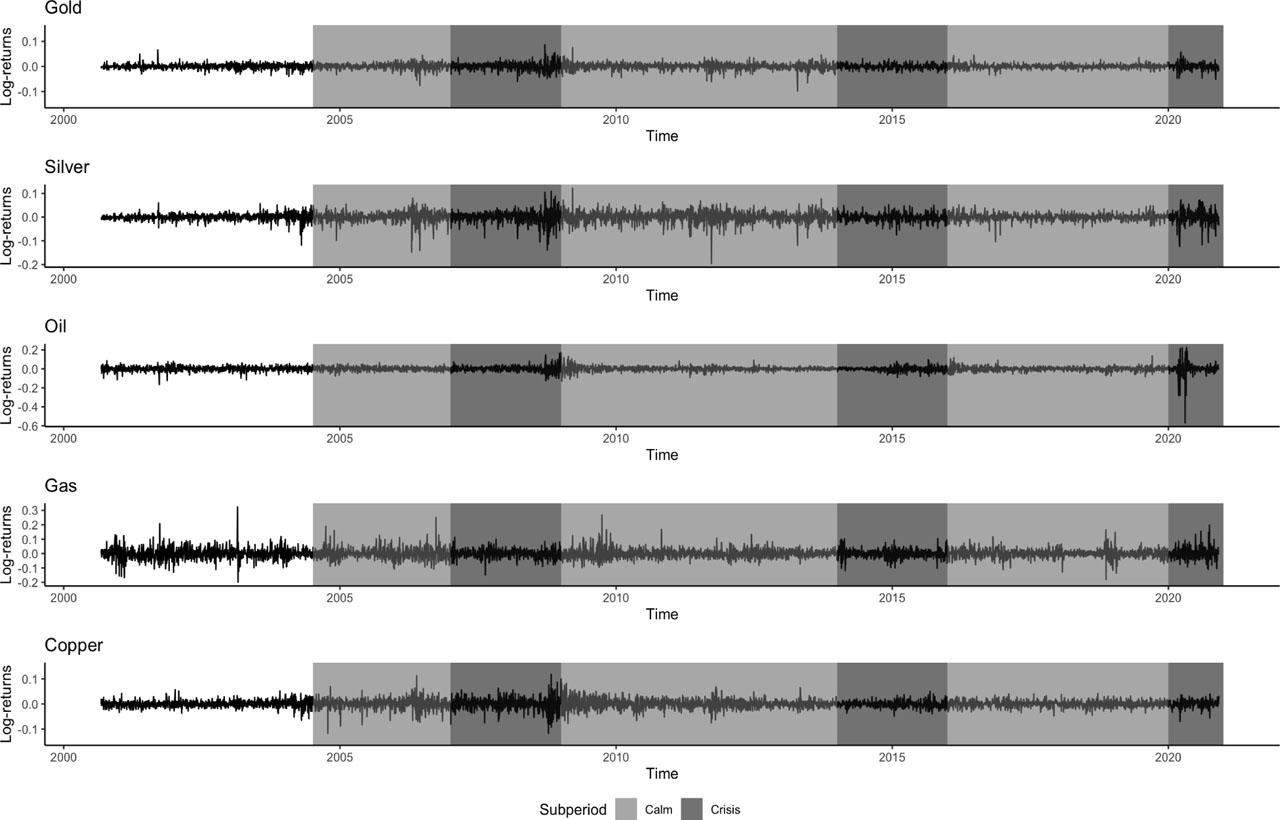

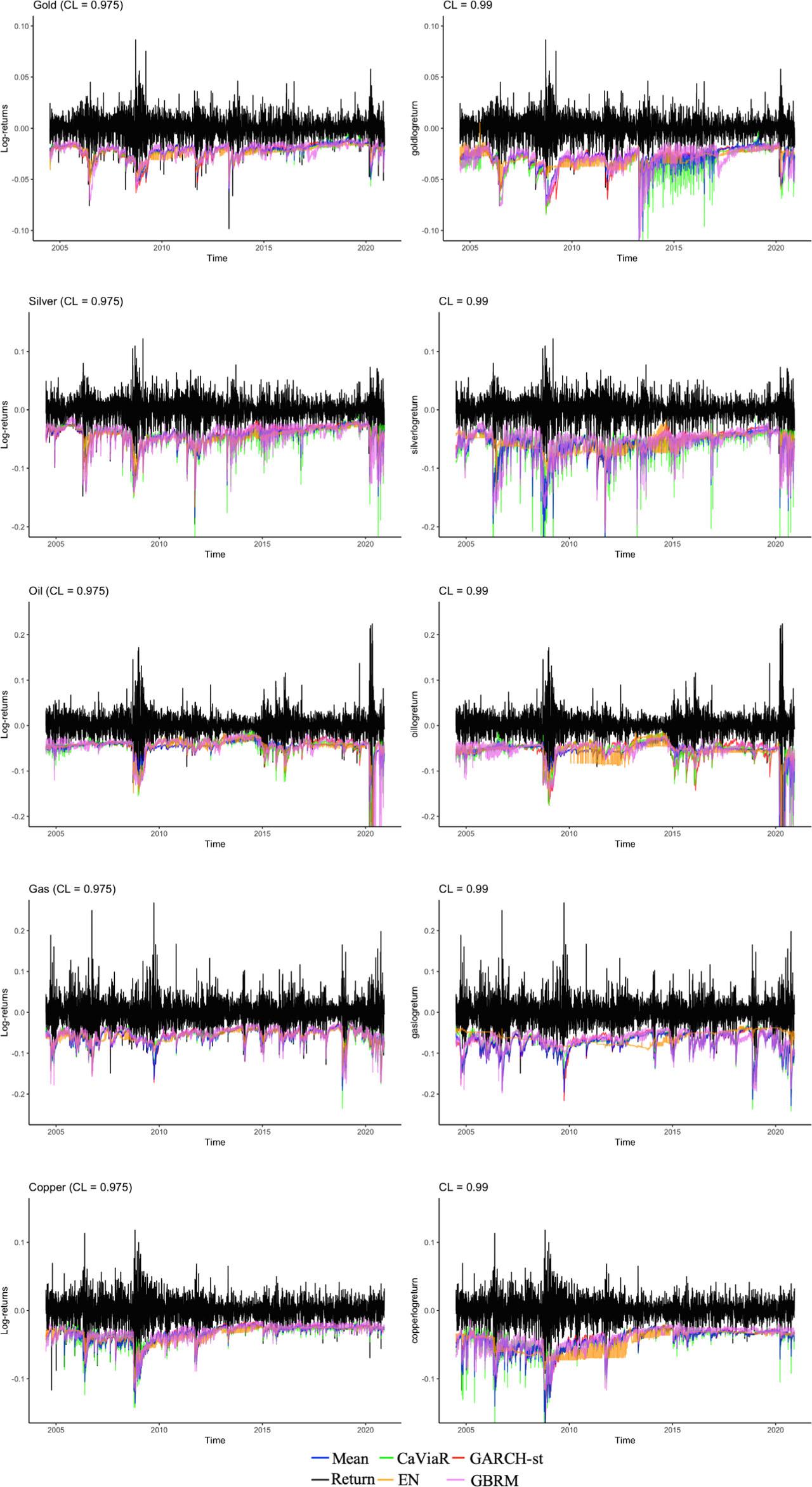

Figure 1.

