Figure 1.

Figure 2.

Figure 3.

Figure 4.

Allocations of funds from Polish sovereign green bonds in mln EUR

| Allocations from issuances [mln EUR] | 1st (2016) | 2nd (2018) | 3rd (2019) | 4th (2019) | TOTAL |

|---|---|---|---|---|---|

| Clean transportation | 241.3 | 767.9 | 750.7 | 247.6 | 2007.5 |

| Sustainable agricultural operations | 292.1 | 84.1 | 198.1 | 65.3 | 639.6 |

| Renewable energy | 155.2 | 71.7 | 92.8 | 30.6 | 350.3 |

| National parks | 35.4 | 54.1 | 41 | 13.5 | 144 |

| Afforestation | 21 | 19.8 | 17 | 5.6 | 63.4 |

| Reclamation of heaps | 0.02 | 0.2 | 0.94 | 0.3 | 1.46 |

Volume of issuance of European green bonds by target category

| Volume of green bond issuance, EUR billion | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | Average |

|---|---|---|---|---|---|---|---|---|

| Energy | 10.06 | 9.15 | 12.58 | 22.50 | 20.11 | 36.45 | 48.12 | 22.71 |

| Building construction | 2.34 | 2.80 | 3.87 | 12.70 | 14.55 | 29.54 | 31.97 | 13.97 |

| Transport | 0.81 | 1.89 | 1.97 | 6.79 | 12.25 | 21.94 | 31.02 | 10.95 |

| Water resource management | 1.08 | 0.98 | 1.12 | 3.45 | 3.87 | 6.30 | 4.57 | 3.05 |

| Waste management | 0.72 | 0.91 | 0.34 | 2.30 | 3.10 | 3.77 | 2.70 | 1.98 |

| Land use | 0.72 | 0.19 | 0.44 | 2.82 | 3.61 | 5.16 | 10.48 | 3.35 |

| Others | 0.55 | 0.81 | 0.69 | 0.96 | 1.95 | 3.23 | 3.04 | 1.60 |

| TOTAL | 16.27 | 16.73 | 21.01 | 51.52 | 59.44 | 106.40 | 131.90 | 57.61 |

Issuance of funds of sovereign green bonds in Poland

| Emissions’ information | 1st emission | 2nd emission | 3rd emission | 4th emission |

|---|---|---|---|---|

| Date of emission | 20th December 2016 | 7th February 2018 | 28th February 2019 | |

| Maturity | 5 years | 8 years | 10 years | 30 years |

| Coupon | 0.50% | 1.13% | 1.00% | 2.00% |

| Profitability | 0.63% | 1.15% | 1.06% | 2.07% |

| Value | 0.75 billion EUR | 1 billion EUR | 1.5 billion EUR | 0.5 billion EUR |

| Reported demand | 1.5 billion EUR | 3.25 billion EUR | 3.5 billion EUR | 1.3 billion EUR |

