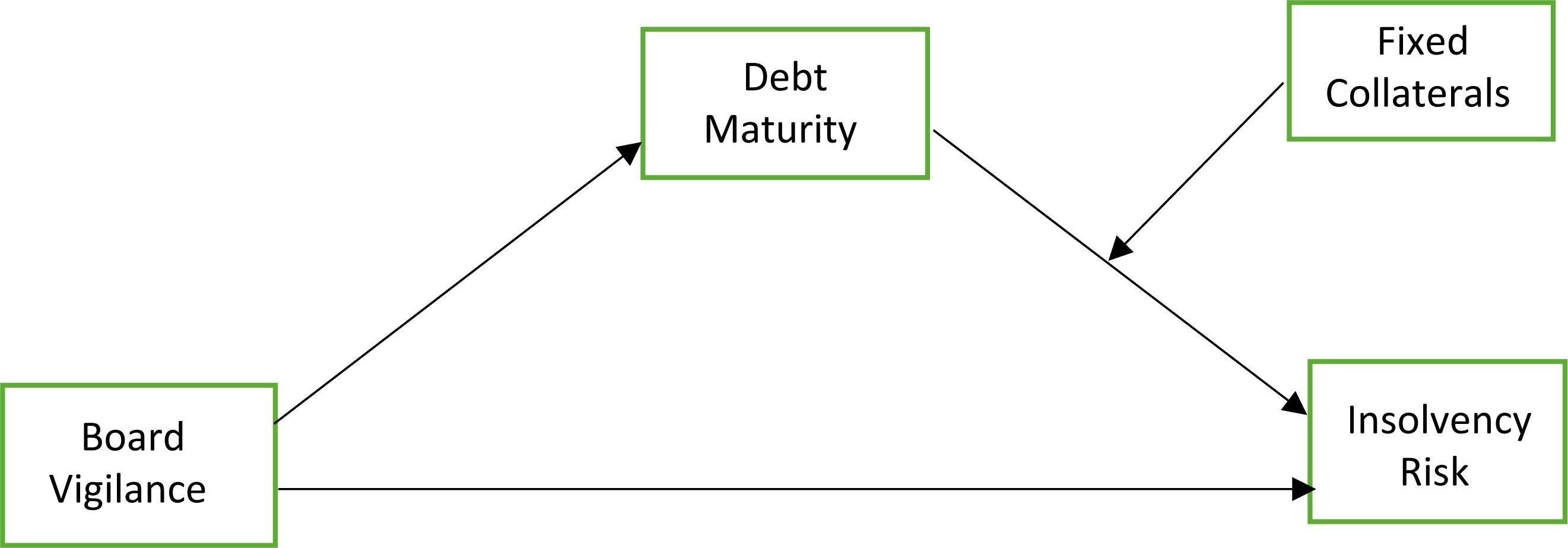

Figure 1

Results of hierarchical PCSE regression with non-duality as IV

| Debt Maturity | Insolvency Risk | |||||||

|---|---|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 | |

| Control Variables | ||||||||

| Size (SIZE) | 0.00160 (0.003) | 0.00224 (0.003) | −0.93308*** (0.321) | −1.02897*** (0.340) | −1.09899*** (0.343) | −0.96605*** (0.332) | −0.97559*** (0.325) | −1.10897*** (0.303) |

| Taxes (TAX) | 0.00772 (0.005) | 0.00769 (0.005) | −0.16607 (0.193) | −0.16175 (0.182) | −0.40188 (0.367) | −0.18751 (0.185) | −0.54600 (0.421) | −0.53800 (0.434) |

| Growth (FG) | 0.04132 (0.023) | 0.04205* (0.024) | −0.34973 (0.500) | −0.46025 (0.488) | −1.77269* (0.999) | −0.16476 (0.576) | −1.53567* (0.860) | −0.28125 (0.651) |

