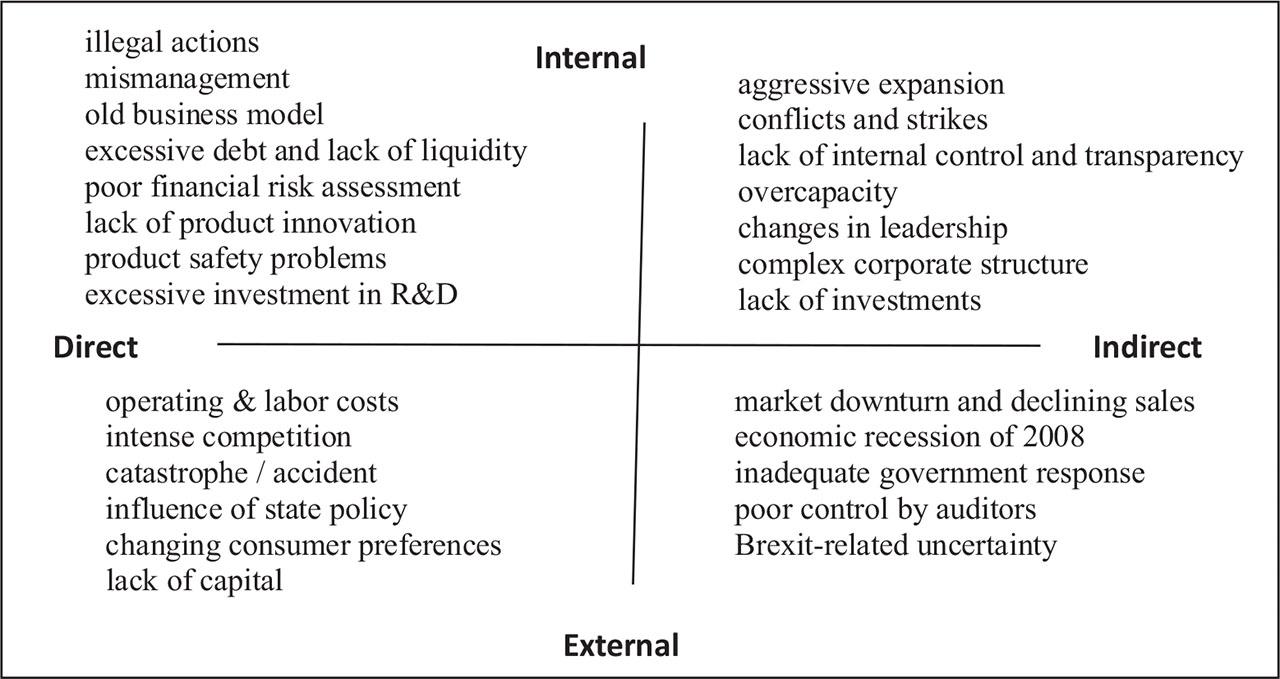

Figure 1.

