the case of a value-based property tax system, a decrease in demand for properties could influence their value and consequently impact the tax amount [Kopańska, 2023]. This tax is paid by all property owners in Poland. It is worth noting that it is paid per area and the rate depends on the use of the property. The maximum rates per square meter are definitely higher for properties used for business purposes (in 2024, max. PLN 33.10) than for others (e.g., residential properties – PLN 1.15 per sq m).

Furthermore, an aging population can affect other revenue categories for LGUs due to limitations in local economic development and entrepreneurship, such as the participation in corporate income tax, vehicle tax, or local fees. In the Polish context, the most significant decline in revenue caused by population aging will affect revenues from shares in PIT and corporate income tax, property tax (the vast majority of property tax revenue is generated by business property), educational subsidies, as well as revenue from fees for municipal and administrative services. The projected decrease will be a consequence of the broadly understood “draining” of social and economic potential and the so-called “snowball effect” (accelerating the aging process, including the phenomenon of “double aging”).

Analyzing changes in the amount of local government’s own revenues in Poland indicates that they have increased the least in recent years where the loss of young people and the relative size of the elderly population were the greatest [Kula and Kopańska, 2021]. Thus, it seems important to address the impact of the aging population on the size of local government revenues in Poland and engage in discussions regarding changes in the financial support system for LGUs. This is to prevent a situation in the future where they are unable to provide public goods and services to their residents. The authors stress that demographic change is already forcing measures to reduce public spending, extend working life, and in extreme cases, reorganize the state to enable local authorities to fulfill their responsibilities [Valkama and Oulasvirta, 2021].

In this study, among the sources of revenue for LGUs in Poland that were identified as directly dependent on demographic conditions, the share in PIT was recognized; almost 40% of this is transferred from the state budget to the LGUs according to the taxpayer’s place of residence. The increase in the proportion of post-working age individuals directly affects the reduction of the tax base by decreasing the number of taxpayers or lowering the income tax rate [Wąsowicz and Kula, 2016]. This is particularly important, as this source holds fiscal significance, contributing nearly 40% to local government own revenues and around 17% to total revenues. Its fiscal importance is expected to diminish in the coming years due to changes introduced by the tax reform known as the Polish Deal. Nevertheless, alongside property tax, these shares will continue to constitute a vital category of local government own revenues [Wyszkowska et al., 2022].

It can be anticipated that the aging population will also lead to a decrease in revenue from indirectly dependent sources, primarily stemming from decreasing entrepreneurial activities, which are simultaneously significant fiscal sources of revenue – such as property tax (commercial properties associated with business activities). The decreasing population will result in reduced demand for both new housing and construction investments. A diminishing number of aging individuals will also determine decreased demand for usable space (linked to business activities). Given the fiscal significance of the identified revenue sources, apart from the share in PIT, further analysis will also focus on property tax.

It is worth noting at this point that attempts to build appropriate models to explain the impact of aging on the finances of LGUs have already been made in the literature. For instance, Wąsowicz and Kula [2016] used a simple general equilibrium model of a city to analyze the impact of aging on a city’s finances. In turn, Kopańska [2023] analyzed the impact of changes in the age structure of populations in units on local government budgets using an econometric model and panel data. Regression models have also been used by Wichowska [2021], who identified demographic factors that influence revenue autonomy in the LGUs located in rural areas of the Warmińsko-Mazurskie province in Poland. In turn, Valkama and Oulasvirta [2021] focused on the challenges of the aging population in Finnish public policies related to municipal structures and finances.

For the purposes of achieving the formulated in our article goals, selected statistical methods were used, including the most important descriptive statistics, statistical tests (the chi-square test of independence), and correspondence analysis.

The study covered all LGUs in Poland. A separate analysis was conducted for LGUs and cities with county rights. In the first stage, data depicting the aging of the population in spatial distribution and the magnitudes of specific revenues subject to further analysis were presented. The data were provided for the years 2011 and 2021 separately. They originate from public statistics resources (Local Data Bank) and the Ministry of Finance databases.

For the purpose of our analysis we decided to take into account three variables, that is, aging ratio (percentage of people aged 65 years and more in the population), PIT per capita, and property tax per capita measured at the level of LGUs in Poland in 2011 and 2021, respectively. Neither the LGU sources of revenue nor their method of calculation has changed in the years under review. Nor have there been any significant changes in the structure of the legal elements of these taxes, which makes it possible to compare the results obtained.

The chi-square independence test and correspondence analysis were used to determine the relationship between population and age structure and two chosen types of LGU revenue. Due to the nonlinear nature of the relationship between the variables considered, the correlation analysis was based on the chi-square test of independence. This non-parametric test was used to determine if there was a significant relationship between two categorical variables (the appropriate variables were categorized accordingly). When a statistically significant relationship was found to exist between a pair of variables under consideration, the direction of the relationship was assessed using correspondence analysis, which is essentially an approach to constructing a model that displays the associations among a set of categorical variables. We used correspondence analysis as a technique for displaying multivariate (in our case bivariate) categorical data graphically by deriving coordinates to represent the categories of both the row and column variables, which then were plotted to display the pattern of association between the variables graphically [Greenacre, 2007].