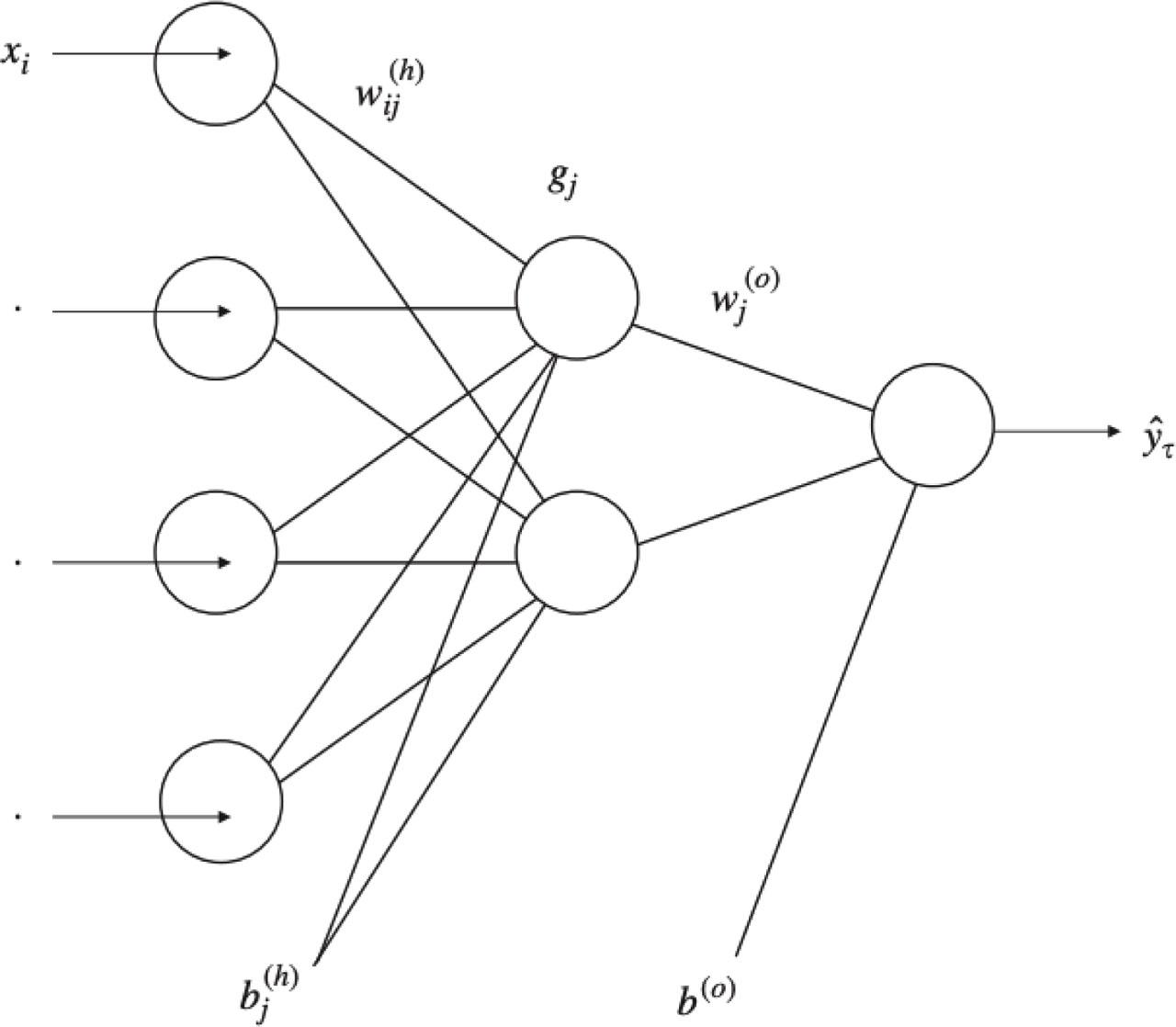

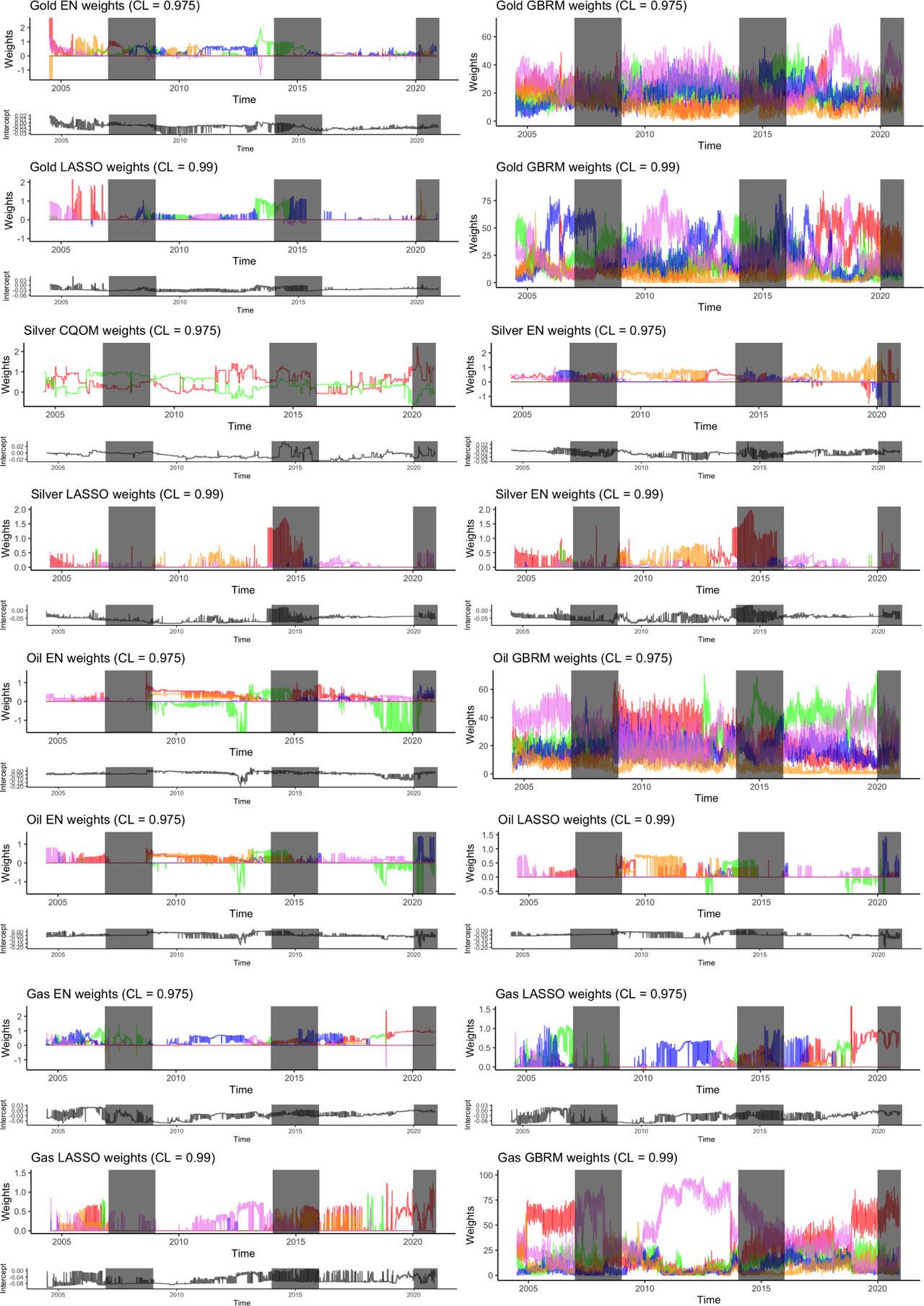

Figure 2.

