Illustr. 1

Fig. 1

Fig. 2

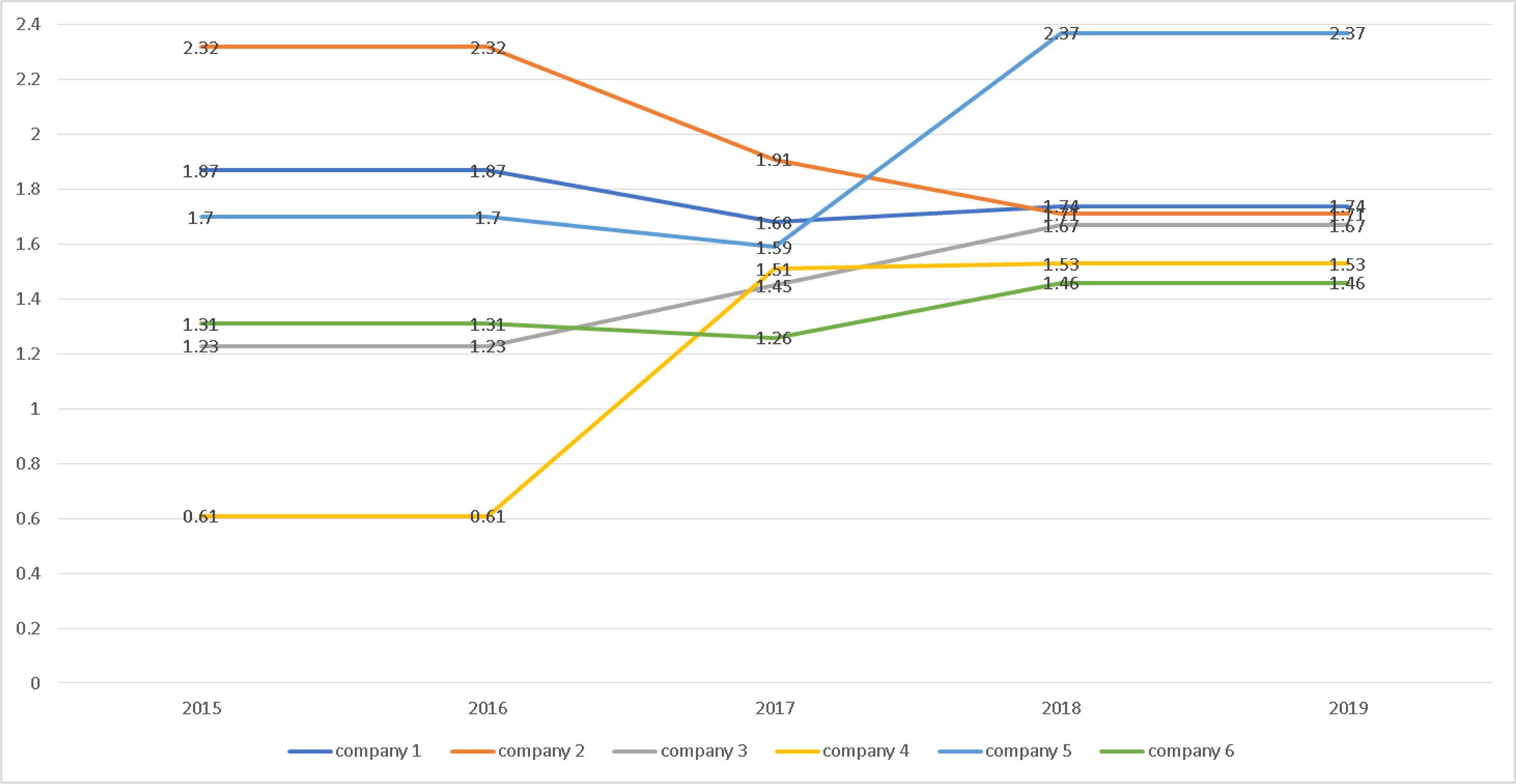

Ratio analysis of financial statements of the studied entities

| Ratio | Company 1 | Company 2 | Company 3 | Company 4 | Company 5 | Company 6 | ||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2015 | 2016 | 2017 | 2018 | 2019 | 2015 | 2016 | 2017 | 2018 | 2019 | 2015 | 2016 | 2017 | 2018 | 2019 | 2015 | 2016 | 2017 | 2018 | 2019 | 2015 | 2016 | 2017 | 2018 | 2019 | 2015 | 2016 | 2017 | 2018 | 2019 | |

