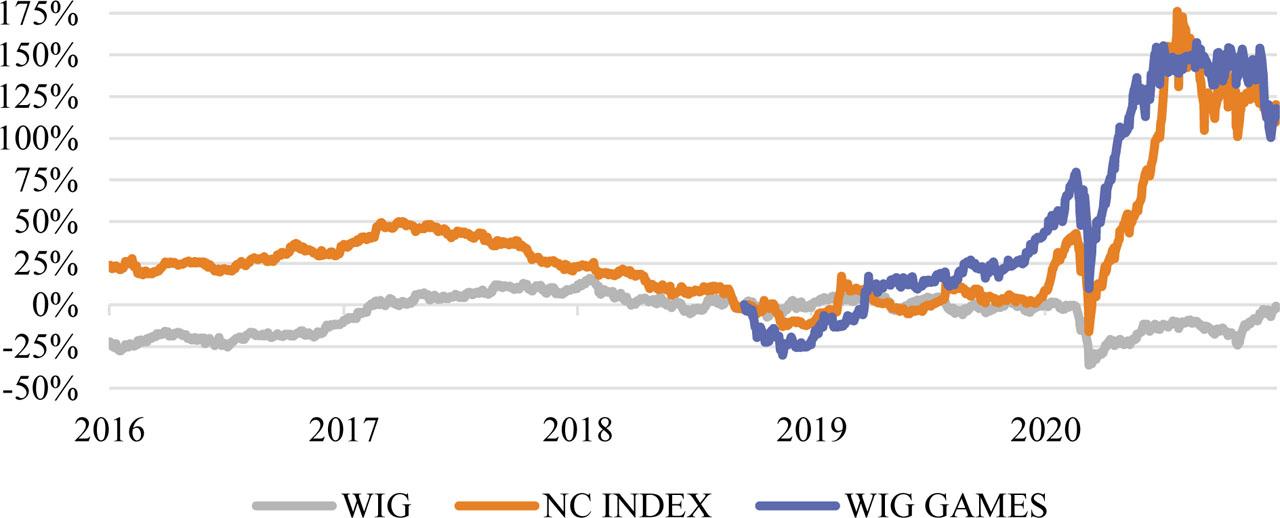

Figure 1

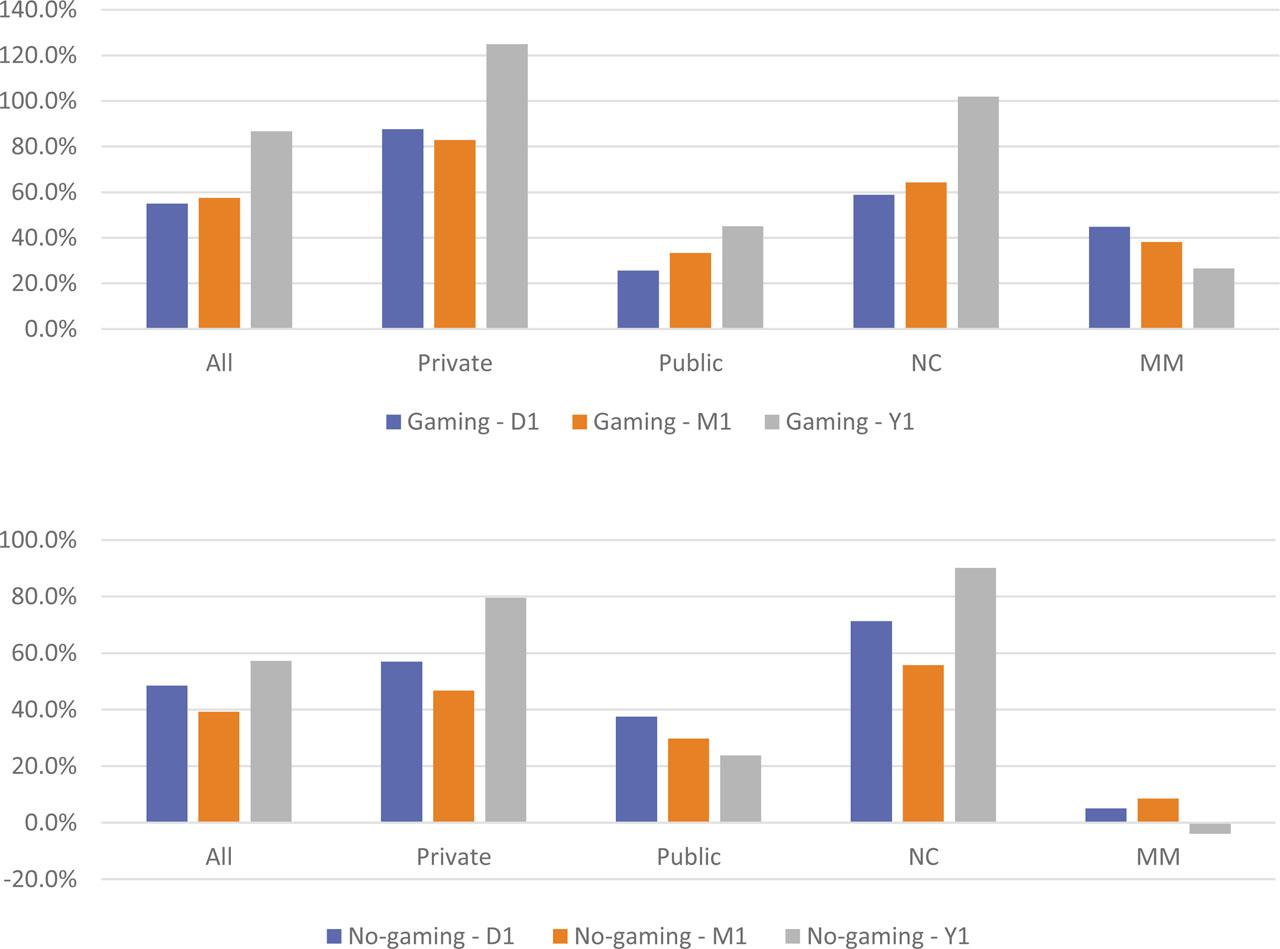

Figure 2

Figure 3

Characteristics of the first offers rates of returns from the game and no-game sectors in the period 2016–2020

| All game sector | Game sector: private offers | Game sector: public offers | Game sector: NewConnect | Game sector: Main Market | |

|---|---|---|---|---|---|

| Mean (%) | 55.0 | 87.7 | 22.3 | 58.9 | 41.2 |

| SD | 0.795664964 | 0.936708 | 0.450111 | 0.871573 | 0.451503 |

| t-Statistics | 3.911173637 | 3.746282 | 1.981368 | 3.377911 | 2.413904 |

| Statistical significance | *** | *** | * | *** | * |

| N | 32 | 16 | 16 | 25 | 7 |

Basic statistics of NewConnect and WSE issuers in 2016–2020*

| 2016 | 2017 | 2018 | 2019 | 2020 | ||

|---|---|---|---|---|---|---|

| NewConnect | Listed companies | 406 | 408 | 387 | 375 | 377 |

| Debuting companies | 16 | 19 | 15 | 15 | 14 | |