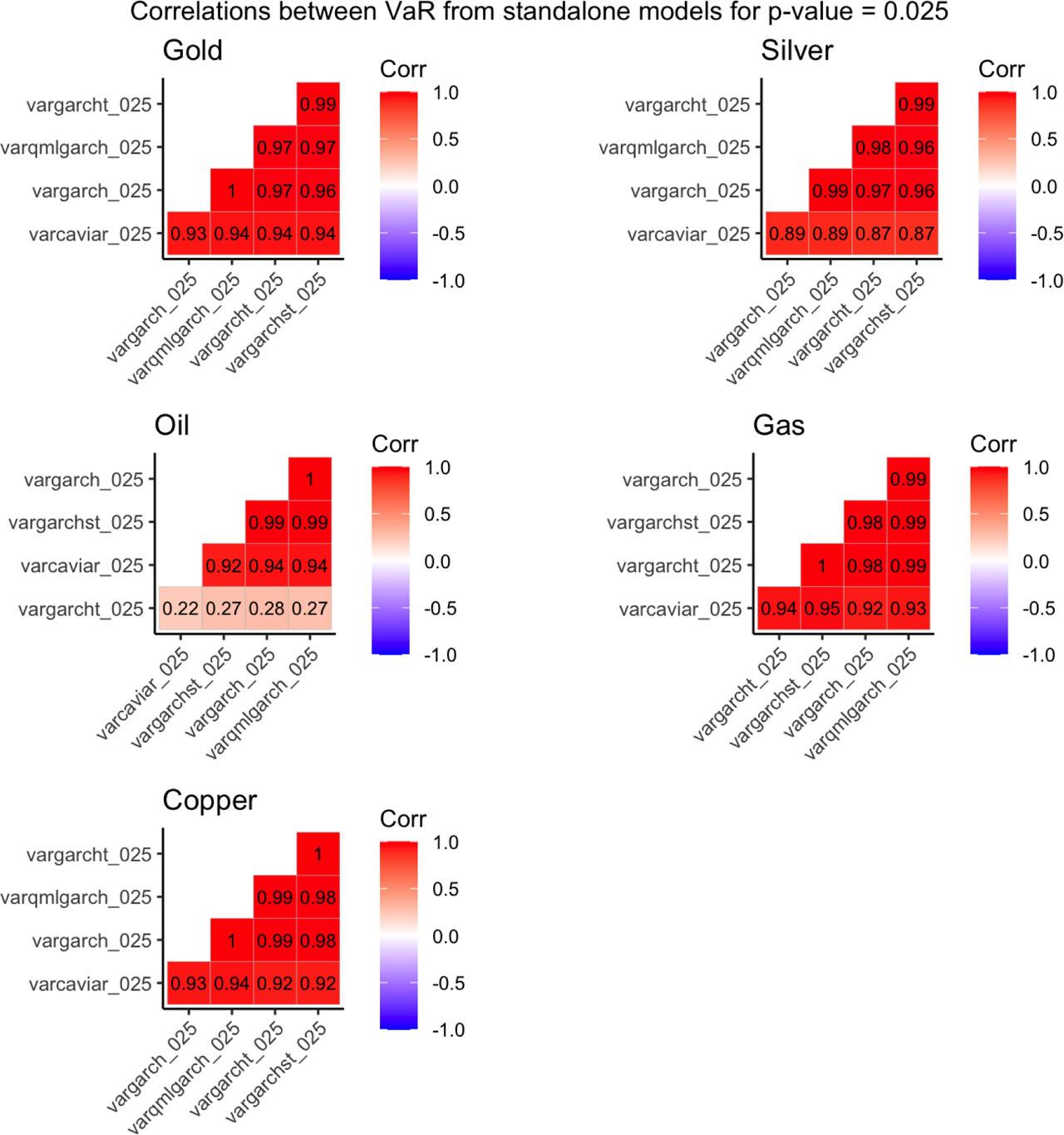

Figure 3.

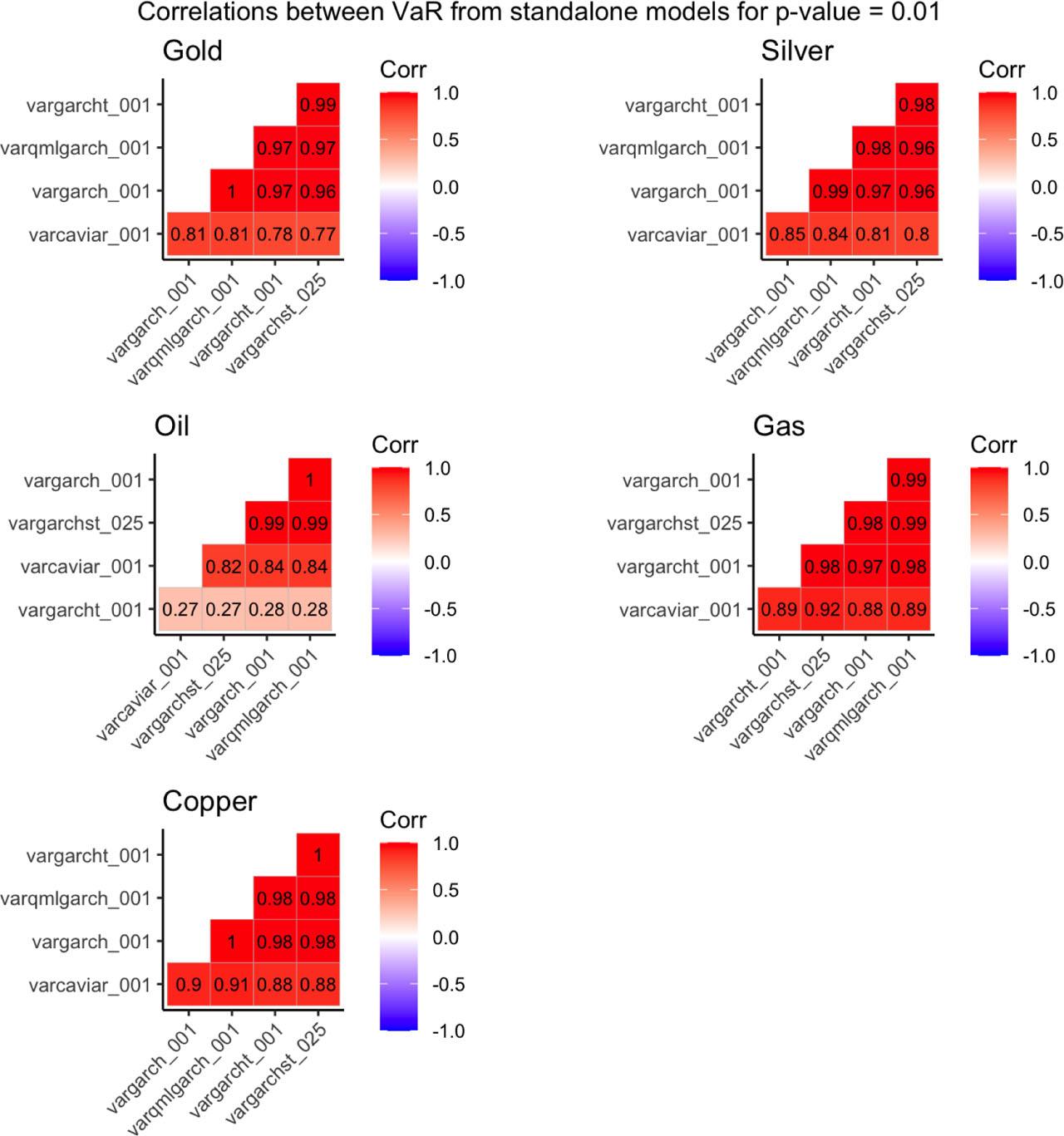

Figure 4.

Figure 5.

Figure 6.

Test results: Excess Ratio (ER), Kupiec (UC), Christoffersen (CC), Dynamic Quantile (DQ) and Traffic Light (TL) divided into the analysed models and periods for silver for confidence level equal to 0_99

| Model | Period I (Whole period) | Period II (All calm periods) | Period I (All crisis periods) | Period I (COVID period) | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ER | UC | CC | DQ | TL | ER | UC | CC | DQ | TL | ER | UC | CC | DQ | TL | ER | UC | CC | DQ | TL | |

| GARCH | 2.36% | 56.00 | 62.62 | 114.64 | R | 2.30% | 36.32 | 39.22 | 67.05 | R | 2.50% | 19.83 | 23.85 | 56.09 | R | 3.46% | 12.30 | 15.63 | 76.45 | Y |

| GARCH-t | 1.30% | 3.43 | 19.68 | 58.92 | Y | 1.06% | 0.12 | 8.50 | 25.70 | G | 1.85% | 7.28 | 14.45 | 46.95 | Y | 2.23% | 11.52 | 15.63 | 73.12 | Y |

| GARCH-st | 1.03% | 0.05 | 21.68 | 77.52 | G | 0.75% | 1.94 | 14.40 | 42.41 | G | 1.69% | 4.96 | 13.18 | 47.30 | Y | 2.16% | 11.30 | 15.63 | 75.03 | Y |

| QML-GARCH | 2.31% | 52.56 | 62.26 | 120.78 | R | 2.20% | 31.39 | 34.78 | 61.32 | R | 2.58% | 21.72 | 28.68 | 71.24 | R | 3.51% | 12.73 | 15.63 | 74.50 | Y |

| CaViaR | 1.11% | 0.46 | 3.05 | 19.34 | G | 0.93% | 0.16 | 1.48 | 4.38 | G | 1.53% | 3.03 | 4.14 | 39.88 | Y | 2.60% | 20.58 | 20.79 | 88.35 | R |

| Mean | 1.01% | 0.00 | 11.44 | 36.79 | G | 0.82% | 0.98 | 12.38 | 38.30 | G | 1.45% | 2.22 | 3.49 | 11.08 | Y | 3.46% | 11.90 | 12.19 | 48.59 | Y |

| Highest VaR | 2.65% | 78.37 | 84.86 | 157.60 | R | 2.44% | 43.32 | 45.64 | 76.26 | R | 3.14% | 36.67 | 41.01 | 101.95 | R | 3.46% | 31.46 | 32.44 | 130.63 | R |

| Lowest VaR | 0.70% | 4.29 | 10.09 | 20.68 | G | 0.62% | 4.99 | 7.69 | 9.93 | G | 0.89% | 0.17 | 3.18 | 21.35 | G | 2.16% | 4.13 | 6.42 | 55.81 | Y |

| CQOM | 1.64% | 14.24 | 29.29 | 108.75 | R | 1.51% | 6.61 | 19.03 | 76.54 | Y | 1.93% | 8.57 | 11.55 | 52.32 | Y | 2.60% | 11.60 | 12.19 | 54.94 | Y |

| Elastic Net | 1.30% | 3.43 | 19.68 | 87.01 | Y | 1.10% | 0.27 | 8.30 | 44.48 | G | 1.77% | 6.07 | 13.76 | 55.34 | Y | 3.46% | 14.19 | 17.72 | 82.18 | R |

| LASSO | 1.20% | 1.62 | 24.93 | 104.71 | G | 1.06% | 0.12 | 13.66 | 64.24 | G | 1.53% | 3.03 | 12.44 | 50.30 | Y | 3.90% | 11.93 | 15.63 | 65.06 | Y |

| QRF | 2.89% | 99.07 | 99.71 | 290.41 | R | 2.64% | 54.69 | 56.27 | 136.88 | R | 3.46% | 46.41 | 46.60 | 187.82 | R | 4.76% | 13.24 | 12.03 | 98.63 | Y |

| GBRM | 1.56% | 11.38 | 23.52 | 68.29 | Y | 1.41% | 4.32 | 13.57 | 42.35 | Y | 1.93% | 8.57 | 11.55 | 40.85 | Y | 2.60% | 2.37 | 11.96 | 92.74 | Y |

| QRNN | 3.61% | 171.00 | 177.55 | 776.88 | R | 3.46% | 109.12 | 115.76 | 459.11 | R | 3.95% | 62.45 | 63.00 | 339.63 | R | 6.06% | 47.94 | 48.22 | 305.35 | R |

