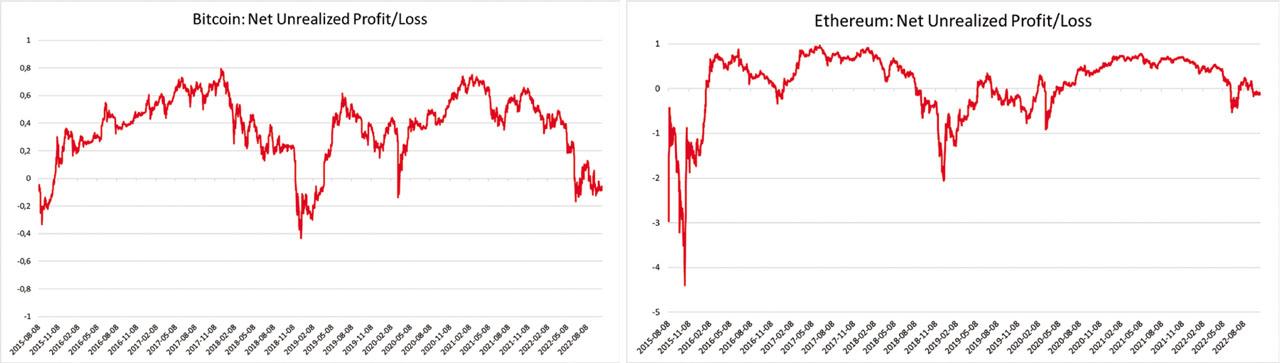

Figure 1

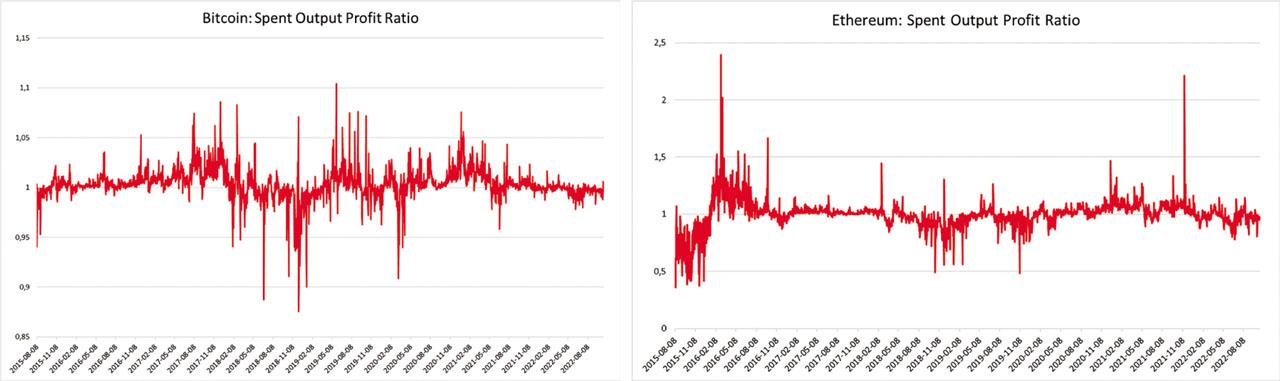

Figure 2

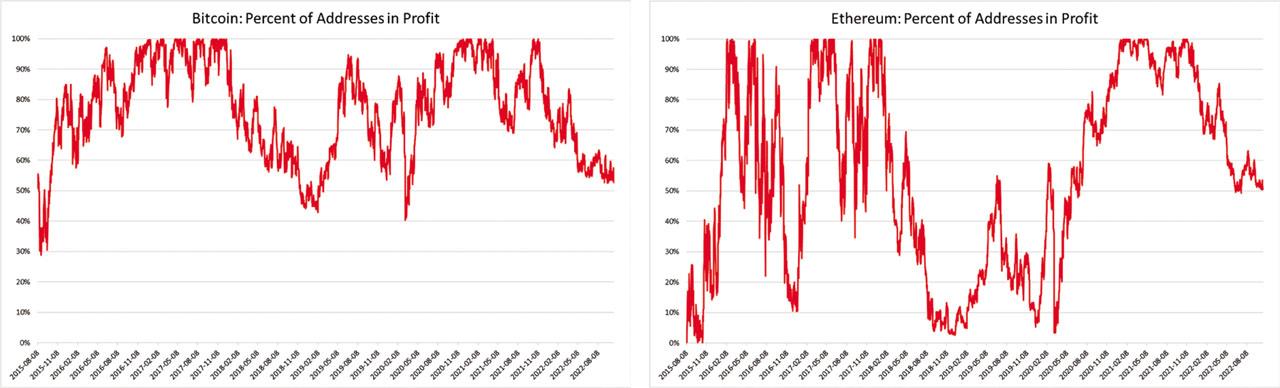

Figure 3

NUPL strategies: performance in the COVID-19 period (2020–2022)