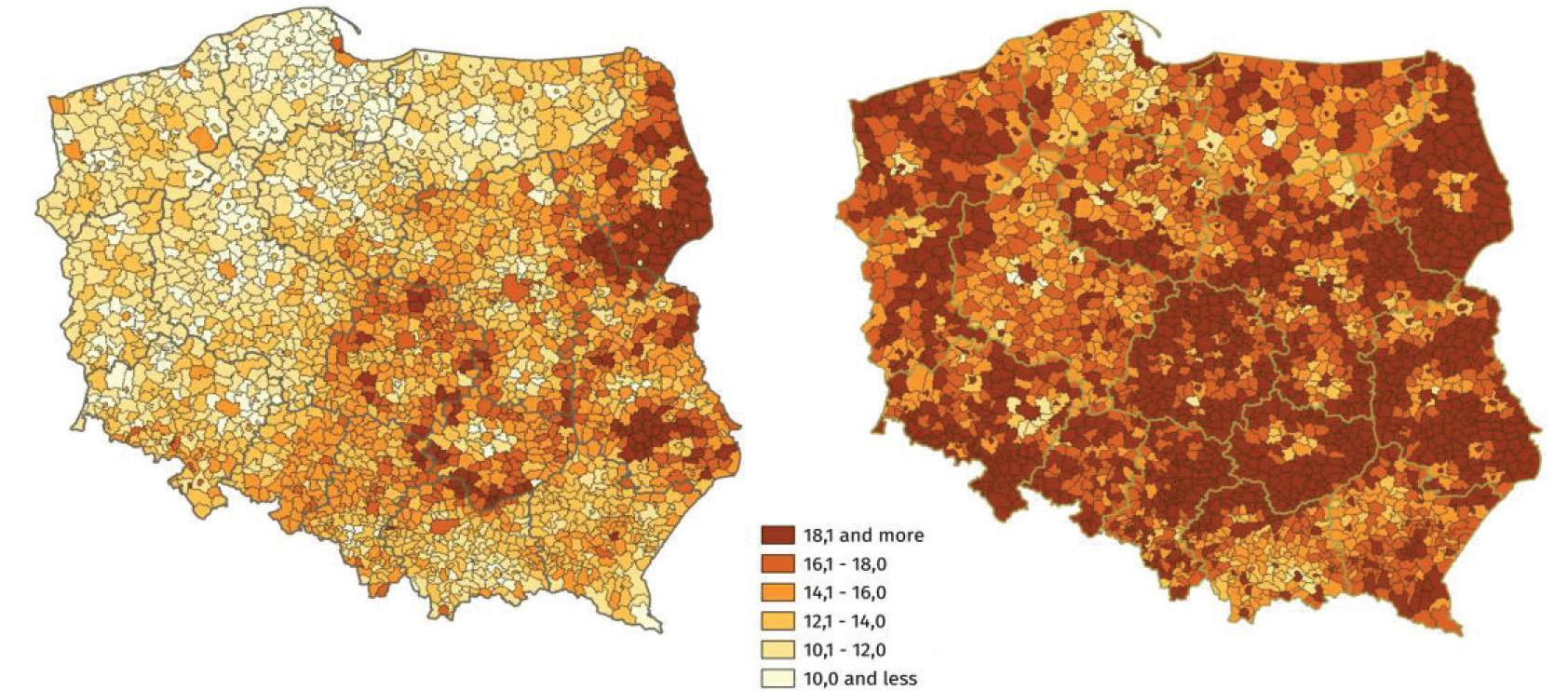

Of the 2,477 LGUs in Poland in 2021, a decrease in population compared with 2011 was observed in 1,776 LGUs, including 1,181 LGUs >5% and 397 >10% [GUS, 2022]. Most of the LGUs that recorded a significant decline in population (over 10%) are located in the so-called “eastern wall” areas, mainly in Podlaskie province (representing 48% of the LGUs in this province), in the southern part of Lubelskie province, areas near the border with Russia, the eastern part of Western Pomerania, and mountainous areas in the southern part of the country. The urban unit of Hel and the rural unit of Dubicze Cerkiewne recorded the largest decrease in population in the past 10 years. Such a significant decline in the population of LGUs means that these units are beginning to have problems securing revenue to finance the local public tasks assigned to them. Indeed, it should be stressed that the problem is not only the depopulation of the designated areas, but also the rapidly advancing aging of the population. From this point of view, it is very important to assess the degree of spatial differentiation of the population aging process in Poland, taking into account LGUs (the first research question). A comparison of the 2011 and 2021 census results shows a rapid population aging process that is closely linked to depopulation. In 2011, the share of population aged 65 years and more was >20% in only 51 LGUs (2.06% of all LGUs). These LGUs were mainly located in the Podlaskie and Lubelskie provinces. In 2021, on the other hand, LGUs with a share of older people >20% account for >20% of LGUs in Poland. In 2011, the number of LGUs with <10% of people aged 65 years and over was 221, with only seven in 2021. The spatial distribution of demographic old age, defined as the share of people aged 65 years and more in the total population, is presented in Figure 1, separately for 2011 and 2021.

Aging ratio (percentage of people aged 65 years and more in the population) in Polish LGUs in 2011 (left panel) and 2021 (right panel). LGUs, local government units.

