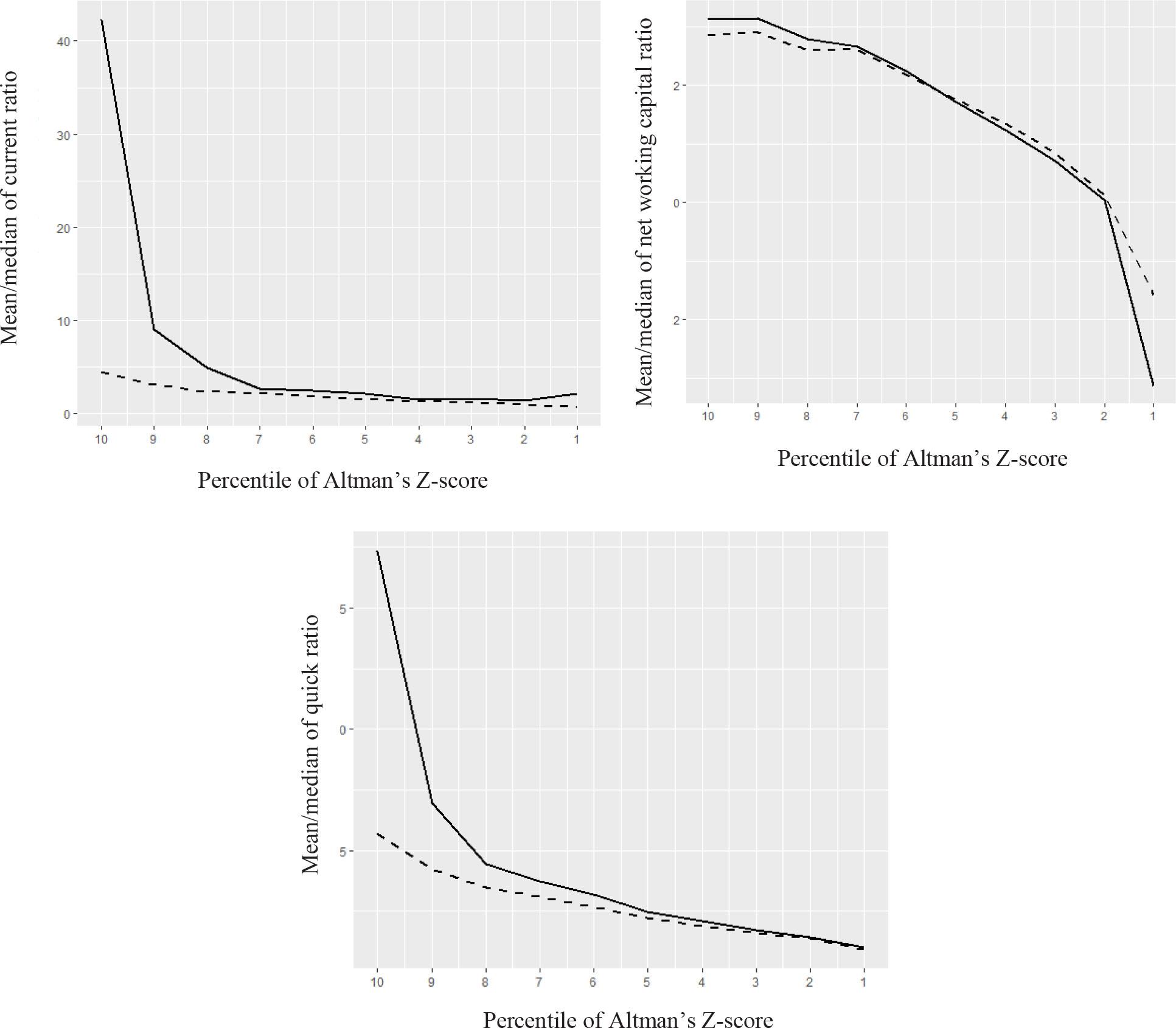

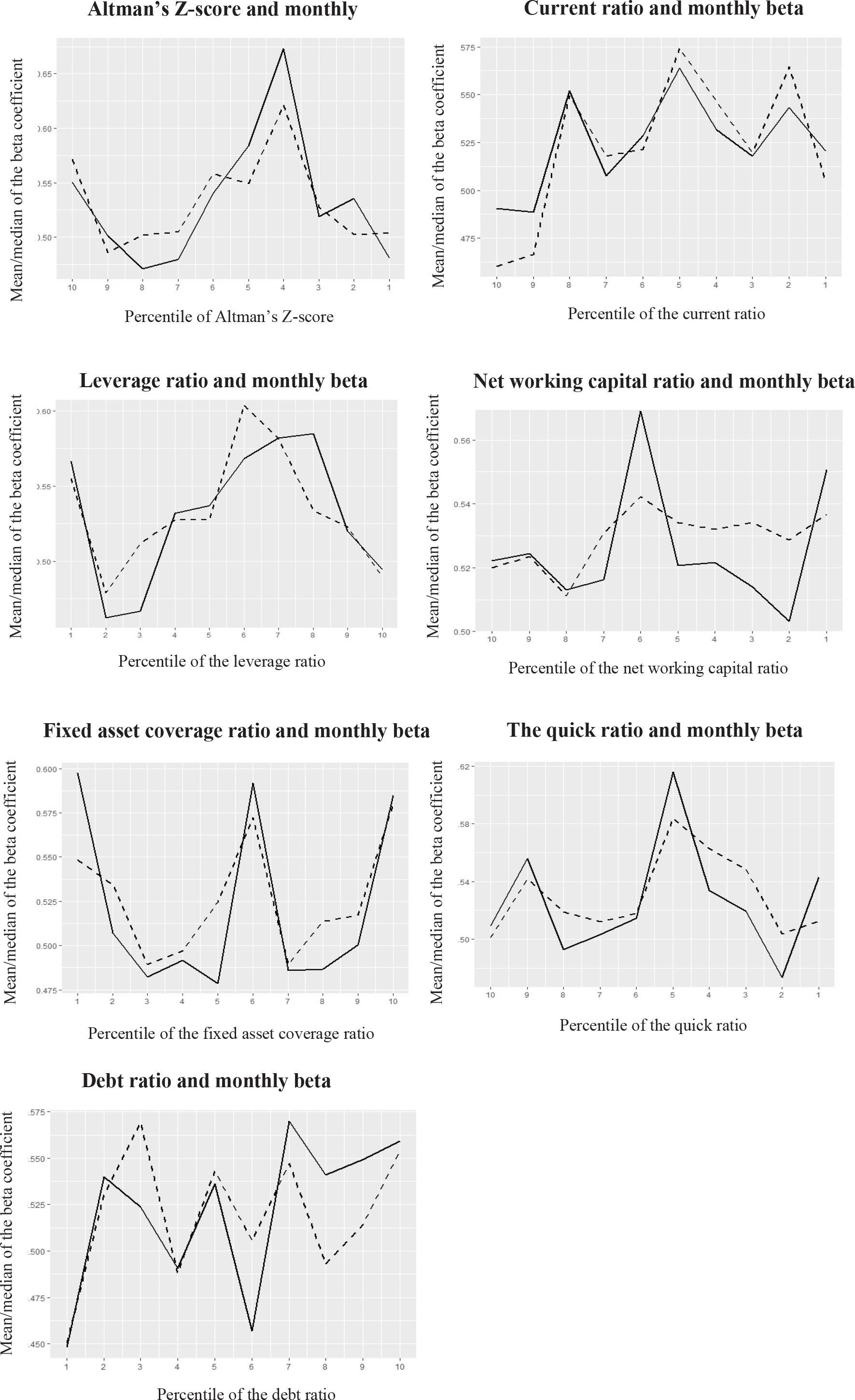

Fig. 1

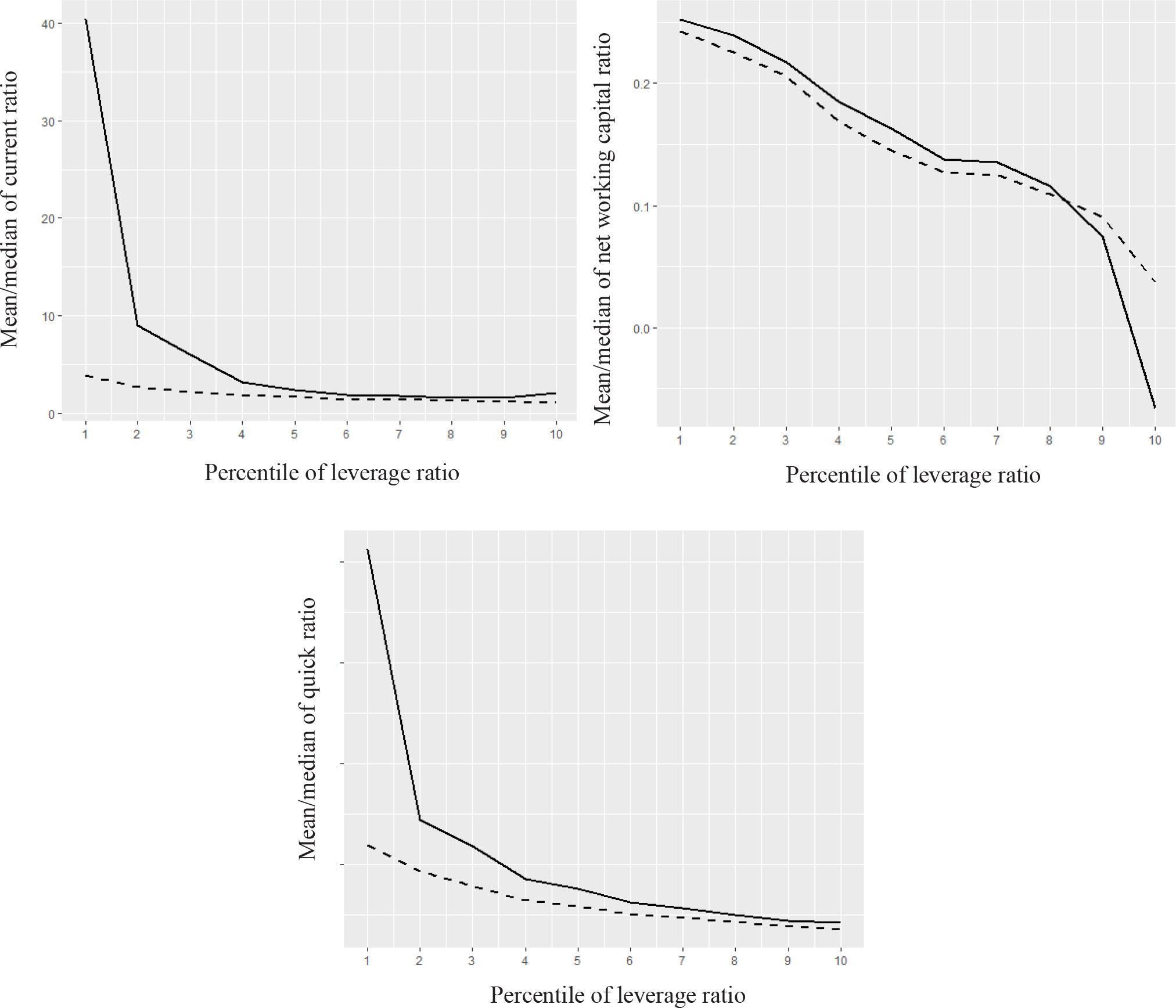

Fig. 2

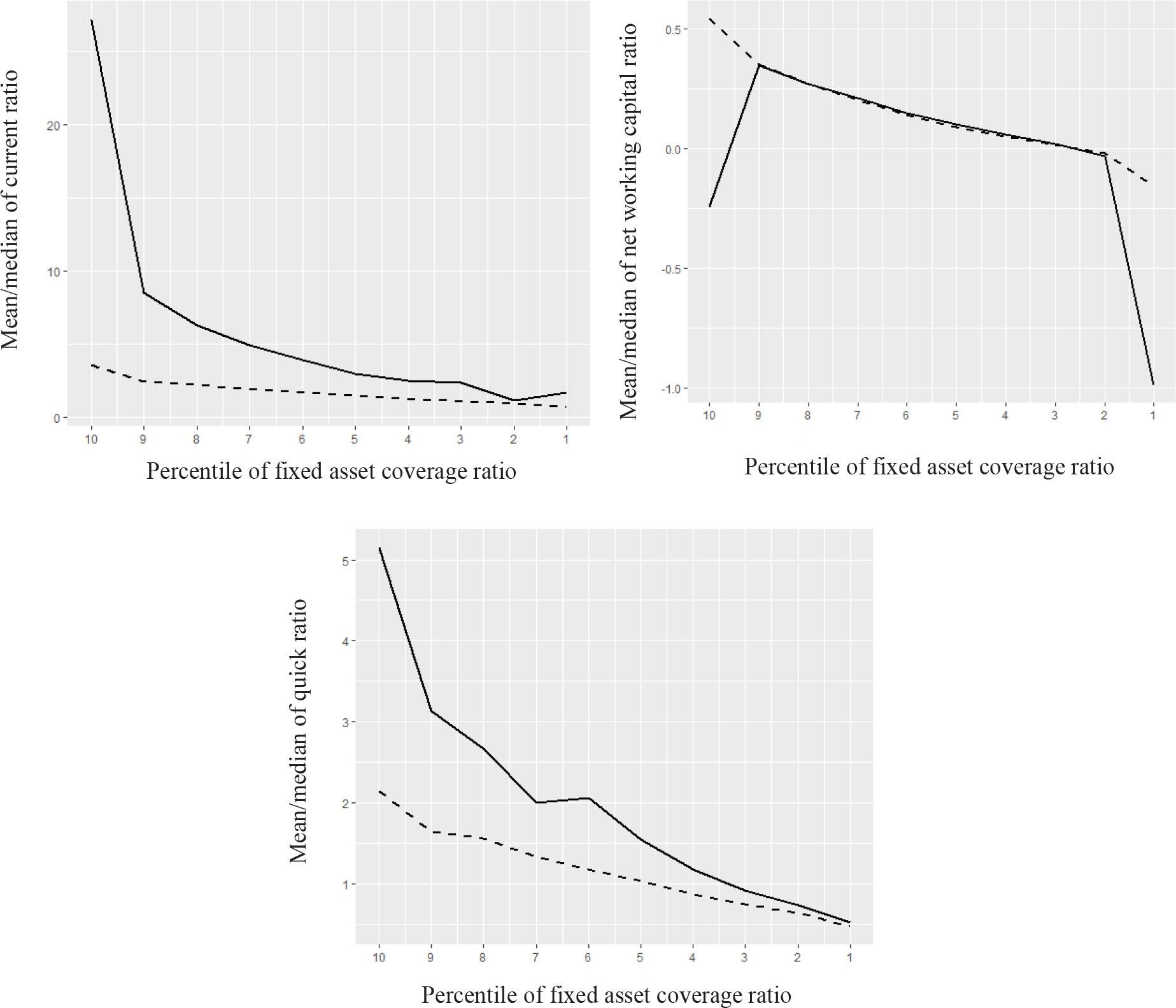

Fig. 3