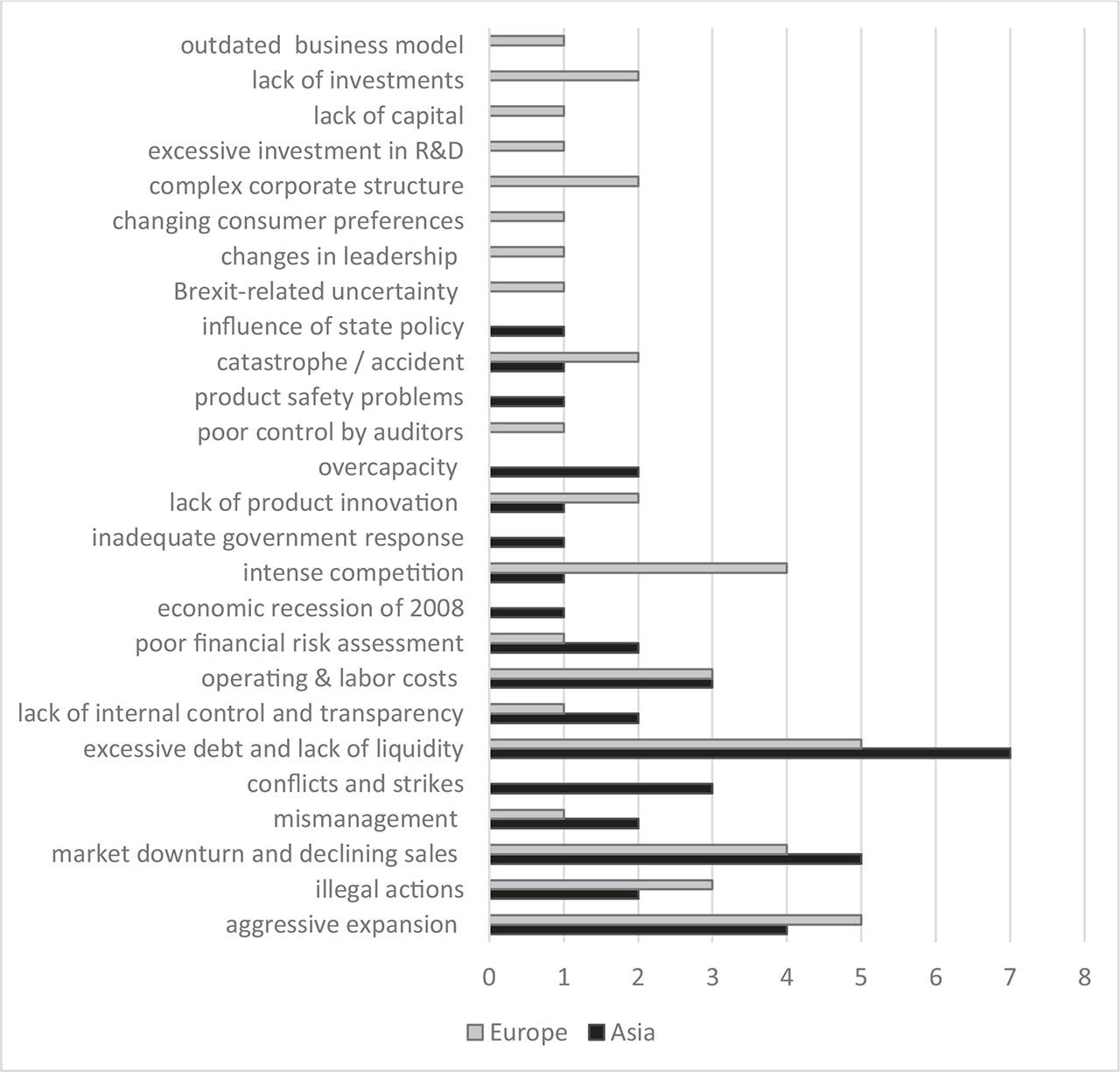

Figure 2.