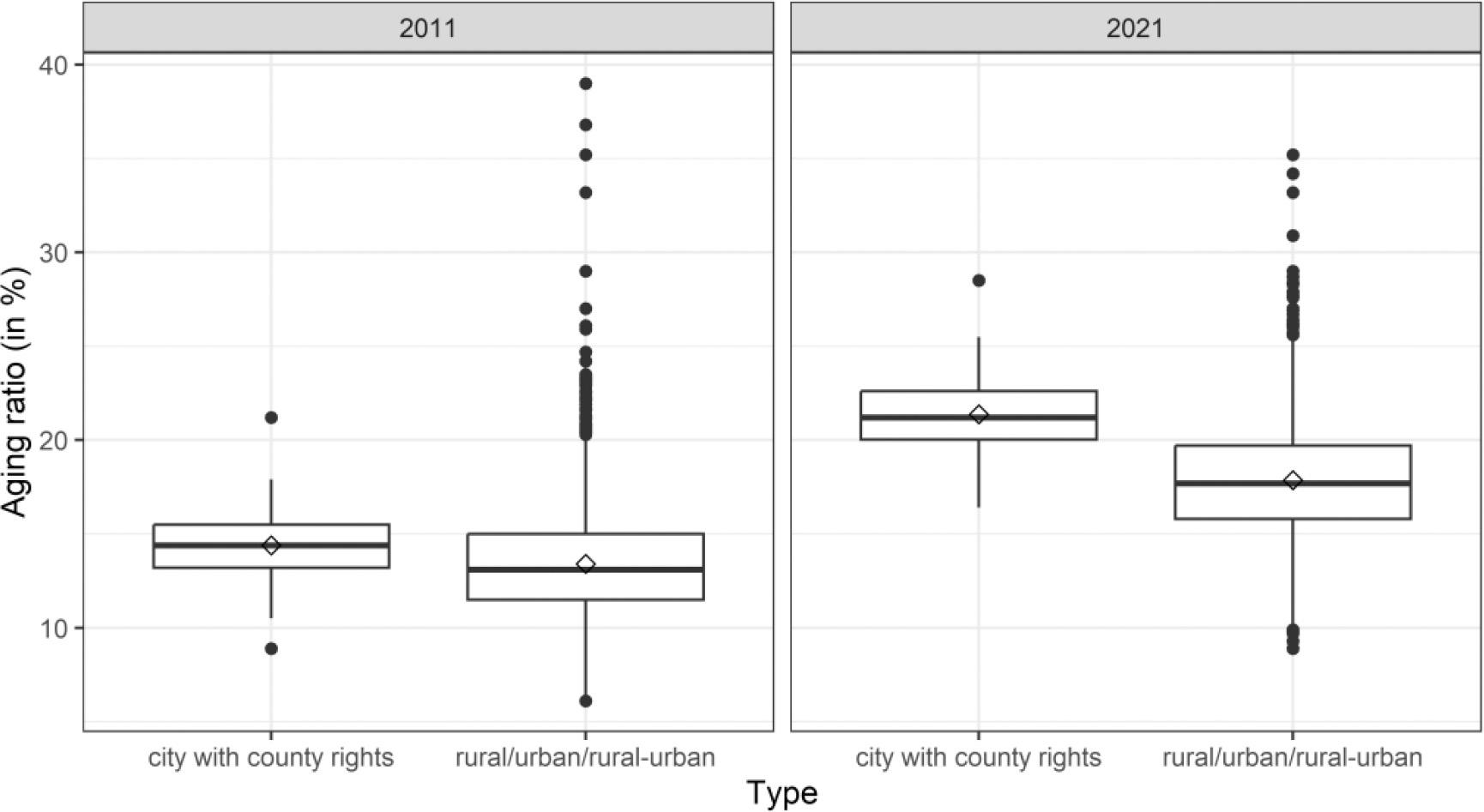

It is also worth noting the existing differences in the aging ratio not only in the two census years under consideration, 2011 and 2021, but also by type of units. When analyzing the data in Figure 2, it should be noted that in both 2011 and 2021, the value of the aging ratio was slightly higher (in terms of average) in cities with county rights than in other LGUs.

Distribution of aging ratio (in%) in Polish LGUs in 2011 and 2021 by type of units. LGUs, local government units.

In 2011, the average value of the aging ratio in the cities with county rights and the other LGUs was 14.4% and 13.4%, respectively (with medians of 14.4% and 13.1%, respectively). However, the cities with county rights are much less differentiated compared with the other LGUs in terms of the development of the aging ratio. In the group of cities with county rights, the coefficient of variation was 13.4%, with a minimum of 8.9% (city of Żory) and a maximum of 21.2% (city of Sopot).

In the remaining LGUs, the coefficient of variation was 21.6%, with a minimum of 6.1% (rural unit of Kołbaskowo) and a maximum of 39% (rural unit of Dubicze Cerkiewne). In contrast, a significant increase in the average level of the aging ratio is observed in 2021, both in the cities with county rights and in the other LGUs. In 2021, the average value of the aging ratio in the cities with county rights and in the other LGUs is 21.4% and 17.9%, respectively (with medians of 21.2% and 17.7%, respectively). Cities with county rights are also much less differentiated than other LGUs in terms of the aging ratio in 2021. In cities with county rights, the coefficient of variation was 9.6%, with a minimum of 16.4% (city of Suwałki) and a maximum of 28.5% (city of Sopot). In other LGUs, on the other hand, the coefficient of variation was 16.9%, with a minimum of 8.9% (rural gmina Kleszczewo) and a maximum of 35.2% (rural gmina Orla). When analyzing the indicator values presented, it should be explained that the higher level of old age in cities with county rights may be due to the fact that people move to larger urban centers as they get older due to better access to health and social care facilities. Although the literature refers mainly to the migration of younger people, in practice the movement of older people from rural to urban areas is observed.

