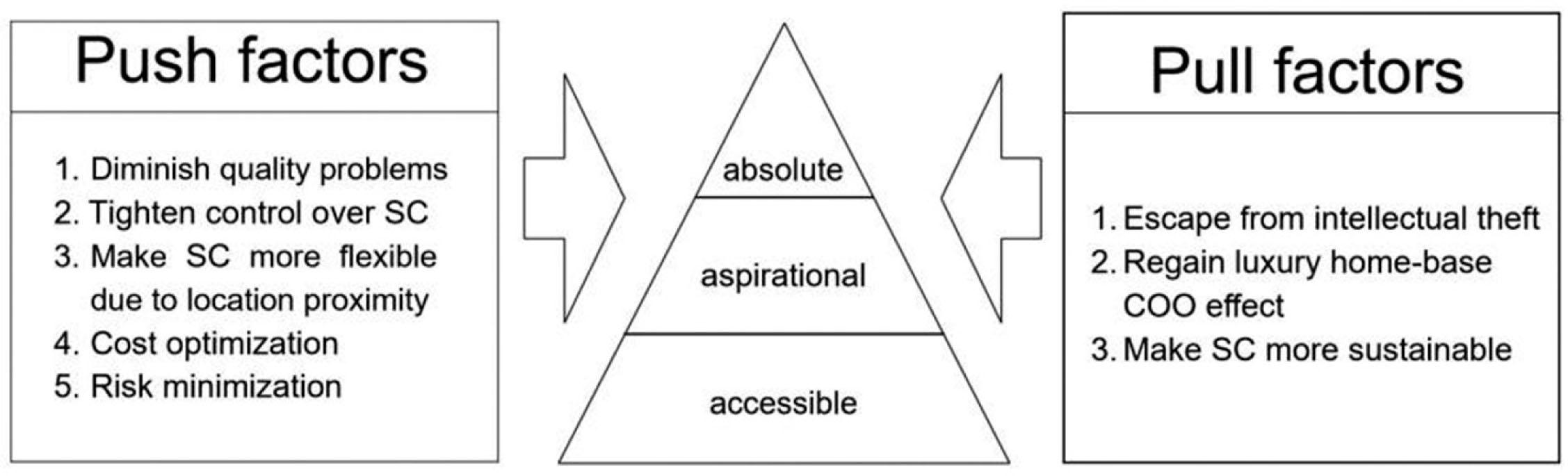

Figure 1

Reshoring premises in the luxury sector in the respective luxury pyramid tiers

| Tier | Luxury fashion | Luxury cars | Luxury jewelry |

|---|---|---|---|

| Absolute | Luxury – home production base as the core value. Offshoring activities kept secret, reshoring communicated only when offshore production is publicly disclosed and condemned. | Luxury – home production base as one of the core values. No need to reshore: assembly at brand heritage country, control over SC in producer's hands. Producer is the brand owner | Bringing the mining of gemstones, silver, gold, etc. home not possible. Local design and production add value mostly to niche – local brands. |

| Aspirational | Bringing production home (back-reshoring) adds COO value; near-reshoring regains control over SC, makes SC more flexible and consumer demand responsive | Defragmented SC; production dispersed all over the world, many suppliers concentrated around assemblies. Assemblies placed in lower-labor-cost regions. Some finishing activities, aimed at changing COO into luxury home base, visible. | Production place not regarded as very important, offshored mainly to Far East countries. The brand owners are mostly distributors, to a much-lesser extent, producers themselves. Some early signs of near-reshoring visible, mainly due to quality problems. The consumers’ attention is mainly on the gems’ origin, although SC sustainability plays an important role. |

| Accessible | Reshoring drivers are mostly push factors: the method of regaining control over the SC, diminish the risk of international SC, transport costs, and time etc. Brand's COO is usually outside the traditional luxury home base; Far East production location accepted as a price concession for accessible luxury | More often near-reshoring than back-reshoring drivers both push and pull factors: the method of tightening control over the SC, diminish the risk of international transport costs | Reshoring drivers mostly are push factors; the method of regaining control over the SC, diminish the risk of international SC, transport costs and time, more flexible and consumer demand–responsive SC |

Examples of back-reshoring and near-reshoring

| Company name | Company country | Host country | Reshoring (back-/near-reshoring) country | Reshoring (back-/near-reshoring) year | Push factors (drivers) | Pull factors (drivers) | Source |

|---|---|---|---|---|---|---|---|

| Manufacture of luxury wearing apparel | |||||||

| Burberry | United Kingdom | China | United Kingdom | 2015–2018 |

|

| UK Investor Magazine[2016], The Businessof Fashion [2016], The Guardian[2015] |

| Paul Smith | United Kingdom | China, Far East | United Kingdom | 2014–2015 |

| The Weekend Australia [2014] | |

| Piquadro | Italy | China | Italy | 2014–2017 |

| - “Made-in” effect | Crivelli [2016a] |

| Prada | Italy | China | Italy, CEE | 2014–2015 |

| - “Made-in” effect | Corriere Della Sera[2014], The Prada Group [2017] |

| Benetton | Italy | Croatia | Italy | 2015–2016 |

| - “Made-in” effect | Ganz [2016], Business Insider[2017] |

| Falconeri | Italy | Romania | Italy | 2015 | - Poor quality of offshored production | - “Made-in” effect | Crivelli [2016b] |

| Jewelry, watches, and accessories | |||||||

| The Forever Companies Jewelry Group | US | China | US | 2015 |

| - “Made-in” effect | Forever Companies [2015] |

| Mauboussin | France | India | France | 2013–2016 (France and Italy) |

|

| Le Point [2016], Dromard [2016] |

| Automotive industry | |||||||

| Tesla Motors | US | Japan | US | 2017 |

| - Image/brand | Galas [2014] |

| McLaren | United Kingdom | Austria | United Kingdom | 2017, 2018 |

| - Image/brand | Peters [2018] |