Financial planning has been recognised as a profession since 1973, when the first group of Certified Financial Planner® professionals (CFP®) received their certification (Financial Planning Standards Board 2025a). In South Africa, however, financial planning has only been recognised as a formalised profession in the financial services industry since the introduction of the Financial Advisory and Intermediary Services (FAIS) Act No. 37 and supporting legislation in 2002 (Richards, Robinson, & Willows 2024, p. 8).

CFP® professionals provide financial advice by applying the six-step financial planning process, which is advocated by The Financial Planning Standards Board (FPSB). The FPSB is an international standards-setting body for the financial planning industry and oversees the CFP® designation outside of the United States (FPI 2019a). The FPSB’s six-step financial planning process represents best practice regarding financial planning methodology (Goodall, Rossini, Botha, Geach, du Preez and Rabenowitz 2025, p. 17). The majority of the CFP® professionals apply this process to provide financial advice, except in the United States, where the seven-step financial planning process is applied, which the CFP Board advocates. The CFP® certification determines the minimum financial planning standards that must be followed by all financial planning professionals globally (van Schalkwyk 2018, p. 1087). As of 2025, there are approximately 230,000 CFP® professionals in 26 different territories. Among these territories that apply the globally recognised six-step financial planning process, South Africa ranks sixth based on the number of registered CFP® professionals (approximately 5,000) (Financial Planning Standards Board 2025b; Hesse 2019).

When considering the application of the six-step financial planning process in a South African context, it is important to consider the racial, cultural, linguistic, ethnic and religious diversity that characterises South Africa. South Africa’s diversity is also evident in the fact that there are 11 official languages and 14 different ethno-cultural groups that are divided into 4 main population groups (Chaka and Adanlawo 2023, p. 315). These population groups have their own sets of beliefs, values, and cultural practices, and thus view aspects such as wealth (the creation, preservation, and transference thereof), marriage, and retirement differently (Afolayan 2004).

Consumers need financial planners who understand their cultural beliefs and needs, and provide differentiated financial services tailored to those needs. Financial advice is intangible in nature, as the benefits thereof are only realised in the future (Botha, du Preez, Geach, Goodall, Palframan and Rossini 2025, p. 9). If South African consumers do not perceive that their financial planner understands their cultural beliefs and do not trust that they can address their needs and goals, a large majority of consumers may be excluded from participating in the financial planning industry and associated financial products and services. This may lead to a financial planning advice gap because consumers are not receiving appropriate advice to address their financial needs.

Research on holistic financial planning based on the six-step financial planning process is limited in South Africa; however, several studies have been conducted in a global context in regions such as America, Europe and Australia. Sharpe, Anderson, White, Galvan and Siesta (2007) investigated the role of communication in establishing a relationship of trust and commitment between the financial planner and client (step one). Asebedo and Seay (2015) considered positive psychology when analysing the financial needs of clients (step three).

Chieffe and Rakes (1999) attempted to produce an integrated financial planning model by reconceptualising the six-step financial planning process into a matrix that considers whether anticipated events are current or future-oriented, and whether these events may be expected or unexpected. Boon, Yee and Ting (2011) reconceptualised the six-step financial planning by integrating financial literacy into the reviewing and monitoring stage (step six). Finally, Knutsen and Cameron (2012) reconceptualised the financial planning process into a financial coaching advice model that emphasises the client’s financial accountability by integrating financial literacy at every stage of the process. Previous research conducted in a global context has focused on only some of the steps in the six-step financial planning process. This study thus aims to address the research gap by focusing on all six steps in the financial planning process, considering the perceptions and experiences of CFP® professionals who are required to apply the six-step financial planning process in South Africa.

There is a pressing need for a South African approach to the six-step financial planning process that will include aspects that are unique to South African consumers. It can also be argued that the academic curriculum of recognised financial planning education providers – as well as product and business-specific training provided by FSPs as per the fit and proper requirements outlined by the FAIS Act – is not comprehensive enough to address the unique needs of South African consumers. To address this need, it is important to assess the application of the six-step financial planning process and gather the perceptions and experiences of CFP® professionals who are responsible for applying the six-step financial planning process when providing financial planning advice. These CFP® professionals will also be able to give insight into the education and training provided as part of the competency requirements to be a CFP® professional. The aim of the study is thus not to establish the financial needs that are unique to South African consumers, but rather to determine the perceptions that CFP® professionals have of the suitability of the six-step financial planning process that they are required to apply, given South Africa’s monolithic cultures and diversity. In particular, the study aims to determine whether CFP® professionals perceive that the required education and training as required by the FPI and FSCA equipped them to apply the six-step financial planning process in a South African context.

Financial planning is a profession within the financial services industry and is thus influenced by the legislation and regulators that govern the financial services industry. The financial planning profession is also regulated by national (FPI) and international (FPSB) practice standards that all financial planners are required to adhere to (Brown 2008, p. 4). The FPSB works through national organisations in each country, which are referred to as ‘affiliates’. There are 26 national organisations which are affiliated to the FPSB. These affiliate countries manage training, compliance with global standards, and the CFP® certification. The FPSB is also responsible for developing the six-step financial planning process that all financial planners are expected to apply when providing advice. The FPI is the national affiliate organisation that is responsible for the certification, training and regulation of the financial planning profession in South Africa. The FPI is affiliated to the South African Qualifications Authority (SAQA) and is one of nine approved Recognised Controlling Bodies (RCBs) recognised by the South African Receiver of Revenue (SARS) (SARS 2019).