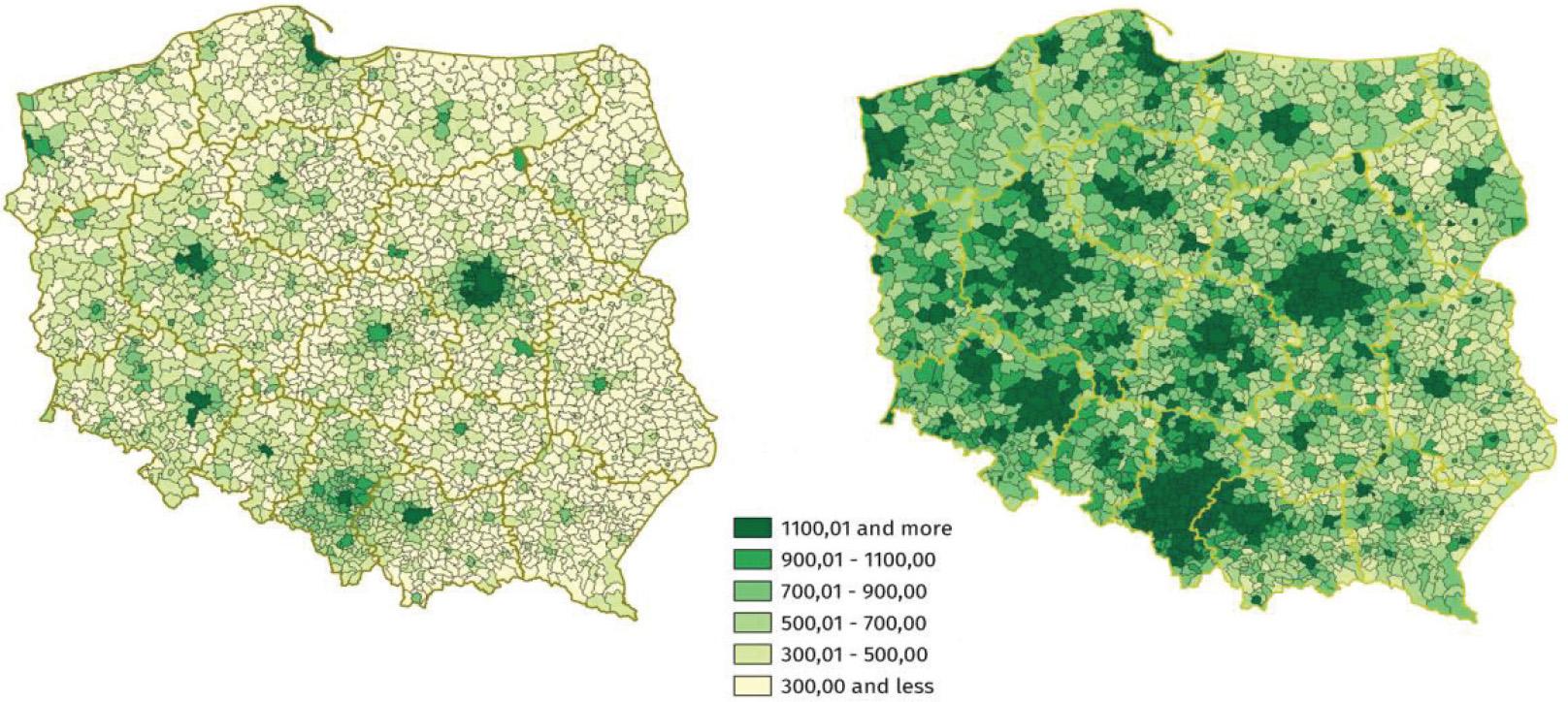

Similar to the aging ratio, LGUs differ in terms of their PIT per capita (see Figure 3). In this case, one can see significantly higher values in province cities (the largest cities with county rights) and in their surroundings. In addition, a clear increase in their values in 2021 compared with 2011 can be seen.

PIT per capita in Polish LGUs in 2011 (left panel) and 2021 (right panel). LGUs, local government units; PIT, personal income tax.

