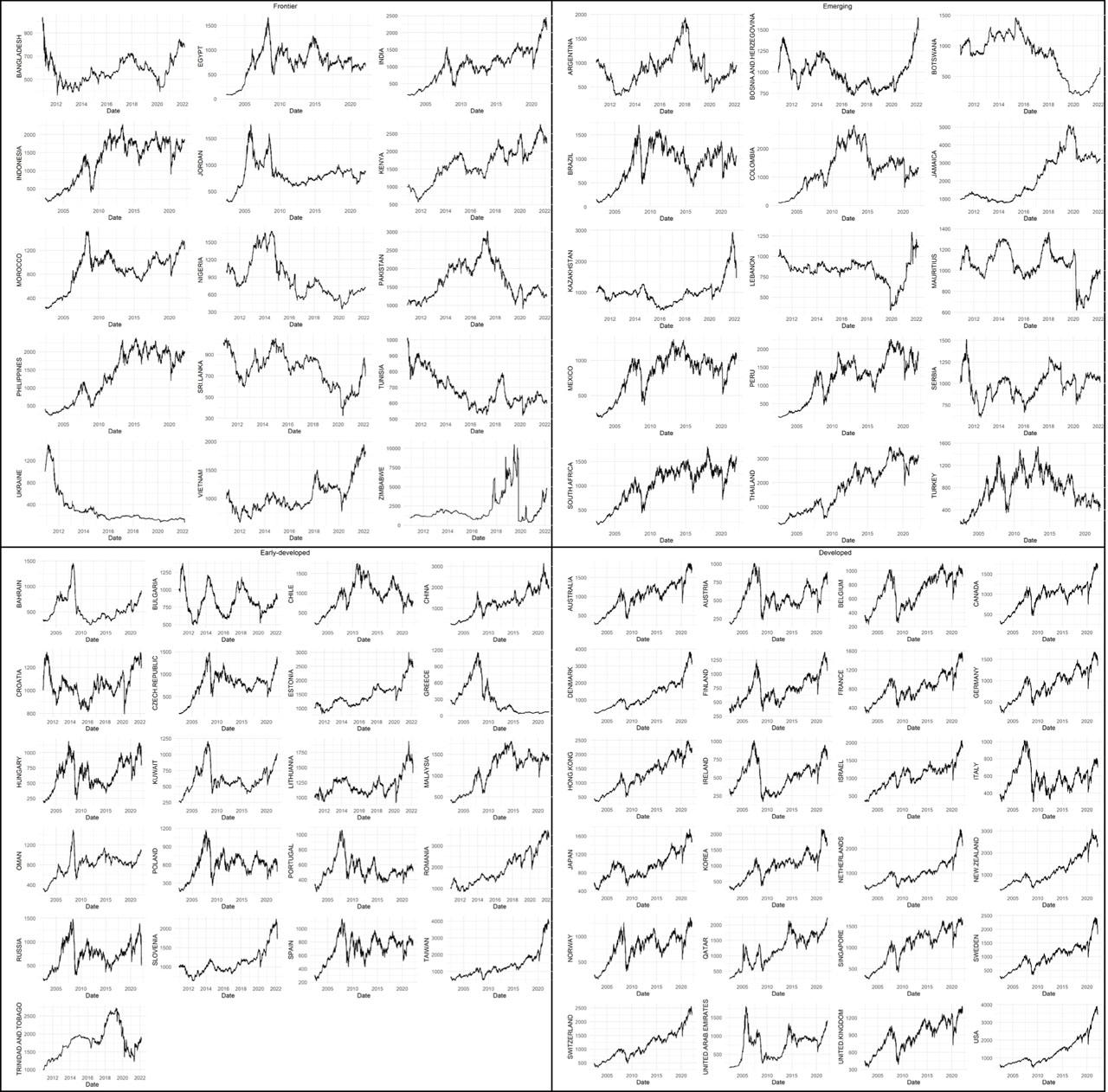

Figure 1.

