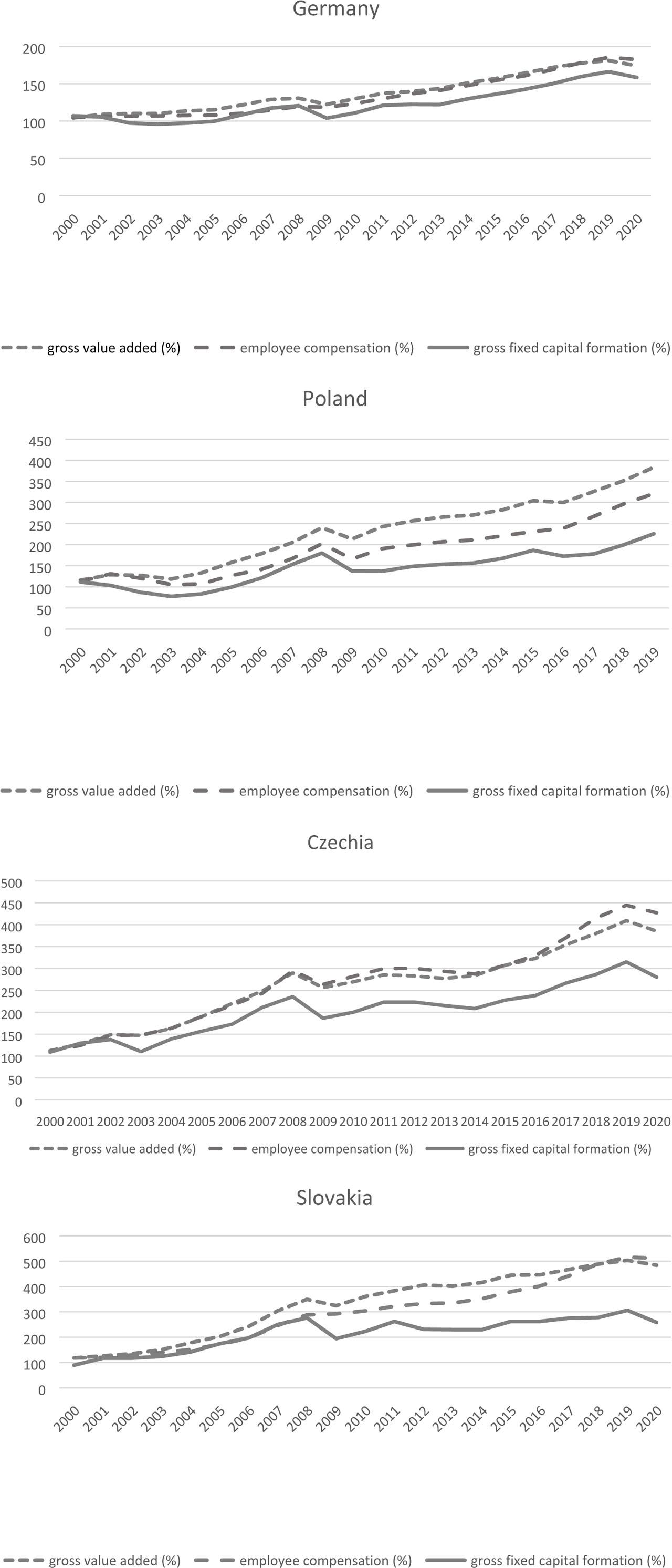

Figure 1- 4

Descriptive Statistics for Dependent, Independent, and Control Variables With Wilcoxon Test Results

| Classes of periods | 1 | 2 | 3 | 4 | Wilcoxon test results | Wilcoxon test results | Wilcoxon test results | Wilcoxon test results |