| Profitability (ROA) | −0.00013 (0.000) | −0.00011 (0.000) | 0.36536*** (0.097) | 0.36229*** (0.096) | 0.36585*** (0.098) | 0.33794*** (0.089) | 0.30989*** (0.079) | 0.30508*** (0.082) |

| Volatility of returns (σROA) | −0.00289*** (0.000) | −0.00280*** (0.000) | −0.53881*** (0.342) | −0.55181*** (0.096) | −0.46419*** (0.093) | −0.55673*** (0.087) | −0.44523*** (0.072) | −0.43472*** (0.0750 |

| Liquidity (LIQ) | −0.00035 (0.001) | −0.00035 (0.001) | 1.14943*** (0.035) | 1.14839*** (0.034) | 1.15940*** (0.041) | 1.10864*** (0.034) | 1.06987*** (0.024) | 1.13018*** (0.041) |

| Independent Variable | ||||||||

| Non–duality (NDU) | −0.02763*** (0.006) | 4.14921*** (1.497) | 5.01171*** (1.747) | 3.58257** (1.508) | 3.98121*** (1.641) | 3.77374** (1.465) | ||

| Mediator | ||||||||

| Debt Maturity (DMR) | 31.20601*** (6.960) | 42.07174*** (8.680) | 134.6859*** (21.667) | |||||

| Fixed Collateral (FC) | −11.74894*** (4.09) | −27.59376*** (4.556) | 0.16597 (2.589) | |||||

| Moderator | ||||||||

| DM*FC | −140.6002*** (21.716) | |||||||

| Year Effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry Effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| R2 | 0.24 | 0.24 | 0.06 | 0.06 | 0.06 | 0.06 | 0.07 | 0.08 |

| Prob>chi2 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

Results of hierarchical OLS regression with board independence as IV

| Debt Maturity | Insolvency Risk | |||||||

|---|---|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 | |

| Control Variables | ||||||||

| Size (SIZE) | 0.00160 (0.003) | −0.00022 (0.003) | −0.93308 (1.373) | −0.94319 (1.393) | −0.93628 (1.390) | −0.87341 (1.394) | −0.77118 (1.388) | −0.91159 (1.383) |

| Taxes (TAX) | 0.00772 (0.011) | 0.00958 (0.011) | −0.16607 (4.654) | −0.15579 (4.662) | −0.45210 (4.651) | −0.20001 (4.662) | −0.66659 (4.642) | −0.65639 (4.624) |

| Growth (FG) | 0.04132*** (0.010) | 0.03958*** (0.010) | −0.34973 (4.157) | −0.35935 4.164 | −1.58314 (4.174) | −0.04862 (4.172) | −1.32004 (4.167) | −0.07162 (4.166) |

| Profitability (ROA) | −0.00013 (0.000) | −0.00013 (0.000) | 0.36536*** (0.131) | 0.36533*** (0.131) | 0.36963*** (0.131) | 0.33940** (0.133) | 0.31087** (0.132) | 0.30597** (0.132) |

| Volatility of returns (σROA) | −0.00289*** (0.001) | −0.00302*** (0.001) | −0.53881*** (0.201) | −0.53956*** (0.202) | −0.44588** (0.204) | −0.54528*** (0.202) | −0.42396** (0.204) | −0.41421** (0.203) |

| Liquidity (LIQ) | −0.00035 (0.001) | −0.00038 (0.001) | 1.14943*** (0.202) | 1.14930*** (0.202) | 1.16113*** (0.202) | 1.10768*** (0.205) | 1.06866*** (0.205) | 1.12913*** (0.205) |

| Independent Variable | ||||||||

| Board Independence (BI) | 0.07101*** (0.022) | 0.39269 (9.045) | −1.80295 (9.052) | −0.28789 (9.061) | −4.21389 (9.084) | −4.14236 (9.048) | ||

| Mediator | ||||||||

| Debt Maturity (DMR) | 30.91784*** (10.630) | 42.55229*** (11.548) | 135.3171*** (29.115) | |||||

| Fixed Collateral (FC) | −12.32151 (10.381) | −28.694** (11.249) | −0.84991 (13.784) | |||||