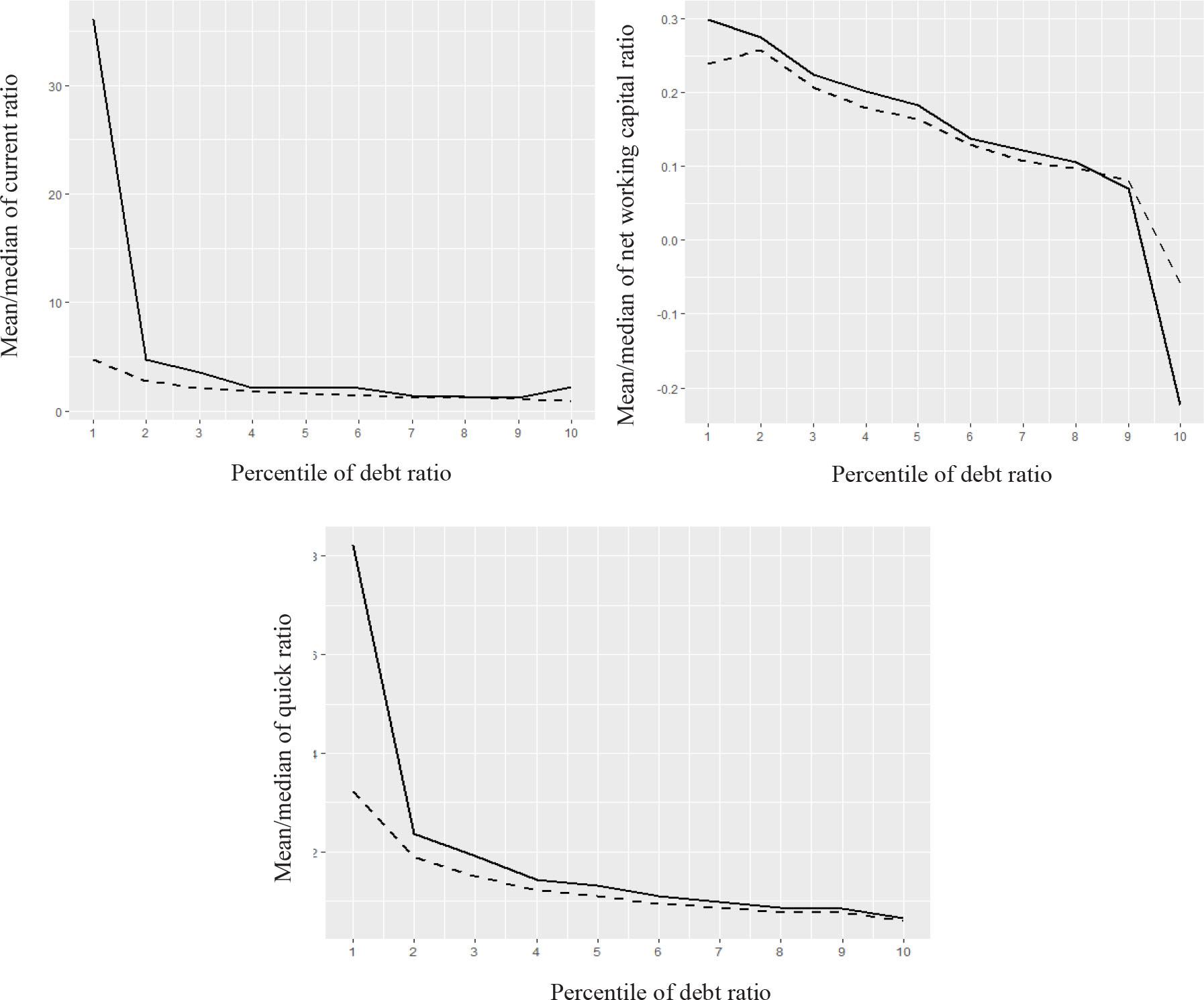

Fig. 4

Fig. 5

Portfolios created for the net working capital ratio: models estimated with the least-squares method (left) and quantile regression (right)_

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| αCAPM | −0.01 | −0.014 | −0.006 | 0.006 | −0.002 | 0.002 | 0.02** | 0.014* | 0.014 | 0.012 | −0.005 | −0.017* | −0.010 | −0.002 | −0.008 | −0.002 | 0.008 | 0.009 | 0.013 | 0.018* |

| αFF | −0.014 | −0.013 | −0.006 | 0.006 | −0.001 | 0.004 | 0.021** | 0.014 | 0.016 | 0.013 | −0.008 | −0.015 | −0.010 | 0.005 | −0.005 | 0.00 | 0.012* | 0.016 | 0.017 | 0.016 |

| αCarhart | −0.015 | −0.015 | −0.002 | 0.006 | −0.006 | −0.003 | 0.018* | 0.014* | 0.009 | 0.012 | −0.016 | −0.017 | −0.013 | 0.005 | −0.01 | 0.002 | 0.007 | 0.017 | 0.001 | 0.021* |

