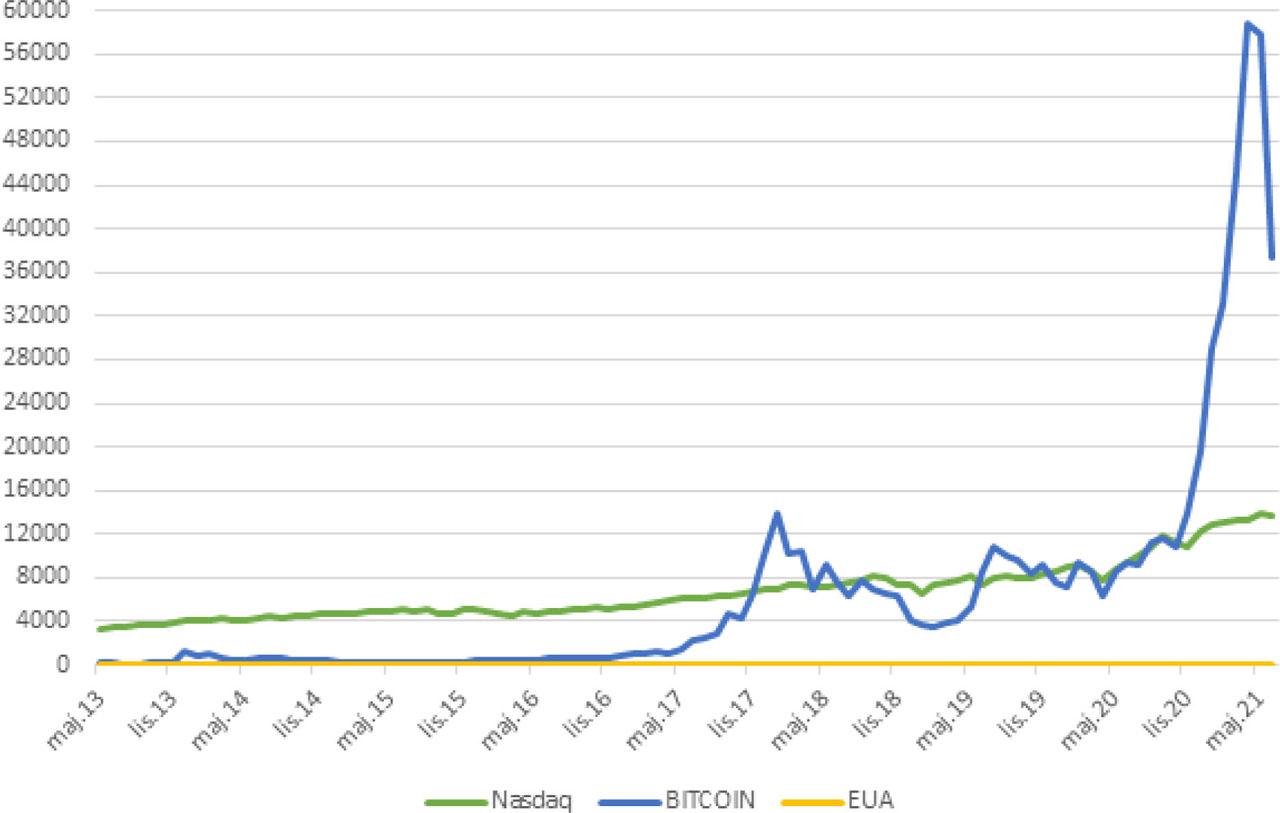

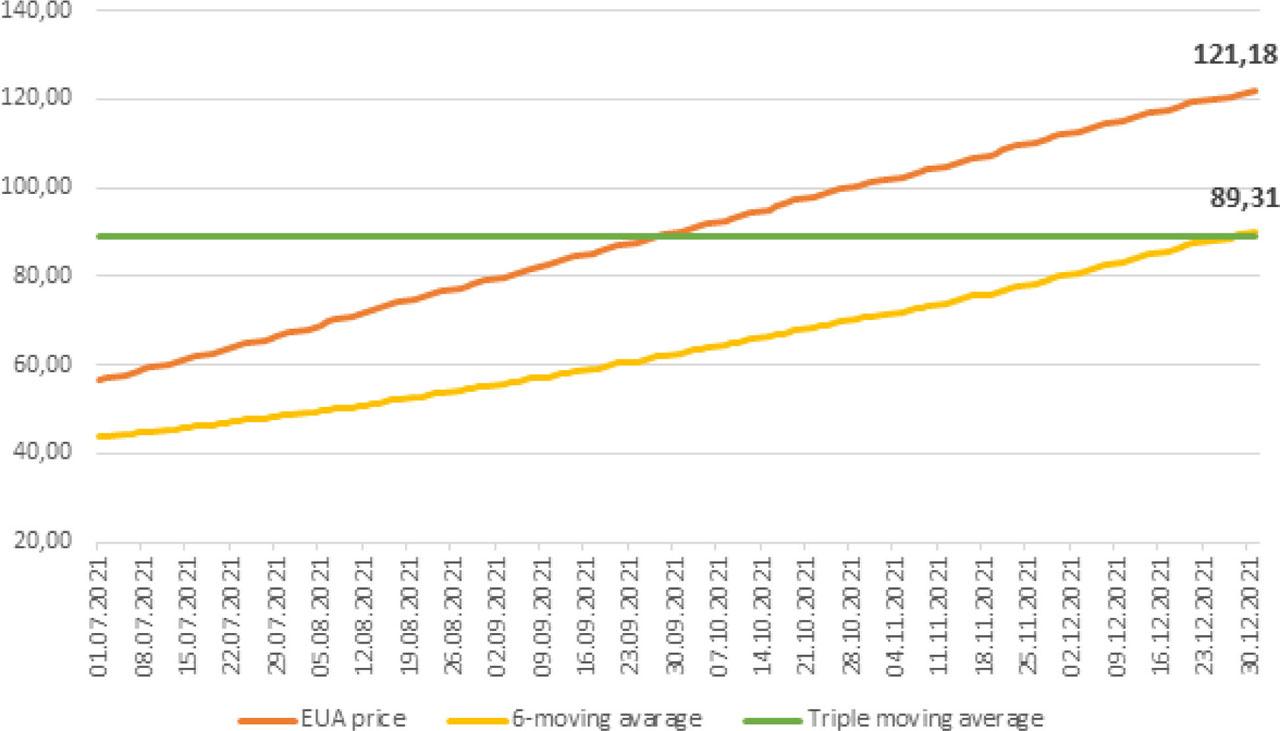