Test results: Excess Ratio (ER), Kupiec (UC), Christoffersen (CC), Dynamic Quantile (DQ) and Traffic Light (TL) divided into the analysed models and periods for oil for confidence level equal to 0_975_

| Model | Period I (Whole period) | Period II (All calm periods) | Period I (All crisis periods) | Period I (COVID period) | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ER | UC | CC | DQ | TL | ER | UC | CC | DQ | TL | ER | UC | CC | DQ | TL | ER | UC | CC | DQ | TL | |

| GARCH | 2.96% | 3.39 | 3.43 | 10.66 | Y | 2.37% | 0.22 | 3.56 | 7.97 | G | 4.35% | 14.30 | 15.37 | 19.82 | R | 5.63% | 6.88 | 8.63 | 20.99 | Y |

| GARCH-t | 3.54% | 16.26 | 37.79 | 313.36 | R | 1.75% | 7.51 | 8.57 | 55.08 | G | 7.73% | 90.37 | 99.57 | 311.51 | R | 4.76% | 22.16 | 24.91 | 157.82 | R |

| GARCH-st | 2.43% | 0.09 | 0.95 | 5.04 | G | 1.96% | 3.83 | 6.10 | 8.43 | G | 3.54% | 4.91 | 7.86 | 9.45 | Y | 4.33% | 2.61 | 6.14 | 21.69 | Y |

| QML-GARCH | 3.04% | 3.53 | 3.43 | 10.71 | Y | 2.39% | 0.24 | 3.56 | 8.09 | G | 4.35% | 14.30 | 15.37 | 19.84 | R | 5.77% | 6.97 | 8.63 | 20.99 | Y |

| CaViaR | 2.57% | 0.09 | 1.66 | 14.89 | G | 1.96% | 3.83 | 3.84 | 7.94 | G | 4.03% | 10.04 | 11.73 | 24.06 | Y | 5.19% | 3.85 | 6.69 | 21.18 | Y |

| Mean | 2.50% | 0.00 | 0.68 | 18.03 | G | 1.37% | 18.14 | 19.25 | 26.72 | G | 5.15% | 27.59 | 27.74 | 37.72 | R | 4.76% | 5.28 | 5.49 | 11.16 | Y |

| Highest VaR | 4.86% | 74.74 | 83.96 | 264.82 | R | 3.16% | 4.76 | 4.76 | 29.49 | Y | 8.86% | 125.64 | 131.16 | 328.47 | R | 6.49% | 39.66 | 41.25 | 172.61 | R |

| Lowest VaR | 1.59% | 16.27 | 18.80 | 24.20 | G | 0.99% | 34.98 | 35.56 | 29.30 | G | 2.98% | 1.10 | 3.52 | 7.61 | G | 3.46% | 0.25 | 1.96 | 6.54 | G |

| CQOM | 3.01% | 4.12 | 22.26 | 157.69 | Y | 1.78% | 6.80 | 6.81 | 45.91 | G | 5.88% | 42.38 | 56.14 | 181.95 | R | 3.90% | 27.60 | 34.10 | 133.16 | R |

| Elastic Net | 2.98% | 3.75 | 5.04 | 22.36 | Y | 1.96% | 3.83 | 3.84 | 9.29 | G | 5.39% | 32.24 | 32.77 | 59.60 | R | 6.49% | 14.83 | 15.27 | 63.54 | R |

| LASSO | 3.03% | 4.51 | 10.03 | 69.61 | Y | 1.78% | 6.80 | 7.78 | 12.84 | G | 5.96% | 44.17 | 45.66 | 108.55 | R | 7.36% | 17.15 | 18.83 | 85.82 | R |

| QRF | 5.82% | 137.72 | 139.48 | 253.06 | R | 5.28% | 70.54 | 70.63 | 217.80 | R | 7.09% | 72.17 | 74.44 | 124.92 | R | 8.66% | 19.60 | 25.83 | 74.65 | R |

| GBRM | 3.39% | 12.23 | 12.24 | 24.87 | Y | 2.81% | 1.13 | 2.11 | 15.93 | G | 4.75% | 20.50 | 21.00 | 32.50 | R | 4.76% | 3.85 | 4.23 | 13.35 | Y |

| QRNN | 5.65% | 125.62 | 126.08 | 208.16 | R | 4.73% | 47.48 | 50.07 | 297.87 | R | 7.81% | 92.75 | 92.77 | 156.26 | R | 9.09% | 53.11 | 53.12 | 134.19 | R |

Test results: Excess Ratio (ER), Kupiec (UC), Christoffersen (CC), Dynamic Quantile (DQ) and Traffic Light (TL) divided into the analysed models and periods for gas for confidence level equal to 0_99_

| Model | Period I (Whole period) | Period II (All calm periods) | Period I (All crisis periods) | Period I (COVID period) | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ER | UC | CC | DQ | TL | ER | UC | CC | DQ | TL | ER | UC | CC | DQ | TL | ER | UC | CC | DQ | TL | |

| GARCH | 1.03% | 0.05 | 0.95 | 3.12 | G | 0.79% | 1.41 | 1.78 | 5.43 | G | 1.61% | 3.94 | 4.60 | 9.29 | Y | 3.46% | 2.37 | 2.60 | 26.03 | Y |

| GARCH-t | 0.67% | 5.05 | 5.43 | 8.05 | G | 0.48% | 9.84 | 9.98 | 10.05 | G | 1.13% | 0.20 | 0.51 | 2.29 | G | 2.16% | 0.19 | 0.27 | 2.44 | G |

| GARCH-st | 0.99% | 0.01 | 0.82 | 9.81 | G | 0.75% | 1.94 | 2.27 | 6.23 | G | 1.53% | 3.03 | 3.62 | 13.25 | Y | 2.09% | 1.02 | 1.17 | 27.33 | G |

| QML-GARCH | 1.08% | 0.28 | 1.26 | 3.39 | G | 0.81% | 1.48 | 1.78 | 5.38 | G | 1.77% | 6.07 | 6.87 | 12.93 | Y | 3.54% | 2.45 | 2.60 | 26.19 | Y |

| CaViaR | 1.05% | 0.07 | 0.95 | 5.60 | G | 0.82% | 0.98 | 1.38 | 5.06 | G | 1.53% | 3.03 | 3.62 | 10.03 | Y | 2.60% | 1.02 | 1.17 | 9.73 | G |

| Mean | 0.84% | 1.11 | 1.70 | 4.82 | G | 0.65% | 4.07 | 4.32 | 8.78 | G | 1.29% | 0.96 | 1.37 | 4.27 | G | 3.46% | 0.29 | 0.27 | 2.80 | G |

| Highest VaR | 1.25% | 2.45 | 3.77 | 10.26 | Y | 0.99% | 0.00 | 0.58 | 2.86 | G | 1.85% | 7.28 | 8.14 | 19.35 | Y | 3.46% | 2.37 | 2.60 | 26.07 | Y |

| Lowest VaR | 0.63% | 6.80 | 7.12 | 9.37 | G | 0.41% | 13.10 | 13.20 | 12.22 | G | 1.13% | 0.20 | 0.51 | 2.41 | G | 2.16% | 0.19 | 0.27 | 2.70 | G |

| CQOM | 4.40% | 264.51 | 268.51 | 748.76 | R | 4.67% | 209.24 | 212.38 | 615.08 | R | 3.78% | 56.92 | 57.68 | 156.26 | R | 2.60% | 11.30 | 12.03 | 29.88 | Y |

