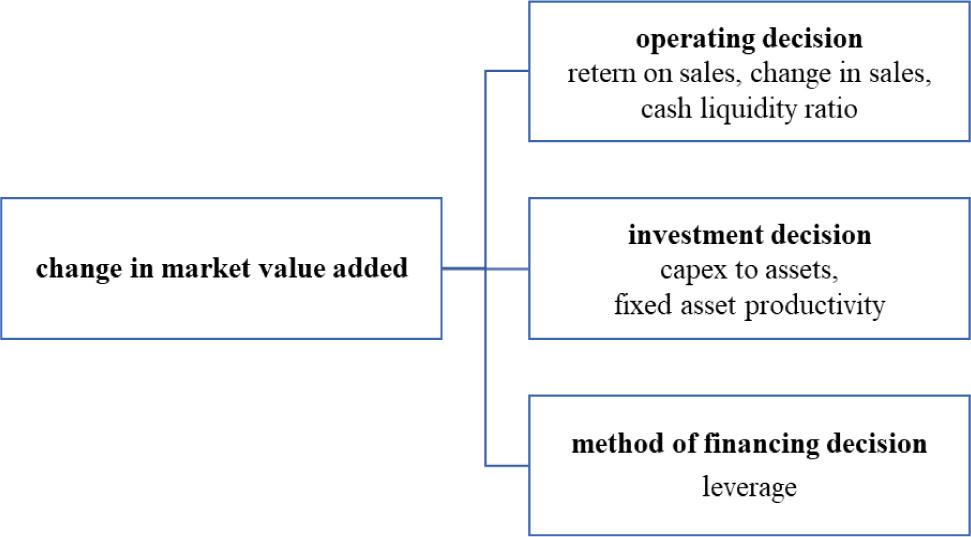

Figure 1.

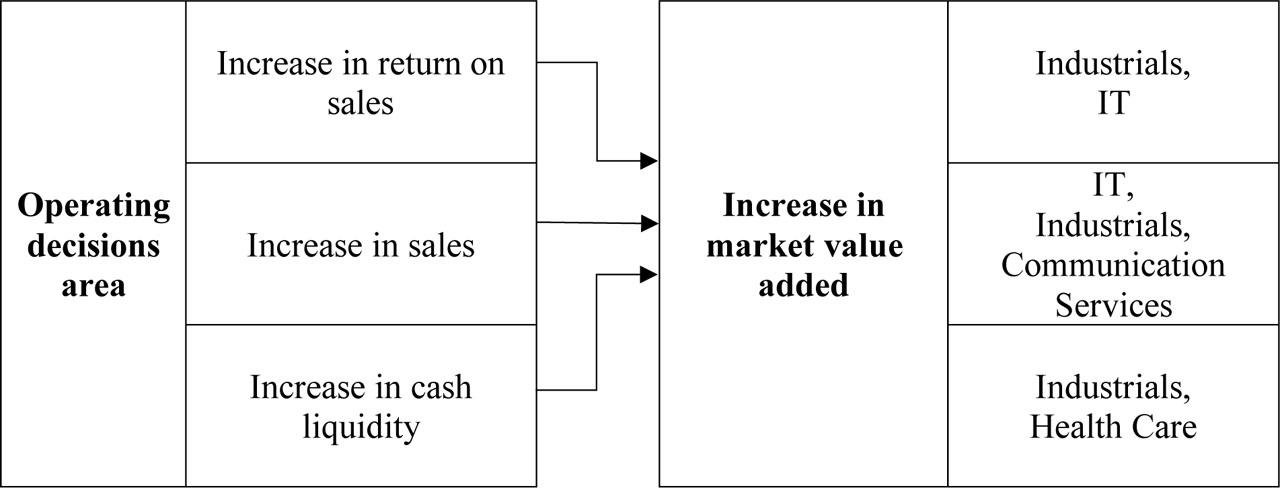

Figure 2.