| Moderator | ||||||||

| DM*FC | −140.8334*** (40.606) | |||||||

| Year Effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry Effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| R2 | 0.24 | 0.25 | 0.06 | 0.06 | 0.06 | 0.06 | 0.07 | 0.08 |

| Adjusted R2 | 0.23 | 0.23 | 0.04 | 0.04 | 0.05 | 0.04 | 0.05 | 0.06 |

| F stat | 19.29*** | 19.01*** | 3.75*** | 3.59*** | 3.81*** | 3.51*** | 3.92*** | 4.25*** |

j_ijme-2020-0032_apptab_001

| Sector | Total Firms | Selected Firms | Percentage | |

|---|---|---|---|---|

| 1 | Textile | 136 | 101 | 74.26% |

| 2 | Sugar | 30 | 23 | 76.67% |

| 3 | Food Sector | 16 | 11 | 68.75% |

| 4 | Chemical & Pharmaceuticals | 43 | 34 | 79.07% |

| 5 | Manufacturing | 31 | 25 | 80.65% |

| 6 | Mineral Products | 09 | 05 | 55.56% |

| 7 | Cement Sector | 17 | 17 | 100% |

| 8 | Motor Vehicles, Trailers & Autoparts | 18 | 18 | 100% |

| 9 | Fuel & Energy Sector | 22 | 14 | 63.64% |

| 10 | Information & Communication | 11 | 10 | 90.91% |

| 11 | Coke & Refined Petroleum Products | 10 | 09 | 90% |

| 12 | Paper, Paperboard & Products | 09 | 07 | 77.78% |

| 13 | Electrical machinery & Apparatus | 07 | 05 | 71.43% |

| 14 | Other Services Activities | 10 | 05 | 50% |

| Total | 369 | 284 | 76.96% |

j_ijme-2020-0032_apptab_002

| Variable | Notation | Measurement | Unit | |

|---|---|---|---|---|

| 1 | Insolvency risk | IR | Measured through emergent market Z-score proposed by Altman (2005). | Ratio |

| 2 | Non-duality | NDU | A binary variable that assumes value ‘0’ in case of CEO duality and ‘1’ otherwise. | Binary |

| 3 | Board Independence | BI | Ratio of independent & non-executive directors to total directors. | Ratio |

| 4 | Debt Maturity | DMR | Ratio of long term debt to total debt. | Ratio |

| 5 | Fixed Collaterals | FC | Ratio of fixed assets to total assets. | Ratio |

| 6 | Size | SIZE | Natural log of value of total assets in each financial year. | Number |

| 7 | Taxes | TAX | Natural log of value of total taxes in each financial year. | Number |

| 8 | Firm Growth | FG | Rate of growth in firm's total assets. | Ratio |

| 9 | Profitability | ROA | Net profit (loss) scaled by total assets. | Ratio |

| 10 | Volatility of returns | σROA | Standard deviation of return on assets for last five years. | Ratio |

| 11 | Liquidity | LIQ | Ratio of current assets to current liabilities. | Ratio |

Summarized Results

| Paths | Indirect Path | Direct Path | Mediation | Moderation | ||

|---|---|---|---|---|---|---|

| Path A | Path B | Path C | ||||

| OLS regression | ||||||

| 1 | NDU-DMR*FC-IR | −0.02763* (0.014) | 134.6859*** (29.084) | 3.77374 (5.771) | Full Mediation | Negative Moderation |

| 2 | BI-DMR*FC-IR | 0.07101*** (0.022) | 135.3171*** (29.115) | −4.14236 (9.048) | Full Mediation | Negative Moderation |

| PCSE regression | ||||||

| 3 | NDU-DMR*FC-IR | 0.02763*** (0.006) | 134.6859*** (21.667) | 3.77374** (1.465) | Partial Mediation | Negative Moderation |

| 4 | BI-DMR*FC-IR | 0.07101*** (0.021) | 135.3171*** (21.898) | −4.14236 (4.648) | Full Mediation | Negative Moderation |

