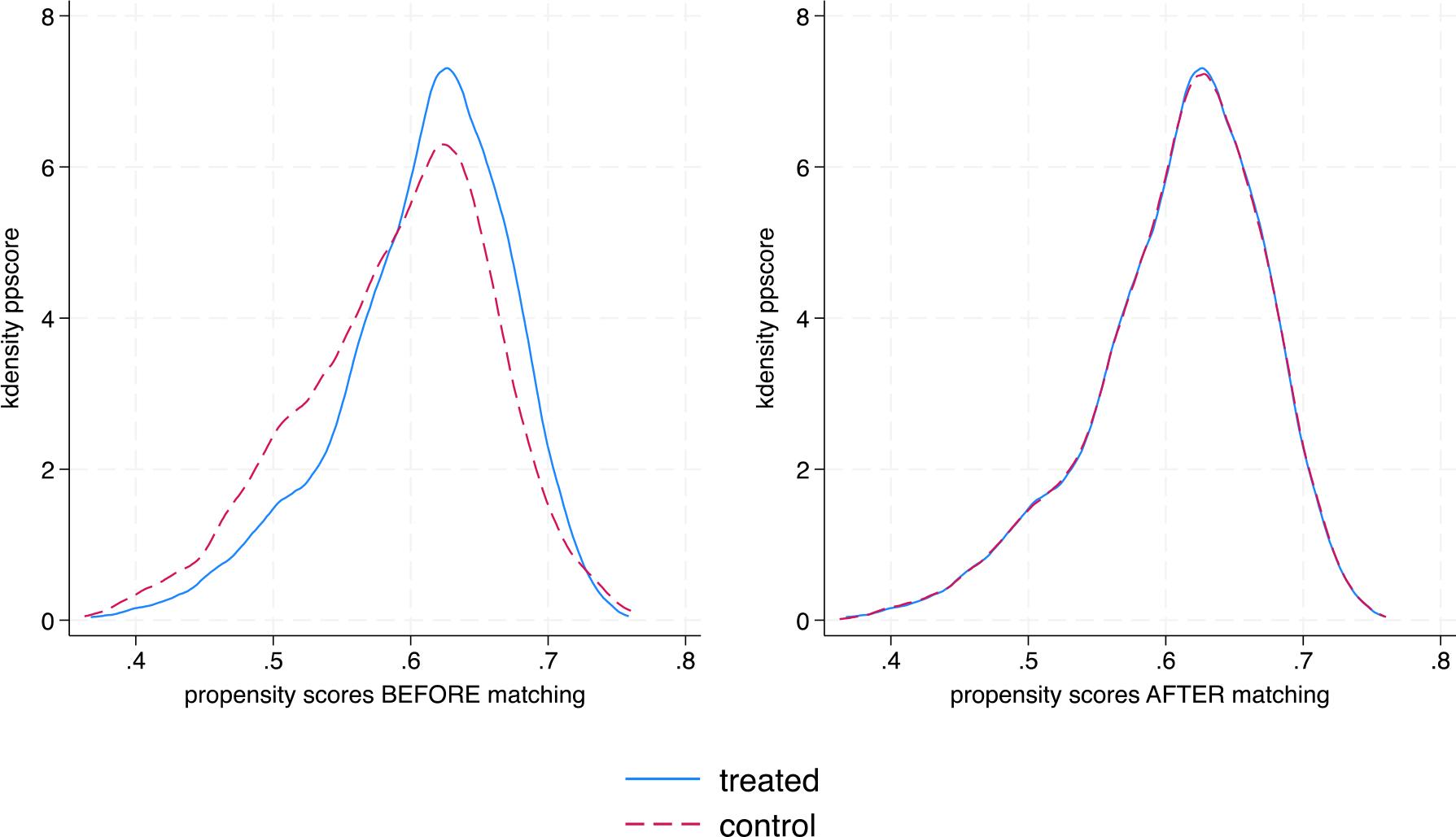

Figure 1:

Impact of access to credit on expenditures

| Outcomes Variable | Nearest neighbor Matching | Caliper Matching | Kernel Matching |

|---|---|---|---|

| Transport Expenditure | 63.75*** | 66.56*** | 66.59*** |

| Food Expenditure | 150.27*** | 157.02*** | 157.04*** |

| Household income | 816.52*** | 850.97*** | 851.26*** |

| Health Expenditure | 28.87*** | 28.56*** | 28.56*** |

| Closing Expenditure | 36.68*** | 37.68*** | 37.68*** |

| Education Expenditure | 50.88*** | 52.06*** | 52.06*** |

| Rent Expenditure | 57.35*** | 63.01*** | 63.03*** |

Outcome Variables and Covariates

| Variables | Description |

|---|---|

| Outcome variables | |

| Food expenditure | (Amount of food expenses) |

| Transport expenditure | (Amount of transport expenditure) |

| Household income | (Household income) |

| Health expenditure | (Amount of health expenditure) |

| Clothing expenditure | (Amount of closing expenditure) |

| Education expenditure | (Amount of education expenditure) |

| Rent Expenditure | (Amount of rent expenditure) |

| Independent variable | |

| Access to Credit | =1 if a household has access to credit and =0 if no access to credit |

| Covariates | |

| Hhage (years) | Age of the respondent |

| HHsize | Household size |

| Female | Dummy (1= female and 0 =male) |

| Educated | Dummy (1=primary school and above and 0 =not educated |

| Single | Dummy (1= single and 0 =otherwise) |

| Rural | Dummy for the area (1=Rural and 0 =Urban) |

Covariates Balance Check

| Mean | |||||

|---|---|---|---|---|---|

| Before matching | Treated | Control | Bias reduction (%) | P-value | |

| Female | .41 | .40 | 0.000 | ||

| Educated | .86 | .87 | 0.000 | ||

| Single | .15 | .22 | 0.000 | ||

| HHsize | 4.07 | 3.86 | 0.011 | ||

| Rural | .59 | .63 | 0.078 | ||

| HHage | 49.68 | 51.21 | 0.017 | ||

| After matching | |||||

| Female | .41 | .41 | 44.3 | 0.561 | |

| Educated | .86 | .86 | 91.2 | 0.938 | |

| Single | .15 | .14 | 84.1 | 0.340 | |

| HHsize | 4.07 | 3.86 | 96.9 | 0.886 | |

| Rural | .59 | .60 | 70.6 | 0.951 | |

| HHage | 49.68 | 50.13 | 95.0 | 0.426 | |

Summary Statistics

| Variables | Treatment group | Control group | Difference |

|---|---|---|---|

| Treatment variable | |||

| Access to credit | 1 | 0 | |

| Outcomes variable | |||

| Transport Expenditure | 184.72 | 113.98 | 70.74 |

| Food Expenditure | 644.12 | 470.19 | 173.93 |

| Household income | 2324.87 | 1420.33 | 904.54 |

| Health Expenditure | 100.04 | 71.41 | 28.63 |

| Closing Expenditure | 54.47 | 15.90 | 38.57 |

| Education Expenditure | 86.71 | 32.46 | 54.25 |

| Rent Expenditure | 131.73 | 64.54 | 67.19 |

| Covariates | |||

| Rural | .59 | .63 | -0.04 |

| Hhage | 49.68 | 51.21 | -1,53 |

| Hhsize | 4.07 | 3.86 | 0,21 |

| Female | .41 | .40 | 0.01 |

| Educatwed | .86 | .87 | -0.01 |

| Single | .15 | .22 | -0.07 |

| Observations | 1,805 | 1,194 | 2,999 |

Inverse Probability weighting regression adjustment estimation

| Outcomes variable | IPWRA estimation | MDM estimation |

|---|---|---|

| Transport Expenditure | 64.39*** | 56.28*** |

| Food Expenditure | 157.33*** | 157.98*** |

| Household income | 844.77*** | 785.08*** |

| Health Expenditure | 27.21*** | 25.37*** |

| Closing Expenditure | 38.09*** | 38.40*** |

| Education Expenditure | 51.78*** | 36.64*** |

| Rent Expenditure | 60.62*** | 43.91*** |