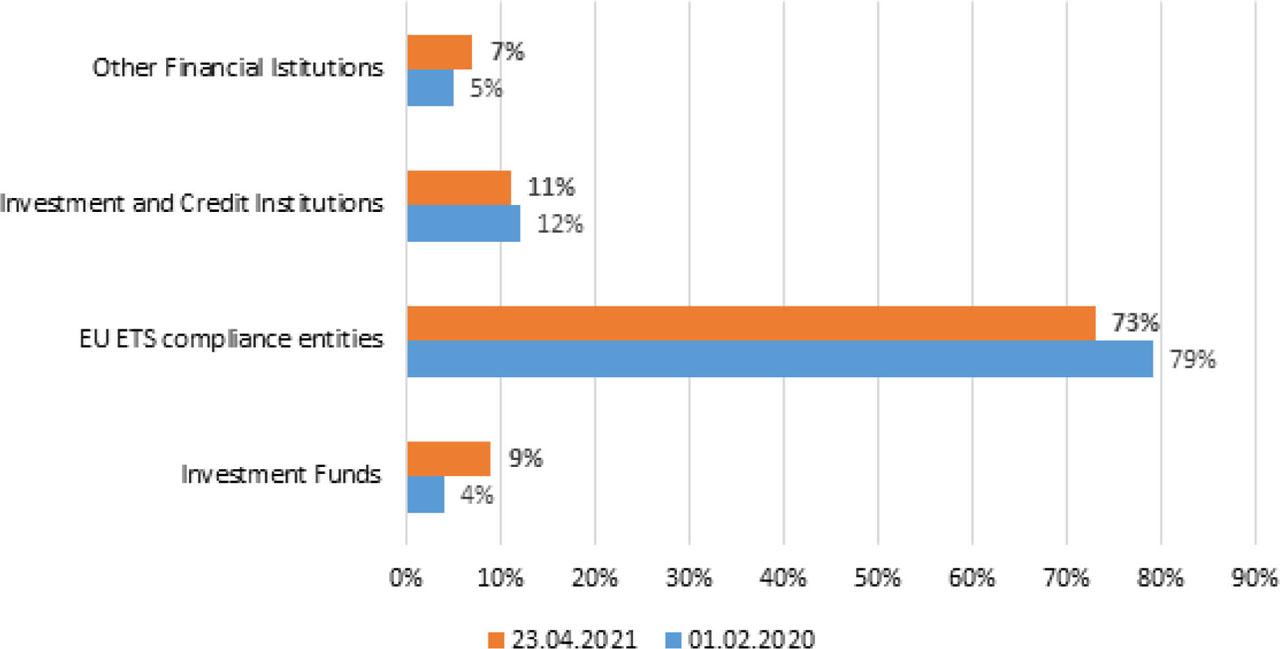

Figure 1

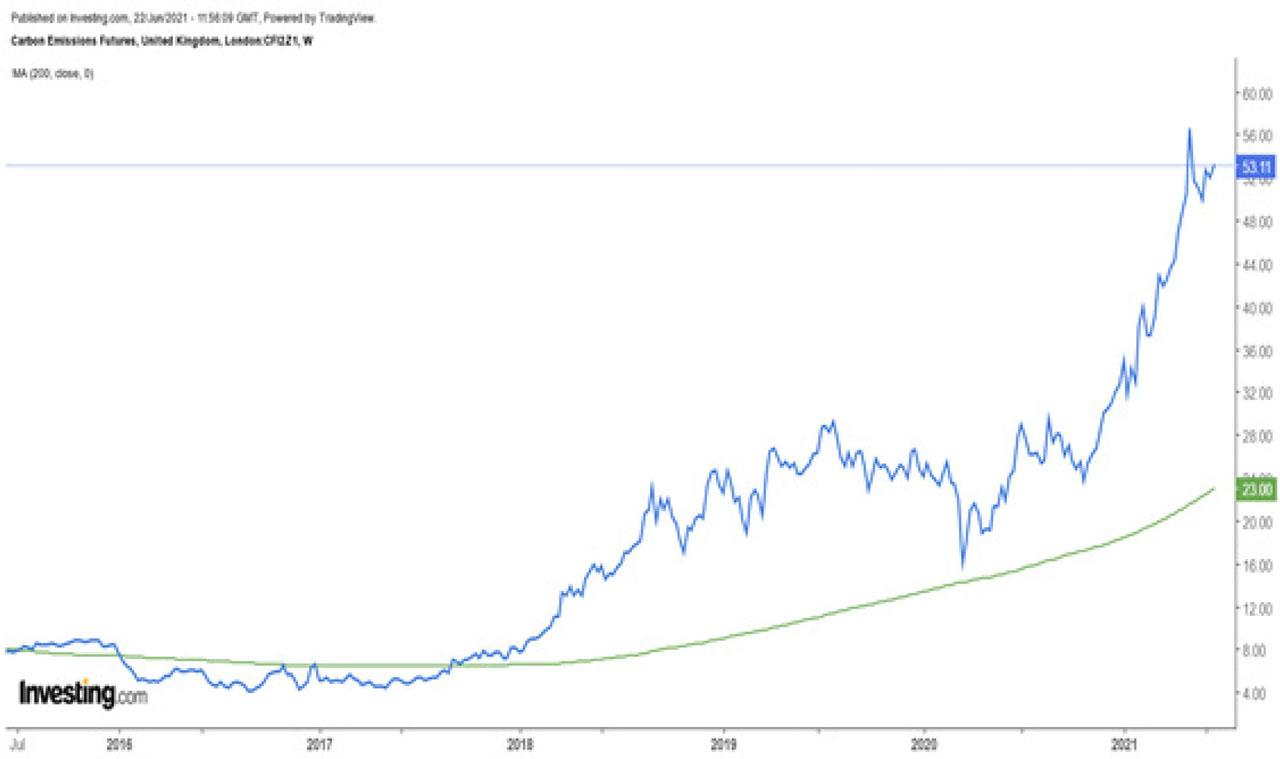