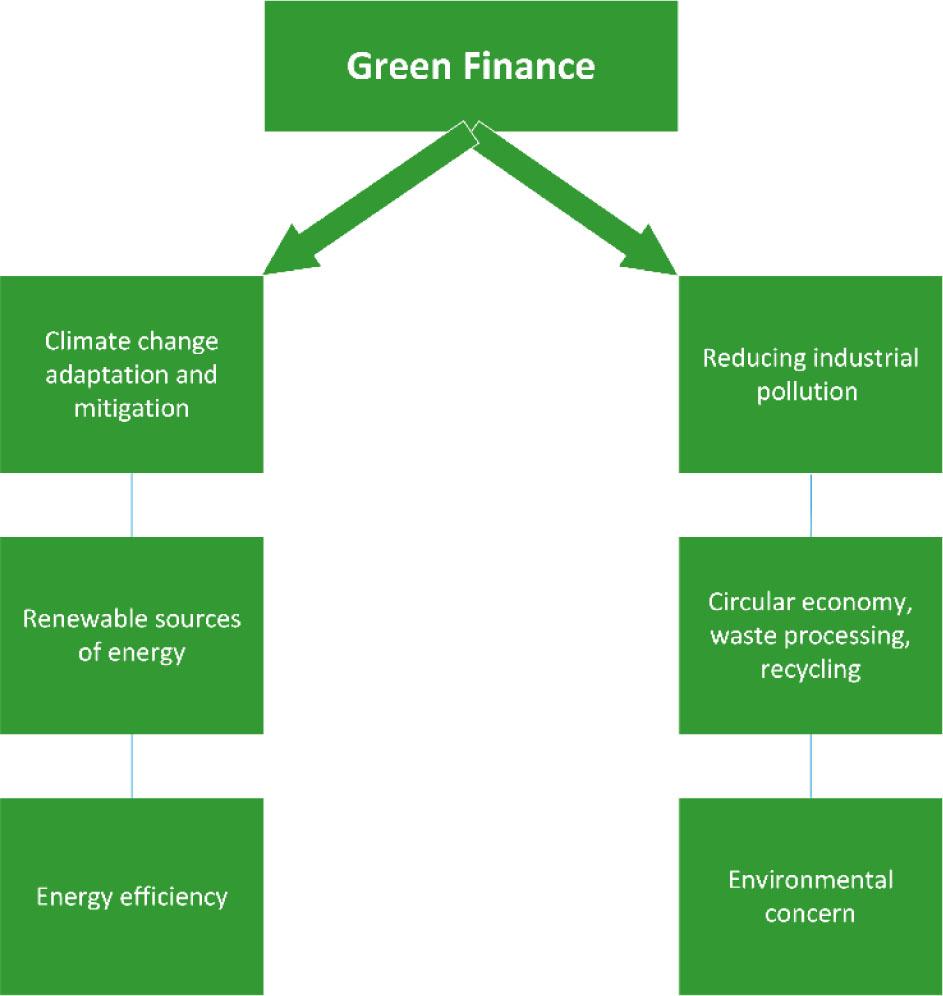

Various definitions of green finance

| Definition | Author |

|---|---|

| ‘Green finance refers to financial investments flowing into sustainable development projects and initiatives, environmental products, and policies that encourage the development of a more sustainable economy. Green finance includes climate finance but is not limited to it. It also refers to a wider range of other environmental objectives, for example, industrial pollution control, water sanitation, or biodiversity protection’. | International Development Finance Club, 2012 |

| ‘Green finance represents a wider lens than green investment. It includes capital cost and, unlike green investment, includes operational costs such as project preparation and land acquisition costs’. | Zadek, Flynn, 2013 |

| ‘For the banking sector, green finance is defined as financial products and services, under the consideration of environmental factors throughout the lending decision-making, ex-post monitoring, and risk management processes, provided to promote environmentally responsible investments and stimulate low-carbon technologies, projects, industries, and businesses’. | PricewaterhouseCoopers Consultants (PWC), 2013 |

| ‘Green finance is finance for achieving economic growth while reducing pollution and greenhouse gas emissions, minimising waste and improving efficiency in the use of natural resources’. | Organisation for Economic Co-operation and Development (OECD) |

| ‘Green finance comprises the financing of public and private green investments (including preparatory and capital costs)…, the financing of public policies (including operational costs) that encourage the implementation of environmental and environmental-damage mitigation or adaptation projects and initiatives…, and components of the financial system that deal specifically with green investments…’. | Lindenberg, 2014 |

| Green finance is a set of financial instruments used to finance environmentally friendly investments. These investments must meet certain environmental standards and must not have negative environmental and social effects. The aim of projects financed through green finance is to develop a low-carbon economy, adapt and mitigate climate change, implement sustainable development, and establish a circular economy. | Sobik |