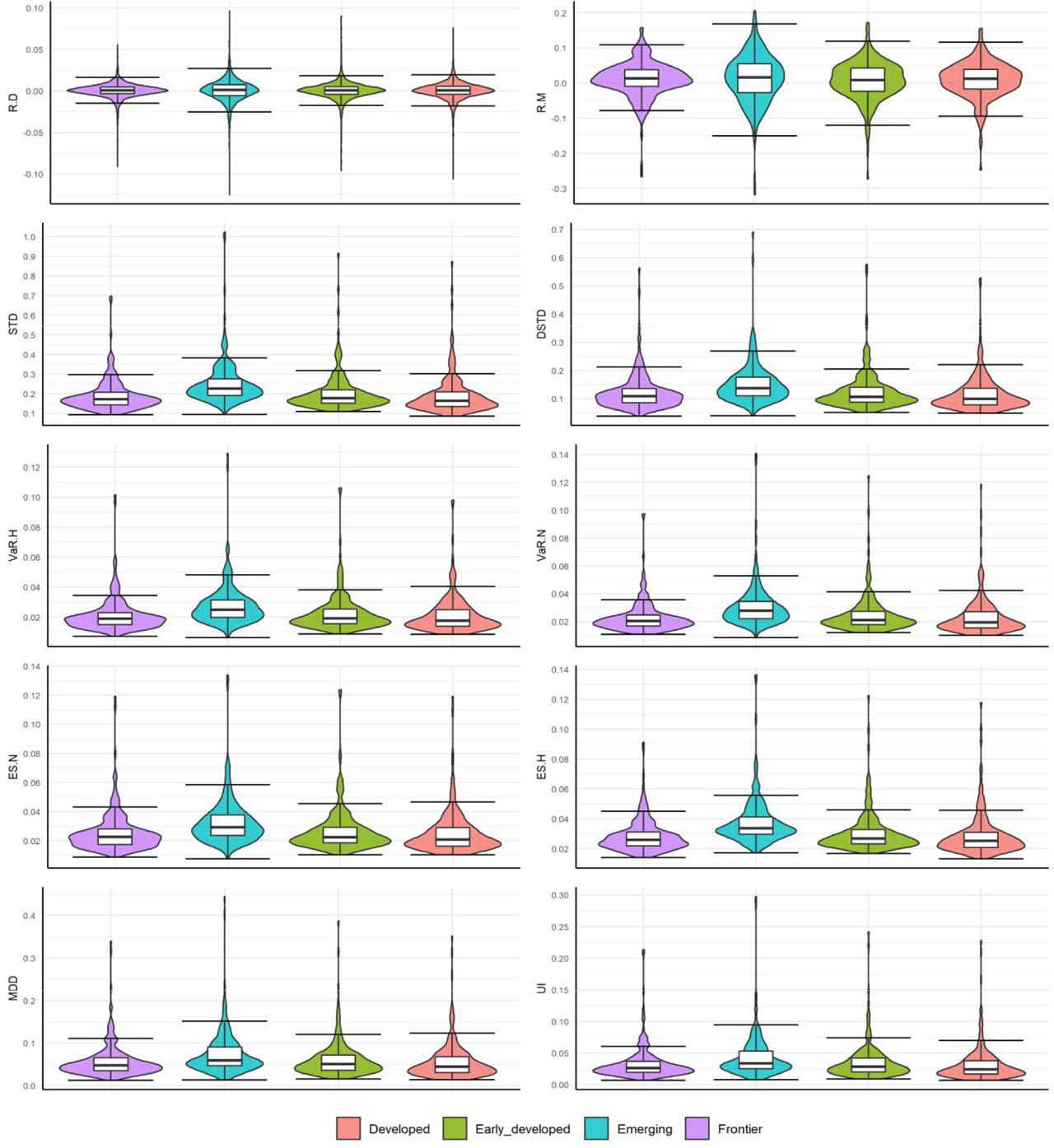

Figure 2.