| operating cash flow/sales ratio | 0.03 | 0.03 | 0.01 | 0.01 | 0.01 | 0.03 | 0.03 | 0.03 | 0.03 | 0.03 | 0.02 | 0.02 | −0.01 | 0 | 0 | 0.01 | 0.01 | 0.02 | 0.01 | 0.01 | 0.01 | 0.01 | 0.11 | 0.05 | 0.05 | −0.02 | −0.02 | 0.06 | 0.03 | 0.03 |

| operating cash flow/current assets ratio | 5.85 | 5.85 | 0.06 | 0.29 | 0.29 | 0.29 | 0.29 | 0.27 | 0.21 | 0.21 | 0.16 | 0.16 | −0.03 | 0.03 | 0.03 | 5.79 | 5.79 | 0.1 | 0.3 | 0.3 | 0.03 | 0.03 | 0.37 | 0.18 | 0.18 | −0.15 | −0.15 | 0.25 | 0.1 | 0.1 |

| operating cash flow/current liabilities ratio | 0.29 | 0.29 | 0.09 | 0.14 | 0.14 | 0.66 | 0.66 | 0.51 | 0.35 | 0.35 | 0.19 | 0.19 | −0.04 | 0.03 | 0.03 | 0.04 | 0.04 | 0.06 | 0.04 | 0.04 | 0.05 | 0.05 | 0.58 | 0.42 | 0.42 | −0.2 | −0.2 | 0.31 | 0.15 | 0.15 |

| current liquidity ratio | 1.87 | 1.87 | 1.68 | 1.74 | 1.74 | 2.32 | 2.32 | 1.91 | 1.71 | 1.71 | 1.23 | 1.23 | 1.45 | 1.67 | 1.67 | 0.61 | 0.61 | 1.51 | 1.53 | 1.53 | 1.7 | 1.7 | 1.59 | 2.37 | 2.37 | 1.31 | 1.31 | 1.26 | 1.46 | 1.46 |

| quick ratio | 1.42 | 1.42 | 1.18 | 1.27 | 1.27 | 1.73 | 1.73 | 1.61 | 1.39 | 1.39 | 0.3 | 0.3 | 0.27 | 0.1 | 0.1 | 1.21 | 1.21 | 1.21 | 1.21 | 1.21 | 1.18 | 1.18 | 1.22 | 1.43 | 1.43 | 1 | 1 | 0.9 | 1.07 | 1.07 |

| immediate liquidity ratio | 0.02 | 0.02 | 0.01 | 0.01 | 0.01 | 0.2 | 0.2 | 0.01 | 0.1 | 0.1 | 0.2 | 0.2 | 0.13 | 0.93 | 0.93 | 0.47 | 0.47 | 0.41 | 0.47 | 0.47 | 0.73 | 0.73 | 0.2 | 0.53 | 0.53 | 0.84 | 0.84 | 0.75 | 0.53 | 0.53 |

| inventory turnover cycle | 10 | 10 | 15 | 13 | 13 | 9 | 9 | 4 | 7 | 7 | 8 | 8 | 7 | 6 | 6 | 21 | 21 | 25 | 31 | 31 | 15 | 15 | 18 | 12 | 12 | 4 | 4 | 5 | 6 | 6 |

| receivables turnover cycle | 14 | 14 | 18 | 20 | 20 | 4 | 4 | 9 | 7 | 7 | 5 | 5 | 3 | 3 | 3 | 34 | 34 | 42 | 34 | 34 | 24 | 24 | 13 | 16 | 16 | 6 | 6 | 10 | 11 | 11 |

