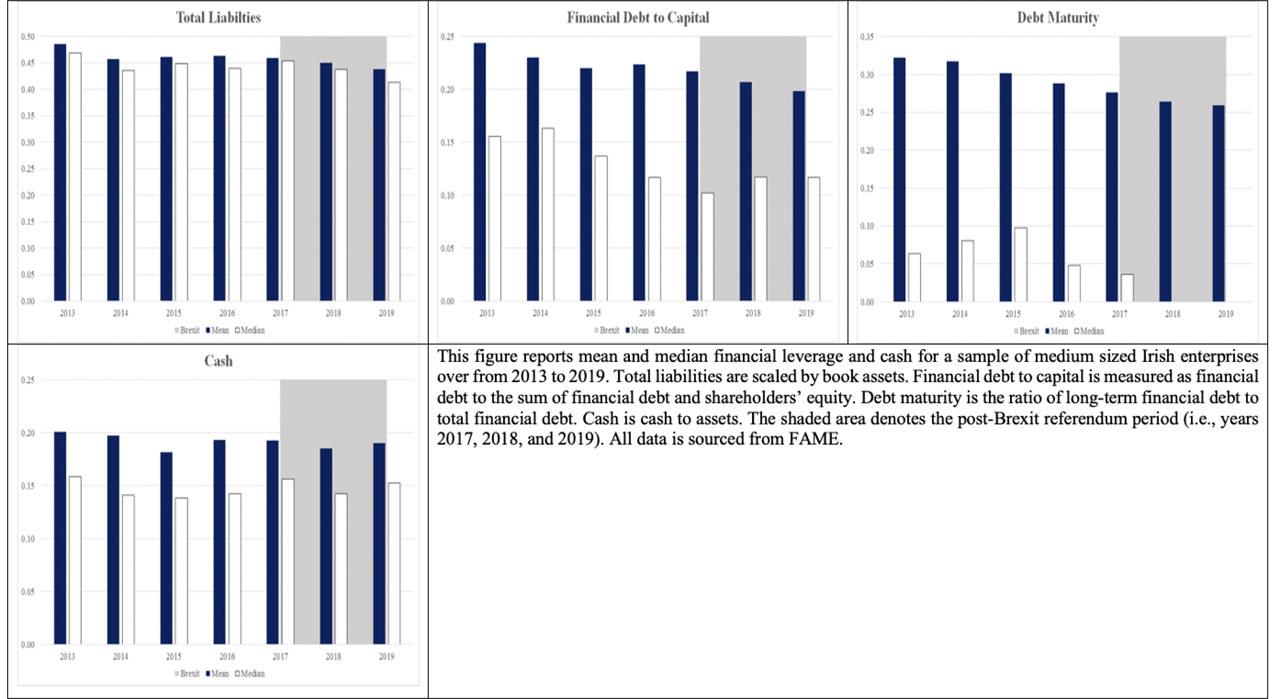

Figure 1

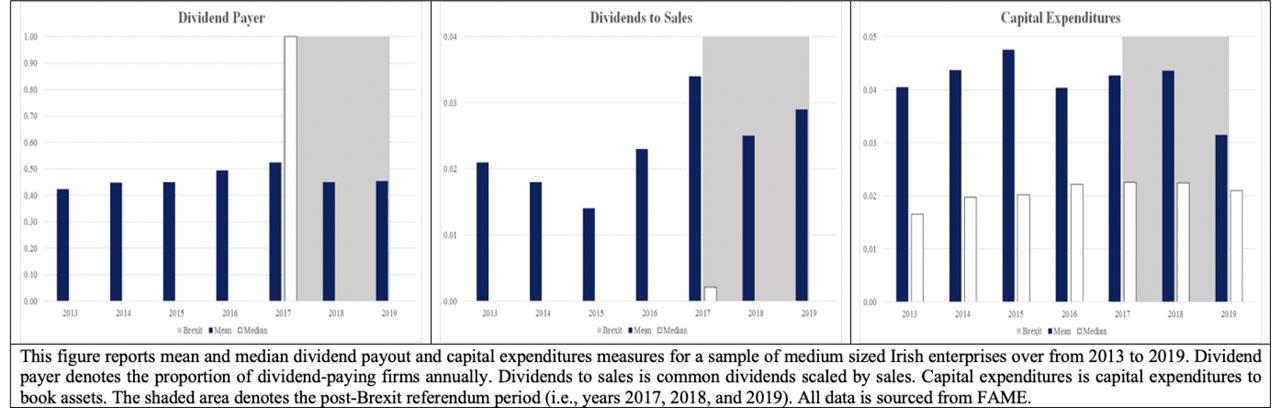

Figure 2

Figure 3

Working capital regressions

| Dependent variable is | |||||

|---|---|---|---|---|---|

| Working capital | Inventory days | Receivables days | Payables days | Cash cycle | |