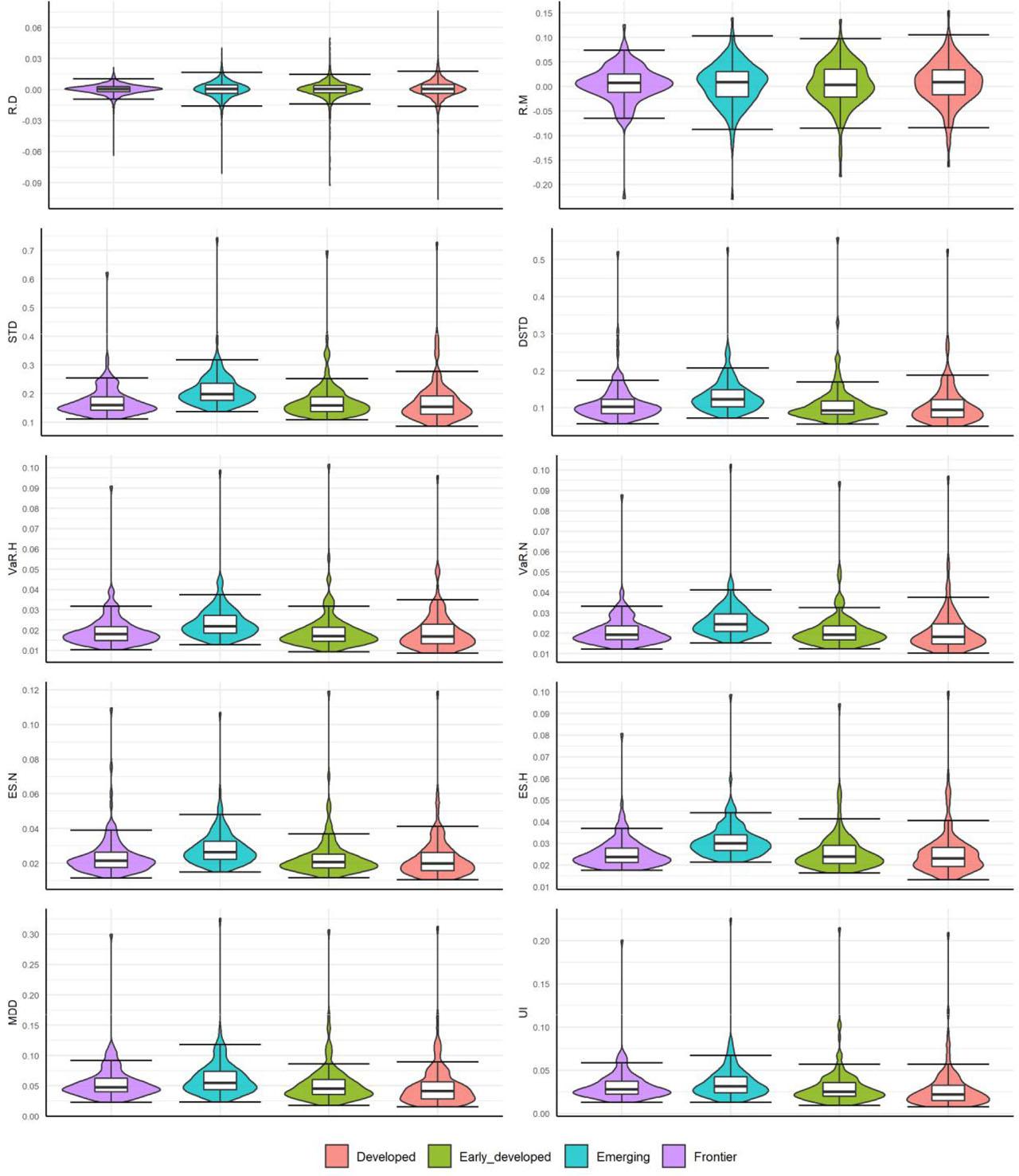

Figure 3.

Comparison of MSCI and Baseline Classifications with early-developed included in emerging category

| Baseline classification, ED in E | MSCI classification | Differences | |

|---|---|---|---|

| Frontier | Bangladesh, Egypt, India, Indonesia, Jordan, Kenya, Morocco, Nigeria, Pakistan, Philippines, Sri Lanka, Tunisia, Ukraine, Vietnam, Zimbabwe | Bahrain, Bangladesh, Benin, Burkina Faso, Croatia, Estonia, Iceland, Ivory Coast, Jordan, Kazakhstan, Kenya, Lithuania, Mauritius, Morocco, Nigeria, Oman, Pakistan, Romania, Senegal, Serbia, Slovenia, Sri Lanka, Tunisia, Vietnam | Egypt, India, Indonesia, emerging in MSCI classification; Ukraine and Zimbabwe, standalone |

| Emerging | Argentina, Bahrain, Bosnia and Herzegovina, Botswana, Brazil, Bulgaria, Chile, China, Colombia, Croatia, Czech Republic, Estonia, Greece, Hungary, Jamaica, Kazakhstan, Kuwait, Lebanon, Lithuania, Malaysia, Mauritius, Mexico, Oman, Peru, Poland, Portugal, Romania, Russia, Serbia, Slovenia, South Africa, Spain, Taiwan, Thailand, Trinidad and Tobago, Turkey | Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Kuwait, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Russia, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey, United Arab Emirates | Bahrain, Croatia, Estonia, Kazakhstan, Lithuania, Mauritius, Romania, Serbia, Slovenia, frontier; Portugal, Spain, developed; Argentina, Bosnia and Herzegovina, Botswana, Bulgaria, Trinidad and Tobago, Lebanon, Jamaica, standalone |

| Developed | Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Korea, Netherlands, New Zealand, Norway, Qatar, Singapore, Sweden, Switzerland, United Arab Emirates, United Kingdom, USA | Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, United Kingdom, USA | Korea, Qatar, United Arab Emirates, emerging in MSCI classification |

| Standalone | Argentina, Bosnia and Herzegovina, Botswana, Bulgaria, Jamaica, Lebanon, Malta, Palestine, Panama, Trinidad and Tobago, Ukraine, Zimbabwe | We chose not to use this classification, and instead added early-developed market class. |