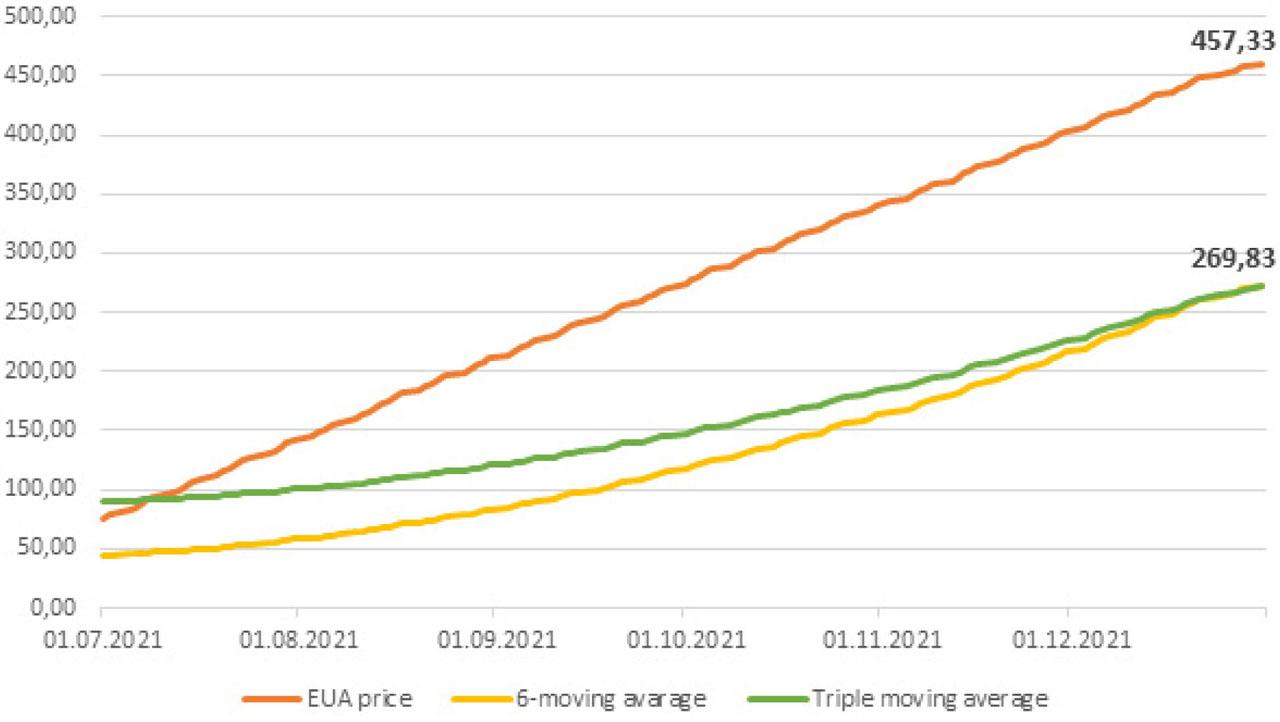

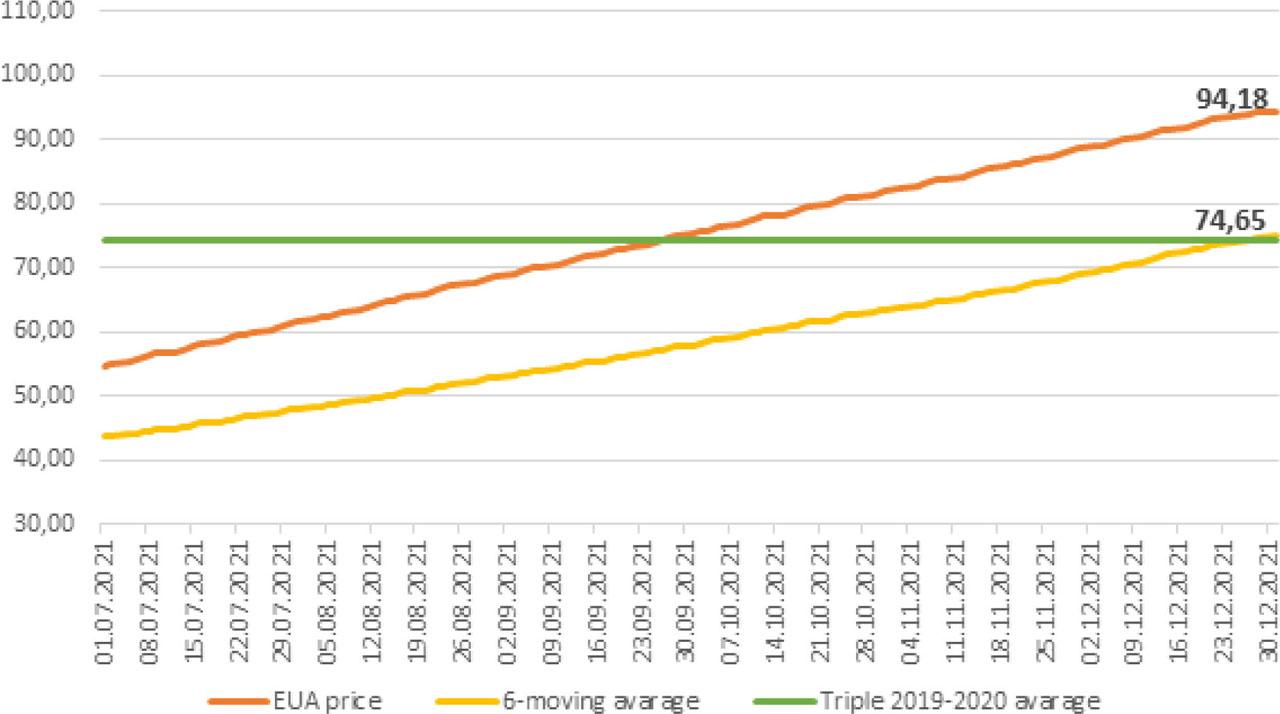

Figure 2

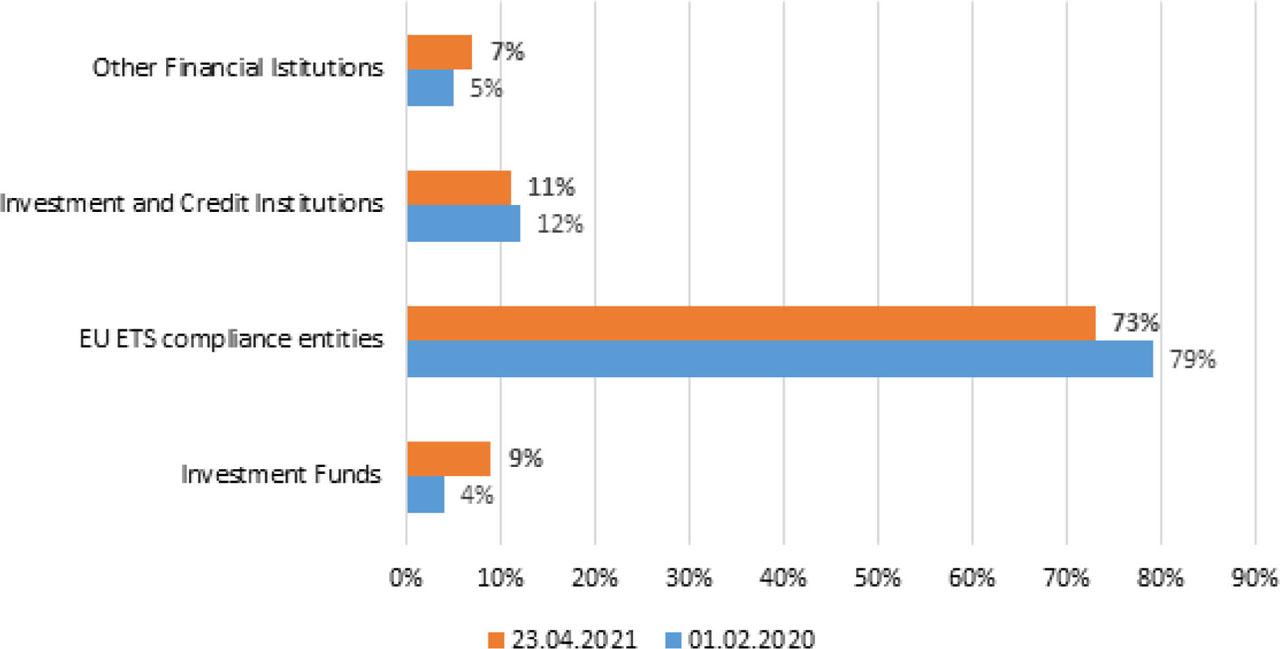