| WSE Main Market | Listed companies | 487 | 482 | 465 | 449 | 436 |

| Debuting companies | 19 | 15 | 7 | 7 | 7 |

Characteristics of the first offers rate of returns from the game and all sectors

| D1 | M1 | Y1 | ||

|---|---|---|---|---|

| Game IPOs | Min-Max (%) | −69.5 to 250.5 | −80.2 to 379.7 | −81.0 to 657.8 |

| Median (%) | 32.7 | 49.8 | 57.1 | |

| Mean (%) | 55.0 | 57.5 | 86.8 | |

| SD (%) | 79.6 | 91.3 | 151.5 | |

| Game IPOs | Min-Max (%) | −69.5 to 250.5 | −80.2 to 379.7 | −81.0 to 657.8 |

| Median (%) | 34.5 | 48.6 | 66.8 | |

| Mean (%) | 58.9 | 64.3 | 101.9 | |

| SD (%) | 87.2 | 101.0 | 161.6 | |

| Game IPOs | Min-Max (%) | −6.9 to 101.9 | −14.4 to 67.6 | −56.4 to 179.1 |

| Median (%) | 30.9 | 57.0 | 1.7 | |

| Mean | 41.2 | 32.8 | 26.6 | |

| SD | 45.2 | 37.3 | 90.1 | |

| No-game IPOs | Min-Max (%) | −44.0 to 620.0 | −72.0 to 485.1 | −88.5 to 1,186.7 |