Results of hierarchical PCSE regression with board independence as IV

| Debt Maturity | Insolvency Risk | |||||||

|---|---|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 | |

| Control Variables | ||||||||

| Size (SIZE) | 0.00160 (0.003) | −0.00022 (0.003) | −0.93308*** (0.321) | −0.94319** (0.391) | −0.93628** (0.374) | −0.87341** (0.384) | −0.77118** (0.340) | −0.91159*** (0.321) |

| Taxes (TAX) | 0.00772 (0.005) | 0.00958 (0.006) | −0.16607 (0.193) | −0.15579 (0.204) | −0.45210 (0.370) | −0.20001 (0.225) | −0.66659 (0.463) | −0.65639 (0.451) |

| Growth (FG) | 0.04132* (0.023) | 0.03958* (0.022) | −0.34973 (0.500) | −0.35935 (0.502) | −1.58314* (0.922) | −0.04862 (0.600) | −1.32004* (0.767) | −0.07162 (0.663) |

| Profitability (ROA) | −0.00013 (0.000) | −0.00013 (0.000) | 0.36536*** (0.097) | 0.36533*** (0.097) | 0.36963*** (0.099) | 0.33940*** (0.089) | 0.31087*** (0.079) | 0.30597*** (0.082) |

| Volatility of returns (σROA) | −0.00289*** (0.000) | −0.00302*** (0.000) | −0.53881*** (0.096) | −0.53956*** (0.099) | −0.44588*** (0.097) | −0.54528*** (0.089) | −0.42396*** (0.075) | −0.41421*** (0.079) |

| Liquidity (LIQ) | −0.00035 (0.001) | −0.00038 (0.001) | 1.14943*** (0.035) | 1.14930*** (0.035) | 1.16113*** (0.043) | 1.10768*** (0.033) | 1.06866*** (0.022) | 1.12913*** (0.041) |

| Independent Variable | ||||||||

| Board Independence (BI) | 0.07101*** (0.021) | 0.39269 (4.675) | −1.80295 (4.723) | −0.28779 (4.805) | −4.21389 (4.967) | −4.14236 (4.648) | ||

| Mediator | ||||||||

| Debt Maturity (DMR) | 30.91784*** (6.871) | 42.55229*** (8.859) | 135.3171*** (21.898) | |||||

| Fixed Collateral (FC) | −12.32152*** (4.235) | −28.69400*** (5.015) | −0.84991 (2.689) | |||||

| Moderator | ||||||||

| DM*FC | −140.8334*** (21.898) | |||||||

| Year Effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry Effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| R2 | 0.24 | 0.25 | 0.06 | 0.06 | 0.06 | 0.06 | 0.07 | 0.08 |

| Prob>chi2 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

Mean, Standard Deviation and Correlations

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1) Insolvency Risk (IR) | 1 | ||||||||||

| 2) Board Independence (BI) | 0.0017 | 1 | |||||||||

| 3) Non-duality (NDU) | 0.0262 | 0.1321* | 1 | ||||||||

| 4) Debt Maturity (DMR) | 0.0390 | 0.0163 | −0.0642* | 1 | |||||||

| 5) Fixed Collaterals (FC) | −0.0832* | −0.1496* | −0.1127* | −0.4745* | 1 | ||||||

| 6) Size (SIZE) | −0.0092 | 0.2247* | 0.1168* | 0.0590* | 0.0021 | 1 | |||||

| 7) Taxes (TAX) | 0.0035 | −0.0509 | 0.0046 | 0.0112 | −0.0224 | 0.0354 | 1 | ||||

| 8) Growth (FG) | −0.0030 | 0.0475 | 0.0420 | 0.0948* | 0.0361 | 0.0174 | 0.0086 | 1 | |||

| 9) Profitability (ROA) | 0.0897* | 0.0622* | 0.0800* | −0.0265 | −0.1993* | 0.2091* | 0.0434 | 0.443 | 1 | ||