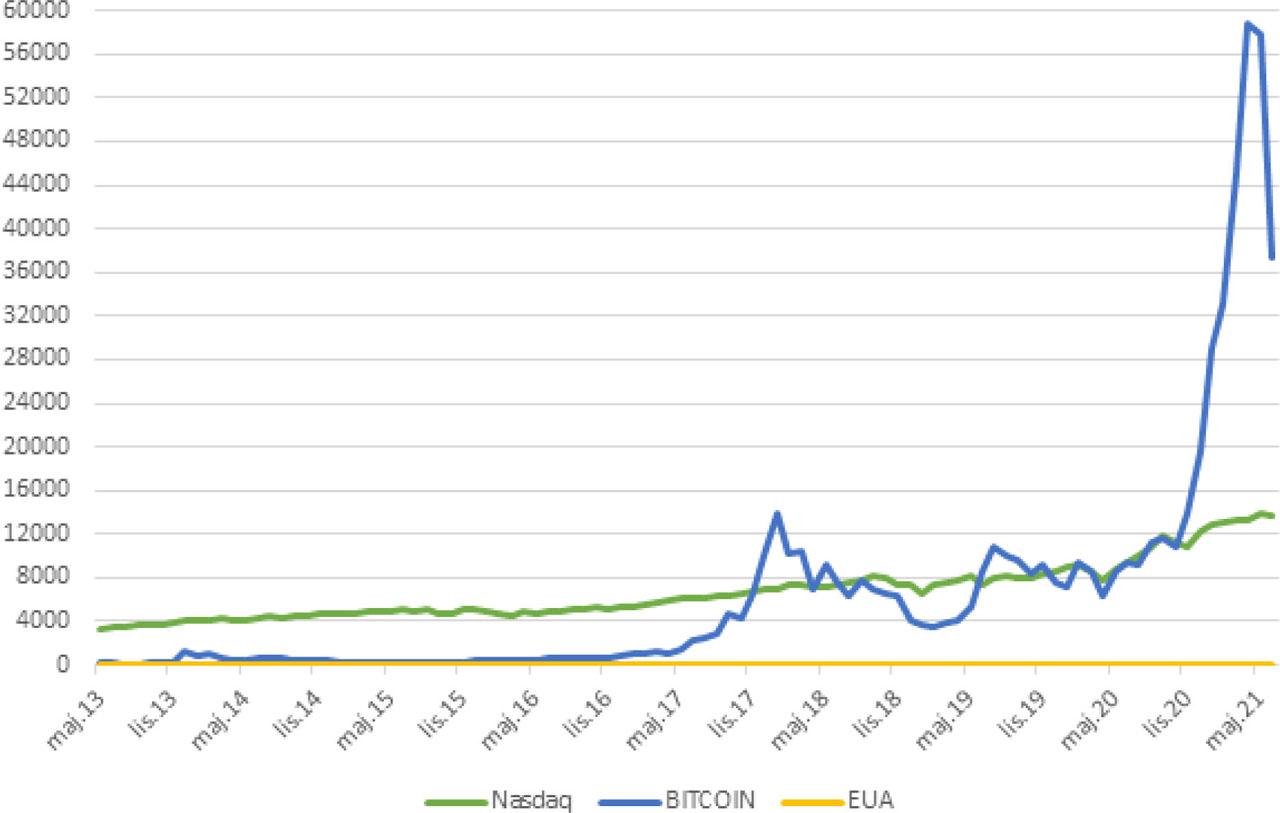

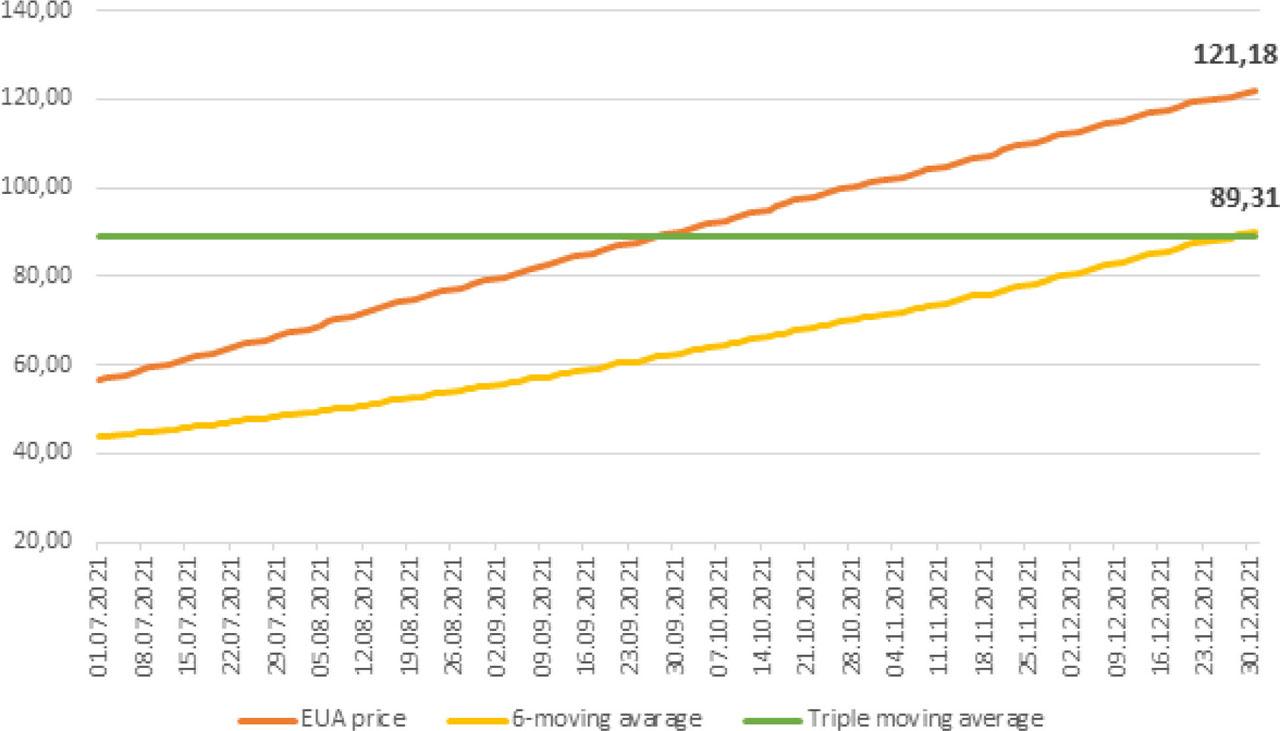