| Median (%) | 13.6 | 9.4 | −15.1 | |

| Mean (%) | 48.5 | 39.3 | 57.2 | |

| SD (%) | 105.5 | 95.5 | 206.6 | |

| No-game IPOs | Min-Max (%) | −44.0 to 620.0 | −72.0 to 485.1 | −88.5 to 1,186.7 |

| Median (%) | 37.4 | 15.8 | −1.9 | |

| Mean (%) | 71.3 | 55.8 | 90.2 | |

| SD (%) | 122.3 | 114.4 | 246.2 | |

| No-game IPOs | Min-Max (%) | −29.3 to 62.8 | −32.0 to 84.9 | −79.7 to 179.1 |

| Median (%) | 3.8 | 5.4 | −19.6 | |

| Mean (%) | 5.1 | 8.5 | −4.0 | |

| SD (%) | 15.7 | 21.3 | 68.3 |

Characteristics of the first offer rate of returns from the game and no-game sectors for subsequent years in the period of 2016–2020

| 2016 | 2017 | 2018 | 2019 | 2020 | 2016–2020 | ||

|---|---|---|---|---|---|---|---|

| Game sector | Debuts | 5 | 2 | 7 | 8 | 10 | 32 |

| Underpricing | 3 | 1 | 6 | 7 | 8 | 25 | |

| Overpricing | 2 | 1 | 1 | 1 | 2 | 7 | |

| Mean (%) | 25.7 | −16.3 | 20.9* | 73.6* | 93.0** | 55.0*** | |

| Median (%) | 22.0 | −16.3 | 23.3 | 39.1 | 84.9 | 32.7 | |

| No-game sector | Debuts | 20 | 23 | 11 | 7 | 6 | 67 |

| Underpricing | 16 | 16 | 9 | 4 | 6 | 51 | |

| No change | 0 | 2 | 1 | 1 | 0 | 4 | |

| Overpricing | 4 | 5 | 1 | 2 | 0 | 12 | |

| Mean (%) | 24.1** | 27.6*** | 45.5* | 47.1 | 217.3 | 48.5*** | |

| Median (%) | 12.7 | 8.7 | 17.4 | 28.0 | 67.8 | 13.6 |

Trading volumes for IPOs in the game and non-game sectors at D1, M1, and Y1

| All game companies | Game companies: private offers | Game companies: public offers | Game companies: NewConnect | Game companies: Main Market | |

|---|---|---|---|---|---|

| D1 | |||||

| Mean | 301,399 | 392,770.13 | 210,028.38 | 302,120.24 | 298,824.29 |

| SD | 324,138.2165 | 383,423.80 | 228,716.65 | 340,636.188 | 280,529.67 |

| t-Statistics | 5.26001422 | 4.097503876 | 3.6731629 | 4.43464685 | 2.818293 |

| Statistical significance | *** | *** | *** | *** | ** |

| n | 32 | 16 | 16 | 25 | 7 |

| M1 | |||||

| Median | 47,356.26 | 49,809.42 | 25,252.60 | 34,647.57 | 65,907.36 |

| Mean | 46,110 | 65,481.96 | 38,200.14 | 50,551.74 | 56,445.72 |

| SD | 64,024.69073 | 70,470.72 | 35,322.09479 | 61,516.64934 | 36,850.69 |

| t-Statistics | 4.074008224 | 3.716832367 | 4.325920183 | 4.108785612 | 4.052607 |

| Statistical significance | *** | *** | *** | *** | *** |

| n | 32 | 16 | 16 | 25 | 7 |

| Y1 | |||||

| Mean | 21,799 | 32,078.55 | 10,088.99 | 22,219.54 | 18,739.66 |

| SD | 24,961.54411 | 26,106.18 | 13,673.27731 | 24,969.7522 | 18,422.20 |

| t-Statistics | 4.366518793 | 4.430402103 | 2.556028617 | 3.97956683 | 2.274601 |