Results of Baseline Income Categorization

| R.D | R.M | STD | DSTD | VaR.H | VaR.N | ES.H | ES.N | MDD | UI | |

|---|---|---|---|---|---|---|---|---|---|---|

| Kruskal–Wallis rank sum test p values of H statistic: | ||||||||||

| First sample | 0.201 | 0.767 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Pairwise Wilcoxon rank sum test p values of U statistic | ||||||||||

| F_E | - | - | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| F_ED | - | - | 0.077 | 0.479 | 0.306 | 0.077 | 0.515 | 0.096 | 0.265 | 0.185 |

| F_D | - | - | 0.34 | 0.222 | 0.453 | 0.341 | 0.515 | 0.365 | 0.265 | 0.185 |

| E_ED | - | - | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| E_D | - | - | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| ED_D | - | - | 0.008 | 0.044 | 0.078 | 0.016 | 0.06 | 0.009 | 0.027 | 0.009 |

| Kruskal–Wallis rank sum test p values of H statistic | ||||||||||

| Second sample | 0.524 | 0.91 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Pairwise Wilcoxon rank sum test p values of U statistic | ||||||||||

| F_E | - | - | 0 | 0 | 0 | 0 | 0 | 0 | 0.023 | 0.075 |

| F_ED | - | - | 0.761 | 0.417 | 0.513 | 0.804 | 0.463 | 0.729 | 0.097 | 0.075 |

| F_D | - | - | 0.272 | 0.086 | 0.273 | 0.159 | 0.146 | 0.457 | 0.003 | 0 |

| E_ED | - | - | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| E_D | - | - | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| ED_D | - | - | 0.282 | 0.417 | 0.513 | 0.186 | 0.463 | 0.501 | 0.089 | 0.033 |

Results of the Time Period Change

| R.D | R.M | STD | DSTD | VaR.H | VaR.N | ES.H | ES.N | MDD | UI | |

|---|---|---|---|---|---|---|---|---|---|---|

| Kruskal–Wallis rank sum test p values of H-statistic: | ||||||||||

| First sample | 0.695 | 0.945 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Pairwise Wilcoxon rank sum test p values of U statistic: | ||||||||||

| F_E | - | - | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| F_ED | - | - | 0 | 0.096 | 0.015 | 0.001 | 0.034 | 0 | 0.017 | 0.015 |

| F_D | - | - | 0.292 | 0.966 | 0.534 | 0.451 | 0.725 | 0.236 | 0.83 | 0.588 |

| E_ED | - | - | 0 | 0 | 0 | 0 | 0 | 0 | 0.006 | 0.015 |

| E_D | - | - | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| ED_D | - | - | 0.021 | 0.096 | 0.083 | 0.02 | 0.077 | 0.027 | 0.02 | 0.011 |

| Kruskal–Wallis rank sum test p values of H-statistic: | ||||||||||

| Second sample | 0.833 | 0.995 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Pairwise Wilcoxon rank sum test p values of U statistic: | ||||||||||

| F_E | - | - | 0 | 0 | 0 | 0 | 0 | 0 | 0.018 | 0.093 |

| F_ED | - | - | 0.287 | 0.224 | 0.548 | 0.362 | 0.447 | 0.189 | 0.17 | 0.093 |

| F_D | - | - | 0.049 | 0.098 | 0.299 | 0.072 | 0.156 | 0.03 | 0.018 | 0.002 |

| E_ED | - | - | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.001 |

| E_D | - | - | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| ED_D | - | - | 0.287 | 0.437 | 0.548 | 0.362 | 0.447 | 0.203 | 0.17 | 0.093 |

Income Categorization Method Outcomes

| Baseline | Version 2 | Version 3 | Version 4 | Version 5 | |

|---|---|---|---|---|---|

| Frontier | Pakistan, Zimbabwe, Kenya, India, Bangladesh, Nigeria, Vietnam, Morocco, Philippines, Tunisia, Egypt, Sri Lanka, Ukraine, Indonesia, Jordan | + Lebanon, Jamaica, Colombia | + Lebanon, Jamaica, Colombia | Baseline | Baseline |

| Emerging | Lebanon, Jamaica, Colombia, South Africa, Bosnia and Herzegovina, Peru, Botswana, Brazil, Thailand, Serbia, Mexico, Turkey, Argentina, Mauritius, Kazakhstan | − Lebanon, Jamaica, Colombia | − Lebanon, Jamaica, Colombia | + Bulgaria, Russia, Malaysia, China | + Bulgaria, Russia, Malaysia, China |

| Early-developed | Bulgaria, Russia, Malaysia, China, Romania, Chile, Croatia, Oman, Trinidad and Tobago, Poland, Hungary, Greece, Lithuania, Bahrain, Portugal, Czech Republic, Estonia, Kuwait, Slovenia, Spain, Taiwan | − Bulgaria, Russia, Malaysia, China | − Bulgaria, Russia, Malaysia, China | − Bulgaria, Russia, Malaysia, China | − Bulgaria, Russia, Malaysia, China |

| Developed | Korea, Italy, United Arab Emirates, France, Japan, United Kingdom, New Zealand, Canada, Israel, Belgium, Germany, Hong Kong, Austria, Finland, Qatar, Australia, Sweden, Netherlands, Singapore, Denmark, USA, Norway, Ireland, Switzerland | Baseline | − Korea, Italy, United Arab Emirates | Baseline | − Korea, Italy, United Arab Emirates |