| Elastic Net | 3.49% | 158.07 | 167.67 | 609.97 | R | 3.43% | 106.60 | 113.48 | 430.37 | R | 3.62% | 51.57 | 54.28 | 217.59 | R | 3.46% | 61.53 | 61.96 | 212.30 | R |

| LASSO | 1.35% | 4.56 | 11.81 | 67.51 | Y | 1.10% | 0.27 | 8.30 | 4.77 | G | 1.93% | 8.57 | 9.06 | 39.17 | Y | 3.90% | 6.24 | 6.68 | 26.86 | Y |

| QRF | 3.32% | 140.58 | 140.62 | 422.57 | R | 2.78% | 62.80 | 62.83 | 203.90 | R | 4.59% | 86.18 | 86.24 | 262.53 | R | 4.76% | 17.29 | 18.39 | 63.33 | R |

| GBRM | 1.54% | 10.50 | 10.50 | 39.50 | Y | 1.23% | 1.51 | 2.04 | 16.13 | G | 2.25% | 14.56 | 15.85 | 44.46 | R | 2.60% | 2.37 | 2.60 | 25.28 | Y |

| QRNN | 3.78% | Inf | Inf | 1181.52 | R | 4.12% | 160.80 | 160.80 | 1024.17 | R | 2.98% | 32.11 | 34.39 | 194.18 | R | 6.06% | 4.13 | 4.46 | 71.51 | Y |

Test results: Excess Ratio (ER), Kupiec (UC), Christoffersen (CC), Dynamic Quantile (DQ) and Traffic Light (TL) divided into the analysed models and periods for gold for confidence level equal to 0_99

| Model | Period I (Whole period) | Period II (All calm periods) | Period I (All crisis periods) | Period I (COVID period) | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ER | UC | CC | DQ | TL | ER | UC | CC | DQ | TL | ER | UC | CC | DQ | TL | ER | UC | CC | DQ | TL | |

| GARCH | 1.85% | 24.38 | 24.59 | 47.78 | R | 1.65% | 10.30 | 10.36 | 20.23 | Y | 2.33% | 16.25 | 16.39 | 40.37 | R | 3.46% | 8.64 | 9.89 | 31.80 | Y |

| GARCH-t | 1.13% | 0.69 | 6.40 | 18.19 | G | 1.06% | 0.12 | 1.02 | 3.17 | G | 1.29% | 0.96 | 6.88 | 34.25 | G | 2.19% | 2.39 | 5.38 | 30.03 | Y |

| GARCH-st | 0.91% | 0.32 | 4.16 | 9.17 | G | 0.89% | 0.36 | 1.79 | 3.81 | G | 0.97% | 0.01 | 2.69 | 9.69 | G | 2.16% | 2.37 | 5.38 | 30.07 | Y |

| QML-GARCH | 1.90% | 24.66 | 24.59 | 47.38 | R | 1.67% | 10.35 | 10.36 | 20.02 | Y | 2.37% | 16.43 | 16.39 | 40.04 | R | 3.55% | 8.87 | 9.89 | 31.55 | Y |

| CaViaR | 1.03% | 0.05 | 3.07 | 15.54 | G | 1.10% | 0.27 | 1.09 | 6.80 | G | 0.89% | 0.17 | 3.18 | 13.09 | G | 2.60% | 4.13 | 6.42 | 26.36 | Y |

| Mean | 1.30% | 3.43 | 5.09 | 18.31 | Y | 1.30% | 2.48 | 2.89 | 8.34 | G | 1.29% | 0.96 | 2.61 | 18.09 | G | 3.46% | 8.64 | 9.89 | 31.23 | Y |

| Highest VaR | 1.88% | 25.64 | 26.93 | 52.17 | R | 1.65% | 10.30 | 10.36 | 19.95 | Y | 2.42% | 18.01 | 19.63 | 49.68 | R | 3.46% | 8.64 | 9.89 | 31.27 | Y |

| Lowest VaR | 0.84% | 1.11 | 5.53 | 12.07 | G | 0.86% | 0.63 | 2.19 | 3.78 | G | 0.81% | 0.51 | 3.89 | 13.52 | G | 2.16% | 2.37 | 5.38 | 30.17 | Y |

| CQOM | 1.54% | 10.50 | 13.28 | 51.94 | Y | 1.44% | 5.04 | 7.12 | 34.06 | Y | 1.77% | 6.07 | 6.77 | 35.15 | Y | 2.60% | 4.13 | 6.42 | 52.00 | Y |

| Elastic Net | 1.32% | 3.98 | 11.47 | 62.74 | Y | 1.10% | 0.27 | 8.30 | 39.08 | G | 1.85% | 7.28 | 7.86 | 40.96 | Y | 3.46% | 8.64 | 9.89 | 43.82 | Y |

| LASSO | 1.27% | 2.92 | 4.68 | 34.99 | Y | 1.06% | 0.12 | 1.02 | 7.58 | G | 1.77% | 6.07 | 6.77 | 42.25 | Y | 3.90% | 11.30 | 12.19 | 48.62 | Y |

| QRF | 3.61% | 171.00 | 171.03 | 448.16 | R | 3.64% | 122.05 | 122.39 | 323.10 | R | 3.54% | 48.97 | 52.20 | 148.36 | R | 4.76% | 17.29 | 18.39 | 73.79 | R |

| GBRM | 1.35% | 4.56 | 11.81 | 80.37 | Y | 0.96% | 0.05 | 4.83 | 17.66 | G | 2.25% | 14.56 | 16.57 | 99.99 | R | 2.60% | 4.13 | 6.42 | 47.14 | Y |

| QRNN | 3.42% | 150.49 | 160.82 | 541.10 | R | 3.29% | 96.70 | 102.40 | 349.83 | R | 3.70% | 54.22 | 58.90 | 206.00 | R | 6.06% | 27.68 | 27.71 | 80.57 | R |

Test results: Excess Ratio (ER), Kupiec (UC), Christoffersen (CC), Dynamic Quantile (DQ) and Traffic Light (TL) divided into the analysed models and periods for gas for confidence level equal to 0_975_

| Model | Period I (Whole period) | Period II (All calm periods) | Period I (All crisis periods) | Period I (COVID period) | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ER | UC | CC | DQ | TL | ER | UC | CC | DQ | TL | ER | UC | CC | DQ | TL | ER | UC | CC | DQ | TL | |

| GARCH | 2.19% | 1.72 | 1.72 | 5.62 | G | 1.78% | 6.80 | 6.81 | 8.64 | G | 3.14% | 1.93 | 1.98 | 7.75 | G | 5.63% | 0.79 | 1.36 | 10.87 | G |

| GARCH-t | 2.09% | 2.99 | 3.01 | 6.79 | G | 1.75% | 7.51 | 7.52 | 8.66 | G | 2.90% | 0.77 | 0.77 | 5.75 | G | 4.76% | 1.58 | 2.32 | 10.97 | G |

| GARCH-st | 2.45% | 0.04 | 0.13 | 2.93 | G | 2.09% | 2.10 | 2.47 | 2.96 | G | 3.30% | 2.98 | 3.08 | 10.15 | Y | 4.33% | 1.49 | 2.32 | 11.11 | G |

| QML-GARCH | 2.24% | 1.22 | 1.22 | 4.27 | G | 1.85% | 5.50 | 5.50 | 6.19 | G | 3.14% | 1.93 | 1.98 | 7.59 | G | 5.63% | 0.79 | 1.36 | 11.01 | G |

| CaViaR | 2.53% | 0.01 | 0.06 | 12.09 | G | 1.99% | 3.34 | 3.88 | 9.26 | G | 3.78% | 7.28 | 7.71 | 20.93 | Y | 5.19% | 1.57 | 2.32 | 13.96 | G |

| Mean | 2.24% | 1.22 | 1.60 | 9.07 | G | 1.82% | 6.13 | 7.02 | 11.42 | G | 3.22% | 2.43 | 2.50 | 10.27 | Y | 4.76% | 0.79 | 1.36 | 10.88 | G |

| Highest VaR | 2.86% | 2.14 | 2.20 | 8.51 | G | 2.37% | 0.22 | 0.30 | 1.96 | G | 4.03% | 10.04 | 10.71 | 24.08 | Y | 6.49% | 2.61 | 3.52 | 14.67 | Y |

| Lowest VaR | 1.83% | 8.48 | 8.72 | 12.70 | G | 1.41% | 16.94 | 17.20 | 17.60 | G | 2.82% | 0.50 | 0.50 | 5.85 | G | 3.46% | 0.79 | 1.36 | 10.63 | G |