| Statistical significance | *** | *** | ** | *** | * |

| n | 25 | 13 | 12 | 20 | 5 |

Regression results (2)

| GIPOS – Private offers | GIPOs – Public offers | No-GIPOS – Private offers | No-GIPOS – Public offers | |

|---|---|---|---|---|

| NewConnect [1]\WSE [0] | - | −0.335962 (−1.548574) | - | 0.652091 (4.470154)*** |

| Year of IPO | 0.247473 (1.563250) | 0.162970 (2.227296)** | −0.043191 (−0.454099) | 0.153701 (3.497488)*** |

| WIG [D1] | 5.228206 (0.124626) | −11.72320 (−0.857939) | 25.61639 (1.964242)* | −21.73320 (−2.529616)** |

| WIG [D–1] | 5.216321 (0.395991) | −30.11302 (−1.575983) | −3.482968 (−0.343858) | −19.48325 (−2.715175)** |

| WIG [T–1] | 10.66208 (0.943780) | 0.936019 (0.158950) | −1.985592 (−0.449925) | −4.191893 (−1.180513) |

| WIG [M–1] | −8.617495 (−1.548601) | 3.686187 (2.234503)** | −1.604716 (−0.654016) | −2.029404 (−1.005749) |

| WIG.GAMES [D1] | −13.23927 (−1.332557) | 3.092303 (0.172944) | −22.57897 (−1.367175) | −1.712193 (−0.092173) |

| WIG.GAMES [D–1] | 14.88058 (1.463901) | −7.880833 (−0.656460) | −3.949185 (−0.903998) | −21.54909 (−1.469102) |

| WIG.GAMES [W–1] | 7.684992 (1.046982) | 2.511047 (0.716086) | −2.865255 (−1.256690) | −0.094838 (−0.019052) |

| WIG.GAMES [M–1] | −3.197250 (−0.390122) | 1.291315 (1.056550) | −1.339054 (−2.357194)* | 3.829869 (1.525959) |

| NCINDEX [D1] | 2.871421 (0.263108) | 45.90438 (3.135237)*** | −14.64240 (−1.052499) | 0.257850 (0.031096) |

| NCINDEX [D–1] | −6.640788 (−1.175878) | 21.46843 (2.240100)** | 17.47464 (1.490351) | −16.05207 (−1.776898)* |

| NCINDEX [W–1] | −1.692563 (−0.326314) | 7.159107 (1.562447) | 2.872322 (0.648556) | 3.690085 (1.025435) |

| NCINDEX M–1 [M–1] | 1.003331 (0.328602) | 2.316720 (3.002314)*** | 3.256832 (1.314066) | −0.277059 (−0.145136) |

| The value of the offer | −3.22E−08 (−0.310808) | 1.16E−09 (0.540782) | −2.80E−08 (−2.407204)** | 3.11E−11 (0.784123) |

| The capitalization of the company | −9.77E−09 (−0.891123) | 2.05E−10 (0.622635) | −4.37E−09 (−2.296425)** | 9.14E−12 (1.029754) |

| The value of the shares introduced to the trading | −2.06E−08 (−0.919658) | 2.37E−10 (0.723325) | −5.15E−09 (−1.791981)* | 9.19E−12 (1.036916) |

| The value of free float | −1.48E−07 (−2.022439)* | 8.69E−10 (0.770001) | −1.72E−08 (−1.967373)* | 3.19E−11 (0.921920) |

| n | 16 | 16 | 37 | 28 |

| Underpricing – mean (%) | 87.73 | 22.30 | 44.53 | 16.73 |

| Underpricing – SD (%) | 90.70 | 43.58 | 55.43 | 37.89 |

| Number of private IPOs | 16 | 0 | 0 | 28 |

| Number of public IPOs | 0 | 16 | 37 | 0 |

Characteristics of the IPO rates of returns from the game and no-game sectors after 1M and 1Y from their debuts