| βCAPM | 1.206*** | 0.989*** | 1.042*** | 1.064*** | 1.025*** | 1.076*** | 1.151*** | 1.237*** | 1.147*** | 1.082*** | 1.083*** | 0.925*** | 1.026*** | 1.022*** | 0.928*** | 1.038*** | 1.183*** | 1.161*** | 1.133*** | 1.129*** |

| l. quarter | 71 | 70 | 70 | 70 | 70 | 70 | 70 | 70 | 70 | 70 | 71 | 70 | 70 | 70 | 70 | 70 | 70 | 70 | 70 | 70 |

| The Sharpe ratio | −0.846 | −0.994 | −0.999 | −0.917 | −1.072 | −0.799 | −0.741 | −0.924 | −0.777 | −0.791 | −0.846 | −0.994 | −0.999 | −0.917 | −1.072 | −0.799 | −0.741 | −0.924 | −0.777 | −0.791 |

Portfolios created for the quick ratio: models estimated with the least-squares method (left) and quantile regression (right)_

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| αCAPM | −0.0050 | 0.0041 | 0.0013 | 0.0094 | −0.0001 | 0.0068 | 0.0028 | 0.0269** | 0.0023 | −0.0133 | −0.0149 | 0.0042 | −0.0037 | 0.0075 | −0.0111 | 0.0019 | 0.0102 | 0.0176 | 0.0021 | −0.0153** |

| αFF | −0.0082 | 0.0068 | 0.0001 | 0.0096 | 0.0001 | 0.0074 | 0.0054 | 0.0278** | 0.0030 | −0.0123 | −0.0177** | 0.0089 | −0.0052 | 0.0083 | −0.0070 | 0.0066 | 0.0088 | 0.0139 | 0.0025 | −0.0207*** |

| αCarhart | −0.0154 | 0.0097 | 0.0005 | 0.0074 | 0.0061 | 0.0045 | 0.0014 | 0.0286** | −0.0026 | −0.0129 | −0.0171* | 0.0083 | −0.0062 | 0.0030 | −0.0038 | 0.0014 | −0.0044 | 0.0230** | 0.0031 | −0.0209** |

| βCAPM | 1.3159*** | 1.0246*** | 1.0082*** | 1.0067*** | 1.0928*** | 1.0718*** | 1.1985*** | 1.3046*** | 1.0950*** | 0.8759*** | 1.1322*** | 1.0193*** | 0.9580*** | 0.9929*** | 0.9824*** | 0.9910*** | 1.2822*** | 1.2463*** | 1.1132*** | 0.8773*** |

| l. quarter | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 |

| The Sharpe ratio | −0.8247 | −0.7885 | −1.0241 | −0.8734 | −0.9975 | −0.9392 | −0.9480 | −0.6543 | −0.9893 | −0.9759 | −0.8247 | −0.7885 | −1.0241 | −0.8734 | −0.9975 | −0.9392 | −0.9480 | −0.6543 | −0.9893 | −0.9759 |

Portfolios created for the current ratio: models estimated with the least-squares method (left) and quantile regression (right)_

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| αCAPM | −0.019 | 0.008 | −0.004 | 0.009 | 0.02** | 0.006 | 0.009 | 0.018* | −0.003 | −0.006 | −0.018** | 0.001 | −0.008 | 0.013** | 0.020 | −0.006 | 0.004 | 0.012 | −0.005 | −0.007 |

| αFF | −0.022 | 0.008 | −0.005 | 0.011 | 0.022** | 0.008 | 0.009 | 0.015 | −0.001 | −0.004 | −0.020** | −0.003 | −0.012** | 0.023*** | 0.031 | −0.007 | 0.005 | 0.008 | −0.005 | −0.004 |

| αCarhart | −0.023 | 0.004 | −0.004 | 0.016 | 0.022** | 0.005 | 0.004 | 0.013 | −0.006 | −0.005 | −0.011 | −0.001 | −0.011** | 0.024*** | 0.033 | −0.009 | −0.001 | 0.007 | −0.006 | −0.001 |

