Figure 1.

Perceptions of the Financial Planning Education and Training Received

| Theme and Sub-Themes | Quote | P | ||

|---|---|---|---|---|

| Financial planning education and training | Changes to the academic curriculum | Human side of financial planning | “So I think far more focus needs to be on a human element or a people element as equal as there is on the financial or on the number side as well.” | 1 |

| “…we train people in terms of numbers and products. However we don’t train them in terms of the human side of money… So I think far more focus needs to be on a human element or a people element as equal as there is on the financial or on the number side as well.” | 9 | |||

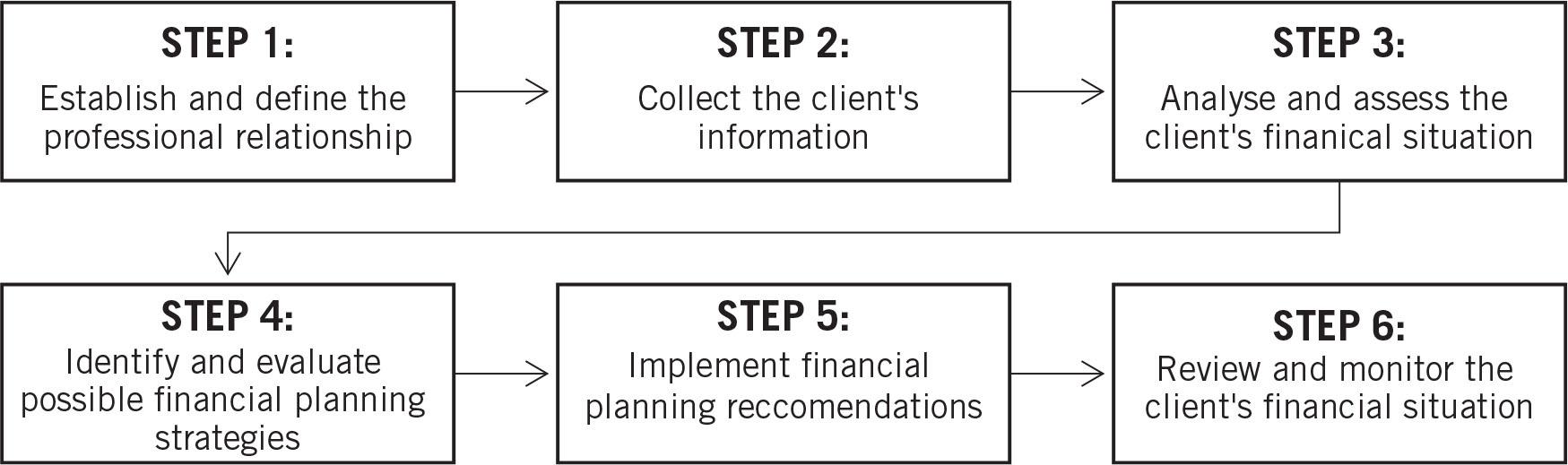

| “…it doesn’t build in the human element… but it is something that is not taught or included or incorporated within the six steps of financial planning.” | 12 | |||

| Behavioural finance | “I think the training I did in the behavioural coaching course stood me in far better stead than anything I studied for the board exam...” | 1 | ||

| “So, there is a big drive or trend towards behavioural finance and that covers a lot of the meat that is not covered within the six-step financial planning process.” | 4 | |||

| “What is unfortunately happening is specifically the CFP Board in America is confusing the human side with behavioural finance, and they are saying ‘we are going to teach you about biases and identifying that’.” | 8 | |||

| Financial coaching elements | “So coaching, relating to people which would either be through coaching or through some HR training … for me those are much more useable skills as opposed to what we are doing now…” | 7 | ||

| “…so the FPI equivalent in Canada has exclusively added coaching to the CFP curriculum so I think our approach is too compliance-based.” | 10 | |||