|---|---|---|---|---|---|---|---|---|

| Dependent Variables | ||||||||

| Investment ratio | ||||||||

| Mean | 7.3 | 4.3 | 3.5 | 3.1 | −7.887*** | −9.293*** | −3.582*** | −4.277*** |

| Median | 6.8 | 3.3 | 2.7 | 2.0 | ||||

| Min | 0.1 | 0.0 | 0.0 | 0.0 | ||||

| Max | 24.5 | 17.4 | 10.8 | 11.9 | ||||

| Sd | 4.9 | 3.8 | 2.8 | 2.9 | ||||

| Independent Variables | ||||||||

| Debt ratio | ||||||||

| Mean | 44.3 | 40.7 | 47.1 | 47.0 | −2.996** | −2.303* | −0.609 | −3.410** |

| Median | 46.5 | 40.0 | 46.3 | 45.8 | ||||

| Min | 3.5 | 1.4 | 2.8 | 0.5 | ||||

| Max | 82.1 | 86.2 | 96.0 | 97.3 | ||||

| Sd | 16.7 | 17.5 | 18.4 | 19.5 | ||||

| Bank debt ratio | ||||||||

| Mean | 11.1 | 10.5 | 12.3 | 11.2 | −0.196 | −2.309* | −2.868** | −0.591 |

| Median | 6.2 | 5.3 | 10.6 | 7.7 | ||||

| Min | 0.0 | 0.0 | 0.0 | 0.0 | ||||

| Max | 42.5 | 40.17 | 37.6 | 50.0 | ||||

| Sd | 12.1 | 11.9 | 10.6 | 11.4 | ||||

| Change in bank debt ratio | ||||||||

| Mean | 7.6 | 4.1 | 2.7 | 2.8 | −4.289*** | −4.501*** | −0.744 | −0.785 |

| Median | 0.4 | 0.0 | 0.0 | 0.0 | ||||

| Min | 0.0 | 0.0 | 0.0 | 0.0 | ||||

| Max | 97.3 | 97.3 | 60.3 | 134.4 | ||||

| Sd | 14.1 | 11.1 | 6.9 | 9.9 | ||||

| Control Variables | ||||||||

| Profitability | ||||||||

| Mean | 6.1 | 1.7 | 1.3 | −7.9 | −5.083*** | −0.959 | −5.797*** | −0.016 |

| Median | 5.9 | 3.5 | 3.0 | 3.3 | ||||

| Sales growth | ||||||||

| Mean | 29.5 | 4.1 | 10.1 | 1.5 | −7.399*** | −5.940*** | −2.714** | −0.533 |

| Median | 14.6 | −2.4 | 2.9 | −1.0 | ||||

| Tangibility | ||||||||

| Mean | 44.6 | 48.0 | 51.9 | 51.8 | −5.143*** | −5.481*** | −1.310 | −1.821* |

| Median | 44.0 | 50.3 | 50.8 | 50.8 | ||||

| Cash ratio | ||||||||

| Mean | 10.7 | 9.8 | 7.7 | 9.7 | −1.731* | −0.040 | −4.240*** | −5.084*** |

| Median | 7.5 | 6.8 | 5.2 | 6.1 | ||||

| Dividend ratio | ||||||||

| Mean | 1.9 | 1.7 | 1.7 | 1.2 | −0.501 | −0.945 | −1.402 | −5.144*** |

| Median | 0.1 | 0.0 | 0.3 | 0.0 | ||||

| Total assets (Millions of PLN) | ||||||||

| Mean | 3,200 | 3,800 | 5,604 | 5,818 | −5.665*** | −3.539*** | −5.454*** | −8.461*** |

Results of GMM Analysis With Investment Ratio as Dependent Variable

| Dependent variable Independent variables | Investment Ratio | Investment Ratio | Investment Ratio |

|---|---|---|---|

| Debt ratio t-1 | −0.377** (0.133) | X | X |

| Bank debt ratio t-1 | X | −1.299* (0.516) | X |

| Change in bank debt ratio t-1 | x | X | 0.884*** (0.218) |

| Investment ratio t-1 | 0.827*** (0.153) | −0.554 (1.896) | 0.208 (0.229) |

| Size t-1 | −0.070* (0.032) | 0.217 (2.998) | −0.025 (0.027) |

| Sales growth t-1 | 0.000 (0.001) | 0.000 (0.001) | −0.001 (0.001) |

| Tangibility t-1 | -0.888 (0.662) | 0.052 (1.331) | −0.176 (0.239) |

| Profitability t-1 | 0.466** (0.187) | 0.254 (0.499) | 0.137 (0.419) |

| Dividend ratio t-1 | 2.130 (1.741) | 1.176 (2.361) | −1.243 (2.139) |

| Cash ratio t-1 | 1.154** (0.456) | −0.835 (7.513) | 0.471 (0.526) |

| PreGFC | −0.038 (0.035) | 0.012 (0.014) | −0.072** (0.021) |

| GFC | 0.145** (0.058) | 0.059 (0.042) | 0.193*** (0.033) |

| PreCOV | −0.027 (0.043) | −0.047* (0.029) | 0.237** (0.087) |

| COV | 0.009 (0.034) | −0.005 (0.025) | 0.205** (0.067) |

| PreGFC*IND | −0.035* (0.020) | 0.088 (0.071) | −1.657* (0.781) |

| GFC*IND | 0.111* (0.060) | 0.298 * (0.141) | 6.600 * (3.062) |

| PreCOV*IND | 0.035 (0.032) | −0.100 (0.082) | 6.021* (2.849) |

| COV*IND | 0.013 (0.011) | 0.039 (0.091) | 2.041 (1.290) |

| No. of companies | 232 | 232 | 232 |

| No. of periods | 4 | 4 | 4 |

| Total no. of observations | 928 | 928 | 928 |

Classes of Periods

| Class | Years | Characteristic | Name |

|---|---|---|---|

| 1 | 2007–2008 | Period before global financial crisis | PreGFC |

| 2 | 2009 | Global financial crisis period | GFC |

| 3 | 2018–2019 | Period before COVID-19 crisis | PreCOV |

| 4 | 2020 | COVID-19 crisis period | COV |

Correlation Coefficients With Investment Ratio

| Whole Period | PreGFC | GFC | PreCOV | COV | |

|---|---|---|---|---|---|

| Debt ratio | −0.070** | −0.127** | 0.041 | −0.127** | −0.088 |

| Bank debt ratio | −0.051* | −0.070* | 0.051 | −0.031 | −0.058 |

| Change in Bank Debt Ratio | 0.091** | 0.022 | 0.204 ** | −0.120* | −0.001 |

| N | 928 | 232 | 232 | 232 | 232 |

Definition of the Vvariables Included in the Research

| Variables | Formula | Expected sign | |

|---|---|---|---|

| Dependent Variable | |||

| Corporate investment | Investment ratio | CAPEX to total assets (%) | NA |

| Independent Variables | |||

| Company indebtness | Debt ratio | Total liabilities (both long and short-term) to total assets (%) | − |

| Bank dependence | Bank debt ratio | Bank total liabilities (both long and short-term) to total assets (%) | − |

| Bank dependence | Change in bank debt ratio | Change in bank total liabilities (both long and short-term) to total assets (%) | + |

| Control Variables | |||

| Size | Natural logarithm of total assets | −/+ | |

| Sales growth | Sales revenue change to sales revenue (%) | + | |

| Tangibility | Fixed assets to total assets (%) | + | |

| Profitability | Net profit to total assets (%) | + | |

| Dividend ratio | Dividend payment to total assets (%) | − | |

| Cash ratio | Cash holdings to total assets (%) | −/+ | |