| CQOM | 4.52% | 56.49 | 67.33 | 232.88 | R | 4.22% | 29.41 | 43.33 | 169.76 | R | 5.23% | 29.10 | 29.21 | 76.81 | R | 3.90% | 0.63 | 0.77 | 10.55 | G |

| Elastic Net | 2.45% | 0.04 | 0.84 | 8.38 | G | 2.02% | 2.90 | 7.23 | 11.76 | G | 3.46% | 4.22 | 7.31 | 17.85 | Y | 6.49% | 1.79 | 2.32 | 10.66 | G |

| LASSO | 2.45% | 0.04 | 2.09 | 13.69 | G | 2.09% | 2.10 | 6.04 | 14.24 | G | 3.30% | 2.98 | 3.08 | 17.62 | Y | 7.36% | 1.86 | 2.32 | 9.07 | G |

| QRF | 5.53% | 117.24 | 117.29 | 357.06 | R | 5.25% | 68.99 | 69.14 | 221.09 | R | 6.20% | 49.73 | 49.74 | 141.98 | R | 8.66% | 6.88 | 8.44 | 18.56 | Y |

| GBRM | 3.30% | 9.83 | 12.20 | 37.10 | Y | 2.85% | 1.38 | 2.39 | 12.48 | G | 4.35% | 14.30 | 15.37 | 39.06 | R | 4.76% | 2.61 | 3.22 | 12.55 | Y |

| QRNN | 5.27% | 99.63 | 105.52 | 453.83 | R | 5.21% | 67.45 | 70.62 | 349.00 | R | 5.39% | 32.24 | 35.09 | 119.62 | R | 9.09% | 6.88 | 6.98 | 64.95 | Y |

Test results: Excess Ratio (ER), Kupiec (UC), Christoffersen (CC), Dynamic Quantile (DQ) and Traffic Light (TL) divided into the analysed models and periods for copper for confidence level equal to 0_99_

| Model | Period I (Whole period) | Period II (All calm periods) | Period I (All crisis periods) | Period I (COVID period) | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ER | UC | CC | DQ | TL | ER | UC | CC | DQ | TL | ER | UC | CC | DQ | TL | ER | UC | CC | DQ | TL | |

| GARCH | 1.71% | 17.36 | 21.56 | 53.94 | R | 1.44% | 5.04 | 6.26 | 9.79 | G | 2.33% | 16.25 | 24.63 | 98.67 | R | 3.46% | 11.30 | 15.63 | 110.23 | Y |

| GARCH-t | 1.18% | 1.27 | 10.40 | 38.94 | G | 0.93% | 0.16 | 0.67 | 8.74 | G | 1.77% | 6.07 | 18.76 | 79.58 | Y | 2.16% | 4.13 | 11.96 | 99.07 | Y |

| GARCH-st | 1.08% | 0.28 | 10.67 | 40.15 | G | 0.89% | 0.36 | 0.82 | 8.16 | G | 1.53% | 3.03 | 18.17 | 92.27 | Y | 2.12% | 4.11 | 11.96 | 99.36 | Y |

| QML-GARCH | 1.78% | 20.75 | 24.47 | 55.48 | R | 1.54% | 7.47 | 8.88 | 12.95 | G | 2.33% | 16.25 | 24.63 | 98.80 | R | 3.49% | 11.41 | 15.63 | 131.62 | Y |

| CaViaR | 1.20% | 1.62 | 3.71 | 27.18 | G | 1.13% | 0.49 | 1.25 | 16.74 | G | 1.37% | 1.53 | 6.99 | 30.44 | G | 2.60% | 2.37 | 5.38 | 82.34 | Y |

| Mean | 1.01% | 0.00 | 11.44 | 45.52 | G | 0.89% | 0.36 | 0.82 | 6.08 | G | 1.29% | 0.96 | 19.09 | 118.12 | G | 3.46% | 4.13 | 11.96 | 107.81 | Y |

| Highest VaR | 1.95% | 29.58 | 32.33 | 73.24 | R | 1.72% | 12.41 | 14.15 | 27.03 | G | 2.50% | 19.83 | 27.24 | 95.92 | R | 3.46% | 11.30 | 15.63 | 110.69 | Y |

| Lowest VaR | 0.87% | 0.79 | 5.01 | 21.97 | G | 0.75% | 1.94 | 2.27 | 8.58 | G | 1.13% | 0.20 | 7.18 | 38.09 | G | 2.16% | 2.37 | 5.38 | 59.22 | Y |

| CQOM | 1.85% | 24.38 | 33.04 | 376.94 | R | 1.34% | 3.04 | 3.40 | 84.60 | G | 3.06% | 34.37 | 42.11 | 389.48 | R | 2.60% | 31.46 | 32.44 | 159.44 | R |

| Elastic Net | 1.27% | 2.92 | 7.43 | 78.15 | Y | 1.13% | 0.49 | 1.25 | 53.05 | G | 1.61% | 3.94 | 12.74 | 66.78 | Y | 3.46% | 2.37 | 5.38 | 26.06 | Y |

| LASSO | 1.23% | 2.02 | 2.21 | 136.46 | G | 1.06% | 0.12 | 0.78 | 55.47 | G | 1.61% | 3.94 | 4.90 | 112.99 | Y | 3.90% | 2.42 | 5.38 | 27.19 | Y |

| QRF | 3.63% | 173.63 | 178.33 | 542.73 | R | 3.36% | 101.61 | 101.76 | 317.23 | Y | 4.27% | 74.00 | 81.26 | 275.12 | R | 4.76% | 13.24 | 12.19 | 81.67 | Y |

| GBRM | 1.73% | 18.46 | 20.31 | 64.03 | R | 1.48% | 5.80 | 7.09 | 29.37 | G | 2.33% | 16.25 | 20.93 | 56.39 | R | 2.60% | 9.54 | 12.19 | 49.56 | Y |

| QRNN | 3.56% | 165.79 | 168.16 | 374.11 | R | 4.01% | 152.20 | 153.27 | 351.61 | R | 2.50% | 19.83 | 21.28 | 76.59 | R | 6.06% | 17.29 | 17.67 | 104.84 | R |

The best model for each commodity (rows) and for all periods (columns) for confidence level of 0_975 (upper part), and 0_99 (lower part) achieved using MCS procedure

| Model | Period I (Whole period) | Period II (All calm periods) | Period III (All crisis periods) | Period IV (COVID period) |

|---|---|---|---|---|

| Confidence level = 0.025 | ||||

| Gold | GARCH-t | GARCH-t | GARCH-t | CQOM |

| Silver | Mean | GARCH-st | Mean | Mean |

| Oil | GARCH | GARCH | GARCH-st | GARCH-st |

| Gas | GARCH-st | Highest VaR | GARCH-st | LASSO |

| Copper | Mean | GARCH | Elastic Net | Elastic Net |

| Confidence level = 0.01 | ||||

| Gold | Lowest VaR | Lowest VaR | GARCH-st | GARCH-st |

| Silver | Lowest VaR | Lowest VaR | Lowest VaR | Lowest VaR |

| Oil | Lowest VaR | Mean | Lowest VaR | Lowest VaR |

| Gas | Lowest VaR | GARCH-t | Lowest VaR | CQOM |

| Copper | Lowest VaR | Lowest VaR | Lowest VaR | GARCH-st |

Test results: Excess Ratio (ER), Kupiec (UC), Christoffersen (CC), Dynamic Quantile (DQ) and Traffic Light (TL) divided into the analysed models and periods for oil for confidence level equal to 0_99_

| Model | Period I (Whole period) | Period II (All calm periods) | Period I (All crisis periods) | Period I (COVID period) | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ER | UC | CC | DQ | TL | ER | UC | CC | DQ | TL | ER | UC | CC | DQ | TL | ER | UC | CC | DQ | ||

| GARCH | 1.54% | 10.50 | 13.28 | 25.45 | Y | 1.27% | 1.97 | 2.92 | 11.38 | G | 2.17% | 12.95 | 18.36 | 24.49 | R | 3.43% | 8.41 | 13.93 | 72.02 | Y |

| GARCH-t | 2.41% | 59.53 | 80.88 | 490.49 | R | 0.96% | 0.05 | 1.25 | 106.88 | G | 5.80% | 136.83 | 145.95 | 536.93 | R | 2.16% | 39.45 | 44.28 | 346.76 | R |

| GARCH-st | 1.01% | 0.00 | 0.58 | 3.13 | G | 0.89% | 0.36 | 0.82 | 10.06 | G | 1.29% | 0.96 | 2.61 | 6.28 | G | 2.16% | 4.13 | 6.42 | 24.85 | Y |

| QML-GARCH | 1.52% | 9.64 | 12.55 | 24.38 | Y | 1.29% | 2.01 | 2.92 | 11.47 | G | 2.09% | 11.41 | 17.23 | 23.12 | Y | 3.45% | 8.55 | 13.93 | 72.03 | Y |