To be considered a professional financial planner, the FPI outlines specific requirements that must be met, namely ethics, experience, education and examination requirements (Botha et al. 2019:19). Individuals who can comply with these requirements successfully are distinguished as CFP® professionals. Prospective CFP® professionals need to adhere to the ethics and practice standards of the FPI, which is rules-based and is intended to promote ethical behaviour (FPI 2022). The experience requirement involves the active and ongoing acquisition of knowledge, skills, and expertise in the financial services industry. To meet the education requirement of the FPI, an appropriate postgraduate (NQF 8) qualification is required from an FPI-approved education provider to practice as a CFP® (Goodall et al. 2025, p. 7). The FPI requires prospective CFP® professionals to complete the Professional Competency Examination (PCE), which is also informally referred to as the FPI ‘Board exam’ (Goodall et al. 2025, p. 117). The examination aims to assess the candidate’s ability to collect, analyse and synthesise information to provide advice based on realistic financial planning problems (FPI 2019c).

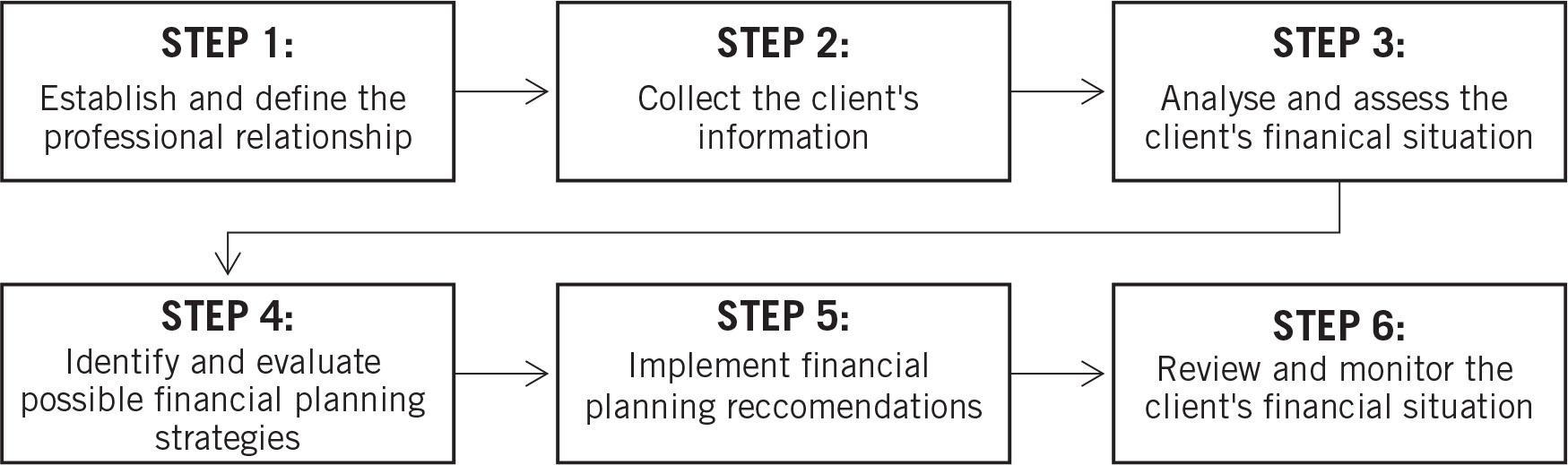

As previously mentioned, the FPSB is an international standards-setting body which oversees the CFP® certification and sets forth the financial planning standards that all financial planning professionals must follow. The FPSB has developed the six-step financial planning process, which represents best practices regarding the financial planning methodology (Financial Planning Standards Board 2025c). Figure 1 provides a graphic display of the six-step financial planning process.

The six-step financial planning process.

Source: Botha et al. (2020:17); Collins and O'Rourke (2012); Cull (2009); Yeske (2010).

When considering the first step of the financial planning process (establish and define the professional relationship with the client), in a South African context, it is important to consider the fact that individuals from different cultural backgrounds establish relationships in different ways (Hofstede 2011). According to Hutchison and Sibanda (2017:384), human relations and networks play an important role in repeated or ongoing transactions, particularly among the African community. It is also important to note that contracts in South African customary law usually affect the entire family or broader community, and require or expect the head of the family (usually a male) to consult with the older male members of the family before concluding a contract (Hutchison and Sibanda 2017, p. 381). Financial planners need to be aware of cultural nuances when approaching or addressing clients from different cultural backgrounds, as a lack of awareness may hinder their ability to establish professional relationships with these clients.