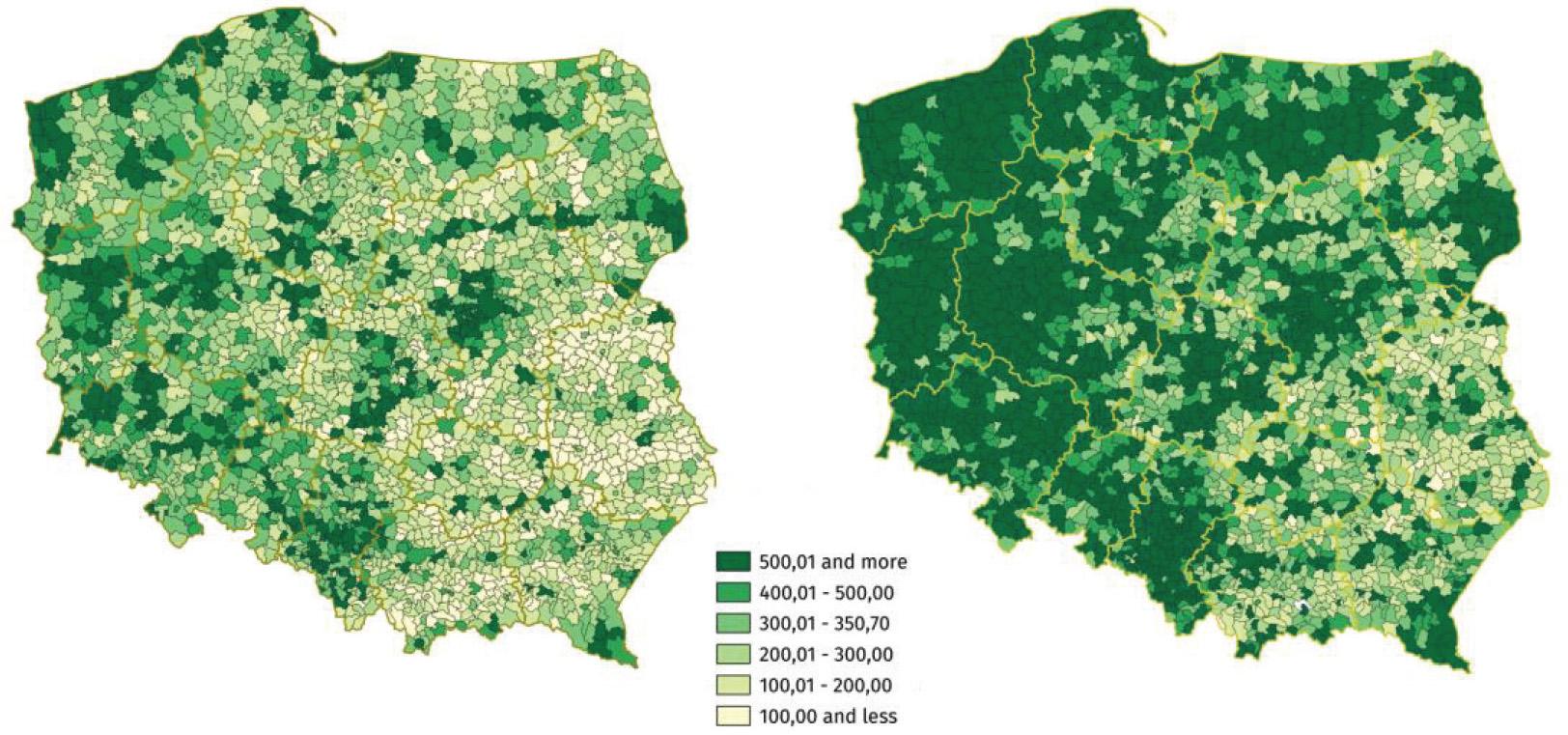

Significant differences between LGUs can also be seen in relation to property tax revenue per capita. Interestingly, it is difficult to notice a regularity here that the highest values of this tax are found in cities with county rights. On the cartogram in Figure 4 (especially for the year 2021), a clear difference can be seen between units located in the western and northern parts of Poland and the rest of the LGUs. This is due, on the one hand, to the way in which space is developed and economic entities (which are the largest payers of this tax) are located, and on the other hand, to the small number of inhabitants in some LGUs (especially in the south-eastern part of Podlaskie and Podkarpackie provinces), which has an impact on the size of the analyzed indicator.

Property tax per capita in Polish LGUs in 2011 (left panel) and 2021 (right panel). LGUs, local government units.

The demographic situation in Poland will evolve even more unfavorably in the future. According to forecasts from Statistics Poland, the process of population aging will progress more intensively and will exhibit significant spatial variation. By 2040, LGUs with a proportion of elderly people >20% will constitute almost three-quarters of all LGUs in Poland [GUS, 2023]. LGUs will experience varying degrees of impact from these trends on both their revenues and expenditure (unit with the highest increase in Siechnice 43.9%, with the highest decrease in Ceranów 42.9%).

The challenge faced by LGUs most affected by the aging population process is not only the decreasing size of their own revenue but also the high per-unit cost of providing public services. Research results confirm the existence of economies of scale, particularly among LGUs. Smaller entities incur higher per-unit costs for delivering goods and public services. This applies to the most valuable category of costs related to education and upbringing as well.