Average Summary Statistics of Equity Indices Daily Returns

| GDP | R.A | Mean | Min | Median | Max | ASD | Skewness | Kurtosis | |

|---|---|---|---|---|---|---|---|---|---|

| First sample: 51 Countries, 2002–2022 | |||||||||

| Frontier | 3334 | 9.24% | 0.04% | −13.2% | 0.05% | 13.0% | 22.2% | −0.72 | 18.2 |

| Emerging | 6852 | 9.73% | 0.04% | −13.4% | 0.06% | 13.6% | 29.1% | −0.25 | 12.6 |

| Early_developed | 18122 | 5.43% | 0.04% | −14.9% | 0.05% | 13.1% | 24.2% | −0.52 | 19.3 |

| Developed | 50603 | 7.69% | 0.04% | −15.7% | 0.04% | 14.3% | 22.7% | −0.24 | 12.4 |

| Second sample: 75 Countries, 2010–2022 | |||||||||

| Frontier | 2804 | 0.52% | 0.03% | −13.8% | 0.03% | 9.4% | 21.7% | −1.77 | 45.4 |

| Emerging | 6921 | 0.52% | 0.02% | −14.4% | 0.02% | 9.9% | 24.8% | −1.20 | 38.4 |

| Early_developed | 17858 | 2.13% | 0.02% | −15.1% | 0.02% | 10.8% | 20.4% | −0.82 | 22.2 |

| Developed | 50603 | 6.80% | 0.02% | −17.5% | 0.01% | 10.4% | 19.7% | −0.54 | 12.3 |

MDD for All Countries Under Investigation from Baseline Classification

| Country | Class | First (%) | Second (%) | Country | Class | First (%) | Second (%) |

|---|---|---|---|---|---|---|---|

| ARGENTINA | Emerging | 80.6 | LITHUANIA | Early-developed | 33.5 | ||

| AUSTRALIA | Developed | 66.8 | 46.5 | MALAYSIA | Early-developed | 51.9 | 47.0 |

| AUSTRIA | Developed | 76.8 | 59.3 | MAURITIUS | Emerging | 54.7 | |

| BAHRAIN | Early-developed | 83.3 | 34.4 | MEXICO | Emerging | 64.8 | 60.2 |

| BANGLADESH | Frontier | 64.9 | MOROCCO | Frontier | 55.8 | 44.3 | |

| BELGIUM | Developed | 75.1 | 47.0 | NETHERLANDS | Developed | 64.2 | 34.7 |

| BOSNIA AND HERZEGOVINA | Emerging | 48.9 | NEW ZEALAND | Developed | 65.7 | 36.5 | |

| BOTSWANA | Emerging | 87.3 | NIGERIA | Frontier | 79.2 | ||

| BRAZIL | Emerging | 75.7 | 74.2 | NORWAY | Developed | 75.2 | 53.2 |

| BULGARIA | Early-developed | 64.2 | OMAN | Early-developed | 66.2 | 36.5 | |

| CANADA | Developed | 61.5 | 43.3 | PAKISTAN | Frontier | 70.2 | |

| CHILE | Early-developed | 72.7 | 72.7 | PERU | Emerging | 67.9 | 57.8 |

| CHINA | Early-developed | 73.2 | 41.7 | PHILIPPINES | Frontier | 61.7 | 49.9 |

| COLOMBIA | Emerging | 77.6 | 77.6 | POLAND | Early-developed | 78.2 | 59.9 |

| CROATIA | Early-developed | 40.3 | PORTUGAL | Early-developed | 67.4 | 50.4 | |

| CZECH REPUBLIC | Early-developed | 67.2 | 61.1 | QATAR | Developed | 64.2 | 43.9 |

| DENMARK | Developed | 64.2 | 34.7 | ROMANIA | Early-developed | 44.3 | |

| EGYPT | Frontier | 70.3 | 58.2 | RUSSIA | Early-developed | 79.8 | 66.5 |

| ESTONIA | Early-developed | 34.5 | SERBIA | Emerging | 60..2 | ||

| FINLAND | Developed | 73.4 | 47.4 | SINGAPORE | Developed | 64.3 | 39.5 |

| FRANCE | Developed | 60.7 | 39.8 | SLOVENIA | Early-developed | 40.1 | |

| GERMANY | Developed | 62.9 | 46.4 | SOUTH AFRICA | Emerging | 63.2 | 60.8 |

| GREECE | Early-developed | 97.4 | 91.1 | SPAIN | Early-developed | 62.7 | 51.9 |

| HONG KONG | Developed | 64.4 | 32.5 | SRI LANKA | Frontier | 69.3 | |

| HUNGARY | Early-developed | 81.3 | 62.5 | SWEDEN | Developed | 68.3 | 38.2 |

| INDIA | Frontier | 74.3 | 46.2 | SWITZERLAND | Developed | 52.7 | 26.6 |

| INDONESIA | Frontier | 72.1 | 60.5 | TAIWAN | Early-developed | 60.6 | 30.8 |

| IRELAND | Developed | 83.5 | 41.0 | THAILAND | Emerging | 62.3 | 46.5 |

| ISRAEL | Developed | 41.4 | 39.4 | TRINIDAD AND TOBAGO | Early-developed | 55.0 | |