| CaViaR | 1.49% | 8.81 | 8.82 | 14.83 | Y | 1.10% | 0.27 | 0.98 | 5.46 | G | 2.42% | 18.01 | 18.10 | 27.26 | R | 2.60% | 6.24 | 7.95 | 36.61 | Y |

| Mean | 1.44% | 7.26 | 7.28 | 20.93 | Y | 0.96% | 0.05 | 0.59 | 21.48 | G | 2.58% | 21.72 | 21.76 | 30.45 | R | 3.41% | 8.24 | 7.95 | 37.61 | Y |

| Highest VaR | 3.49% | 158.07 | 169.88 | 460.74 | R | 1.99% | 22.40 | 22.42 | 79.80 | R | 7.00% | 194.17 | 201.30 | 574.54 | R | 3.46% | 56.90 | 61.42 | 306.55 | R |

| Lowest VaR | 0.46% | 15.51 | 18.66 | 17.14 | G | 0.27% | 21.77 | 21.81 | 15.72 | G | 0.89% | 0.17 | 3.18 | 8.15 | G | 2.16% | 1.02 | 4.98 | 40.55 | G |

| CQOM | 2.36% | 56.00 | 94.71 | 707.99 | R | 1.51% | 6.61 | 11.24 | 151.64 | Y | 4.35% | 76.99 | 104.99 | 671.01 | R | 2.60% | 39.45 | 44.28 | 297.04 | R |

| Elastic Net | 1.64% | 14.24 | 14.83 | 27.95 | R | 0.99% | 0.00 | 0.58 | 15.67 | G | 3.14% | 36.67 | 37.11 | 69.57 | R | 3.46% | 14.19 | 14.79 | 46.58 | R |

| LASSO | 1.59% | 12.31 | 14.83 | 120.13 | Y | 0.79% | 1.41 | 1.78 | 41.45 | G | 3.46% | 46.41 | 47.70 | 137.00 | R | 3.90% | 17.29 | 17.67 | 112.70 | R |

| QRF | 3.68% | 178.14 | 179.09 | 390.91 | R | 3.26% | 94.28 | 94.76 | 279.50 | R | 4.67% | 89.32 | 92.69 | 240.24 | R | 4.76% | 20.58 | 26.33 | 125.31 | R |

| GBRM | 1.80% | 21.93 | 22.21 | 34.37 | R | 1.48% | 5.80 | 7.09 | 38.64 | Y | 2.58% | 21.72 | 23.01 | 40.31 | R | 2.60% | 6.24 | 7.95 | 25.84 | Y |

| QRNN | 4.43% | 267.55 | 269.31 | 1197.81 | R | 3.40% | 104.09 | 104.84 | 533.39 | R | 6.84% | 186.18 | 186.44 | 816.55 | R | 6.06% | 66.27 | 69.41 | 542.78 | R |

Statistics of prices’ log-returns

| Commodity | Min. | 1st Qu. | Median | Mean | 3rd Qu. | Max | J-B test | Skewness | Ex. Kurtosis |

|---|---|---|---|---|---|---|---|---|---|

| Gold | −0.0982 | −0.0049 | 0.0005 | 0.0004 | 0.006 | 0.0864 | 6398 (<0.001) | –0.2658 | 8.7160 |

| Silver | −0.1955 | −0.0080 | 0.0011 | 0.0003 | 0.0090 | 0.1220 | 13942 (<0.001) | –0.9263 | 10.8079 |

| Oil | −0.2799 | −0.0128 | 0.0008 | 0.0001 | 0.0130 | 0.3196 | 52559 (<0.001) | –1.9164 | 52.6291 |

| Gas | −0.1990 | −0.1911 | −0.0007 | −0.0001 | 0.0173 | 0.3238 | 6833 (<0.001) | 0.5643 | 8.7537 |

| Copper | −0.1169 | −0.0082 | 0.0002 | 0.0003 | 0.0089 | 0.1177 | 4279 (<0.001) | –0.1731 | 7.6239 |

Test results: Excess Ratio (ER), Kupiec (UC), Christoffersen (CC), Dynamic Quantile (DQ) and Traffic Light (TL) divided into the analysed models and periods for copper for confidence level equal to 0_975

| Model | Period I (Whole period) | Period II (All calm periods) | Period I (All crisis periods) | Period I (COVID period) | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ER | UC | CC | DQ | TL | ER | UC | CC | DQ | TL | ER | UC | CC | DQ | TL | ER | UC | CC | DQ | TL | |

| GARCH | 2.96% | 3.39 | 4.77 | 19.79 | Y | 2.61% | 0.14 | 0.14 | 4.71 | G | 3.78% | 7.28 | 9.54 | 30.64 | Y | 5.63% | 3.85 | 6.69 | 29.71 | Y |

| GARCH-t | 2.67% | 0.48 | 3.05 | 18.85 | G | 2.33% | 0.34 | 0.45 | 2.93 | G | 3.46% | 4.22 | 7.42 | 36.25 | Y | 4.76% | 1.58 | 5.92 | 35.76 | G |

| GARCH-st | 2.65% | 0.36 | 3.04 | 20.04 | G | 2.37% | 0.22 | 0.30 | 3.05 | G | 3.30% | 2.98 | 6.71 | 39.01 | Y | 4.33% | 2.61 | 6.14 | 31.14 | Y |

| QML-GARCH | 2.99% | 3.44 | 4.77 | 19.46 | Y | 2.65% | 0.16 | 0.14 | 4.21 | G | 3.78% | 7.28 | 9.54 | 30.72 | Y | 5.63% | 3.85 | 6.69 | 42.44 | Y |

| CaViaR | 2.57% | 0.09 | 0.62 | 10.85 | G | 2.26% | 0.69 | 3.75 | 9.95 | G | 3.30% | 2.98 | 6.71 | 16.07 | Y | 5.19% | 2.71 | 6.14 | 51.69 | Y |

| Mean | 2.43% | 0.09 | 0.95 | 10.86 | G | 2.23% | 0.91 | 3.87 | 4.65 | G | 2.90% | 0.77 | 6.12 | 22.07 | G | 4.65% | 2.55 | 6.14 | 40.23 | Y |

| Highest VaR | 3.27% | 9.27 | 10.61 | 29.07 | Y | 2.88% | 1.66 | 1.74 | 12.79 | G | 4.19% | 12.09 | 15.09 | 45.05 | Y | 6.49% | 3.85 | 6.69 | 30.17 | Y |

| Lowest VaR | 2.12% | 2.64 | 4.58 | 13.18 | G | 1.92% | 4.35 | 6.54 | 7.42 | G | 2.58% | 0.03 | 6.99 | 23.06 | G | 3.46% | 1.58 | 5.92 | 40.33 | G |

| CQOM | 4.43% | 51.67 | Inf | 960.75 | R | 2.98% | 2.65 | 13.39 | 230.53 | G | 7.81% | 92.75 | 121.91 | 806.55 | R | 3.90% | 218.89 | 219.00 | 703.95 | R |

| Elastic Net | 2.62% | 0.25 | 1.65 | 17.45 | G | 2.37% | 0.22 | 0.51 | 9.27 | G | 3.22% | 2.43 | 6.46 | 38.25 | Y | 6.49% | 3.85 | 6.69 | 25.60 | Y |

| LASSO | 2.62% | 0.25 | 1.65 | 43.06 | G | 2.37% | 0.22 | 0.51 | 36.09 | G | 3.22% | 2.43 | 6.46 | 30.80 | Y | 7.36% | 5.28 | 7.53 | 31.78 | Y |

| QRF | 4.91% | 77.52 | 78.43 | 231.96 | R | 4.39% | 35.03 | 35.06 | 121.60 | R | 6.12% | 47.85 | 49.03 | 128.29 | R | 8.66% | 10.57 | 13.88 | 49.29 | Y |

| GBRM | 3.08% | 5.33 | 7.41 | 33.89 | Y | 2.95% | 2.29 | 3.56 | 21.25 | G | 3.38% | 3.57 | 12.79 | 40.09 | Y | 4.76% | 3.85 | 6.69 | 23.83 | Y |

| QRNN | 4.52% | 56.49 | 61.01 | 421.32 | R | 4.49% | 38.60 | 39.35 | 325.86 | R | 4.59% | 17.91 | 23.66 | 136.29 | R | 9.09% | 10.57 | 11.54 | 78.96 | Y |