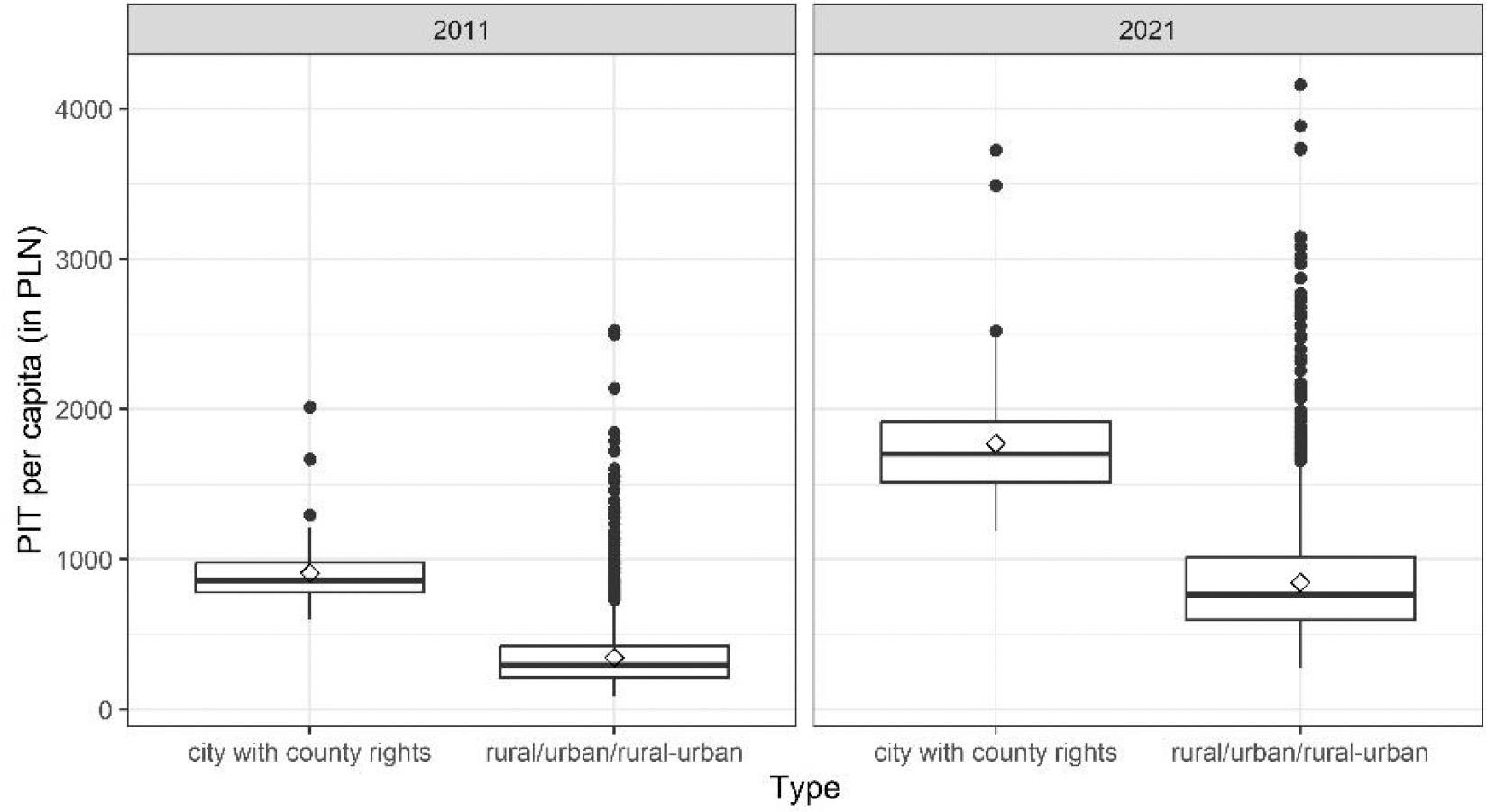

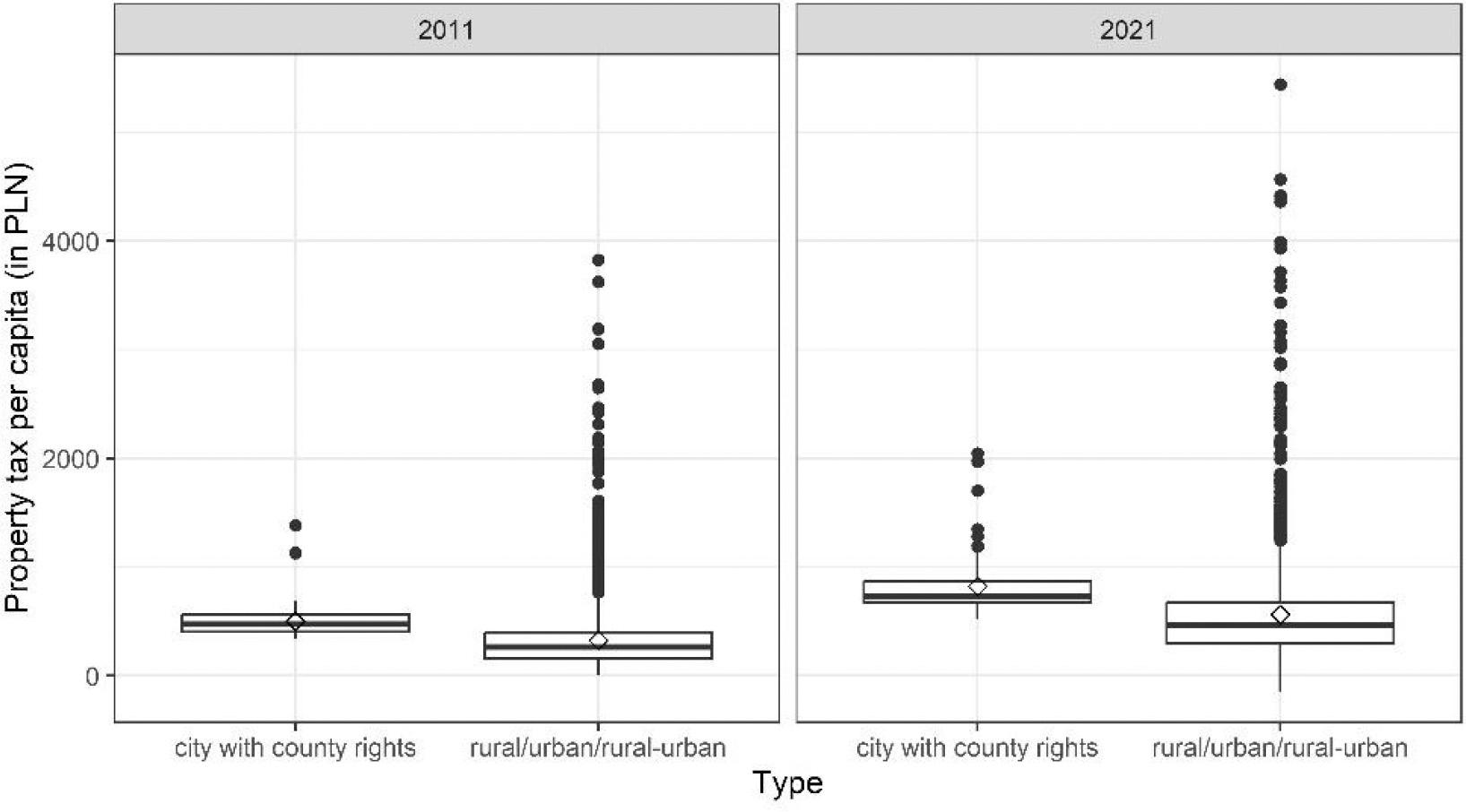

Cumulatively, LGUs have experienced a consistent growth in both revenue and expenditure in subsequent years. In 2021, total unit revenues (excluding cities with county rights) amounted to 216% of the 2011 revenues, while their own revenues reached 201%, including 228% from the PIT and 165% from property tax. For cities with county rights, the corresponding figures were 195%, 175%, 195%, and 154%, respectively. An important fiscal category of revenue, especially for cities with county rights, is the revenue from the PIT, which directly depends on the number and age structure of the population residing within the jurisdiction of a given unit. Property tax is also a significant fiscal source of revenue for LGUs and cities with county rights. It is important to note that the majority of revenue from this source comes from properties utilized for commercial purposes, and thus depends on the level of entrepreneurship. The distribution of analyzed revenue categories per capita in 2011 and 2021 by type of units is presented in Figures 5 and 62.

Distribution of PIT per capita in 2011 and 2021 by type of units. PIT, personal income tax.

Distribution of property tax per capita in 2011 and 2021 by type of units.