| BTC | ETH | |||||||

|---|---|---|---|---|---|---|---|---|

| B&H | NUPL 1 | NUPL 2 | NUPL 3 | B&H | NUPL 1 | NUPL 2 | NUPL 3 | |

| Min | 1.24 | 1.38 | 1.83 | 3.90 | −1.18 | 1.49 | 1.36 | 1.14 |

| Max | 2.47 | 1.59 | 2.18 | 4.87 | 3.11 | 3.21 | 5.10 | 14.84 |

| Median | 1.14 | 1.50 | 2.05 | 4.62 | 1.92 | 2.63 | 2.70 | 2.77 |

| Mean | 0.64 | 1.50 | 2.02 | 4.50 | 1.18 | 2.43 | 2.52 | 3.00 |

| St. dev. | 1.01 | 0.07 | 0.13 | 0.32 | 1.26 | 0.56 | 0.67 | 2.01 |

| Sharpe ratio | 0.63 | 20.91 | 15.18 | 13.95 | 0.94 | 4.34 | 3.75 | 1.49 |

| N | 7 | 8 | 9 | 103 | 121 | 158 | ||

| Success rate | 100% | 100% | 100% | 100% | 100% | 98.10% | ||

PAP strategies: performance in the COVID-19 period (2020–2022)

| BTC | ETH | |||||||

|---|---|---|---|---|---|---|---|---|

| B&H | PAP 1 | PAP 2 | PAP 3 | B&H | PAP 1 | PAP 2 | PAP 3 | |

| Min | 1.24 | 1.74 | 1.59 | 1.44 | −1.18 | 1.62 | 1.31 | 1.09 |

| Max | 2.47 | 2.27 | 2.19 | 2.18 | 3.11 | 2.93 | 2.58 | 2.43 |

| Median | 1.14 | 2.00 | 1.85 | 1.69 | 1.92 | 2.35 | 2.02 | 1.92 |

| Mean | 0.64 | 2.00 | 1.85 | 1.77 | 1.18 | 2.24 | 1.93 | 1.81 |

| St. dev. | 1.01 | 0.19 | 0.21 | 0.23 | 1.26 | 0.35 | 0.33 | 0.35 |

| Sharpe ratio | 0.63 | 10.56 | 9.01 | 7.74 | 0.94 | 6.42 | 5.87 | 5.18 |

| N | 13 | 17 | 22 | 136 | 151 | 174 | ||

| Success rate | 100% | 100% | 100% | 100% | 100% | 94.83% | ||

NUPL strategies: performance and testing results for the period 2015–2019

| BTC | ETH | |||||||

|---|---|---|---|---|---|---|---|---|

| B&H | NUPL 1 | NUPL 2 | NUPL 3 | B&H | NUPL 1 | NUPL 2 | NUPL 3 | |

| Min | −1.79 | 1.13 | 0.96 | 0.91 | −2.47 | 1.77 | 1.58 | 1.40 |

| Max | 3.22 | 4.02 | 4.88 | 5.48 | 4.93 | 20.72 | 27.44 | 27.44 |

| Median | 0.85 | 2.00 | 1.96 | 1.85 | 1.21 | 5.57 | 5.27 | 5.34 |

| Mean | 0.84 | 2.18 | 2.19 | 2.18 | 1.18 | 7.02 | 6.65 | 6.67 |

| St. dev. | 1.01 | 0.79 | 1.04 | 1.16 | 1.89 | 4.54 | 4.66 | 4.93 |

| Sharpe ratio | 0.83 | 2.76 | 2.10 | 1.88 | 0.62 | 1.54 | 1.43 | 1.35 |

| N | 210 | 214 | 217 | 205 | 213 | 227 | ||

| Success rate | 100% | 100% | 100% | 100% | 100% | 100% | ||

| p-value (one-sided test for two means) | 0.03** | 0.06* | 0.14 | 0.01** | <0.01*** | <0.01*** | ||

| p-value (one-sided test for two Sharpe ratios) | 0.07* | 0.15 | 0.24 | 0.07* | 0.01** | 0.03** | ||