Cash ratio as operating activity value driver

| Year | Industry | CS | CD | HC | In | IT | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Tercile / Value | L | U | U-L | L | U | U-L | L | U | U-L | L | U | U-L | L | U | U-L | |

| 2016 | Mean | 0.3 *** | 0.5 *** | 0.2 | 0.6 *** | 0.4 *** | −0.2 | 0.4 *** | 0.7 *** | 0.3 * | 0.4 *** | 0.4 *** | 0.0 *** | 0.6 | 0.6 *** | 0.0 |

| Median | 0.2 *** | 0.3 *** | 0.1 | 0.3 *** | 0.3 *** | 0.0 | 0.3 *** | 0.7 *** | 0.4 * | 0.2 *** | 0.3 *** | 0.1 *** | 0.5 | 0.5 *** | 0.0 | |

| 2017 | Mean | 0.5 *** | 0.4 *** | −0.1 | 0.3 *** | 0.4 *** | 0.1 | 0.5 *** | 0.8 *** | 0.3 | 0.3 *** | 0.4 *** | 0.1 | 0.5 *** | 0.7 *** | 0.2 * |

| Median | 0.3 *** | 0.3 *** | −0.0 | 0.2 *** | 0.2 *** | 0.0 * | 0.3 *** | 0.5 *** | 0.2 | 0.2 *** | 0.3 *** | 0.1 ** | 0.3 *** | 0.6 *** | 0.3 ** | |

| 2018 | Mean | 0.3 *** | 0.4 *** | 0.1 | 0.3 *** | 0.4 *** | 0.1 | 0.6 *** | 0.6 *** | −0.0 | 0.4 *** | 0.3 *** | −0.1 | 0.6 *** | 0.4 *** | −0.2 ** |

| Median | 0.2 *** | 0.2 *** | −0.0 | 0.2 *** | 0.2 *** | 0.0 | 0.4 *** | 0.3 *** | −0.1 | 0.3 *** | 0.1 *** | −0.2 *** | 0.5 *** | 0.3 *** | −0.2 *** | |

| 2019 | Mean | 0.3 *** | 0.4 *** | 0.1 | 0.3 *** | 0.3 *** | −0.0 | 0.4 *** | 0.7 *** | 0.3 * | 0.3 *** | 0.4 *** | 0.1 | 0.6 *** | 0.6 *** | −0.0 |

| Median | 0.1 *** | 0.2 *** | 0.1 * | 0.2 *** | 0.2 *** | 0.0 | 0.2 *** | 0.4 *** | 0.2 * | 0.1 *** | 0.2 *** | 0,1 *** | 0.3 *** | 0.4 *** | 0.1 | |

| 2020 | Mean | 0.5 *** | 0.8 *** | 0.3 | 0.5 *** | 0.4 *** | −0.1 | 0.9 *** | 0.6 *** | −0.3 | 0.5 *** | 0.5 *** | 0.0 | 0.6 *** | 0.7 *** | 0.1 |

| Median | 0.2 *** | 0.6 *** | 0.4 *** | 0.3 *** | 0.2 *** | −0.1 | 0.6 *** | 0.3 *** | −0.3 * | 0.3 *** | 0.4 *** | 0.1 | 0.5 *** | 0.6 *** | 0.1 | |

Return on sales as operating activity value driver (%)

| Year | Industry | CS | CD | HC | In | IT | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Tercile / Value | L | U | U-L | L | U | U-L | L | U | U-L | L | U | U-L | L | U | U-L | |

| 2016 | Mean | 11.0 *** | 7.0 *** | −4.0 | 6.4 *** | 6.1 *** | −0.3 | 10.2 *** | 7.1 ** | −3.1 | 4.2 *** | 5.8 *** | 1.6 | 4.1 *** | 7.0 *** | 2.9 |

| Median | 8.0 *** | 6.3 *** | −1.7 | 5.4 *** | 4.5 *** | −0.9 | 10.4 *** | 9.4 ** | −1.0 | 3.8 *** | 5.9 *** | 2.1 | 4.1 *** | 5.5 *** | 1.3 | |