When analyzing Figures 5 and 6, it can be seen that PIT per capita and property tax per capita are higher (on average) in cities with county rights compared with the other types of units. The higher revenue from the first title can be explained by the universality of the PIT, which is levied on residents of cities with county rights (as opposed to municipalities, especially in rural and rural–urban areas), as well as the higher level of salaries of residents, especially in large cities. On the other hand, property tax revenues are higher in county cities because of the way in which property is developed and used. A significant proportion of these properties are subject to this tax in the first place (in rural areas, a significant proportion of properties are subject to agricultural tax), and these properties are also taxed at business rates, which, as mentioned above, are significantly higher. Receipts from these taxes increased in 2021 compared with 2011, with a significant increase observed in 2021 compared with 2011, primarily in relation to PIT per capita. It is also worth noting that the difference between cities with county rights and other types of units became apparent in 2021, especially with regard to per capita PIT. It is worth noting that significantly greater variability was observed in both categories of taxes in rural, urban, and rural–urban units than in cities with county rights in each of the two analyzed periods.

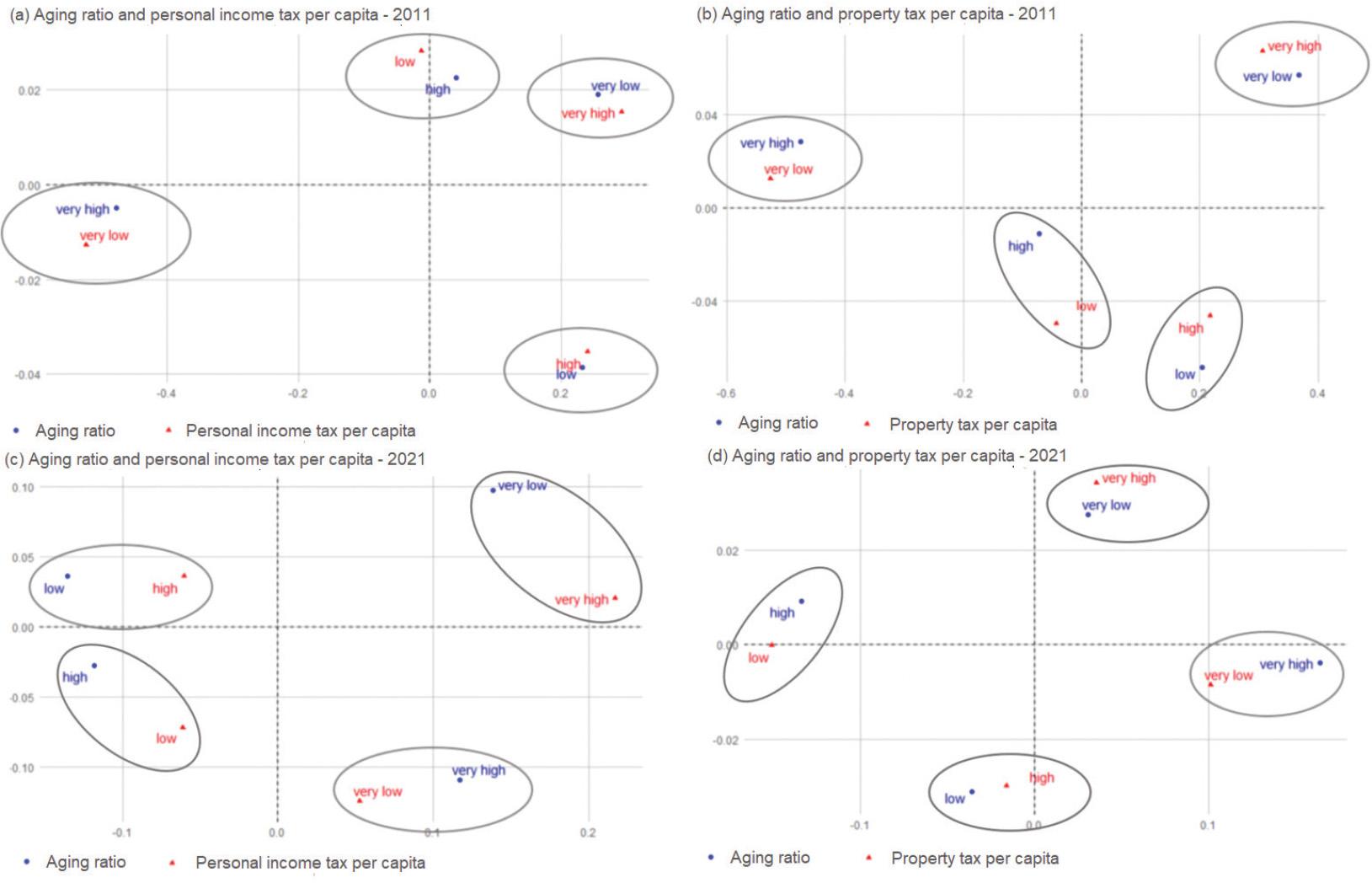

In the next step, it was checked whether there were statistically significant relationships between the aging ratio and PIT per capita and the aging ratio and per property tax capita. The analysis was carried out separately depending on the type of units (cities with county rights and other types of units, i.e., rural, urban, and rural–urban) for the years 2011 and 2021. In this way, attempt was made to answer the second research question related to whether population aging affects selected categories of LGUs revenue. A total of eight different dependency options were therefore considered. For each of the three variables, four levels were distinguished according to the value of the quartiles of that variable. For example, the very high level referred to all those LGUs where the value of the variable exceeded the estimated value of the third quartile of that variable. The chi-square test of independence was used to analyze the correlations, and where a statistically significant relationship was found, it was visualized using correspondence analysis.

Table 1 shows the p-value of the chi-square test of independence between the analyzed variables. p-values <0.05 indicate statistically significant relationships. As can be seen in the case of cities with county rights, regardless of the year analyzed, no statistically significant correlations are observed between aging ratio and PIT per capita and aging ratio and property tax per capita. This is most likely due to the fact that these LGUs are not as diversified in terms of the level of all three considered variables as other types of units. They represent, in terms of aging ratio, PIT per capita and property tax per capita, a more homogeneous group of units compared with rural, urban, or rural–urban units. The situation is different for the other LGUs, where there are statistically significant relationships between aging ratio and PIT per capita and aging ratio and property tax per capita. These relationships are visualized in Figure 7 using so-called perceptual maps obtained through correspondence analysis.