Test results: Excess Ratio (ER), Kupiec (UC), Christoffersen (CC), Dynamic Quantile (DQ) and Traffic Light (TL) divided into the analysed models and periods for silver for confidence level equal to 0_975_

| Model | Period I (Whole period) | Period II (All calm periods) | Period I (All crisis periods) | Period I (COVID period) | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ER | UC | CC | DQ | TL | ER | UC | CC | DQ | TL | ER | UC | CC | DQ | TL | ER | UC | CC | DQ | TL | |

| GARCH | 3.58% | 17.72 | 21.25 | 41.94 | R | 3.46% | 9.96 | 11.56 | 22.90 | Y | 3.86% | 8.16 | 10.22 | 22.05 | Y | 5.63% | 3.85 | 6.69 | 28.62 | Y |

| GARCH-t | 3.42% | 12.86 | 21.07 | 38.19 | Y | 3.16% | 4.76 | 9.27 | 19.21 | Y | 4.03% | 10.04 | 13.55 | 24.26 | Y | 4.76% | 2.85 | 6.14 | 22.35 | Y |

| GARCH-st | 2.91% | 2.74 | 13.82 | 34.46 | Y | 2.68% | 0.36 | 8.13 | 24.97 | G | 3.46% | 4.22 | 7.42 | 16.69 | Y | 4.33% | 2.74 | 6.14 | 23.15 | Y |

| QML-GARCH | 3.44% | 13.51 | 21.50 | 43.07 | R | 3.40% | 8.65 | 11.93 | 24.52 | Y | 3.54% | 4.91 | 10.27 | 22.85 | Y | 5.69% | 2.90 | 6.14 | 23.09 | Y |

| CaViaR | 2.84% | 1.87 | 3.74 | 25.47 | G | 2.64% | 0.24 | 0.24 | 9.71 | G | 3.30% | 2.98 | 6.86 | 29.91 | Y | 5.19% | 10.57 | 11.72 | 38.85 | Y |

| Mean | 2.77% | 1.17 | 4.91 | 16.11 | G | 2.47% | 0.01 | 0.75 | 5.15 | G | 3.46% | 4.22 | 7.55 | 18.32 | Y | 4.76% | 6.88 | 8.88 | 31.12 | Y |

| Highest VaR | 4.14% | 38.32 | 44.18 | 74.44 | R | 3.81% | 17.68 | 20.61 | 38.17 | R | 4.91% | 23.23 | 25.99 | 42.50 | R | 6.49% | 12.63 | 13.45 | 34.59 | R |

| Lowest VaR | 2.21% | 1.46 | 6.86 | 19.48 | G | 2.09% | 2.10 | 2.47 | 10.64 | G | 2.50% | 0.00 | 7.41 | 22.49 | G | 3.46% | 2.61 | 6.14 | 30.82 | Y |

| CQOM | 2.38% | 0.24 | 18.45 | 51.46 | G | 2.16% | 1.44 | 14.15 | 34.88 | G | 2.90% | 0.77 | 6.12 | 20.39 | G | 3.90% | 2.69 | 6.14 | 27.15 | Y |

| Elastic Net | 2.48% | 0.01 | 8.00 | 30.60 | G | 2.30% | 0.50 | 3.40 | 15.17 | G | 2.91% | 0.78 | 6.12 | 22.45 | G | 6.49% | 3.85 | 6.69 | 34.39 | Y |

| LASSO | 2.72% | 0.79 | 17.15 | 72.79 | G | 2.26% | 0.69 | 12.27 | 39.12 | G | 3.78% | 7.28 | 11.65 | 55.77 | Y | 7.36% | 17.15 | 17.42 | 73.08 | R |

| QRF | 4.81% | 72.00 | 73.95 | 217.41 | R | 4.39% | 35.03 | 35.37 | 107.96 | R | 5.80% | 40.61 | 42.44 | 126.89 | R | 8.66% | 10.57 | 10.57 | 55.56 | Y |

| GBRM | 3.32% | 10.41 | 19.53 | 59.65 | Y | 3.05% | 3.42 | 6.62 | 22.87 | Y | 3.95% | 9.08 | 15.27 | 47.33 | Y | 4.76% | 6.88 | 8.63 | 29.33 | Y |

| QRNN | 5.00% | 83.19 | 102.20 | 395.17 | R | 4.70% | 46.17 | 55.58 | 253.17 | R | 5.72% | 38.88 | 48.45 | 157.84 | R | 9.09% | 39.66 | 40.11 | 147.69 | R |

Test results: Excess Ratio (ER), Kupiec (UC), Christoffersen (CC), Dynamic Quantile (DQ) and Traffic Light (TL) divided into the analysed models and periods for gold for confidence level equal to 0_975

| Model | Period I (Whole period) | Period II (All calm periods) | Period I (All crisis periods) | Period I (COVID period) | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ER | UC | CC | DQ | TL | ER | UC | CC | DQ | TL | ER | UC | CC | DQ | TL | ER | UC | CC | DQ | TL | |

| GARCH | 3.10% | 5.77 | 6.02 | 21.07 | Y | 2.85% | 1.38 | 1.55 | 9.22 | G | 3.70% | 6.45 | 6.50 | 16.92 | Y | 5.63% | 6.88 | 6.98 | 26.48 | Y |

| GARCH-t | 2.81% | 1.62 | 1.77 | 18.08 | G | 2.57% | 0.06 | 0.07 | 2.48 | G | 3.38% | 3.57 | 3.80 | 28.92 | Y | 4.76% | 3.85 | 4.23 | 21.16 | Y |

| GARCH-st | 2.38% | 0.24 | 0.41 | 16.80 | G | 2.20% | 1.16 | 1.29 | 5.88 | G | 2.82% | 0.50 | 1.36 | 21.53 | G | 4.33% | 2.61 | 3.22 | 22.78 | Y |

| QML-GARCH | 3.17% | 5.91 | 6.02 | 22.59 | Y | 2.88% | 1.66 | 1.80 | 9.14 | G | 3.62% | 5.66 | 5.74 | 19.26 | Y | 5.59% | 6.80 | 6.98 | 26.36 | Y |

| CaViaR | 2.65% | 0.36 | 0.74 | 20.85 | G | 2.47% | 0.01 | 0.04 | 15.69 | G | 3.06% | 1.49 | 2.02 | 14.36 | G | 5.19% | 5.28 | 7.53 | 31.81 | Y |

| Mean | 2.81% | 1.62 | 1.77 | 14.83 | G | 2.64% | 0.24 | 0.24 | 9.74 | G | 3.22% | 2.43 | 2.79 | 11.04 | Y | 4.76% | 3.85 | 4.23 | 15.45 | Y |

| Highest VaR | 3.46% | 14.18 | 14.38 | 41.56 | R | 3.19% | 5.25 | 5.25 | 15.70 | Y | 4.11% | 11.05 | 11.42 | 33.81 | Y | 6.49% | 10.57 | 11.54 | 41.72 | Y |

| Lowest VaR | 2.07% | 3.37 | 3.39 | 10.49 | G | 1.92% | 4.35 | 4.36 | 8.59 | G | 2.42% | 0.04 | 0.14 | 7.87 | G | 3.46% | 0.79 | 2.04 | 7.83 | G |

| CQOM | 2.69% | 0.63 | 9.01 | 56.89 | G | 2.47% | 0.01 | 4.21 | 39.29 | G | 3.25% | 2.48 | 6.46 | 44.63 | Y | 3.90% | 1.58 | 2.48 | 11.99 | G |

| Elastic Net | 2.50% | 0.00 | 1.85 | 24.77 | G | 2.20% | 1.16 | 1.39 | 7.99 | G | 3.27% | 2.49 | 4.23 | 30.53 | Y | 6.49% | 10.57 | 11.54 | 81.74 | Y |

| LASSO | 2.62% | 0.25 | 6.95 | 30.04 | G | 2.26% | 0.69 | 6.14 | 14.90 | G | 3.46% | 4.22 | 5.51 | 44.51 | Y | 7.36% | 14.83 | 15.27 | 91.46 | R |

| QRF | 5.15% | 92.01 | 92.12 | 246.98 | R | 4.87% | 52.90 | 52.90 | 158.42 | R | 5.80% | 40.61 | 41.02 | 93.76 | R | 8.66% | 22.16 | 22.59 | 57.90 | R |

| GBRM | 2.89% | 2.43 | 2.51 | 16.97 | G | 2.57% | 0.06 | 0.07 | 5.19 | G | 3.62% | 5.66 | 5.74 | 19.85 | Y | 4.76% | 3.85 | 4.23 | 17.65 | Y |

| QRNN | 4.71% | 66.66 | 70.04 | 223.39 | R | 4.49% | 38.60 | 39.35 | 105.05 | R | 5.23% | 29.10 | 32.44 | 212.53 | R | 9.09% | 24.82 | 29.35 | 176.38 | R |