| 2017 | Mean | 4.6 | 7.9 *** | 3.3 | 5.7 *** | 4.8 *** | −0.9 | 9.6 *** | 9.4 *** | −0.2 | 4.6 *** | 7.6 *** | 3.0 *** | 3.5 ** | 8.5 *** | 5.0 ** |

| Median | 4.3 ** | 8.5 *** | 4.2 | 5.6 *** | 5.1 *** | −0.6 | 13.0 *** | 12.7 *** | −0.3 | 3.1 *** | 7.2 *** | 4.2 *** | 3.2 *** | 7.9 *** | 4.7 *** | |

| 2018 | Mean | 8.8 | 3.0 | −5.8 | 4.6 *** | 1.9 | −2.7 | 9.1 *** | 2.6 | −6.5 | 7.2 *** | 2.3 ** | −4.9 *** | 8.1 *** | 2.1 | −6.0 *** |

| Median | 9.5 *** | 4.6 | −4.9 | 5.3 *** | 3.7 * | −1.6 | 11.6 *** | 4.8 | −6.8 | 6.6 *** | 3.8 *** | −2.8 *** | 6.6 *** | 3.3 ** | −3.3 *** | |

| 2019 | Mean | 8.9 *** | 8.6 *** | −0.3 | 4.5 *** | 1.7 | −2.8 | 2.6 | 11.0 *** | 8.4 *** | 4.9 *** | 6.5 *** | 1.6 | 2.8 * | 5.5 *** | 2.7 |

| Median | 8.1 *** | 6.0 *** | −2.1 | 4.7 *** | 3.5 * | −1.2 | 2.0 * | 7.4 *** | 5.4 *** | 4.0 *** | 6.1 *** | 2.1 ** | 4.5 *** | 6.0 *** | 1.5 | |

| 2020 | Mean | 6.0 | 6.9 ** | 0.9 | 0.5 | 3.2 | 2.7 | 8.3 *** | 8.2 *** | 0.1 | 1.8 | 4.7 *** | 2.9 * | 4.2 ** | 8.7 *** | 4.5 ** |

| Median | 10.5 ** | 6.3 *** | −4.2 | 3.9 ** | 3.1 | −0.8 | 10.2 *** | 7.7 *** | −2.5 | 3.3 *** | 4.9 *** | 1.6 * | 4.3 *** | 8.0 *** | 3.7 *** | |

Capex ratio as investment activity value driver (%)

| Year | Industry | CS | CD | HC | In | IT | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Tercile / Value | L | U | U-L | L | U | U-L | L | U | U-L | L | U | U-L | L | U | U-L | |

| 2016 | Mean | 5.0 *** | 2.9 *** | −2.1 | 4.5 *** | 3.9 *** | −0.5 | 3.4 *** | 2.7 *** | −0.8 | 3.3 *** | 3.9 *** | 0.6 | 3.6 *** | 3.3 *** | −0.3 |

| Median | 2.4 *** | 2.7 *** | 0.3 | 3.8 *** | 3.2 *** | −0.6 | 2.6 *** | 2.5 *** | −0.1 | 2.4 *** | 3.2 *** | 0.8 ** | 2.6 *** | 1.9 *** | −0.7 | |

| 2017 | Mean | 2.7 *** | 5.2 *** | 2.5 ** | 3.7 *** | 4.5 *** | 0.7 | 3.0 *** | 2.9 *** | −0.1 | 3.3 *** | 3.9 *** | 0.6 | 2.9 *** | 4.2 *** | 1.3 ** |

| Median | 1.2 *** | 3.9 *** | 2.7 ** | 3.3 *** | 3.4 *** | 0.2 | 2.5 *** | 1.8 *** | −0.6 | 2.5 *** | 3.3 *** | 0.9 * | 2.0 *** | 3.0 *** | 1.0 ** | |

| 2018 | Mean | 3.8 *** | 2.8 *** | −1.0 | 5.1 *** | 3.5 *** | −1.6 * | 3.1 *** | 3.4 *** | 0.3 | 4.4 *** | 3.2 *** | −1.2 ** | 3.9 *** | 2.4 *** | −1.5 ** |