| Post-Referendum | 0.006 | 3.844*** | 4.611** | 4.827*** | 3.860 |

| Log firm size | 0.114 | -9.461 | -17.170 | -12.648 | -13.313 |

| Firm growth | 0.032 | -8.647** | -13.271** | -14.900*** | -7.927 |

| Profitability | 0.161** | 7.162 | 16.037 | 5.311 | 17.638 |

| Profit volatility | 0.190 | 2.272 | 4.781 | -10.945 | 18.331 |

| Log firm age | -0.004 | -26.232 | -42.590*** | -35.501** | -33.884 |

| Total liabilities | -0.370*** | -9.209 | 3.432 | -4.699 | 0.196 |

| Financing constraints | 0.096 | -23.075 | -60.299* | -34.462 | -48.702 |

| Log of GDP per capita | 0.005 | 17.307** | 12.784 | 16.191 | 14.266 |

| Observations | 996 | 996 | 996 | 996 | 996 |

| R-squared (overall) | 0.185 | 0.027 | 0.050 | 0.039 | 0.098 |

| R-squared (within) | 0.146 | 0.101 | 0.128 | 0.145 | 0.079 |

| Predicted amounts in the pre- and post-Referendum periods | |||||

| Pre-Referendum | 0.26 | 23.22 | 34.12 | 25.09 | 32.15 |

| Post-Referendum | 0.26 | 27.07*** | 38.73** | 29.92*** | 36.01 |

Regressions by pre-Referendum firm size

| Dependent variable is | ||||||||

|---|---|---|---|---|---|---|---|---|

| Dividend policy | Capital structure | Cash | Investment | |||||

| Div-payer | Div-sales | TL/TA | FD/CAP | Debt maturity | ||||

| Post-Referendum | -0.008 | 0.012 | -0.005 | -0.019 | -0.027 | 0.002 | 0.006 | |

| Post-Referendum * size | 0.021 | 0.003 | -0.013 | 0.017 | 0.012 | 0.007 | -0.001 | |

| Observations | 990 | 906 | 1,026 | 1,367 | 1,367 | 1,306 | 1,018 | |

| Controls | Included | Included | Included | Included | Included | Included | Included | |

| R-squared (overall) | 0.008 | 0.035 | 0.010 | 0.035 | 0.104 | 0.000 | 0.023 | |

| R-squared (within) | 0.021 | 0.121 | 0.100 | 0.058 | 0.048 | 0.068 | 0.103 | |

| Dependent variable is | ||||||||

| Working capital | Inventory days | Receivables days | Payables days | Cash cycle | ||||

| Post-Referendum | -0.004 | 9.331*** | 10.047*** | 12.555*** | 6.712* | |||

| Post-Referendum * size | 0.016 | -8.806** | -9.610** | -12.873*** | -4.974 | |||

| Observations | 996 | 996 | 996 | 996 | 996 | |||

| Controls | Included | Included | Included | Included | Included | |||

| R-squared (overall) | 0.224 | 0.010 | 0.060 | 0.001 | 0.101 | |||

| R-squared (within) | 0.153 | 0.122 | 0.148 | 0.195 | 0.083 | |||

Variable description

| Variable | Description | Mean | p25 | Median | p75 | p95 | Sthev |

|---|---|---|---|---|---|---|---|

| Financial flexibility variables | |||||||

| Dividends-sales | Dividends paid to common shareholders to sales | 0.03 | 0.00 | 0.00 | 0.01 | 0.15 | 0.08 |

| Dividend payer | Equals 1 if the firm pays a dividend in year t | 0.48 | 0.00 | 0.00 | 1.00 | 1.00 | 0.50 |

| Working capital | (Current assets - current liabilities) to book assets | 0.29 | 0.10 | 0.31 | 0.47 | 0.70 | 0.26 |

| Inventory days | (Inventory/net sales) * 365 | 21.58 | 0.00 | 7.21 | 34.76 | 84.84 | 29.76 |

| Receivables days | (Accounts receivable/net sales) * 365 | 32.30 | 0.00 | 10.51 | 59.59 | 99.31 | 43.38 |