Step two of the six-step financial planning process (gathering information or data) includes the collection of qualitative information, such as the client’s propensity to save or their attitude towards money. When considering the client’s attitude towards money, it is important to note that perceptions and beliefs about wealth and poverty may differ amongst clients, according to their ethnicity. According to Davids, Roberts, Houston, and Mustapha (2022), White and Black individuals differ in their perceptions related to poverty, since Black individuals are more likely to perceive poverty as being structural, that is, it is due to poor wages, low-quality school education, and discrimination, which is a result of the post-apartheid economic and social issues that remain. In contrast, Davids et al. (2022) find that White and Indian individuals, especially those within a higher living standards group, tend to attribute poverty to the lack of personal effort or personal failure. This perception is fuelled by wealth inequality among different population groups in South Africa (Branson, Hjellbrekke, Leibbrandt, Ranchod, Savage and Whitelaw 2024, p. 617; Chelwa, Maboshe and Hamilton 2024:424). At this step in the process, it is also important to consider the diverse needs of consumers in determining what information is important and what information might have future financial implications. Financial planners who are not aware of the needs that are unique to different cultures may overlook information that is relevant and important to their clients.

Step three requires financial planners to analyse the information that was collected from their clients. To do so, they are required to comply with the FPI competency profile (illustrating knowledge, ability and skill) and analyse and synthesise the information based on the knowledge and practice areas as these pertain to their clients (Knutsen and Cameron 2012:38). Having knowledge and understanding of clients’ culture is important given that aspects such as religion can impact estate planning or investments in the case of Muslim clients (Islamic succession and the need for Shariah compliant funds) or cultural rites and traditions could impact estate planning, as is the case with many Black African tribes (customary succession). Thus, if financial planners are not appropriately trained or lack experience in dealing with clients with culturally diverse needs, their analysis of client information may not be accurate. As a result, they will be unable to provide suitable advice.

A vast knowledge of suitable financial products and strategies is required to make suitable recommendations, which is related to step four of the six-step financial planning process (FPI 2019b). However, traditional financial products and practices are often overlooked when recommending financial planning strategies (Seabi 2025). Furthermore, the poor savings culture in South Africa – in addition to low levels of financial literacy – also needs to be taken into consideration when obtaining commitment from the client to implement these recommendations (step five).

South Africa’s low levels of financial literacy necessitate client education about the principles of investment and how fluctuations in financial markets will affect their investments (Rootman and Antoni 2014:476). Lower financial literacy levels are often reported among Black South Africans in particular (Matemane 2018, p. 3). Furthermore, if there is a disconnect between the perceived needs of the client (step three). The recommendations made (step four) create an advice gap, which makes implementation of the financial planning recommendations (step five) considerably more difficult. A financial advice gap occurs where wealthier clients with more complex needs receive comprehensive advice. In contrast, lower-income earners with simpler needs receive only basic or generic advice, or no advice at all. Similarly, middle-income earners (who are considered to be the mass market) are underserved and thus unengaged in comprehensive financial planning services (Hurman & Costain 2012).

Given South Africa’s low levels of financial literacy and the financial advice gap as a result of wealth inequality, it is possible that South African consumers may not understand the advice that is provided. Further to this notion, it is important to understand how unconscious cultural biases may influence the type of advice that is given and how the advice is delivered especially if the financial planner is from a different cultural background from their client (Craft, Brimble, Cull, MacDonald and Hunt 2025, p.4). In addition, various studies (Sweet 2018; Lim & Gray; Koochel 2022) have found that having cultural humility is a critical lens for transforming financial planning into a more inclusive, effective and ethical practice that ensure that financial planners can better serve Black consumers and challenge systemic inequities that are directly applicable to financial planning. Based on the above discussion, factors specific to the South African context are relevant to and influence the way in which financial planning is offered, implemented and experienced in the country. Thus, it can be argued that a review of the six-step financial planning process is warranted.

There are currently approximately 5,000 CFP® professionals in South Africa who are required to apply the six-step financial planning process (Hesse 2019; FPSB 2025). From this population, 35 CFP® professionals were approached to participate in the study, and 16 CFP® professionals formed part of the final sample. This was considered an adequate sample size for qualitative studies, which is supported by Marshall et al. (2013, p. 14), who state that for interviews as a data collection method, a minimum sample size of 12 is considered to provide validity and data saturation. This sample of CFP® professionals was drawn using criterion sampling and accessed using convenience sampling by identifying them through LinkedIn and the FPI online directory of active CFP® professionals. To be eligible for participation in the study, the participant had to be registered as a CFP® professional during the 2022/2023 cycle. The potential participants were approached for participation through a private message on LinkedIn.

An interpretivist research philosophy and qualitative research methodology were deemed to be most appropriate for this study to gain a deeper understanding of CFP® professionals’ perceptions of the appropriateness of the six-step financial planning process for the South African context (Saunders, Lewis and Thornhill 2019, p. 130). A qualitative survey strategy was used, using semi-structured interviews as a data collection method (Nardo 2003, p. 646). These interviews took place online using either Microsoft Teams or Zoom. Permission to record these interviews and to have them further transcribed was obtained from the participants. To analyse the data, a latent content analysis was used, and codes, themes and sub-themes were developed using this data analysis technique (Dooley 2016, p. 244). Atlas Ti data analysis software was used to assist with the analysis of the transcribed data.