Figure 3

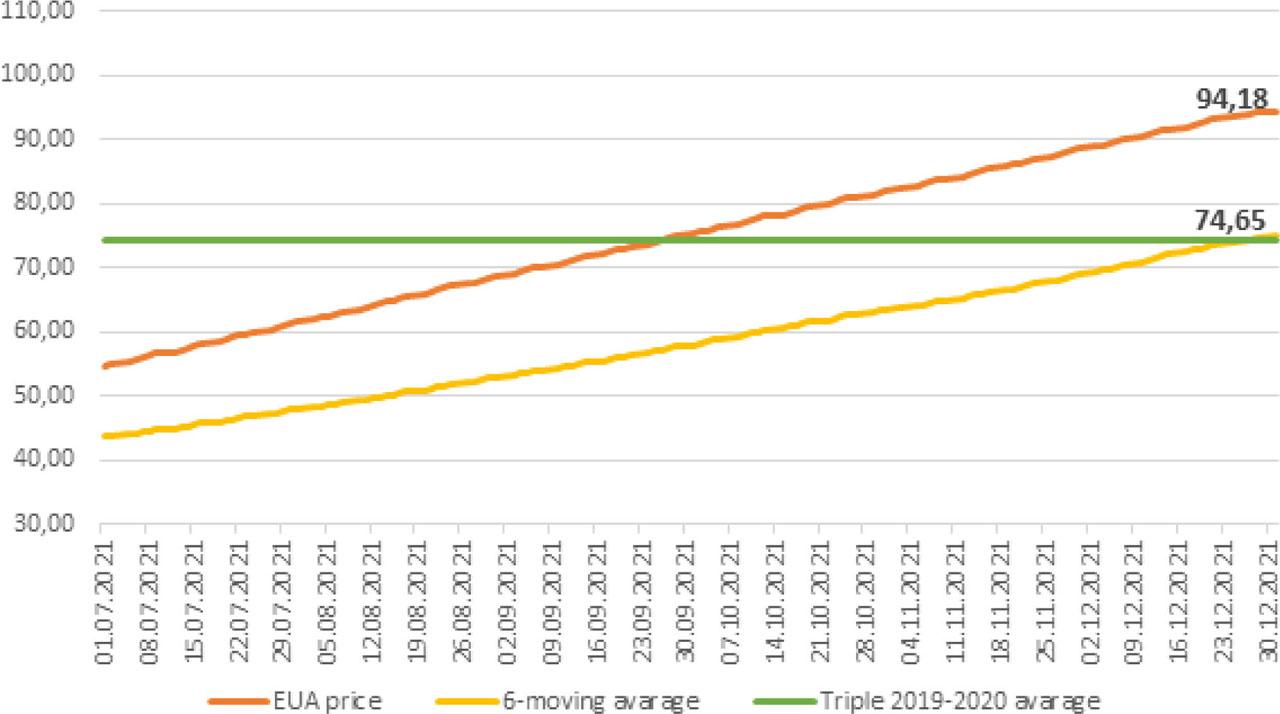

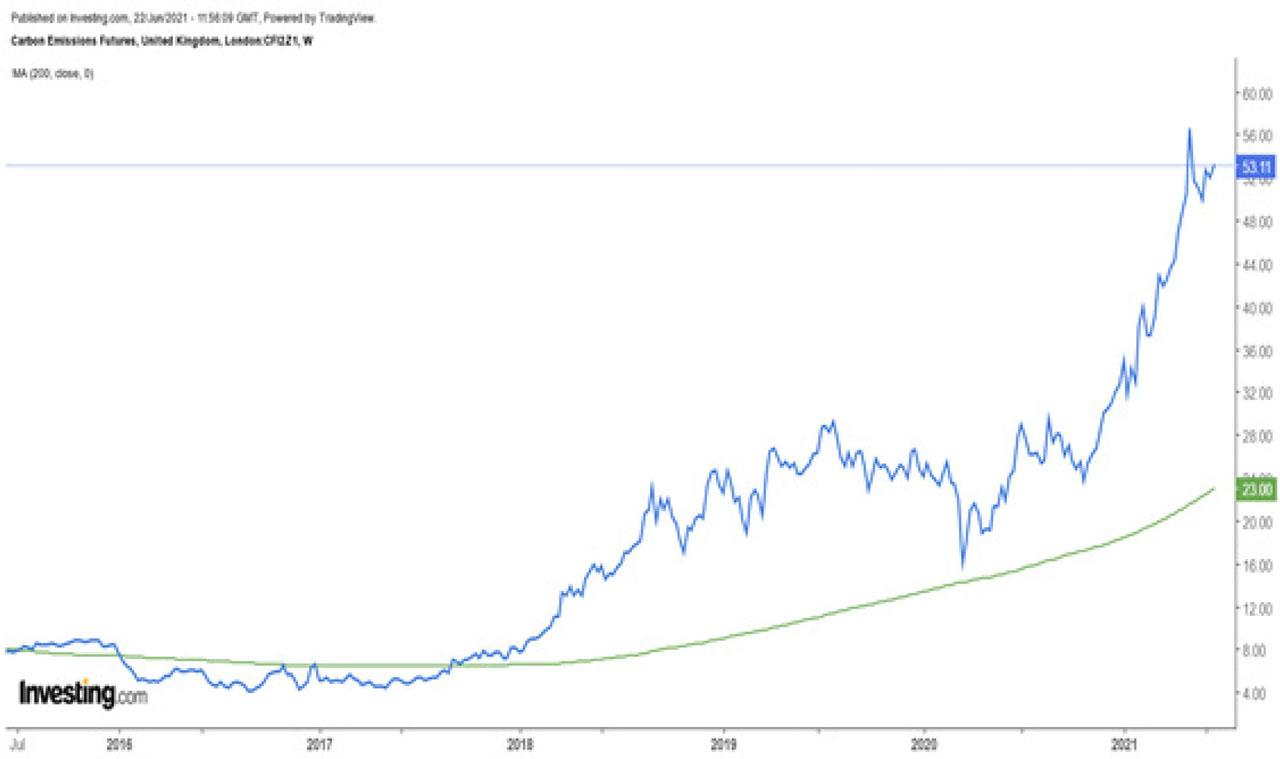