| Payables days | (Accounts payable/net sales) * 365 | 23.58 | 0.00 | 16.02 | 36.15 | 71.62 | 33.72 |

| Cash conversion cycle | Days in receivables + days in inventory - days in payables | 31.25 | 0.00 | 15.31 | 60.65 | 113.98 | 47.81 |

| Cash holdings | Cash to assets | 0.19 | 0.06 | 0.15 | 0.27 | 0.55 | 0.17 |

| Total liabilities | Total liabilities to book assets | 0.45 | 0.26 | 0.44 | 0.63 | 0.83 | 0.23 |

| Financial debt to capital | Financial debt to sum of financial debt and equity | 0.21 | 0.01 | 0.12 | 0.34 | 0.71 | 0.24 |

| Debt maturity | Long-term financial debt to total financial debt | 0.28 | 0.00 | 0.02 | 0.62 | 0.92 | 0.35 |

| Investment | Capital expenditures to book assets | 0.04 | 0.01 | 0.02 | 0.06 | 0.16 | 0.07 |

| Control variables | |||||||

| Asset tangibility | Fixed to total assets | 0.36 | 0.13 | 0.30 | 0.53 | 0.89 | 0.27 |

| Firm age | Year less establishment year | 31.40 | 18.00 | 28.00 | 40.00 | 65.00 | 19.82 |

| Firm size | Log of book assets in thousands of euro | 2.50 | 1.97 | 2.51 | 3.06 | 4.02 | 0.83 |

| Profitability | Earnings before interest and taxation to book assets | 0.09 | 0.03 | 0.07 | 0.13 | 0.33 | 0.13 |

| Profit volatility | Standard deviation of ROA over the previous three years | 0.06 | 0.01 | 0.03 | 0.06 | 0.21 | 0.08 |

| Sales growth | One-year growth in sales | 0.08 | (0.01) | 0.06 | 0.15 | 0.44 | 0.21 |

| Asset growth | One-year growth in book assets | (0.06) | (0.13) | (0.05) | 0.01 | 0.22 | 0.19 |

| Financing constraints | HP index equals (-0.737 * size + 0.043 * size2 -0.040 * age) | (2.75) | (3.31) | (2.75) | (2.15) | (1.50) | 0.82 |

| △ Working capital | Change in working capital to lagged book assets | 0.32 | 0.10 | 0.32 | 0.51 | 0.79 | 0.29 |

| Foreign sales | The ratio of foreign to total sales | 0.07 | 0.00 | 0.00 | 0.00 | 0.71 | 0.22 |

| GDP per capita | Natural log of GDP per capita in constant euro prices | 10.92 | 10.72 | 10.96 | 11.02 | 11.09 | 0.15 |

| Referendum dummy | Equals 1 in years 2017, 2018, and 2019, 0 otherwise | nm | nm | nm | nm | nm | nm |

| Industry dummies | Industry dummies based on US four-digit primary SIC | nm | nm | nm | nm | nm | nm |

| Number of firms in each industry | |||||||

| Agriculture, Forestry & Fishing | Mining | Construction | Manufacturing | Transportation, Communications, Electric, Gas & Sanitary | |||

| 10 | 7 | 129 | 316 | 106 | |||

| Wholesale trade | Retail trade | Services | Public administration | Other | |||

| 142 | 193 | 441 | 3 | 26 | |||

Regressions by pre-Referendum cash levels

| Dependent variable is | |||||||

|---|---|---|---|---|---|---|---|

| Dividend policy | Capital structure | Cash | Investment | ||||

| Div-payer | Div-sales | TL/TA | FD/CAP | Debt maturity | |||

| Post-Referendum | -0.035 | 0.012 | -0.025** | -0.033** | -0.055*** | 0.028*** | -0.002 |

| Post-Referendum * cash | 0.099 | 0.003 | 0.036** | 0.045** | 0.073*** | -0.056*** | 0.016* |

| Observations | 990 | 906 | 1,026 | 1,367 | 1,367 | 1,306 | 1,018 |

| Controls | Included | Included | Included | Included | Included | Included | Included |

| R-squared (overall) | 0.010 | 0.035 | 0.010 | 0.018 | 0.065 | 0.004 | 0.022 |

| R-squared (within) | 0.025 | 0.121 | 0.114 | 0.069 | 0.059 | 0.104 | 0.109 |

| Dependent variable is | |||||||

| Working capital | Inventory days | Receivables days | Payables days | Cash cycle | |||