Struwig and Stead (2013, p. 178) and Marshall and Rossman (2008) provide guidelines for the phases of data collection and analysis. The first phase of data collection and analysis involved the transcription of the online interviews, conducted by a professional transcriber. Thereafter, the transcripts were studied to ensure that all concepts and discussions were clarified, and to redact any identifying information (phase two). Additional notes made during the interview were used to supplement the transcripts, providing more context. The reviewed transcripts were then sent to the participants for verification. Thereafter, the data were organised based on the main categories of the interview schedule. Phase three involved coding the data by assigning labels to notable statements made by the participants. This was done by searching for concepts which represent abstract representations of events, experiences and opinions, which were then assigned codes (Holton 2010, p. 21). For the current study, a hybrid approach to the development of themes was taken, as suggested by Fereday and Muir-Cochrane (2006, p. 83). This means that a data-driven (inductive) approach using in vivo codes (codes that are based on the language used by a participant) was taken, in conjunction with a template of a priori codes (deductive). In vivo codes refer to codes that are based on the language used by a participant (Saldaña 2014, p. 17), and can also be referred to as natural, verbatim or literal coding (Manning 2017). A priori codes are developed prior to data analysis and are tentative in nature; they can be refined or removed later, if they prove not to be relevant after further analysis (Brooks, McCluskey, Turley and King 2015, p. 203). In this study, a priori codes were developed before the analysis of the data, based on the questions in the interview guide. These a priori codes were thus used as a tentative coding framework, which guided the inductive data analysis to be conducted. Thereafter, phase four of the data analysis involved searching for themes in the data by comparing, contrasting and categorising all the codes (a priori and in vivo) into themes and sub-themes. During phase five of the data analysis process, the findings from the data are interpreted and compared to existing theory (Struwig & Stead 2013, p. 178). During phase six of the data collection and analysis process, alternative understandings of the data are sought. This was done by presenting the findings of the study, along with the interview transcripts, coding framework, and the resulting themes and sub-themes to a small team of researchers. Once the study’s findings were finalised, the final phase (phase seven) involved reducing the data to meaningful chunks. This was achieved by contrasting and comparing the findings, which led to the conclusions presented in this study.

For a study to be useful, the potential users must believe and trust in its integrity, and the findings should be credible (Rossman & Rallis 2017, p. 50). Credibility, transferability, dependability and confirmability are criteria used to ensure rigour and trustworthiness in qualitative research (Struwig & Stead 2013, p.137).

Credibility was ensured by conducting interviews with participants to reach data saturation (Struwig and Stead 2013:137) and by holding interview sessions that lasted approximately 60 to 90 minutes, allowing for prolonged engagement with the participants until all interview questions were comprehensively addressed (Silverman 2010, p. 275). To further promote credibility, the interview transcripts were sent to the research participants to ensure that their words had been transcribed correctly (member checking) and that the transcripts were a true reflection of the participants’ thoughts and feelings. (Candela 2019, p. 620). Transferability was ensured by using a purposive sampling method (criterion sampling) to ensure that relevant and appropriate information was collected from the participants (Babbie & Mouton 2012, p. 277) and by providing a detailed account of the study through a coherent research design and description of the data collection and data analysis processes (Richards & Hemphill 2018, p. 230). Dependability was promoted by coding the data collected from the interviews based on guidance that emerged from the secondary research conducted in the form of the literature review (Struwig & Stead 2013, p. 137). Furthermore, records of all the documentation that is relevant and necessary for the replication of the study – such as the interview schedules, Atlas Ti workbook, Excel sheets with relevant quotes and the interview transcripts – are stored in line with institutional ethical guidelines and are accessible for future reference. Confirmability was ensured by keeping records of all the tools and materials used to collect data (Babbie& Mouton 2012, p. 278). This included digital recordings, transcriptions of interviews, field notes and all drafts of the coding sheet. Furthermore, researcher bias was reduced by having an independent and professional transcriber transcribe the interviews verbatim. Finally, an audit trail was created by carefully documenting all the processes and procedures that were used during data collection and analysis. By addressing the requirements of credibility, transferability, dependability and confirmability, evidence is provided of the rigour and trustworthiness of the findings of this study.

The demographic information of the 16 participants in this sample is tabulated in Table 1. Participant 13 withdrew from the study, so their demographic information has been removed from the table.