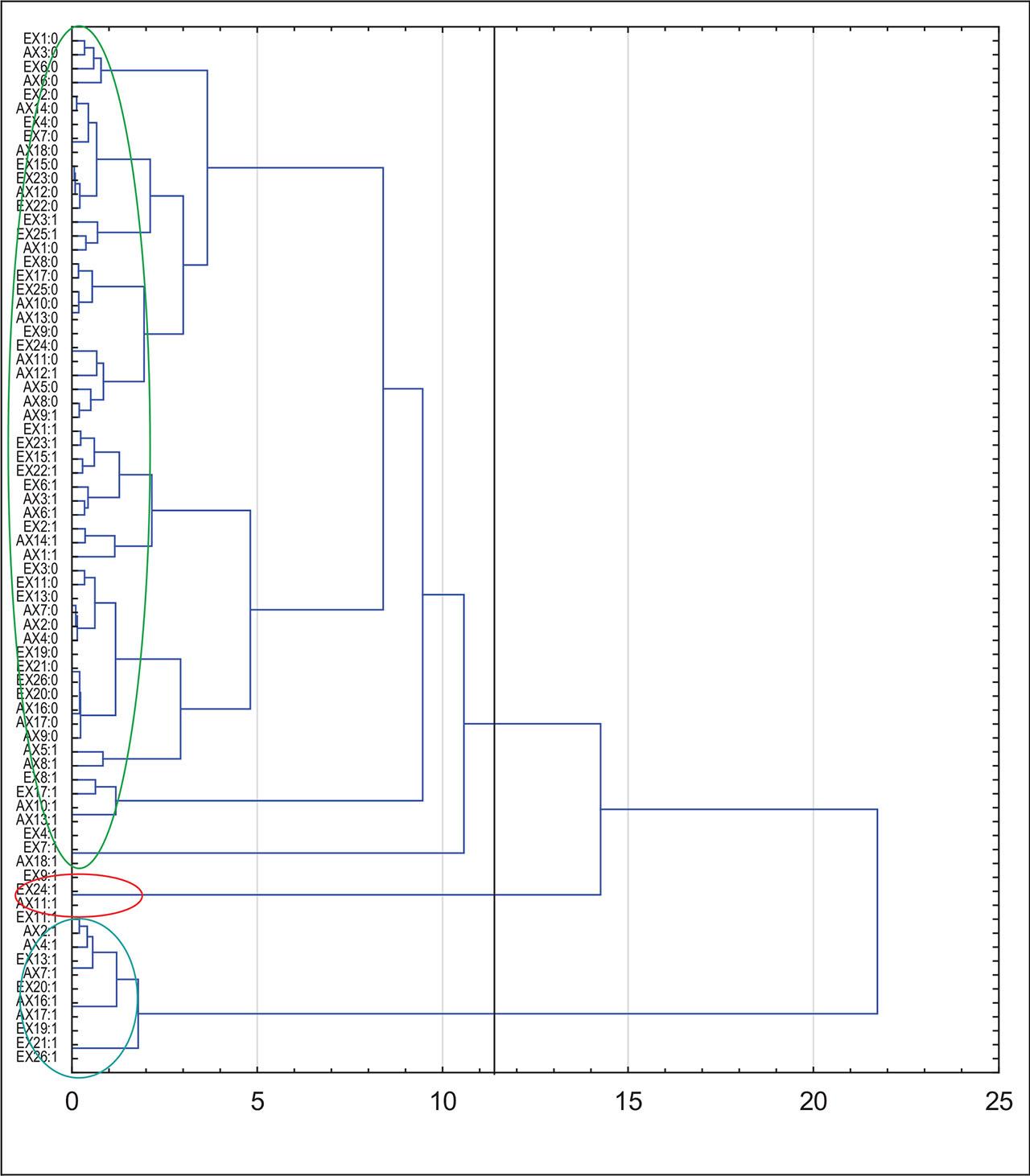

Figure 3.