| ITALY | Developed | 70.7 | 50.5 | TUNISIA | Frontier | 48.6 | |

| JAMAICA | Emerging | 45.5 | TURKEY | Emerging | 75,6% | 75.6 | |

| JAPAN | Developed | 53.3 | 31.2 | UKRAINE | Frontier | 95.1 | |

| JORDAN | Frontier | 67.0 | 37.2 | UNITED ARAB EMIRATES | Developed | 86.1 | 58.1 |

| KAZAKHSTAN | Emerging | 66.6 | UNITED KINGDOM | Developed | 63.7 | 43.2 | |

| KENYA | Frontier | 47.2 | USA | Developed | 55.7 | 35.0 | |

| KOREA | Developed | 72.1 | 50.0 | VIETNAM | Frontier | 49.9 | |

| KUWAIT | Early-developed | 68.5 | 44.6 | ZIMBABWE | Frontier | 96.5 | |

| LEBANON | Emerging | 68.7 |

Pairwise Wilcoxon Test p Values for Income Versions 4 and 5

| STD | VaR.N | ES.N | STD | VaR.N | ES.N | |

|---|---|---|---|---|---|---|

| Version 4 | Version 5 | |||||

| First sample: 51 Countries, 2002–2022 | ||||||

| F_E | 0.034 | 0.037 | 0.044 | 0.031 | 0.037 | 0.044 |

| F_ED | 0.857 | 1 | 1 | 0.507 | 0.357 | 0.571 |

| F_D | 0.857 | 0.669 | 1 | 0.73 | 0.57 | 0.885 |

| E_ED | 0.034 | 0.097 | 0.023 | 0.507 | 0.555 | 0.571 |

| E_D | 0.151 | 0.315 | 0.14 | 0.020 | 0.056 | 0.014 |

| ED_D | 0.857 | 1 | 1 | 0.507 | 0.487 | 0.571 |

| Second sample: 75 Countries, 2010–2022 | ||||||

| F_E | 0.328 | - | 0.253 | 0.328 | - | 0.253 |

| F_ED | 0.716 | - | 0.803 | 0.707 | - | 0.868 |

| F_D | 0.033 | - | 0.034 | 0.031 | - | 0.028 |

| E_ED | 0.716 | - | 0.554 | 0.707 | - | 0.868 |

| E_D | 0.716 | - | 0.803 | 0.707 | - | 0.868 |

| ED_D | 0.093 | - | 0.094 | 0.223 | - | 0.205 |

Comparison of MSCI and Baseline Classifications with early-developed included in developed category

| Baseline classification, ED in D | MSCI classification | Differences | |

|---|---|---|---|

| Frontier | Bangladesh, Egypt, India, Indonesia, Jordan, Kenya, Morocco, Nigeria, Pakistan, Philippines, Sri Lanka, Tunisia, Ukraine, Vietnam, Zimbabwe | Bahrain, Bangladesh, Benin, Burkina Faso, Croatia, Estonia, Iceland, Ivory Coast, Jordan, Kazakhstan, Kenya, Lithuania, Mauritius, Morocco, Nigeria, Oman, Pakistan, Romania, Senegal, Serbia, Slovenia, Sri Lanka, Tunisia, Vietnam | Egypt, India, Indonesia - emerging in MSCI classification; Ukraine and Zimbabwe, standalone |

| Emerging | Argentina, Bosnia and Herzegovina, Botswana, Brazil, Colombia, Jamaica, Kazakhstan, Lebanon, Mauritius, Mexico, Peru, Serbia, South Africa, Thailand, Turkey | Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Kuwait, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Russia, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey, United Arab Emirates | Argentina, Bosnia and Herzegovina, Botswana, Lebanon, Jamaica, standalone in MSCI classification; Kazakhstan, Mauritius, Serbia, frontier |

| Developed | Australia, Austria, Bahrain, Belgium, Bulgaria, Canada, Chile, China, Croatia, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hong Kong, Hungary, Ireland, Israel, Italy, Japan, Korea, Kuwait, Lithuania, Malaysia, Netherlands, New Zealand, Norway, Oman, Poland, Portugal, Qatar, Romania, Russia, Singapore, Slovenia, Spain, Sweden, Switzerland, Taiwan, Trinidad and Tobago, United Arab Emirates, United Kingdom, USA | Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, United Kingdom, USA | Bahrain, Estonia, Oman, Romania, Slovenia, frontier; Chile, China, Czech Republic, Greece, Hungary, Korea, Kuwait, Malaysia, Poland, Qatar, Russia, Taiwan, United Arab Emirates, emerging; Bulgaria, standalone. |

| Standalone | Argentina, Bosnia and Herzegovina, Botswana, Bulgaria, Jamaica, Lebanon, Malta, Palestine, Panama, Trinidad and Tobago, Ukraine, and Zimbabwe | We chose not to use this classification, and instead added Early-developed market class. |