Demographic Information for the CFP® Professionals

| P+ | Gender | Ethnicity | Cultural / tribal affiliation | Experience | Qualifications | Coaching |

|---|---|---|---|---|---|---|

| 1 | Male | White | White English | 5 years | BCom | BCom Hons | CFP | ✗ |

| 2 | Male | Black | Zulu | 6 years | BCom | PG Dip | CFP | ✗ |

| 3 | Male | Black | Shona (Zimbabwe) | 5 years | BCom | PG Dip | CFP | ✗ |

| 4 | Male | Asian | Chinese | 8 years | BCom | PG Dip | CFP | ✗ |

| 5 | Male | Black | Ashanti (Ghana) | 10 years | PhD Finance | CFP | ✗ |

| 6 | Female | White | White Afrikaans | 3.5 years | BCom | PG Dip | CFP | ✗ |

| 7 | Male | Coloured | Coloured | 32 years | BCom Hons | Cert Strat HR | CFP | ✓ |

| 8 | Male | White | White Afrikaans | 9 years | Adv Dip | CFP | CeFT | ✓ |

| 9 | Male | White | White Afrikaans | 32 years | PG Dip | ACC* | CFP | ✓ |

| 10 | Male | Black | Ndebele | 22 years | PG Dip | Adv Dip | ACC* | CFA | CFP | ✓ |

| 11 | Female | Black | Zulu | 13 years | BCom | PG Dip | BCom Hons | CFP | ✗ |

| 12 | Female | Black | Xhosa | 11 years | BCom | Adv Dip | CFP | ✓ |

| 14 | Male | Black | Xhosa | 9 years | BCom | PG Dip | CFP | ✗ |

| 15 | Female | White | White Afrikaans | 24 years | PG Dip | CFP | ✗ |

| 16 | Female | White | None | 24 years | BSc Psych | PG Dip | CFP | ✓ |

| 17 | Male | Indian | Hindi | 25 years | PhD | PG Dip | CFP | ✗ |

Participant |

Associate Coaching Course (ACC).

Source: Researcher’s own construction.

As can be seen from Table 1, the majority of the participants in this sample are male (11). Approximately half are of Black African ethnicity (7), and their cultural and tribal affiliations are varied. It is important to note that participants 3 and 5 are naturalised South African citizens, as defined by the Broad Based Black Economic Empowerment Act. Participants have varied numbers of years of experience in the financial advisory field, with a minimum of 3.5 years (Participant 6) and a maximum of 32 years (Participants 7 and 9). All participants meet the minimum financial-planning-related NQF level 8 qualification requirement.

Participants were asked whether they perceive the six-step financial planning process to be suitable for South African consumers, given the cultural diversity and financial planning needs described. Participants were also asked if they could change the process and how they might do so. Their opinions were sought on whether they perceived the tertiary, professional body and industry-specific training that they received prepared them to provide financial planning advice to South African consumers. Table 2 provides an overview of the themes that emerged relating to these questions, as well as the related quotes to substantiate the findings.

Overview of Emerging Themes and Sub-Themes

| Theme | Sub-Themes |

|---|---|

| Current suitability | Partially suitable |

| Unsuitable | |

| Financial planning education and training | Changes to the academic curriculum |

| Contextualised content and assessment | |

| Changes to the six-step financial planning process | |

Source: Researcher’s own construction.

The main themes that emerged from this study relate to the current suitability of the six-step financial planning process, the financial planning education and training received, and suggested changes to the six-step financial planning process. The findings from the theme current suitability are provided in Table 3 and are accompanied by the relevant quotes to substantiate the findings.

The Current Suitability of the Financial Planning Process

| Theme and Sub-Themes | Quote | P | ||

|---|---|---|---|---|

| Current suitability | Partially suitable | In theory but not practice | “…on paper it looks perfect but in practise it doesn’t get implemented accordingly. So I don’t think there is anything wrong with the six-step process as a principle…” | 16 |

| General framework | “I think the six-step financial process is valuable as a general framework.” | 14 | ||

| Narrow application | “So the process itself is suitable, but the way it is used has a narrowed view….” | 2 | ||

| Requires context | “…it is a good guideline, but I will say it needs more context and maybe some subheadings in each of those steps….” | 4 | ||

| Limited interpretation | “…there is nothing wrong with it, it is just that the interpretation sometimes limits a bit more than desired.” | 5 | ||

| Unsuitable | Sales driven | : “…financial planning is driven by advisors who have to make money from first selling a product…the way we are remunerated as financial planners, conditions us to advise on certain things.” | 2 | |

| Relationship building | “I was disregarding the client and how they felt about the process and what their experience was going through this process with me. And I ended up putting clients off or clients were hesitating.” | 4 | ||

| Needs and characteristics of Black consumers | “The model of financial planning does a major injustice to the African community … creating a negative impression about the profession, which is now very detrimental to the African community.” | 5 | ||

| “I think currently very few financial planners are really equipped to deal with the needs of the African community, and it is not because of them but I think that discussions around financial planning…automatically excludes people from even being considered.” | 5 | |||

| “…the industry is White, the industry is male dominated, and not just White male, it is old White male. And financial services has always been practised and viewed through those lenses. So whether transformation means changing the face of the industry, changing the conversations of the industry, changing the processes of the industry – all of those things are still viewed through those old lenses.” | 7 | |||

| “…it is not 100% compatible to the true South African, or it doesn’t really accommodate the journey the typical South African would actually take in the process of being financially free…it sort of forgets that we are dealing with humans here, specifically Africans….” | 7 | |||

| “…it is about representation, so for me it is a different issue though, it doesn’t speak to the competence of the financial advisor, I don’t think it does, but it does speak to the issue of representation because that is a very different thing to diversity.” | 10 | |||

| Supportive legislation | “…does our legislation make provision for this? ...especially in those traditional cases, because you can tell people what you want to tell them – that’s the legal side – but we are still going to deal with it in the cultural way?” | 9 | ||

Source: Researcher’s own construction.