Perceptual maps in correspondence analysis between aging ratio, personal income per capita, and property tax per capita in rural, urban, and rural–urban units in Poland in 2011 and 2021.

p-values in the chi-square test of independence between aging ratio, PIT per capita, and property tax per capita

| Type of the tax | Aging ratio | |||

|---|---|---|---|---|

| 2011 | 2021 | |||

| City with county rights | Rural/urban/rural–urban | City with county rights | Rural/urban/rural–urban | |

| PIT per capita | 0.211 | 0.000 | 0.437 | 0.000 |

| Property tax per capita | 0.107 | 0.000 | 0.524 | 0.009 |

Source: Own elaboration.

PIT, personal income tax.

Perceptual maps presented in Figure 7 are symmetric plots and show a global pattern within the data. Rows are represented by blue points and columns by red triangles. The distance between any row points or column points gives a measure of their similarity (or dissimilarity).

When analyzing Figure 7, it can be seen that regardless of the year or type of tax analyzed (PIT per capita or property tax per capita), LGUs with a higher aging ratio have lower revenues for the corresponding tax. In LGUs where the aging ratio is lower, revenue from per capita PIT or per capita property tax is higher.

The results of the analysis confirm the conclusions presented in the current rather poor literature on the subject regarding the declining basic income of LGUs as a result of an aging population from sources directly related to the age of the population. In the case of Polish LGUs (except for cities with county rights), this concerns not only the share in the PIT per capita (which was quite intuitive to predict), but also the property tax per capita. It seems that also other sources of income, even indirectly related to economic activity (entrepreneurship) are sensitive to changes in the age structure of the population. This is a thread worth taking up in further research.

Taking into account the results obtained by the authors and the projected further population aging, it can be concluded that, in the near future, the deepening unfavorable demographic changes associated with the aging phenomenon will have a negative impact on various categories of local government revenue (the third research question). The existing literature raises many problems concerning public finances as a result of the depopulation and population aging process observed over the years, but tends to emphasize the expenditure side – the growing expenses of the pension insurance system, social care or the health service. In contrast, the problem of declining local government revenues, caused by an increase in the number of older people, is rarely addressed. The depopulation processes that have been taking place for years, resulting in an increasing aging of the population, seem difficult to reverse. However, attention should be paid to the necessity of taking measures aimed at halting these unfavorable processes and undertaking a discussion on providing funds for the implementation of public tasks by LGUs, as entities responsible for the widest range of provided public goods and services of local importance.

The dynamic demographic changes call for preventive measures to limit the negative effects of a reduction in the number of inhabitants and changes in their age structure.

As a result of the analysis, it can be concluded that:

- –

there is a statistically significant negative correlation between the aging ratio and the level of the analyzed two most efficient sources of own revenue of LGUs in Poland, with the exception of cities with county rights;

- –

the relationship between the aging ratio and PIT per capita has already been analyzed in the literature, and the results achieved confirm previous research findings;

- –

a negative correlation can be observed between the aging ratio and revenues from the property tax per capita, which has not been analyzed or studied so far; it seems to be an effect of the structure of the revenues collected by Polish LGUs from this tax, which is dominated by revenues from property used for economic activities, which is reduced with the age of the population of the units;

- –

there is no statistically significant relationship between the aging ratio and the analyzed sources of income per capita in the case of cities with county rights. The statistical justification for this lack of relationship is presented in the “Research and discussion” section; looking for substantive justification, it should be noted that the level of income attained by city residents is higher than that of other primary-level local authorities, regardless of age. These cities are the main place of business, hence many properties are allocated for this purpose (also transferred by entities to other entities).

The results of the analyses carried out indicate the need to take into account the ongoing demographic changes in the construction of local government financing systems. It may turn out that the current solutions will not ensure the existence of the smallest LGUs. Therefore, it is necessary to pay attention not only to ensuring own efficient sources of financing, as is emphasized in theory, but also to taking into account, at least partially, such sources that are independent of changes in the age structure of the population. This may involve sources of own revenue or taking this factor into account when designing compensation mechanisms.

The results of the analyses should draw the attention of the central authority responsible for the development of local government financing systems to the issues described above. Observing the changes to date in the level of revenue earned by units with the smallest population potential, it is necessary to consider the need to reconstruct the system of revenue of LGUs, especially with regard to the need to balance the tax base and partial autonomy from the number and age structure of the population. This is because it is necessary to ensure the financing of local public goods and services, which is a kind of assurance of the stability of state operations. The equalization system adopted in Poland, in contrast to many European Union (EU) countries, does not provide for the need to support units characterized, among other things, by an unfavorable age structure of the population.

This may prove insufficient in the future and may lead to the need to reconstruct the organization of the local government, as has already happened in other European countries. It is also worth mentioning the limitations of the conducted study. They are mainly a consequence of the adopted methods used to verify the formulated research questions. For instance, the literature emphasizes that correspondence analysis is sensitive to outliers in general. Moreover, this technique only explains a part of the variation in the data and from this point of view may not provide the full picture of interrelationships [Greenacre, 2007]. In addition, the article uses a simple correspondence analysis to explore relationships in a two-way classification (for instance, between aging ratio and PIT per capita). However, one might be tempted to look for interrelationships between more variables. In order to achieve this, multiple correspondence analysis (MCA) should be used, which is an extension of the simple correspondence analysis for summarizing and visualizing a data table containing more than two categorical variables. However, it will be the subject of further research studies conducted by the authors in the area of population aging and its impact on the revenue potential of LGUs in Poland.