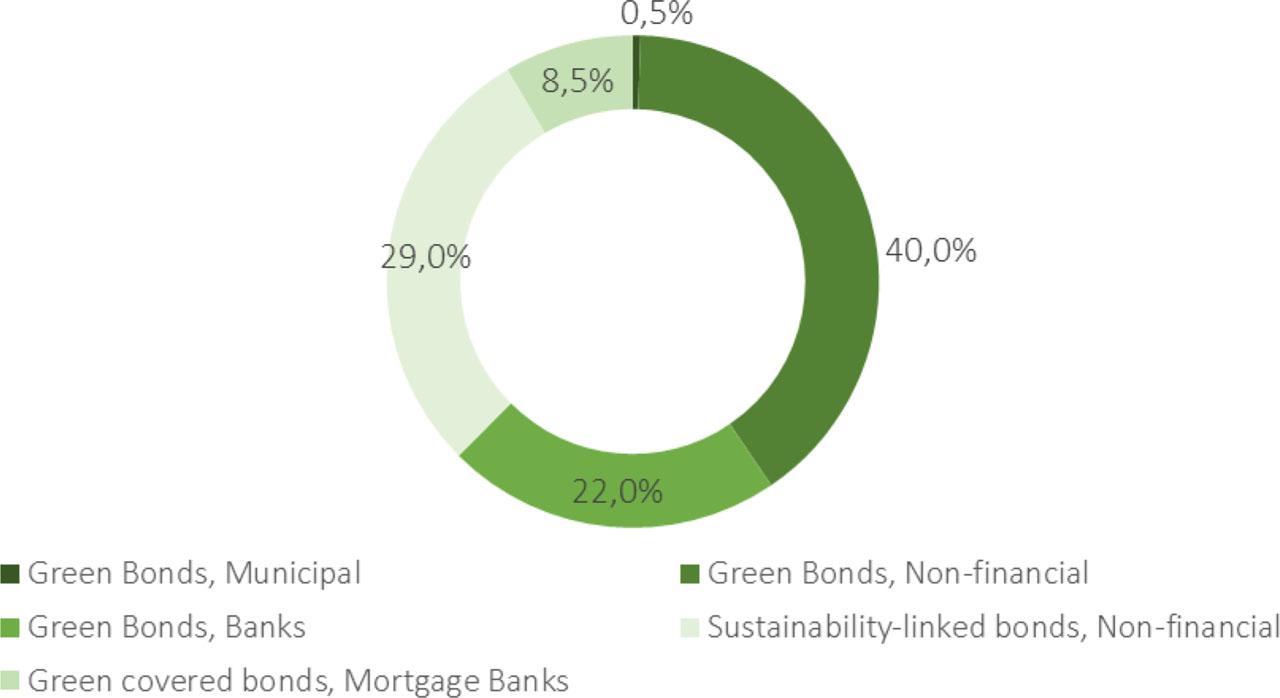

Number of issuers by sector in the European bond market in years 2014–2020

| Number of issuers | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

|---|---|---|---|---|---|---|---|

| International development banks | 3 | 2 | 1 | 2 | 3 | 5 | 5 |

| Financial institutions | 1 | 8 | 7 | 13 | 22 | 44 | 53 |

| Public sector entities | 6 | 12 | 12 | 23 | 18 | 28 | 44 |

| Local authorities | 5 | 5 | 6 | 7 | 12 | 9 | 12 |

| Nonfinancial corporations | 16 | 15 | 18 | 31 | 40 | 80 | 94 |

| Governments | 0 | 0 | 1 | 1 | 5 | 5 | 6 |

| Others | 0 | 0 | 2 | 8 | 6 | 8 | 12 |

| TOTAL | 31 | 42 | 47 | 85 | 106 | 179 | 226 |

| y/y change | - | 35% | 12% | 81% | 25% | 69% | 26% |

Green bond issuance volume by region and total green bond issuance in 2014–2021 ($billion)

| Region | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|---|---|---|---|

| Europe | 49.5% | 43.4% | 29.6% | 38.4% | 39.4% | 45.3% | 52.9% | 56.0% |

| Asia and Pacific | 4.3% | 8.5% | 31.5% | 22.3% | 29.2% | 24.9% | 19.0% | 23.1% |

