Figure 1.

Results of the Two-Sample t-Test

| Category | Number of split rated bonds | Number of non-split rated bonds | Spread mean of split rated bonds | Spread mean of non-split rated bonds | Spread mean difference | One-sided p-value | Two-sided p-value | Levene’s test for equality of variances (p-value) | Shapiro-Wilk test of normality (p-value) | Kolmogorov-Smirnov test of normality (p-value) |

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

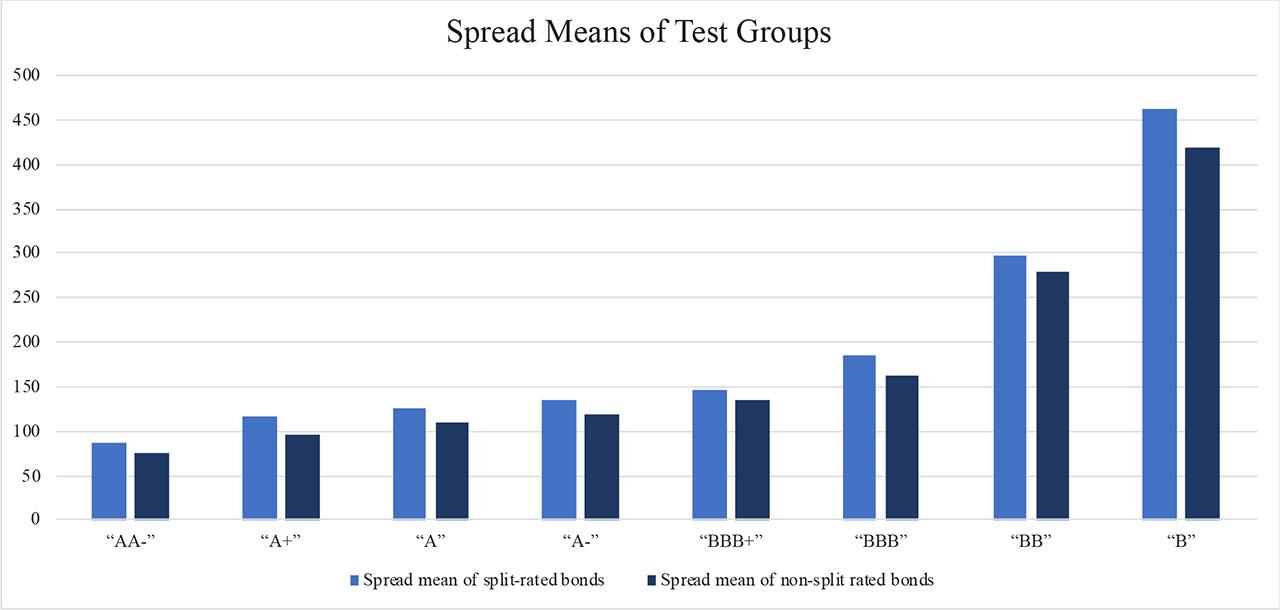

| AA− | 48 | 51 | 86.3 | 76.2 | 10.1 | 0.021 | 0.042 | 0.106 | 0.842 | 0.2 |

| A+ | 26 | 36 | 115.5 | 96.7 | 18.8 | 0.024 | 0.048 | 0.952 | 0.218 | 0.2 |

| A | 84 | 87 | 125.5 | 109.5 | 16 | 0.017 | 0.033 | 0.543 | 0.067 | 0.088 |

| A− | 85 | 85 | 134.63 | 118.14 | 16.49 | 0.005 | 0.01 | 0.808 | 0.063 | 0.2 |

| BBB+ | 133 | 140 | 146 | 134 | 12 | 0.011 | 0.021 | 0.561 | 0.124 | 0.07 |

| BBB | 84 | 92 | 184.3 | 162.2 | 22.1 | 0.002 | 0.005 | 0.883 | 0.082 | 0.2 |

| BB | 65 | 67 | 298.7 | 280.4 | 18.3 | 0.012 | 0.025 | 0.863 | 0.158 | 0.2 |

| B | 68 | 68 | 463.3 | 418 | 45.3 | 0.024 | 0.048 | 0.091 | <0.05 | <0.05 |

Categorisation of Bonds by Risk Grade

| Category (equivalent to S&P ratings) | Pair of split ratings with a two-notches difference Moody’s / S&P | Middle rating of the split pair Moody’s / S&P | Risk |

|---|---|---|---|

| “AA+” | Aa2 / AAA | Aa1 / AA+ | Investment-grade bonds |

| “AA” | Aa3 / AA+ | Aa2 / AA | |

| “AA−” | A1 / AA | Aa3 / AA− | |

| “A+” | A2 / AA− | A1 / A+ | |

| “A” | A3 / A+ | A2 / A | |

| “A−” | Baa1 / A | A3 / A− | |

| “BBB+” | Baa2 / A− | Baa1 / BBB+ | |

| “BBB” | Baa3 / BBB+ | Baa2 / BBB | |

| “BB” | Ba3 / BB+ | Ba2 / BB | Speculative bonds |

| “BB−” | B1 / BB | Ba3 / BB− | |

| “B+” | B2 / BB− | B1 / B+ | |

| “B” | B3 / B+ | B2 / B |