| All game companies | Game companies: private offers | Game companies: public offers | Game companies: NewConnect | Game companies: Main Market | |

|---|---|---|---|---|---|

| M1 | |||||

| Mean (%) | 57.5 | 82.8 | 32.1 | 64.3 | 32.8 |

| SD | 0.9129986 | 1.12129 | 0.57303 | 1.009563 | 0.373363 |

| t-Statistics | 3.5599357 | 2.953819 | 2.24144 | 3.186955 | 2.327168 |

| Statistical significance | *** | *** | ** | *** | * |

| N | 32 | 16 | 16 | 25 | 7 |

| Y1 | |||||

| Mean (%) | 86.8 | 124.9 | 45.6 | 101.9 | 26.6 |

| SD | 1.5153339 | 1.813899 | 1.031422 | 1.615579 | 0.901035 |

| t-Statistics | 2.8656941 | 2.483026 | 1.531832 | 2.821211 | 0.659583 |

| Statistical significance | *** | ** | ** | ||

| n | 25 | 13 | 12 | 20 | 5 |

Regression results (1)

| All IPOs | Game IPOs | No-game IPOs | |

|---|---|---|---|

| Game [1]\no-game [0] | 0.225698 (1.691601)* | - | - |

| Private [1]\public [0] | 0.386802 (3.183515)*** | 0.654334 (2.518507)** | 0.276035 (2.230298)** |

| NewConnect [1]\WSE [0] | 0.381886 (2.893440)*** | 0.176881 (0.513660) | 0.423386 (3.470867)*** |

| Year of IPO | 0.137598 (3.141277)*** | 0.216724 (2.296288)** | 0.067208 (1.261736) |

| WIG [D1] | 1.047926 (0.118864) | −2.592949 (−0.130189) | 2.148557 (0.244202)* |

| WIG [D–1] | −5.629779 (−0.966431) | 0.462730 (0.043916) | −10.58843 (−1.558410) |

| WIG [T–1] | −1.333989 (−0.437430) | 3.440564 (0.496711) | −3.639609 (−1.213683) |

| WIG [M–1] | −1.685412 (−1.147583) | −1.495686 (−0.555861) | −1.976673 (−1.168461) |

| WIG.GAMES [D1] | −8.883673 (−1.346062) | −12.16628 (−1.467447) | 9.211253 (0.848898) |

| WIG.GAMES [D–1] | 9.098525 (1.673614) | 13.13837 (1.610657) | −1.203189 (−0.198984) |

| WIG.GAMES [W–1] | 4.423977 (1.613811) | 6.805883 (1.572765) | −0.256893 (−0.090821) |

| WIG.GAMES [M–1] | 0.292906 (0.219987) | 0.852879 (0.355876) | −0451682 (−0.398930) |

| NCINDEX [D1] | 1.235625 (0.221317) | 6.259028 (0.717509) | −9.900088 (−1.255147) |

| NCINDEX [D–1] | −5.852847 (−1.740861)* | −6.749160 (−1.486992) | 4.135325 (0.505896) |

| NCINDEX [W–1] | 0.719481 (0.309206) | 0.313350 (0.080819) | 2.081392 (0.687925) |

| NCINDEX M–1 [M–1] | 1.740658 (1.842382)* | 1.666198 (1.198618) | 1.170435 (0.702659) |

| The value of the offer | −1.18E−11 (−0.191373) | −2.16E−09 (−0.627552) | 1.42E−12 (0.028054) |

| The capitalization of the company | 8.80E−13 (0.062622) | −2.56E−10 (−0.471025) | 3.43E−12 (0.296494) |

| The value of the shares introduced to the trading | 1.16E−12 (0.082512) | −2.23E−10 (−0.409770) | 3.62E−12 (0.313099) |

| The value of free float | 7.45E−12 (0.145098) | −5.65E−10 (−0.295387) | 1.73E−11 (0.448894) |

| N | 97 | 32 | 65 |

| Underpricing – mean | 39.89% | 55.01% | 32.44% |

| Underpricing – SD | 62.02% | 78.31% | 50.53% |

| Number of private IPOs | 53 | 16 | 37 |

| Number of public IPOs | 44 | 16 | 28 |