| North America | 20.0% | 27.8% | 24.7% | 30.7% | 23.0% | 22.3% | 20.1% | 16.6% |

| Latin America | 0.5% | 2.4% | 1.9% | 2.5% | 0.9% | 1.8% | 3.1% | 1.4% |

| Africa | 0.3% | 0.0% | 0.2% | 0.2% | 0.1% | 0.3% | 0.4% | 0.1% |

| Transnational corporations | 25.4% | 18.0% | 12.1% | 6.0% | 7.4% | 5.3% | 4.5% | 2.8% |

| TOTAL (issued $billion) | 37.0 | 46.1 | 84.5 | 159.5 | 172.5 | 269.3 | 297.2 | 444.4 |

Various definitions of green bonds

| Definition | Author |

|---|---|

| ‘Fixed-income debt securities issued (by governments, multi-national banks or corporations) in order to raise the necessary capital for a project which contributes to a low carbon, climate resilient economy’. | Della Croce et al., 2011 |

| ‘A debt security that is issued to raise capital specifically to support climate-related environmental projects’. | The World Bank, 2015 |

| ‘Green bonds are fixed income securities issued by capital raising entities to fund their environmentally friendly projects, such as renewable energy, sustainable water management, pollution prevention, climate change adaptation and so on’. | Tang & Zhang, 2020 |

| ‘Green bonds are debt instruments (i.e., ‘bonds’), whose proceeds are committed to the financing of low-carbon, climate-friendly projects (i.e., ‘green’). Issuers of green bonds include corporations, municipalities, government entities, and supranational institutions’. | Flammer, 2020 |

| ‘Green bonds are any type of bond instrument where the proceeds or an equivalent amount will be exclusively applied to finance or re-finance, in part or in full, new and/or existing eligible Green Projects (see Use of Proceeds section below) and which are aligned with the four core components of the GBP’. | ICMA, 2021 |

| Green bonds are a financial instrument financing pro-ecological, sustainable or climate-related projects without any possible damages to the environment and the climate. In order to qualify as ‘green’, bonds must meet specific standards that are respected worldwide. | Sobik |

Framework of sustainable finance factors depends on the time horizon

| Time horizon | Ranking of factors | Value created |

|---|---|---|

| Short term | Financial value > Social impact and Environmental impact | Shareholder value |

| Medium term | Total value = Financial value + Social value + Environmental value | Stakeholder value |

| Long term | Social impact and Environmental impact > Financial value | Common good value |

Advantages and disadvantages of green bonds for issuers and investors

| For Issuers | |

| Advantages | Disadvantages |

| Demonstrating and implementing issuer's approach to ESG issues | Up front and ongoing transaction costs from labelling and associated administrative, certification, reporting, verification and monitoring requirements (cost estimates vary) |

| Reputational and marketing benefits | Reputational risk if a bond's green credentials are challenged |

| Improving diversification of bond issuer investor base, potentially reducing exposure to bond demand fluctuations | Investors may seek penalties for a ‘green default’, whereby a bond is paid in full but issuer breaks agreed green clauses |

| Evidence of more ‘buy and hold’ investors for green bonds which can lead to lower bond volatility in secondary market | |

| Articulation and enhanced credibility of sustainability strategy | |

| Access to ‘economies of scale’ as the majority of issuance costs are in setting up the processes | |

| For Investors | |

| Advantages | Disadvantages |

| Investors can balance risk-adjusted financial returns with environmental benefits | Small, nascent, and less liquid market, small bond volumes |

| Satisfies ESG requirements | Lack of unified standards can raise confusion and possibility for reputational risk if green integrity of bond questioned |

| Potential use to actively hedge against climate policy risks in a portfolio that includes emissions-intensive assets | Limited scope for legal enforcement of green integrity |

| Improved risk assessment through use of proceeds reporting | Lack of standardisation can lead to complexities in research and a need for extra due diligence that may not always be fulfilled |

| Marketing and image benefits of investing in pro-environmental financial instruments | |