| “What I’m excited about is to see that there’s a lot more emphasis on the coaching and the human side of money. There’s definitely growing recognition that that is incredibly important, and I’m excited to see that happening.” | 16 | |||

| Psychology of the client | “…doesn’t take into account a consideration like the specific client’s cultural background which will have an influence on their perceptions of money, their experiences and also their behaviours around that…a lot more training and education needs to be provided during varsity and also post-varsity once you have started to work.” | 4 | ||

| “… one side is the psychology of the individual that we work with. In the other corner we have the psychology of the community and the workplace etc and then we have the psychology of how do I deal with change and legislation etc…” | 9 | |||

| Contextualised content and assessment | Process | “… the process and the standards, the recommendations – all of those things – I think it has got to be localised; still conforming to what we need to conform to, if that is what we want to conform to, but it has to be locally relevant…” | 9 | |

| FPSB training material | “...even the training content that stems from the FPSB, it doesn’t really accommodate us, our dynamics as South Africans....” | 12 | ||

| FPI assessment tools | “...you will find that the case studies and all of those things, they still talk about you have got ‘die strandhuis [beach house]’ and the farm…When I was doing my CFP in 1999 none of those concepts I could resonate with…I couldn’t identify with it.” | 7 | ||

| Business and product specific assessment tools | “So we always use one or two case studies that focus on a male spouse, a female spouse, married with two children, has a house – you know, it is very rigid, it is not a true reflection of what SA looks like. So a single person with/without children – what are their needs, what products, from what we have currently, what products do we match to this person’s needs?” | 12 | ||

The Current Suitability of the Financial Planning Process

| Theme and Sub-Themes | Quote | P | ||

|---|---|---|---|---|

| Current suitability | Partially suitable | In theory but not practice | “…on paper it looks perfect but in practise it doesn’t get implemented accordingly. So I don’t think there is anything wrong with the six-step process as a principle…” | 16 |

| General framework | “I think the six-step financial process is valuable as a general framework.” | 14 | ||

| Narrow application | “So the process itself is suitable, but the way it is used has a narrowed view….” | 2 | ||

| Requires context | “…it is a good guideline, but I will say it needs more context and maybe some subheadings in each of those steps….” | 4 | ||

| Limited interpretation | “…there is nothing wrong with it, it is just that the interpretation sometimes limits a bit more than desired.” | 5 | ||

| Unsuitable | Sales driven | : “…financial planning is driven by advisors who have to make money from first selling a product…the way we are remunerated as financial planners, conditions us to advise on certain things.” | 2 | |

| Relationship building | “I was disregarding the client and how they felt about the process and what their experience was going through this process with me. And I ended up putting clients off or clients were hesitating.” | 4 | ||

| Needs and characteristics of Black consumers | “The model of financial planning does a major injustice to the African community … creating a negative impression about the profession, which is now very detrimental to the African community.” | 5 | ||

| “I think currently very few financial planners are really equipped to deal with the needs of the African community, and it is not because of them but I think that discussions around financial planning…automatically excludes people from even being considered.” | 5 | |||

| “…the industry is White, the industry is male dominated, and not just White male, it is old White male. And financial services has always been practised and viewed through those lenses. So whether transformation means changing the face of the industry, changing the conversations of the industry, changing the processes of the industry – all of those things are still viewed through those old lenses.” | 7 | |||

| “…it is not 100% compatible to the true South African, or it doesn’t really accommodate the journey the typical South African would actually take in the process of being financially free…it sort of forgets that we are dealing with humans here, specifically Africans….” | 7 | |||

| “…it is about representation, so for me it is a different issue though, it doesn’t speak to the competence of the financial advisor, I don’t think it does, but it does speak to the issue of representation because that is a very different thing to diversity.” | 10 | |||

| Supportive legislation | “…does our legislation make provision for this? ...especially in those traditional cases, because you can tell people what you want to tell them – that’s the legal side – but we are still going to deal with it in the cultural way?” | 9 | ||