| Post-Referendum | 0.017 | 3.343* | 0.823 | 4.073** | 0.462 | ||

| Post-Referendum * cash | -0.029* | 1.661 | 8.698** | 1.856 | 8.151 | ||

| Observations | 996 | 996 | 996 | 996 | 996 | ||

| Controls | Included | Included | Included | Included | Included | ||

| R-squared (overall) | 0.196 | 0.022 | 0.060 | 0.040 | 0.099 | ||

| R-squared (within) | 0.158 | 0.101 | 0.145 | 0.146 | 0.089 | ||

Dividend payout, capital structure, cash, and investment regressions

| Dependent variable is | |||||||

|---|---|---|---|---|---|---|---|

| Dividend policy | Leverage policy | Cash | Investment | ||||

| Div-payer | Div-sales | TL/TA | FD/CAP | Debt maturity | |||

| Post-Referendum | 0.002 | 0.013* | -0.010 | -0.011 | -0.020 | -0.000 | 0.010 |

| Log firm size | -0.130 | -0.020 | -0.004 | 0.048 | 0.079* | 0.056 | -0.005 |

| Firm growth | 0.276** | 0.113*** | -0.055* | -0.093** | -0.180*** | 0.039 | -0.093*** |

| Profitability | -0.260 | -0.047 | -0.203*** | -0.172*** | -0.088 | 0.082 | -0.073* |

| Profit volatility | -0.011 | -0.015 | 0.061 | ||||

| Cash | -0.007 | 0.038 | 0.147*** | ||||

| Log firm age | -0.263 | -0.045 | 0.017 | 0.004 | -0.096 | 0.099* | -0.098 |

| Total liabilities | -0.611** | -0.185*** | |||||

| Tangibility | 0.036 | 0.095 | 0.202** | ||||

| Working capital | 0.158*** | ||||||

| Dividend payout | -0.046 | ||||||

| Financing constraints | 0.154 | ||||||

| △ Working capital | 0.158*** | 0.059** | |||||

| Log of GDP per capita | -0.019 | -0.022 | -0.056** | -0.055* | -0.059 | 0.003 | 0.025 |

| Observations | 990 | 906 | 1,026 | 1,367 | 1,367 | 1,306 | 1,018 |

| R-squared (overall) | 0.004 | 0.039 | 0.005 | 0.034 | 0.087 | 0.155 | 0.010 |

| R-squared (within) | 0.027 | 0.136 | 0.088 | 0.052 | 0.049 | 0.065 | 0.146 |

| Predicted amounts in the pre- and post-Referendum periods | |||||||

| Pre-Referendum | 0.051 | 0.015 | 0.45 | 0.22 | 0.30 | 0.186 | 0.033 |

| Post-Referendum | 0.051 | 0.028* | 0.44 | 0.21 | 0.28 | 0.186 | 0.043 |

Regressions by pre-Referendum leverage levels

| Dependent variable is | ||||||||

|---|---|---|---|---|---|---|---|---|

| Dividend policy | Capital structure | Cash | Investment | |||||

| Div-payer | Div-sales | TL/TA | FD/CAP | Debt maturity | ||||

| Post-Referendum | 0.037 | 0.013 | 0.018* | 0.027*** | -0.005 | -0.011 | 0.007 | |

| Post-Referendum * leverage | -0.056 | 0.000 | -0.048*** | -0.075*** | -0.031 | 0.029** | -0.002 | |

| Observations | 990 | 906 | 1,026 | 1,367 | 1,367 | 1,306 | 1,018 | |

| Controls | Included | Included | Included | Included | Included | Included | Included | |

| R-squared (overall) | 0.010 | 0.034 | 0.004 | 0.000 | 0.082 | 0.000 | 0.023 | |

| R-squared (within) | 0.022 | 0.120 | 0.124 | 0.089 | 0.049 | 0.077 | 0.103 | |

| Dependent variable is | ||||||||

| Working capital | Inventory days | Receivables days | Payables days | Cash cycle | ||||

| Post-Referendum | -0.020 | 7.835*** | 6.625** | 4.323 | 10.076*** | |||

| Post-Referendum * leverage | 0.042*** | -6.385* | -4.032 | 0.607 | -10.558** | |||

| Observations | 996 | 996 | 996 | 996 | 996 | |||

| Controls | Included | Included | Included | Included | Included | |||

| R-squared (overall) | 0.194 | 0.019 | 0.058 | 0.048 | 0.110 | |||

| R-squared (within) | 0.164 | 0.111 | 0.134 | 0.146 | 0.095 | |||