Summary of the Literature Review

| Subject | Summary | Authors |

|---|---|---|

| Economic growth | Increases stock market return | Al-Tamimi et al. (2011) |

| Amaresh et al. (2020) | ||

| Amtiran et al. (2017) | ||

| Giri and Joshi (2017) | ||

| Kalam (2020) | ||

| Montes and Tiberto (2012) | ||

| Osamwonyi and Evbayiro-Osagie (2012) | ||

| Singh et al. (2011) | ||

| Causes stock market development | Cherif and Gazdar (2010) | |

| Ho and Iyke (2017) | ||

| Yartey (2008) | ||

| Banking sector development | Causes stock market development | Dellas and Hess (2005) |

| Ho and Iyke (2017) | ||

| Pradhan et al. (2014) | ||

| Reduces stock market volatility | Dellas and Hess (2005) | |

| Financial liberalization | Reduces stock market volatility | James and Karoglou (2010) |

| Umutlu et al. (2010) | ||

| Downside volatility | Increases stock market return | Ali (2019) |

| Ang et al. (2006) | ||

| Estrada (2007) | ||

| Risk-adjusted returns | Higher in emerging markets | Atilgan and Demirtas (2016) |

Reference to Research Hypotheses and Questions

| RH/RQ | Verification | Details |

|---|---|---|

| RH1 | Rejected | Daily and monthly return do not depend on the level of economic development |

| RH2 | Not rejected | Volatility metrics depend on the level of economic development |

| RQ1 | Rejected | The obtained result is sensitive to varying time periods |

| RQ2 | Rejected | The obtained result is sensitive to varying income categorizations |

Summary Statistics for Metrics of the Second Sample

| Frontier | Emerging | Early-developed | Developed | Frontier | Emerging | Early-developed | Developed | |

|---|---|---|---|---|---|---|---|---|

| Min | R.D | R.M | ||||||

| −6.4 | −8.1 | −9.3 | −10.6 | −22.9 | −23.0 | −18.4 | −16.3 | |

| Mean | 0.0 | 0.0 | 0.0 | 0.0 | 0.5 | 0.3 | 0.4 | 0.7 |

| Median | 0.1 | 0.0 | 0.0 | 0.1 | 0.7 | 0.9 | 0.3 | 0.9 |

| Max | 2.1 | 4.0 | 5.0 | 7.6 | 12.6 | 14.0 | 13.6 | 15.4 |

| Min | STD | DSTD | ||||||

| 11.1 | 13.8 | 10.9 | 8.7 | 5.7 | 7.3 | 5.6 | 5.1 | |

| Mean | 17.4 | 21.3 | 17.5 | 17.1 | 11.4 | 13.3 | 11.0 | 10.7 |

| Median | 16.0 | 19.8 | 15.9 | 15.4 | 10.2 | 12.3 | 9.3 | 9.5 |

| Max | 62.3 | 74.4 | 69.7 | 72.9 | 52.1 | 53.3 | 55.9 | 52.8 |

| Min | VaR.H | VaR.N | ||||||

| 1.0 | 1.3 | 0.9 | 0.9 | 1.2 | 1.5 | 1.2 | 1.0 | |

| Mean | 2.0 | 2.4 | 2.0 | 1.9 | 2.1 | 2.6 | 2.1 | 2.1 |

| Median | 1.8 | 2.2 | 1.7 | 1.7 | 1.9 | 2.4 | 1.9 | 1.8 |

| Max | 9.1 | 9.9 | 10.2 | 9.6 | 8.8 | 10.3 | 9.4 | 9.7 |

| Min | ES.H | ES.N | ||||||

| 1.1 | 1.5 | 1.2 | 1.0 | 1.8 | 2.1 | 1.6 | 1.3 | |

| Mean | 2.4 | 2.9 | 2.3 | 2.3 | 2.6 | 3.2 | 2.6 | 2.6 |

| Median | 2.1 | 2.6 | 2.1 | 2.0 | 2.4 | 3.0 | 2.4 | 2.3 |

| Max | 10.9 | 10.7 | 11.9 | 11.9 | 8.1 | 9.9 | 9.4 | 10.0 |

| Min | MDD | UI | ||||||

| 2.2 | 2.3 | 1.7 | 1.5 | 1.3 | 1.3 | 0.9 | 0.8 | |

| Mean | 5.5 | 6.3 | 5.3 | 4.9 | 3.2 | 3.6 | 3.1 | 2.8 |

| Median | 4.7 | 5.4 | 4.5 | 4.1 | 2.8 | 3.2 | 2.5 | 2.2 |

| Max | 30.0 | 32.6 | 30.7 | 31.3 | 20.1 | 22.6 | 21.5 | 21.0 |

p Values of the Kruskal–Wallis Test for All Income Categorization Outcomes

| R.D | R.M | STD | DSTD | VaR.H | VaR.N | ES.H | ES.N | MDD | UI | |

|---|---|---|---|---|---|---|---|---|---|---|

| First sample: 51 Countries, 2002–2022 | ||||||||||

| Version 2 | 0.279 | 0.819 | 0.153 | 0.628 | 0.419 | 0.248 | 0.548 | 0.151 | 0.32 | 0.594 |

