Figure 1:

Figure 2:

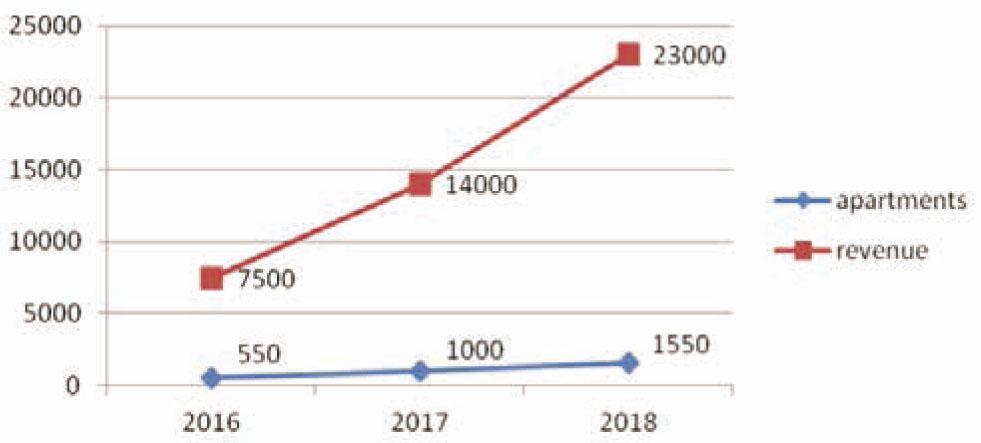

Figure 3:

Properties under management over time

| City | Starting year | Number of properties | Spatial concentration |

|---|---|---|---|

| Milan | 2016 | Over 120 | Central area and neighborhoods |

| Turin | 2017 | Over 110 | Central area |

| Rome | 2017 | Over 120 | Central area |

| Bologna | 2017 | Over 60 | Central area and neighborhoods |

| Florence | 2017 | Over 80 | Central area and neighborhoods |

| Others | 2017 | Over 500 | Seasonal destinations (Adriatic Riviera, Sicily, Sardinia, Friuli), medium-size urban centres (Trieste, Bari, Ferrara, Palermo, Napoli, Verona, Padova, etc..) |

Key success factors

| Business model replicability | Dynamic pricing | Brand Awareness | In-house platform | Company reputation |

|---|---|---|---|---|

| Efficient and flexible operational cycle that enables the rapid activation of a new location with the combination of local resources and centralised coordination, ensuring the capacity for future growth. | Dynamic pricing system structured in order to ensure high rates of property occupation managed at competitive prices. | Unique brand at national level recognised by the owners of real estate. Widespread presence throughout the territory, with geographical diversification that guarantees seasonal reduction effect on total collections. | Platform for the optimisation of Revenue & Reservation Centralised management, which coordinates operational structures in various locations, with autonomy in compliance with standards and Cleanbnb brand policy. | Clusters of operator aggregation in the current phase of market concentration. |