Participants were asked whether they perceived the six-step financial planning process to be suitable for the South African context. Some indicated that it is partially suitable, while others believe it is unsuitable.

From the findings, it was clear that some participants perceived the six-step financial planning process as only partially suitable. Participants noted that it is suitable on paper or in theory and view it as a valuable tool when used as a general framework. The findings also indicate that the participants feel that the six-step financial planning process requires a broader view and more context to guide its application, as it currently offers limited scope for interpretation.

Some participants perceived the six-step financial planning process as unsuitable, offering various reasons for its unsuitability in the South African context. Some participants believe that sales primarily drive the process, and that financial planning needs that cannot be addressed through a product are overlooked as a result. Participant 4 specifically noted that when following the process rigidly without applying it to the client’s context, it becomes difficult to establish a professional relationship with the client. Therefore, the financial planning process requires emphasis on relationship building. This insight is reiterated by Participant 16, who explained that despite perceiving the six-step financial planning process to be a valuable framework, not enough emphasis is placed on the amount of time it takes to really get to know and understand the client’s needs and motivations.

Several participants indicated that the six-step financial planning process, as it is currently applied, is unsuitable specifically for the needs and characteristics of Black South African consumers and think that adjustments need to be made. Participant 5 believes that the model of financial planning is unsuitable for the needs and characteristics of Black African consumers due to the approach financial planners often take. In other words, the approach of some financial planners is not suitable for Black clients who are from a cultural group that is characterised as being suspicious of Black financial planners, who may have lower levels of financial literacy and limited prior exposure to financial products, and who consider speaking about death and finances to be taboo. Participant 5 goes on to state that not all financial planners are equipped to deal with the needs of the Black African community. Participant 7 supports this notion and submits that the financial planning industry is not reflective or representative of the broader South African population, where the large majority of consumers are Black (Black African, Coloured, Asian and Indian). The same participant adds that the application of the financial planning process does not always account for demographic and cultural differences in how information is gathered and interpreted. Participant 9 believes that the problem may not be due to the six-step financial planning process itself, but rather to the supporting legislation in the financial services industry. He refers to the fact that, despite the provisions of estate planning legislation or the RCMA, cultural practices which may not have been the desires of a deceased person still occur. It is clear that despite the presence of supporting legislation for estate and succession planning, the deceased estate is vulnerable to cultural succession practices that may not be in accordance with the desires of the deceased.

Participants were asked to provide suggestions on how the process can be adapted, as well as whether they perceived the training that they received had prepared them for providing financial planning advice to diverse consumers. The main theme of education and training emerged, and among the suggestions that participants made for changes in education and training were changes to the academic curriculum and the need for contextualised content and assessments. These were the two main sub-themes that were identified. Table 4 provides an overview of the sub-themes identified as well as the quotes to substantiate the findings.

Perceptions of the Financial Planning Education and Training Received

| Theme and Sub-Themes | Quote | P | ||

|---|---|---|---|---|

| Financial planning education and training | Changes to the academic curriculum | Human side of financial planning | “So I think far more focus needs to be on a human element or a people element as equal as there is on the financial or on the number side as well.” | 1 |

| “…we train people in terms of numbers and products. However we don’t train them in terms of the human side of money… So I think far more focus needs to be on a human element or a people element as equal as there is on the financial or on the number side as well.” | 9 | |||

| “…it doesn’t build in the human element… but it is something that is not taught or included or incorporated within the six steps of financial planning.” | 12 | |||

| Behavioural finance | “I think the training I did in the behavioural coaching course stood me in far better stead than anything I studied for the board exam...” | 1 | ||

| “So, there is a big drive or trend towards behavioural finance and that covers a lot of the meat that is not covered within the six-step financial planning process.” | 4 | |||

| “What is unfortunately happening is specifically the CFP Board in America is confusing the human side with behavioural finance, and they are saying ‘we are going to teach you about biases and identifying that’.” | 8 | |||

| Financial coaching elements | “So coaching, relating to people which would either be through coaching or through some HR training … for me those are much more useable skills as opposed to what we are doing now…” | 7 | ||

| “…so the FPI equivalent in Canada has exclusively added coaching to the CFP curriculum so I think our approach is too compliance-based.” | 10 | |||

| “What I’m excited about is to see that there’s a lot more emphasis on the coaching and the human side of money. There’s definitely growing recognition that that is incredibly important, and I’m excited to see that happening.” | 16 | |||

| Psychology of the client | “…doesn’t take into account a consideration like the specific client’s cultural background which will have an influence on their perceptions of money, their experiences and also their behaviours around that…a lot more training and education needs to be provided during varsity and also post-varsity once you have started to work.” | 4 | ||

| “… one side is the psychology of the individual that we work with. In the other corner we have the psychology of the community and the workplace etc and then we have the psychology of how do I deal with change and legislation etc…” | 9 | |||