Description of selected crises of European companies

| Company | Dates and key events |

|---|---|

| Swissair |

|

| Parmalat |

|

| Rover Group |

|

| Siemens AG |

|

| Spanair |

|

| Nokia |

|

| Banco Popular |

|

| Thomas Cook Group |

|

| Wirecard |

|

| Abengoa |

|

Variables Used in the Analysis

| Categorization | Direct causes of crises | |

|---|---|---|

| Europe | Asia | |

| EX1 | AX1 | aggressive expansion |

| EX2 | AX2 | illegal actions |

| EX3 | AX3 | market downturn and declining sales |

| EX4 | AX4 | mismanagement |

| EX5 | AX5 | conflicts and strikes |

| EX6 | AX6 | excessive debt and lack of liquidity |

| EX7 | AX7 | lack of internal control and transparency |

| EX8 | AX8 | operating & labor costs |

| EX9 | AX9 | poor financial risk assessment |

| EX10 | AX10 | economic recession of 2008 |

| EX11 | AX11 | intense competition |

| EX12 | AX12 | inadequate government response |

| EX13 | AX13 | lack of product innovation |

| EX14 | AX14 | overcapacity |

| EX15 | AX15 | poor control by auditors |

| EX16 | AX16 | product safety problems |

| EX17 | AX17 | catastrophe / accident |

| EX18 | AX18 | influence of state policy |

| EX19 | AX19 | Brexit-related uncertainty |

| EX20 | AX20 | changes in leadership |

| EX21 | AX21 | changing consumer preferences |

| EX22 | AX22 | complex corporate structure |

| EX23 | AX23 | excessive investment in R&D |

| EX24 | AX24 | lack of capital |

| EX25 | AX25 | lack of investments |

| EX26 | AX26 | outdated business model |

Singular values and eigenvalues with the degree of explained total inertia in the original and modified versions

| Number of dimensions, K | Singular values, γk | Eigenvalues, λk | λk / λ | τk |

|

|

|

|---|---|---|---|---|---|---|---|

| 1 | 0.5113 | 0.2615 | 26.1475 | 26.1475 | 0.2478 | 27.5831 | 27.5831 |

| 2 | 0.3844 | 0.1478 | 14.7757 | 40.9232 | 0.1349 | 15.0177 | 42.6008 |

| 3 | 0.3716 | 0.1381 | 13.8083 | 54.7316 | 0.1254 | 13.9615 | 56.5623 |

| 4 | 0.3398 | 0.1154 | 11.5444 | 66.2759 | 0.1033 | 11.5015 | 68.0638 |

| 5 | 0.3073 | 0.0944 | 9.4419 | 75.7179 | 0.0830 | 9.2357 | 77.2996 |

| 6 | 0.2944 | 0.0867 | 8.6663 | 84.3841 | 0.0755 | 8.4055 | 85.7051 |

| 7 | 0.2551 | 0.0651 | 6.5082 | 90.8924 | 0.0550 | 6.1175 | 91.8226 |

| 8 | 0.2297 | 0.0527 | 5.2740 | 96.1664 | 0.0434 | 4.8280 | 96.6506 |

| 9 | 0.1958 | 0.0383 | 3.8336 | 100.0000 | 0.0301 | 3.3494 | 100.0000 |

|

|

Description of selected crises of Asian companies

| Company | Dates and key events |

|---|---|

| China Aviation Oil |

|

| PT Bank Century |

|

| SsangYong Motor |

|

| AirAsia Japan |

|

| Hanjin Shipping |

|

| Toyota |

|

| LDK Solar |

|

| Kingfisher Airlines |

|

| Satyam Computer Services |

|

| Jet Airways |

|

Homogeneous typological groups according to the occurrence of direct causes of the crisis

| Variable | Group | Variable | Group | Variable | Group |

|---|---|---|---|---|---|

| EX9:1 | 1 | EX11:1 | 2 | EX1:1 | 3 |

| EX24:1 | 1 | EX13:1 | 2 | EX2:1 | 3 |

| AX11:1 | 1 | EX19:1 | 2 | EX3:1 | 3 |

| EX20:1 | 2 | EX4:1 | 3 | ||

| EX21:1 | 2 | EX6:1 | 3 | ||

| EX26:1 | 2 | EX7:1 | 3 | ||

| AX2:1 | 2 | EX8:1 | 3 | ||

| AX4:1 | 2 | EX15:1 | 3 | ||

| AX7:1 | 2 | EX17:1 | 3 | ||

| AX16:1 | 2 | EX22:1 | 3 | ||

| AX17:1 | 2 | EX23:1 | 3 | ||

| 2 | EX25:1 | 3 | |||

| AX1:1 | 3 | ||||

| AX3:1 | 3 | ||||

| AX5:1 | 3 | ||||

| AX6:1 | 3 | ||||

| AX8:1 | 3 | ||||

| AX9:1 | 3 | ||||

| AX10:1 | 3 | ||||

| AX12:1 | 3 | ||||

| AX13:1 | 3 | ||||

| AX14:1 | 3 | ||||

| AX18:1 | 3 |