| liabilities turnover cycle | 6 | 6 | 5 | 8 | 8 | 6 | 6 | 9 | 6 | 6 | 5 | 5 | 5 | 4 | 4 | 15 | 15 | 18 | 20 | 20 | 12 | 12 | 15 | 8 | 8 | 3 | 3 | 6 | 5 | 5 |

| cash conversion cycle | 18 | 18 | 27 | 25 | 25 | 7 | 7 | 4 | 8 | 8 | 8 | 8 | 5 | 5 | 5 | 40 | 40 | 49 | 45 | 45 | 27 | 27 | 16 | 20 | 20 | 7 | 7 | 9 | 12 | 12 |

| overall financial condition ratio | 2.56 | 2.56 | 2.47 | 2.47 | 2.47 | 0.88 | 0.88 | 0.94 | 1.01 | 1.01 | 2.58 | 2.58 | 1.64 | 1.78 | 1.78 | 0.13 | 0.13 | 0.15 | 0.13 | 0.13 | 3.06 | 3.06 | 4.9 | 5.19 | 5.19 | 0.44 | 0.44 | 0.52 | 0.64 | 0.64 |

| ROA | 4.32% | 4.32% | 4.39% | 4.09% | 4.09% | 5.85% | 5.85% | 6.06% | 5.23% | 5.23% | 3.75% | 3.75% | 8.89% | 6.24% | 6.24% | 3.95% | 3.95% | 3.76% | 3.94% | 3.94% | 1.33% | 1.33% | 3.91% | 8.43% | 8.43% | 0.37% | 0.37% | 1.07% | 0.75% | 0.75% |

| ROS | 0.86% | 0.86% | 0.87% | 0.79% | 0.79% | 0.77% | 0.77% | 0.96% | 0.77% | 0.77% | 0.58% | 0.58% | 1.42% | 0.97% | 0.97% | 1.56% | 1.56% | 1.68% | 1.56% | 1.56% | 0.35% | 0.35% | 1.28% | 2.37% | 2.37% | 0.05% | 0.05% | 0.26% | 0.20% | 0.20% |

| ROE | 22.04% | 22.04% | 25.81% | 25.81% | 25.81% | 84.67% | 84.67% | 88.39% | 62.57% | 62.57% | 18.33% | 18.33% | 33.89% | 22.45% | 22.45% | 32.85% | 32.85% | 32.57% | 32.85% | 32.85% | 10.64 | 10.64 | 24.32% | 44.95% | 44.95% | 8.96% | 8.96% | 32.38% | 22.56% | 22.56% |

Correlation matrix (r-Pearson correlation coefficient) between the study variables and the liquidity and profitability of the companies analysed

| Operating cash flow/sales ratio | Operating cash flow/current assets ratio | Operating cash flow/current liabilities ratio | Current liquidity ratio | Quick ratio | Immediate liquidity ratio | ROA | ROS | ROE | |

|---|---|---|---|---|---|---|---|---|---|

| Operating cash flow/sales ratio | 1.000 | 0.023 | 0.773*** | 0.307* | 0.352* | −0.272 | 0.155 | 0.254 | 0.290 |

| Operating cash flow/current assets ratio | 1.000 | −0.003 | −0.332* | 0.222 | −0.221 | 0.017 | 0.199 | −0.080 | |

| Operating cash flow/current liabilities ratio | 1.000 | 0.620*** | 0.532*** | −0.491*** | 0.429** | 0.211 | 0.744*** | ||

| Current liquidity ratio | 1.000 | 0.428** | −0.225 | 0.489*** | 0.199 | 0.485*** | |||