| Contextualised content and assessment | Process | “… the process and the standards, the recommendations – all of those things – I think it has got to be localised; still conforming to what we need to conform to, if that is what we want to conform to, but it has to be locally relevant…” | 9 | |

| FPSB training material | “...even the training content that stems from the FPSB, it doesn’t really accommodate us, our dynamics as South Africans....” | 12 | ||

| FPI assessment tools | “...you will find that the case studies and all of those things, they still talk about you have got ‘die strandhuis [beach house]’ and the farm…When I was doing my CFP in 1999 none of those concepts I could resonate with…I couldn’t identify with it.” | 7 | ||

| Business and product specific assessment tools | “So we always use one or two case studies that focus on a male spouse, a female spouse, married with two children, has a house – you know, it is very rigid, it is not a true reflection of what SA looks like. So a single person with/without children – what are their needs, what products, from what we have currently, what products do we match to this person’s needs?” | 12 | ||

Source: Researcher’s own construction.

When considering aspects that should be incorporated into training and education at the tertiary level, professional level (FPI) and corporate level, participants noted several aspects that relate to changes to the academic curriculum. Several participants believe that incorporating the human side of financial planning into the six-step financial planning process is essential. This should also be reflected in financial planning training and education, and formally taught within the financial planning curriculum.

Several participants shared the sentiment that behavioural finance should be emphasised and differentiated from the human side of financial planning. Participant 4 states that the drive towards behavioural finance is what will provide more context around the six-step financial planning process. Participant 1 agrees with this notion and states that a behavioural coaching course (which combines behavioural finance and coaching) better equipped him to provide suitable financial planning advice. Furthermore, participant 8 believes that behavioural finance is often confused with the human side of money. Behavioural finance relates to the role of investors’ psyche in their financial decision-making and considers the use of psychology to understand how individuals make financial decisions (Kapoor & Prosad 2017, p. 50; Van Zyl & Van Zyl 2016, p. 16). The ‘human side of money’, however, refers to the soft skills of financial planning and incorporates (in addition to psychology) aspects such as philosophy, religion and social theory to understand how individuals make financial decisions (Wagner 2020, p. 50).

Participant 16 reiterates the shared opinion of most participants that the human side of financial planning is becoming an important concept which has hitherto been lacking, but can be rectified through coaching. Participant 7 adds to this notion, believing that coaching enables better relationship-building with people and that greater emphasis should be placed on coaching methodologies. This finding is supported by several authors who think that coaching methodologies should be incorporated into the six-step financial planning process (Collins 2010; Collins, Baker, & Gorey 2007; Goetz, Tombs, & Hampton 2005; van Rooij, Lusardi & Alessie 2012) P. Participant 10 adds that coaching is now included in the curriculum for CFP® professionals in Canada. The approach of integrating coaching elements into the six-step financial planning process is similar to the approach taken by Knutsen and Cameron (2012), who developed the FCAM.

The psychology of financial planning was also noted as an aspect that should be included in the financial planning academic curriculum. This view was held by Participant 9 as well as Participant 4, who noted that the training that he received at university did not prepare him to take into consideration the cultural backgrounds of clients and how that affects their perceptions, experiences and behaviours regarding their finances.

Several participants noted that, in addition to changes to the academic curriculum, financial planning education requires contextualised content and assessments to ensure relevance to South African needs. Given that the financial planning industry is not currently representative of the general population, it stands to reason that the training material is not likely to be representative either. This is an especially important aspect as the FPI PCE plays an important role in the competency requirements of CFP® professionals. To this end, participant 9 states that financial planning content needs to be localised to ensure that it is relevant to South African consumers: Participant 12 adds that that the training material prescribed by the FPSB (global standards setting body) is not relevant to the South African context as reference is made to assets such as farms, holiday homes and trusts which are not commonly used by the large majority of South African consumers. Regarding the assessments of the professional body (FPI), participant 7 states that the FPI assessment tools do not speak to the average South African consumer. Participant 12 agrees with this notion and states that the assessment tools used for business and product-specific training do not speak to the average South African consumer.

In addition to the suggested changes to the academic curriculum and contextualisation of financial planning education and assessments, participants also suggested several changes to some of the steps within the six-step financial planning process or the overall process itself. Table 5 provides an overview of the sub-themes and quotes to substantiate the findings.

Perceptions of the Overall Six-Step Financial Planning Process

| Theme and Sub-Themes | Quote | ||

|---|---|---|---|

| Changes to the six-step financial planning process | Step One | “…establishing that relationship, I think that can be positioned a little bit differently to accommodate a person who was never introduced to financial planning or finances prior…… include communication techniques for this African community...” | 1 |

| Step Two | “The gathering of information should obviously be taken into consideration, the whole background and not just financial, but with a goal to deliver efficient financial planning. It is more about sensitising the advisor towards the approach to gathering information, because we may inadvertently say if I have a Black client he probably wants to take care of his family, he probably wants to do that and that, and so maybe we should just bring him diversity and say the client must just carry on with the desire to help community even though it is to his detriment.” | 5 | |