| Median | 1.8 *** | 1.8 *** | 0.0 | 3.2 *** | 2.3 *** | −0.8 * | 1.7 *** | 2.5 *** | 0.9 | 3.7 *** | 2.1 *** | −1.6 *** | 2.6 *** | 1.3 *** | −1.3 *** | |

| 2019 | Mean | 4.3 *** | 2.3 *** | −2.0 * | 4.2 *** | 3.3 *** | −0.9 | 3.1 *** | 3.7 *** | 0.6 | 3.6 *** | 4.0 *** | 0.4 | 3.2 *** | 3.3 *** | 0.1 |

| Median | 2.5 *** | 1.1 *** | −1.5 * | 2.9 *** | 2.1 *** | −0.8 | 1.7 *** | 3.4 *** | 1.6 | 2.5 *** | 3.1 *** | 0.5 | 1.5 *** | 1.6 *** | 0.1 | |

| 2020 | Mean | 3.3 *** | 2.8 *** | −0.6 | 3.0 *** | 2.3 *** | −0.7 | 2.5 *** | 2.9 *** | 0.4 | 3.3 *** | 2.9 *** | −0.4 | 2.3 *** | 2.8 *** | 0.5 |

| Median | 1.9 *** | 1.5 *** | −0.4 | 1.9 *** | 1.6 *** | −0.3 | 1.4 *** | 2.3 *** | 0.9 | 2.3 *** | 2.4 *** | 0.0 | 1.3 *** | 2.0 *** | 0.7 | |

Leverage as financing activity value driver (%)

| Year | Industry | CS | CD | HC | In | IT | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Tercile / Value | L | U | U-L | L | U | U-L | L | U | U-L | L | U | U-L | L | U | U-L | |

| 2016 | Mean | 47.6 *** | 42.4 *** | −5.2 | 50.5 *** | 503. *** | −0.2 | 38.4 *** | 33.8 *** | −4.6 | 55.3 *** | 53.4 *** | −1.9 | 45.3 *** | 52.4 *** | 7.1 * |

| Median | 53.8 *** | 42.6 *** | −11.3 | 52.3 *** | 54.0 *** | 1.7 | 38.6 *** | 30.0 *** | −8.6 | 57.6 *** | 53.1 *** | −4.4 | 47.2 *** | 55.4 *** | 8.2 | |

| 2017 | Mean | 43.2 *** | 48.6 *** | 5.4 | 49.5 *** | 51.2 *** | 1.7 | 35.3 *** | 36.7 *** | 1.4 | 52.2 *** | 58.3 *** | 6.1 ** | 49.2 *** | 45.5 *** | −3.7 |

| Median | 46.4 *** | 50.5 *** | 4.1 | 50.2 *** | 53.5 *** | 3.3 | 32.7 *** | 31.6 *** | −1.1 | 54.5 *** | 59.3 *** | 4.8 ** | 51.1 *** | 42.7 *** | −8.4 | |

| 2018 | Mean | 57.4 *** | 41.7 *** | −15.6 ** | 54.2 *** | 50.9 *** | −3.3 | 38.4 *** | 39.2 *** | 0.8 | 59.6 *** | 50.7 *** | −9.0 *** | 44.6 *** | 49.9 *** | 5.3 |

| Median | 56.0 *** | 40.7 *** | −15.4 * | 55.0 *** | 55.2 *** | 0.2 | 37.5 *** | 38.5 *** | 1.0 | 60.9 *** | 50.7 *** | −10.2 *** | 43.9 *** | 48.1 *** | 4.2 | |

| 2019 | Mean | 43.8 *** | 60.7 *** | 16.9 ** | 54.3 *** | 63.7 *** | 9.4 * | 38.0 *** | 45.8 *** | 7.9 | 55.3 *** | 58.8 *** | 3.5 | 44.1 *** | 49.0 *** | 4.9 |