| Quick ratio | 1.000 | −0.394** | 0.005 | 0.165 | 0.537*** | ||||

| Immediate liquidity ratio | 1.000 | −0.348 | −0.130 | −0.424** | |||||

| ROA | 1.000 | 0.735*** | 0.539*** | ||||||

| ROS | 1.000 | 0.268 | |||||||

| ROE | 1.000 |

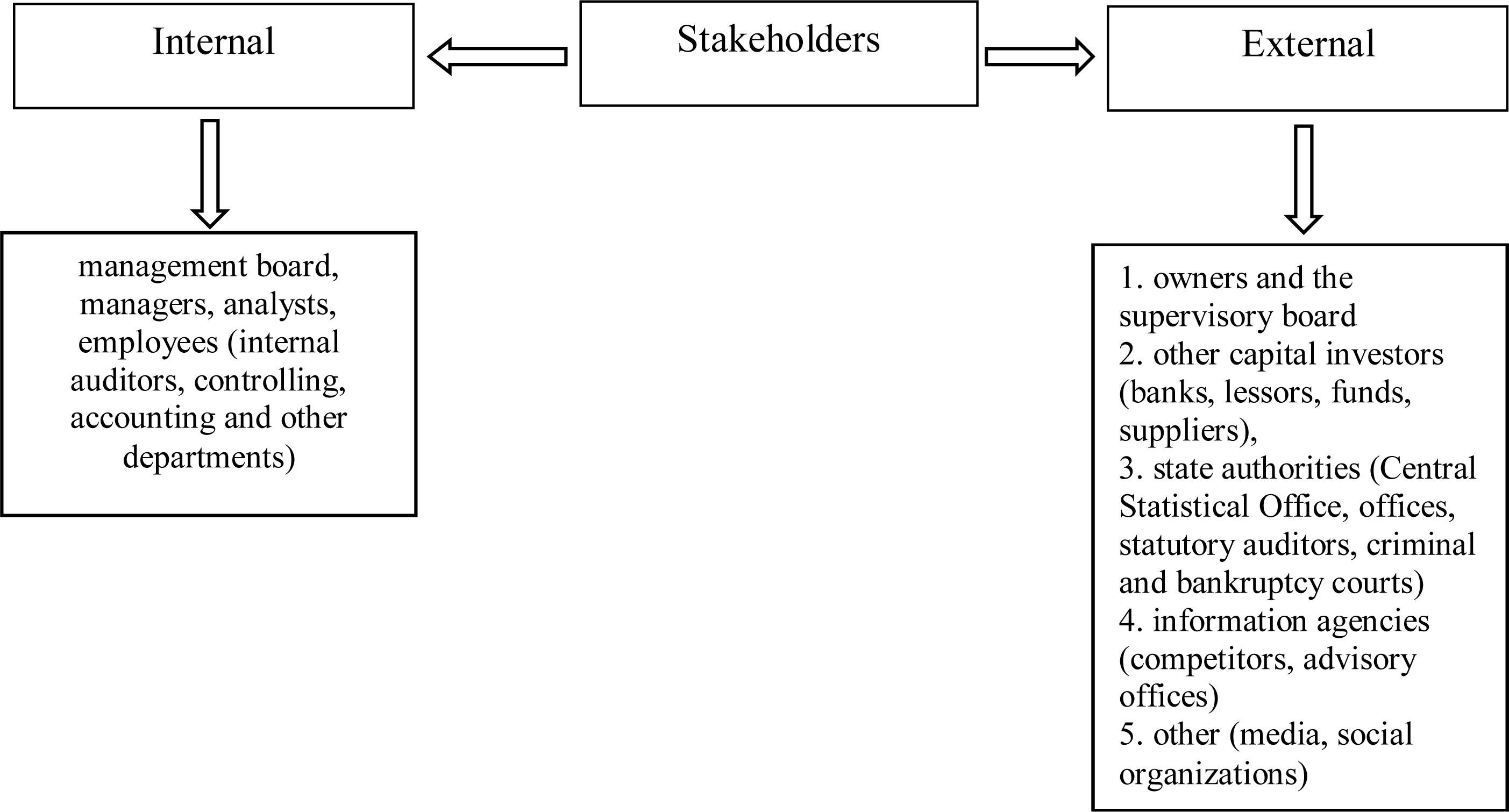

Breakdown of financial statements_

| Item | Characteristics |

|---|---|

| Scope | Annual separate/annual total/annual consolidated |

| Obligatory or not | Obligatory/optional |

| Obligation to publish | Must be published/does not have to be published |

| Frequency | Systematically/sporadically |

| Degree of generality | Synthetic/analytical |

| Reporting period | Ex post (actual return)/ex ante (expected return) |

| Recipients | External/internal |

Items of the cash flow statement in business operations

| Direct method | Indirect method |

|---|---|

|

|

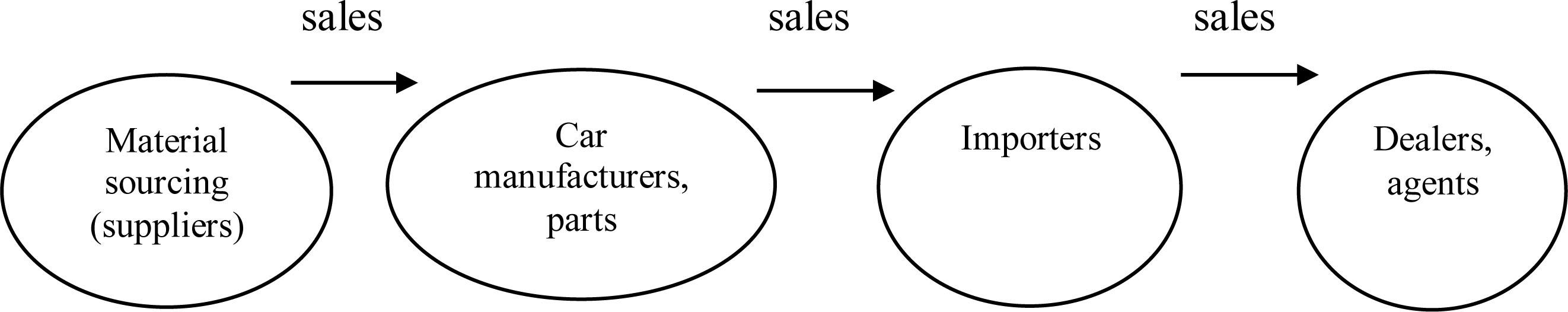

Companies studied in empirical research

| Car brand | Registered name of the company |

|---|---|

| Skoda, Volkswagen, Audi | Volkswagen Group Polska |

| Renault, Dacia | Renault Poland |

| Toyota | Toyota Motor Poland Company Limited |

| Kia | Kia Motors Polska |

| Mercedes | Mercedes-Benz Poland |

| BMW | BMW Vertriebs GMBH Polish branch |

| Ford | Ford Polska |

Functions of financial ratios

| Group of ratios | Purposes |

|---|---|

| Financial liquidity | Assessment of the company's ability to settle liabilities (mainly short-term perspective) |