| “It was never a thing of getting to know what they want from life, and if you are a financial planner, I think the most important thing is to understand what the client wants out of life. Money is not what a person wants at the end of the day, it is what money can buy for you.” | 6 | ||

| “So I don’t think I have a fundamental issue with the steps itself, I have an issue with what sits behind each step and are we aware of the cultural, the demographic, whatever differences in how we gather that information and how we interpret that information?” | 7 | ||

| Step Six | “…reviews are also a bit outdated I think. The annual reviews. So what we do if we can, is spend a whole year and every three months you tackle a different area of financial planning in the first year, just to get the client where they need to be.” Then every half year you do a small check-in to see if any changes have occurred – if you need to make changes to the product, if you need to drop the product, that type of thing. I think it is a more hands-on approach regarding the plans for the client, not the product, and annual reviews are very much product focused.” | 6 | |

Source: Researcher’s own construction.

Participant 1 believes that the first step of the financial planning process – establishing a professional relationship – should be repositioned to better accommodate individuals new to financial planning. The same participant also feels that financial planners should be exposed to or sensitised to communication techniques, particularly as they pertain to Black African consumers, to build meaningful relationships.

Several participants noted changes to the second step of the six-step financial planning process. Participant 5 states that when financial planners apply the second step of the financial planning process (gathering client information), the client’s cultural background should be taken into consideration to sensitise the financial planner to information gathering as it pertains to Black consumers: Participant 6 adds that there should be less emphasis on the collection of numerical data, and more emphasis on the goals and aspirations of clients. Participant 7 suggests that the application of the financial planning process should account for demographic and cultural differences in how information is gathered and interpreted.

No other comments were made regarding the third, fourth or fifth step of the six-step financial planning process. Regarding the sixth step of the financial planning process, Participant 6 believes that annual reviews are outdated and suggests a more suitable approach: reviewing different areas of the financial plan, as annual reviews are product-focused.

The findings of the study reveal that participants perceive the current financial planning process to be partially suitable in theory as a general framework, but the application thereof in South Africa is narrow and requires context, and it does not allow scope for interpretation. Some participants perceive the current financial planning process as completely unsuitable due to its sales-driven nature, lack of emphasis on relationship building, and inability to address the needs and characteristics of Black consumers. Furthermore, the supporting legislation does not always facilitate the application thereof. It can also be concluded that the participants believe several aspects should be added to the academic curriculum for financial planning education and training. It was also found that the content and assessment tools in financial planning education and training require more contextualisation to be representative of South African consumers.

Regarding the overall perceptions of the financial planning process, several participants noted changes to the first step of the financial planning process, where suggestions were made relating to emphasis on relationship building (as opposed to compliance disclosures), communication techniques specifically for the diverse South African community. The findings related to suggested changes to the six-step financial planning process, as well as the participants’ perceptions regarding the overall suitability and application thereof, are consistent with the need to reconceptualise the six-step financial planning process currently used in South Africa.

Based on these findings, it is recommended that recognised education providers and the FPI (which provides accreditation to financial planning programmes) should incorporate aspects that represent the human side of money into the academic curriculum of the formal financial planning qualifications offered. Examples include financial coaching elements, the psychology of the client as it pertains to money, and accounting for different cultural backgrounds. In addition, FSPs and the FPI need to contextualise the training material and examples presented when providing business and product-specific training about the products they offer. It is also advised that cultural intelligence training should be introduced to sensitise financial planners to the needs, beliefs and attitudes toward financial planning of individuals from different cultural backgrounds. This will also assist in how questions are posed so as not to offend or exclude clients from different cultural backgrounds. This will assist FSPs and CFP® professionals in offering financial advice and financial products to Black consumers that will address their particular needs. Furthermore, the FPI and the FPSB need to provide a South African context to the continuous professional development programmes that they offer to members of the FPI, as well as to the assessments for the professional competency examinations. This can be achieved by incorporating examples and questions into the FPSB training material and FPI assessment tools that represent various Black South African households.

By conducting this study, this paper contributes to the financial planning literature by reviewing the financial planning environment and applying the six-step financial planning process in existing studies. Thus, the study assessed the suitability of the financial planning process in a South African context, given the high degree of cultural diversity, and presented several factors that contribute to the unique needs of South African consumers, which indicated the need for an adjusted approach to the application of the six-step financial planning process. This was achieved through a theoretical evaluation of the suitability of each of the six steps in the financial planning process, and its practical application in the South African context. This proved valuable, as South Africa is characterised by aspects such as low financial literacy levels, poor savings behaviour, and income and wealth inequality.

This paper also made an empirical contribution by being the only study to empirically investigate the appropriateness of the six-step financial planning process in a South African context, by considering the perspectives of CFP® professionals. Existing research has been conducted only in a global context and only on certain steps of the financial planning process (Asebedo & Seay 2015; Boon et al. 2011; Chieffe & Rakes 1999; Knutsen & Cameron 2012; Sharpe et al. 2007). In addition, by conducting a detailed investigation of the six-step financial planning process from the perspectives of CFP® professionals, more information is available about the appropriateness and application of the six-step financial planning process in the South African context.