| Median | 42.9 *** | 60.0 *** | 17.1 ** | 55.0 *** | 61.4 *** | 6.4 | 28.9 *** | 45.7 *** | 16.8 | 55.7 *** | 61.9 *** | 6.2 | 35.9 *** | 50.0 *** | 14.1 ** | |

| 2020 | Mean | 57.4 *** | 48.3 *** | −9.1 | 58.1 *** | 56.4 *** | −1.7 | 45.4 *** | 45.4 *** | 0.0 | 54.6 *** | 54.9 *** | 0.3 | 45.7 *** | 45.8 *** | 0.1 |

| Median | 59.8 *** | 45.0 *** | −14.8 * | 53.9 *** | 55.7 *** | 1.8 | 43.0 *** | 44.6 *** | 1.6 | 56.9 *** | 56.1 *** | −0.8 | 46.8 *** | 44.9 *** | −1.9 | |

Fixed asset productivity as investment activity value driver

| Year | Industry | CS | CD | HC | In | IT | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Tercile / Value | L | U | U-L | L | U | U-L | L | U | U-L | L | U | U-L | L | U | U-L | |

| 2016 | Mean | 0.6 *** | 0.5 *** | −0.1 | 0.4 *** | 0.3 *** | −0.1 | 0.8 *** | 0.7 *** | −0.1 | 0.4 *** | 0.4 *** | 0.0 | 0.4 *** | 0.4 *** | 0.0 |

| Median | 0.4 *** | 0.3 *** | −0.1 | 0.3 *** | 0.3 *** | 0.0 | 0.8 *** | 0.4 *** | −0.4 | 0.3 *** | 0.3 *** | 0.0 | 0.4 *** | 0.2 *** | −0.1 | |

| 2017 | Mean | 0.7 *** | 0.5 *** | −0.2 | 0.4 *** | 0.4 *** | 0.0 | 0.8 *** | 0.9 *** | 0.0 | 0.4 *** | 0.4 *** | 0.0 | 0.3 *** | 0.4 *** | 0.1 |

| Median | 0.2 *** | 0.3 *** | 0.1 | 0.2 *** | 0.3 *** | 0.0 | 0.7 *** | 0.7 *** | 0.0 | 0.3 *** | 0.3 *** | 0.0 | 0.3 *** | 0.3 *** | 0.0 | |

| 2018 | Mean | 0.6 *** | 0.5 *** | −0.1 | 0.3 *** | 0.6 *** | 0.2 ** | 0.9 *** | 0.9 *** | 0.1 | 0.4 *** | 0.5 *** | 0.1 | 0.4 *** | 0.3 *** | −0.1 * |

| Median | 0.3 *** | 0.4 *** | 0.1 | 0.3 *** | 0.3 *** | 0.0 | 0.7 *** | 0.8 *** | 0.1 | 0.3 *** | 0.3 *** | 0.0 | 0.2 *** | 0.2 *** | −0.1 | |

| 2019 | Mean | 0.8 *** | 0.4 *** | −0.3 ** | 0.5 *** | 0.4 *** | −0.2 * | 0.8 *** | 0.8 *** | 0.1 | 0.4 *** | 0.4 *** | 0.0 | 0.4 *** | 0.4 *** | 0.0 |

| Median | 0.5 *** | 0.3 *** | −0.2 * | 0.4 *** | 0.3 *** | −0.1 | 0.7 *** | 0.7 *** | 0.0 | 0.3 *** | 0.3 *** | 0.0 | 0.3 *** | 0.3 *** | 0.0 | |

| 2020 | Mean | 0.6 *** | 0.5 *** | −0.1 | 0.7 *** | 0.4 *** | −0.3 ** | 0.8 *** | 0.8 *** | −0.1 | 0.5 *** | 0.5 *** | 0.0 | 0.5 *** | 0.4 *** | 0.0 |

| Median | 0.4 *** | 0.2 *** | −0.2 | 0.4 *** | 0.3 *** | −0.1 * | 0.7 *** | 0.8 *** | 0.1 | 0.3 *** | 0.3 *** | 0.0 | 0.3 *** | 0.4 *** | 0.1 | |