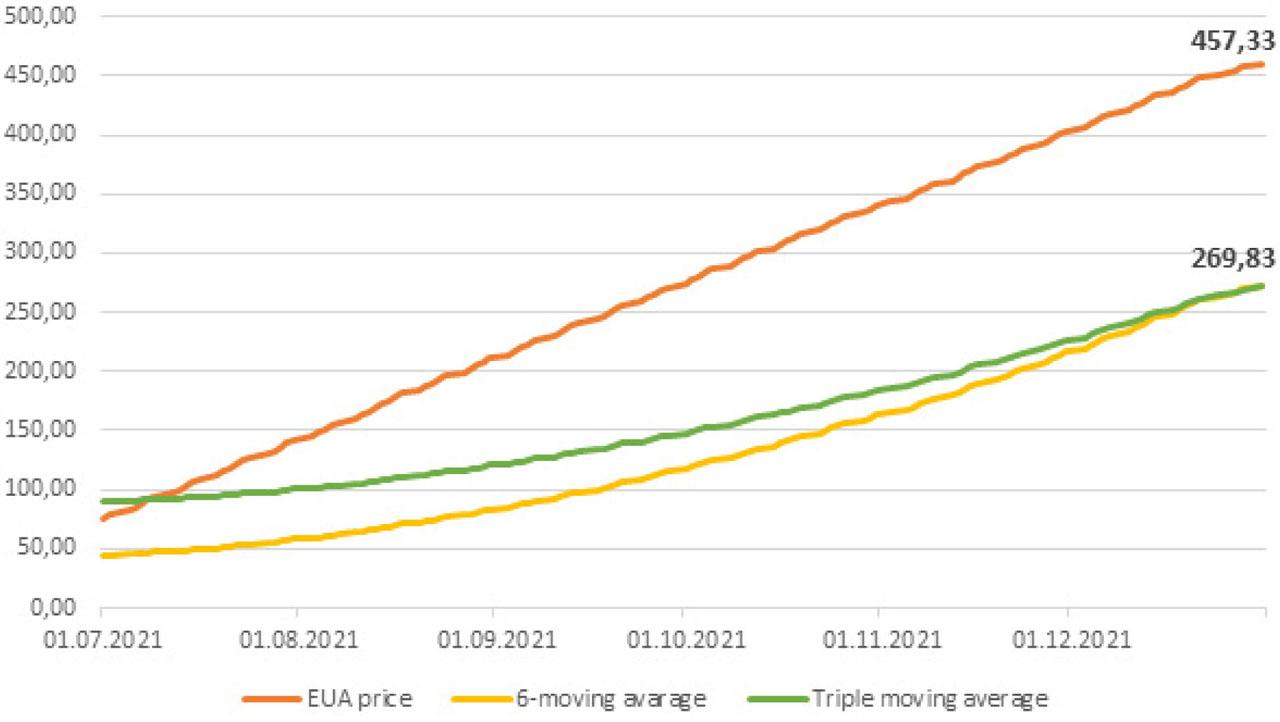

Figure 4

Figure 5

Figure 6

Figure 7

© 2021 Robert Jeszke, Sebastian Lizak, published by National Research Institute, Institute of Environmental Protection

This work is licensed under the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 License.