| 10) Volatility of returns (σROA)) | −0.0598* | 0.0200 | 0.0524* | −0.1519* | −0.0369 | −0.2670* | 0.0046 | 0.0018 | 0.0305 | 1 | |

| 11) Liquidity (LIQ) | 0.1498* | 0.0111 | 0.0115 | −0.0407 | −0.1809* | −0.1223* | 0.0040 | −0.0090 | 0.0349 | 0.0543* | 1 |

| X | 9.96 | 2.64 | − | 0.27 | 0.55 | 15.29 | 16.41 | 0.09 | 4.04 | 7.66 | 2.12 |

| σ | 76.86 | 0.24 | − | 0.21 | 0.22 | 1.76 | 0.43 | 0.48 | 16.23 | 10.44 | 10.08 |

| N | 1420 | 1420 | 1420 | 1420 | 1420 | 1420 | 1420 | 1420 | 1420 | 1420 | 1420 |

Results of hierarchical OLS regression with non-duality as IV

| Debt Maturity | Insolvency Risk | |||||||

|---|---|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 | |

| Control Variables | ||||||||

| Size (SIZE) | 0.00160 (0.003) | 0.00224 (0.003) | −0.93308 (1.374) | −1.02897 (1.380) | −1.09899 (1.376) | −0.96605 (1.381) | −0.97568 (1.375) | −1.10897 (1.370) |

| Taxes (TAX) | 0.00772 (0.011) | 0.00769 (0.011) | −0.16607 (4.654) | −0.16175 (4.655) | −0.40188 (4.643) | −0.18751 (4.655) | −0.54600 (4.635) | −0.53800 (4.617) |

| Growth (FG) | 0.04132*** (0.010) | 0.04205*** (0.010) | −0.34973 (4.157) | −0.46025 (4.160) | −1.77269 (4.173) | −0.16476 (4.168) | −1.53567 (4.166) | −0.28125 (4.166) |

| Profitability (ROA) | −0.00013 (0.000) | −0.00011 (0.000) | 0.36536*** (0.131) | 0.36229*** (0.131) | 0.36585*** (0.131) | 0.33794** (0.133) | 0.30989** (0.132) | 0.30508** (0.132) |

| Volatility of returns (σROA) | −0.00289*** (0.001) | −0.00280*** (0.001) | −0.53881*** (0.201) | −0.55181*** (0.202) | −0.46419** (0.204) | −0.55673*** (0.202) | −0.44523** (0.203) | −0.43472** (0.203) |

| Liquidity (LIQ) | −0.00035 (0.001) | −0.00035 (0.001) | 1.14943*** (0.202) | 1.14839*** (0.202) | 1.15940*** (0.202) | 1.10864*** (0.205) | 1.06987*** (0.205) | 1.13018*** (0.205) |

| Independent Variable | ||||||||

| Non-duality (NDU) | −0.02763* (0.014) | 4.14921 (5.797) | 5.01171 (5.789) | 3.58257 (5.818) | 3.98121 (5.794) | 3.77374 (5.771) | ||

| Mediator | ||||||||

| Debt Maturity (DMR) | 31.20601*** (10.604) | 42.07174*** (11.469) | 134.6859*** (29.084) | |||||

| Fixed Collateral (FC) | −11.74894 (10.398) | −27.59376** (11.217) | 0.16597 (13.751) | |||||

| Moderator | ||||||||

| DM*FC | −140.6002*** (40.604) | |||||||

| Year Effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry Effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| R2 | 0.24 | 0.24 | 0.06 | 0.06 | 0.06 | 0.06 | 0.07 | 0.08 |

| Adjusted R2 | 0.23 | 0.23 | 0.04 | 0.04 | 0.05 | 0.04 | 0.05 | 0.06 |

| F stat | 19.29*** | 18.67*** | 3.75*** | 3.61*** | 3.84*** | 3.52*** | 3.93*** | 4.26*** |