| Solvency | Assessment of the risk of the company's possible bankruptcy (short-term and long-term perspective) |

| Management efficiency | Assessment of the opportunities and threats in the area of effective management (mainly current operations and outlook for the future) |

| Profitability | Assessment of the company's profitability (the prospect of current benefits) |

Financial analysis ratios selected for empirical research

| Item | Calculation formula |

|---|---|

| Operating cash flow to sales ratio | |

| Operating cash flow to current assets ratio | |

| Operating cash flow to current liabilities ratio | |

| 3rd degree (current) liquidity ratio | |

| 2nd degree (quick) liquidity ratio | |

| 1st degree (immediate) liquidity ratio | |

| Inventory turnover cycle | |

| Receivables turnover cycle | |

| Short-term liabilities turnover cycle | |

| Cash conversion cycle | turnover cycle = (inventories + receivables - short-term liabilities) |

| Working capital ratio | current assets - short-term liabilities |

| overall financial condition ratio | |

| ROA (return on assets) | |

| ROS (return on sales) | |

| ROE (return on equity) |

An attempt at a synthetic assessment of the studied group of entities

| Item | The most commonly occurring |

|---|---|

| The most favourable situation | Company 1 |

| The most stable situation | Company 2 |

| The least favourable situation | Company 3 and 6 |