| Version 3 | 0.428 | 0.833 | 0.121 | 0.805 | 0.432 | 0.181 | 0.543 | 0.138 | 0.277 | 0.468 |

| Version 4 | 0.231 | 0.81 | 0.014 | 0.53 | 0.14 | 0.027 | 0.305 | 0.014 | 0.095 | 0.24 |

| Version 5 | 0.358 | 0.819 | 0.01 | 0.697 | 0.138 | 0.018 | 0.293 | 0.012 | 0.081 | 0.177 |

| Second sample: 75 Countries, 2010–2022 | ||||||||||

| Version 2 | 0.484 | 0.867 | 0.145 | 0.275 | 0.233 | 0.191 | 0.238 | 0.161 | 0.156 | 0.075 |

| Version 3 | 0.583 | 0.843 | 0.097 | 0.127 | 0.164 | 0.137 | 0.156 | 0.121 | 0.111 | 0.051 |

| Version 4 | 0.507 | 0.819 | 0.022 | 0.11 | 0.067 | 0.051 | 0.082 | 0.02 | 0.289 | 0.222 |

| Version 5 | 0.622 | 0.85 | 0.03 | 0.225 | 0.095 | 0.067 | 0.117 | 0.026 | 0.384 | 0.302 |

Summary Statistics for Metrics of the First Sample

| Frontier | Emerging | Early-developed | Developed | Frontier | Emerging | Early-developed | Developed | |

|---|---|---|---|---|---|---|---|---|

| Min | R.D | R.M | ||||||

| −9.1 | −12.5 | −9.6 | −10.6 | −26.6 | −31.8 | −27.3 | −24.7 | |

| Mean | 0.0 | 0.1 | 0.0 | 0.0 | 1.0 | 1.2 | 0.7 | 0.8 |

| Median | 0.1 | 0.1 | 0.1 | 0.1 | 1.3 | 1.6 | 0.9 | 1.2 |

| Max | 5.6 | 9.7 | 9.0 | 7.6 | 15.7 | 20.6 | 17.2 | 15.4 |

| Min | STD | DSTD | ||||||

| 9.3 | 9.6 | 11.0 | 8.7 | 3.8 | 3.9 | 5.1 | 4.9 | |

| Mean | 18.9 | 25.2 | 20.4 | 19.2 | 12.2 | 15.2 | 12.5 | 11.7 |

| Median | 17.2 | 22.6 | 17.8 | 16.5 | 10.9 | 13.7 | 10.7 | 9.9 |

| Max | 69.7 | 102.4 | 91.4 | 87.3 | 56.3 | 69.1 | 57.6 | 52.8 |

| Min | VaR.H | VaR.N | ||||||

| 0.7 | 0.6 | 0.9 | 0.9 | 1.1 | 0.9 | 1.2 | 1.0 | |

| Mean | 2.1 | 2.8 | 2.3 | 2.1 | 2.3 | 3.1 | 2.5 | 2.3 |

| Median | 1.9 | 2.5 | 1.9 | 1.8 | 2.0 | 2.8 | 2.1 | 1.9 |

| Max | 10.1 | 12.9 | 10.6 | 9.8 | 9.7 | 14.1 | 12.5 | 11.9 |

| Min | ES.H | ES.N | ||||||

| 0.9 | 0.7 | 1.0 | 1.0 | 1.4 | 1.7 | 1.7 | 1.3 | |

| Mean | 2.5 | 3.3 | 2.7 | 2.5 | 2.8 | 3.8 | 3.0 | 2.9 |

| Median | 2.3 | 2.9 | 2.2 | 2.1 | 2.6 | 3.4 | 2.7 | 2.5 |

| Max | 11.9 | 13.4 | 12.4 | 11.9 | 9.1 | 13.6 | 12.3 | 11.8 |

| Min | MDD | UI | ||||||

| 1.2 | 1.3 | 1.5 | 1.4 | 0.7 | 0.8 | 0.9 | 0.7 | |

| Mean | 5.7 | 7.4 | 6.1 | 5.6 | 3.3 | 4.3 | 3.5 | 3.2 |

| Median | 4.7 | 5.9 | 5.0 | 4.4 | 2.6 | 3.3 | 2.8 | 2.4 |

| Max | 33.9 | 44.5 | 38.7 | 35.2 | 21.4 | 29.8 | 24.1 | 22.9 |