PAP strategies: performance and testing results for the period 2015–2019

| BTC | ETH | |||||||

|---|---|---|---|---|---|---|---|---|

| B&H | PAP 1 | PAP 2 | PAP 3 | B&H | PAP 1 | PAP 2 | PAP 3 | |

| Min | −1.79 | 0.52 | 1.00 | 0.69 | −2.47 | 0.41 | 0.40 | 0.38 |

| Max | 3.22 | 1.50 | 3.69 | 3.91 | 4.93 | 14.18 | 26.56 | 26.56 |

| Median | 0.85 | 0.81 | 2.06 | 1.91 | 1.21 | 3.46 | 3.58 | 3.45 |

| Mean | 0.84 | 0.99 | 2.03 | 1.90 | 1.18 | 3.98 | 4.28 | 4.41 |

| St. dev. | 1.01 | 0.33 | 0.74 | 0.80 | 1.89 | 2.91 | 3.37 | 3.32 |

| Sharpe ratio | 0.83 | 2.97 | 2.74 | 2.38 | 0.62 | 1.37 | 1.27 | 1.33 |

| N | 125 | 150 | 181 | 326 | 337 | 363 | ||

| Success rate | 38.40% | 100% | 97.25% | 82.82% | 84.57% | 90.64% | ||

| p-value (one-sided test for two means) | 0.39 | 0.12 | 0.15 | <0.01*** | <0.01*** | <0.01*** | ||

| p-value (one-sided test for two Sharpe ratios) | 0.04** | 0.08* | 0.14 | 0.05* | 0.14 | 0.02** | ||

SOPR strategies: performance and testing results for the period 2015–2019

| BTC | ETH | |||||||

|---|---|---|---|---|---|---|---|---|

| B&H | SOPR 1 | SOPR 2 | SOPR 3 | B&H | SOPR 1 | SOPR 2 | SOPR 3 | |

| Min | −1.79 | −22.33 | −43.39 | −43.39 | −2.47 | −11.18 | −11.18 | −33.09 |

| Max | 3.22 | 55.20 | 55.20 | 55.20 | 4.93 | 18.03 | 18.03 | 63.59 |

| Median | 0.85 | 1.13 | 0.80 | 0.90 | 1.21 | 2.18 | 2.15 | 1.29 |

| Mean | 0.84 | 2.96 | 2.13 | 2.06 | 1.18 | 1.93 | 1.77 | 1.55 |

| St. dev. | 1.01 | 7.73 | 8.74 | 8.51 | 1.89 | 4.18 | 4.36 | 7.28 |

| Sharpe ratio | 0.83 | 0.38 | 0.24 | 0.24 | 0.62 | 0.46 | 0.41 | 0.21 |

| N | 172 | 207 | 288 | 233 | 271 | 412 | ||

| Success rate | 54.65% | 49.28% | 50.69% | 66.67% | 64.58% | 51.70% | ||

| p-value (one-sided test for two means) | 0.03** | 0.10 | 0.06* | 0.25 | 0.27 | 0.39 | ||

| p-value (one-sided test for two Sharpe ratios) | 0.35 | 0.14 | 0.03** | 0.27 | 0.28 | 0.35 | ||

SOPR strategies: performance in the COVID-19 period (2020–2022)

| BTC | ETH | |||||||

|---|---|---|---|---|---|---|---|---|

| B&H | SOPR 1 | SOPR 2 | SOPR 3 | B&H | SOPR 1 | SOPR 2 | SOPR 3 | |

| Min | 1.24 | −4.77 | −6.00 | −6.00 | −1.18 | −4.14 | −4.14 | −21.67 |

| Max | 2.47 | 39.65 | 39.65 | 39.65 | 3.11 | 13.00 | 37.21 | 37.21 |

| Median | 1.14 | 4.40 | 2.99 | −0.22 | 1.92 | 1.95 | 2.09 | 1.47 |

| Mean | 0.64 | 5.18 | 5.25 | 2.58 | 1.18 | 1.76 | 2.54 | 2.30 |

| St. dev. | 1.01 | 9.17 | 9.91 | 7.31 | 1.26 | 4.02 | 6.44 | 7.58 |

| Sharpe ratio | 0.63 | 0.57 | 0.53 | 0.35 | 0.94 | 0.44 | 0.39 | 0.30 |

| N | 28 | 39 | 114 | 48 | 49 | 98 | ||

| Success rate | 57.14% | 62.16% | 33.33% | 52.08% | 55.10% | 50% | ||