Perceptions of the Overall Six-Step Financial Planning Process

| Theme and Sub-Themes | Quote | ||

|---|---|---|---|

| Changes to the six-step financial planning process | Step One | “…establishing that relationship, I think that can be positioned a little bit differently to accommodate a person who was never introduced to financial planning or finances prior…… include communication techniques for this African community...” | 1 |

| Step Two | “The gathering of information should obviously be taken into consideration, the whole background and not just financial, but with a goal to deliver efficient financial planning. It is more about sensitising the advisor towards the approach to gathering information, because we may inadvertently say if I have a Black client he probably wants to take care of his family, he probably wants to do that and that, and so maybe we should just bring him diversity and say the client must just carry on with the desire to help community even though it is to his detriment.” | 5 | |

| “It was never a thing of getting to know what they want from life, and if you are a financial planner, I think the most important thing is to understand what the client wants out of life. Money is not what a person wants at the end of the day, it is what money can buy for you.” | 6 | ||

| “So I don’t think I have a fundamental issue with the steps itself, I have an issue with what sits behind each step and are we aware of the cultural, the demographic, whatever differences in how we gather that information and how we interpret that information?” | 7 | ||

| Step Six | “…reviews are also a bit outdated I think. The annual reviews. So what we do if we can, is spend a whole year and every three months you tackle a different area of financial planning in the first year, just to get the client where they need to be.” Then every half year you do a small check-in to see if any changes have occurred – if you need to make changes to the product, if you need to drop the product, that type of thing. I think it is a more hands-on approach regarding the plans for the client, not the product, and annual reviews are very much product focused.” | 6 | |

Demographic Information for the CFP® Professionals

| P+ | Gender | Ethnicity | Cultural / tribal affiliation | Experience | Qualifications | Coaching |

|---|---|---|---|---|---|---|

| 1 | Male | White | White English | 5 years | BCom | BCom Hons | CFP | ✗ |

| 2 | Male | Black | Zulu | 6 years | BCom | PG Dip | CFP | ✗ |

| 3 | Male | Black | Shona (Zimbabwe) | 5 years | BCom | PG Dip | CFP | ✗ |

| 4 | Male | Asian | Chinese | 8 years | BCom | PG Dip | CFP | ✗ |

| 5 | Male | Black | Ashanti (Ghana) | 10 years | PhD Finance | CFP | ✗ |

| 6 | Female | White | White Afrikaans | 3.5 years | BCom | PG Dip | CFP | ✗ |

| 7 | Male | Coloured | Coloured | 32 years | BCom Hons | Cert Strat HR | CFP | ✓ |

| 8 | Male | White | White Afrikaans | 9 years | Adv Dip | CFP | CeFT | ✓ |

| 9 | Male | White | White Afrikaans | 32 years | PG Dip | ACC* | CFP | ✓ |

| 10 | Male | Black | Ndebele | 22 years | PG Dip | Adv Dip | ACC* | CFA | CFP | ✓ |

| 11 | Female | Black | Zulu | 13 years | BCom | PG Dip | BCom Hons | CFP | ✗ |

| 12 | Female | Black | Xhosa | 11 years | BCom | Adv Dip | CFP | ✓ |

| 14 | Male | Black | Xhosa | 9 years | BCom | PG Dip | CFP | ✗ |

| 15 | Female | White | White Afrikaans | 24 years | PG Dip | CFP | ✗ |

| 16 | Female | White | None | 24 years | BSc Psych | PG Dip | CFP | ✓ |

| 17 | Male | Indian | Hindi | 25 years | PhD | PG Dip | CFP | ✗ |

Overview of Emerging Themes and Sub-Themes

| Theme | Sub-Themes |

|---|---|

| Current suitability | Partially suitable |

| Unsuitable | |

| Financial planning education and training | Changes to the academic curriculum |

| Contextualised content and assessment | |

| Changes to the six-step financial planning process | |