Industry year distribution of the sample

| Sector / Year | CS | CD | HC | Ind | IT | Total |

|---|---|---|---|---|---|---|

| 2016 | 78 | 138 | 83 | 275 | 173 | 747 |

| 2017 | 82 | 145 | 84 | 281 | 175 | 767 |

| 2018 | 88 | 150 | 86 | 292 | 183 | 799 |

| 2019 | 99 | 154 | 93 | 293 | 192 | 831 |

| 2020 | 106 | 153 | 97 | 289 | 191 | 836 |

Change in sales as operating activity value driver (%)

| Year | Industry | CS | CD | HC | In | IT | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Tercile / Value | L | U | U-L | L | U | U-L | L | U | U-L | L | U | U-L | L | U | U-L | |

| 2016 | Mean | 6.2 | 4.1 | −2.1 | 0.7 | 3.6 | 3.0 | −7.0 | 3.2 | 10.2 * | −6.1 *** | 1.2 | 7.3 *** | −4.6 | 4.0 | 8.6 ** |

| Median | 3.9 | 2.5 | −1.4 | 0.5 * | 4.1 | 3.7 | −1.3 | 4.0 | 5.3 | −3.9 *** | 0.9 | 4.8 *** | −1.0 | 5.5 ** | 6.5 * | |

| 2017 | Mean | 12.2 ** | 17.1 *** | 4.9 | 19.2 *** | 22.3 *** | 3.1 | 24.8 *** | 23.1 *** | −1.7 | 23.7 *** | 22.4 *** | −1.2 | 21.7 *** | 25.6 *** | 3.9 |

| Median | 8.7 ** | 17.8 *** | 9.1 | 19.7 *** | 24.3 *** | 4.6 | 19.2 *** | 19.1 *** | −0.1 | 22.1 *** | 19.3 *** | −2.7 | 13.8 *** | 25.8 *** | 12.1 ** | |

| 2018 | Mean | 0.7 | −1.1 | −1.8 | −0.4 | −0.9 | −0.5 | 4.9 | −1.4 | −6.3 | 4.8 *** | −0.6 | −5.4 ** | 6.5 *** | −1.9 | −8.5 ** |

| Median | −0.5 | −1.9 | −1.4 | −0.5 | −3.6 | −3.1 | −0.1 | 3.6 | 3.8 | 3.5 *** | 0.0 | −3.5 ** | 4.6 *** | 0.0 | −4.6 *** | |

| 2019 | Mean | −1.8 | 7.2 * | 9.0 * | 3.7 | 0.0 | −3.6 | 2.1 | 7.5 ** | 5.4 | −2.6 * | 1.4 | 4.1 * | −3.3 | 9.7 *** | 13.1 *** |

| Median | −0.9 | 5.3 * | 6.2 * | 1.9 * | 1.0 | −0.9 | 2.4 | 6.9 ** | 4.5 | −2.0 ** | 1.3 | 3.3 *** | −1.9 | 9.0 *** | 10.9 *** | |

| 2020 | Mean | −8.2 * | 5.6 | 13.7 * | −10.1 ** | −4.0 | 6.1 | −5.1 | 6.9 * | 12.0 * | −5.4 ** | −0.6 | 4.8 | 1.1 | 10.3 *** | 9.2 ** |

| Median | −1.4 | 8.8 | 10.2 ** | −6.9 *** | −2.3 | 4.5 | 3.8 | 8.9 ** | 5.0 | −2.8 ** | 0.1 | 2.8 | 0.0 | 13.2 *** | 13.2 ** | |

Share in the Industry Migration Balance (%)

| Year / Industry | CS | CD | HC | In | IT |

|---|---|---|---|---|---|

| 2016 | 15 | 12 | 21 | 31 | 16 |

| 2017 | 42 | 60 | 62 | 63 | 79 |

| 2018 | −62 | −91 | −65 | −89 | −95 |

| 2019 | 48 | 2 | 22 | 22 | 69 |

| 2020 | 63 | 47 | 81 | 43 | 68 |