Figure 1.

Figure 2.

Figure 3.

Comparison of major events in the evolutionary phases of the USA, Israel, and Poland VC industries

| Phase | USA | ISRAEL | POLAND |

|---|---|---|---|

| Background Conditions | 1930–1945

| 1970–1989

| 1989–2004

|

| Pre-Emergence | 1945–1957

| 1989–1992

| 2004–2017

|

| Emergence | 1958–1972

| 1993–2000

| 2017-

|

| Crisis | 1972–1980

| 2001–2003

| |

| Consolidation | 1980-

| 2004-

|

Comparison of PFR Ventures (Poland) and Yozma (Israel) programs

| PFR Ventures (Poland) First edition POIR* | YOZMA (Israel) | |

|---|---|---|

| Objective | Support the development of the local Venture Capital and Private Equity market and the innovation ecosystem. | Creation of a competitive domestic VC industry. |

| Investment Structure | The organisation operates in a fund of funds (FOF) format. Each sub-fund has a specific investment profile. PFR Ventures' maximum contribution to the capitalisation of individual funds ranges from 60% to 80%, depending on the program profile. | The programme, promoted by the OCS, was structured as a fund of funds, making equity investments in hybrid funds without intervening in their operations. The government contributed USD 8 million to each of the ten funds, making up 40% of the total capital raised. |

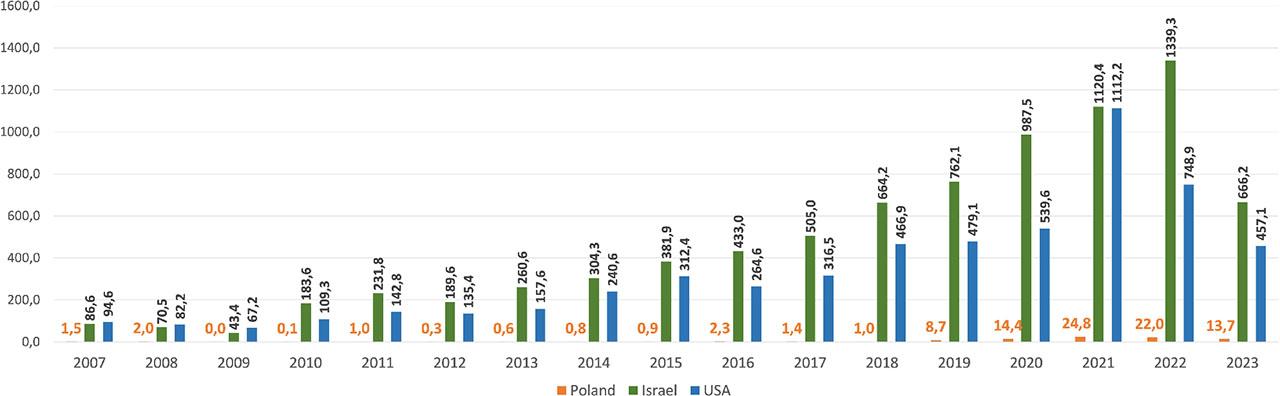

| Investment capital | PFR Ventures invested PLN 1.1 billion in VC funds between 2017 and 2023. Meanwhile, the total investment capital, together with private funds, amounted to PLN 1.6 billion (~ USD 400 million). | Total investment capital of USD 250 million (including government funding of USD 100 million) |

| Investment Focus | Each sub-fund has a specific Investment Focus:

| Early-stage investments in high tech startup companies |

| Form of VC organisations | Depending on the program, VC organisations operate in a standard VC fund, CVC, or co-investment model. | Independent Limited Partnership VC Companies |

| Requirements for Fund managers | Each candidate fund had to meet the experience and competence requirements of the management team. In addition, individual sub-funds had management team contribution requirements that ranged from 1% to 20% of the fund's total capitalisation. | Each VC fund had to have a competent management team, a reputable foreign VC firm, and a domestic financial institution, which helped foster collective learning and leverage international expertise. |

| Incentives for investors | Risk diversification through joint investment in a public-private model. In addition, in most programmes there was a follow-on investment option for successful ventures. | Within a 5-year window, investors could buy the government's share at cost, providing strong incentives for professional VC teams. |

| Impact | Over the period 2017–2023, PFR Ventures invested in more than 380 companies through partnerships with 32 VC funds with funds from POIR. As the investment horizon depending on the programme is 5–12 years most of the investments are still in the development stage, only in the following years with more exits will it be possible to assess success better. | The Yozma fund created a critical mass of VC investment, with most Yozma funds ranking among Israel's top 20 VCs. It spurred high private VC performance, led to follow-up funds and strong capital growth, and served as a model for many other VC companies in Israel. |