| βCAPM | 1.116*** | 1.120*** | 1.036*** | 1.09*** | 1.191*** | 1.042*** | 1.106*** | 1.179*** | 1.052*** | 0.954*** | 1.006*** | 1.087*** | 1.014*** | 1.162*** | 1.14*** | 0.966*** | 1.119*** | 1.169*** | 1.008*** | 0.889*** |

| l. quarter | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 |

| The Sharpe ratio | −0.981 | −0.810 | −1.083 | −0.819 | −0.746 | −1.002 | −0.89 | −0.735 | −0.939 | −0.945 | −0.982 | −0.811 | −1.083 | −0.819 | −0.746 | −1.002 | −0.89 | −0.735 | −0.939 | −0.945 |

Portfolios created for the leverage ratio: models estimated with the least-squares method (left) and quantile regression (right)_

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| αCAPM | −0.01 | −0.014 | −0.006 | 0.006 | −0.002 | 0.002 | 0.02** | 0.014* | 0.014 | 0.012 | −0.005 | −0.017* | −0.010 | −0.002 | −0.008 | −0.002 | 0.008 | 0.009 | 0.013 | 0.018* |

| αFF | −0.014 | −0.013 | −0.006 | 0.006 | −0.001 | 0.004 | 0.021** | 0.014 | 0.016 | 0.013 | −0.008 | −0.015 | −0.010 | 0.005 | −0.005 | 0.00 | 0.012* | 0.016 | 0.017 | 0.016 |

| αCarhart | −0.015 | −0.015 | −0.002 | 0.006 | −0.006 | −0.003 | 0.018* | 0.014* | 0.009 | 0.012 | −0.016 | −0.017 | −0.013 | 0.005 | −0.01 | 0.002 | 0.007 | 0.017 | 0.001 | 0.021* |

| βCAPM | 1.206*** | 0.989*** | 1.042*** | 1.064*** | 1.025*** | 1.076*** | 1.151*** | 1.237*** | 1.147*** | 1.082*** | 1.083*** | 0.925*** | 1.026*** | 1.022*** | 0.928*** | 1.038*** | 1.183*** | 1.161*** | 1.133*** | 1.129*** |

| l. quarter | 71 | 70 | 70 | 70 | 70 | 70 | 70 | 70 | 70 | 70 | 71 | 70 | 70 | 70 | 70 | 70 | 70 | 70 | 70 | 70 |

| The Sharpe ratio | −0.846 | −0.994 | −0.999 | −0.917 | −1.072 | −0.799 | −0.741 | −0.924 | −0.777 | −0.791 | −0.846 | −0.994 | −0.999 | −0.917 | −1.072 | −0.799 | −0.741 | −0.924 | −0.777 | −0.791 |

Definitions of liquidity and solvency ratios used in the empirical study

| Solvency/liquidity ratio | Definition |

|---|---|

| Quick ratio | |

| Current ratio | |

| Net Working Capital Ratio | |

| Leverage ratio | |

| Debt ratio | |

| Altman Z-score | |

| Fixed asset coverage ratio |

Portfolios created for the Altman Z-score: models estimated with the least-squares method (left) and quantile regression (right)

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| αCAPM | −0.019 | 0.008 | −0.004 | 0.009 | 0.02 | 0.006 | 0.009* | 0.018** | −0.003 | −0.006 | −0.018** | 0.001 | −0.008 | 0.013 | 0.020** | −0.006 | 0.004 | 0.012 | −0.005 | −0.007 |

| αFF | −0.023 | 0.008 | −0.005 | 0.012 | 0.022 | 0.008 | 0.009** | 0.015** | −0.001 | −0.004 | −0.020** | −0.003 | −0.012 | 0.023** | 0.031*** | −0.007 | 0.005 | 0.008 | −0.005 | −0.004 |

| αCarhart | −0.024 | 0.004 | −0.004 | 0.016 | 0.022 | 0.005 | 0.004** | 0.013 | −0.006 | −0.005 | −0.011 | −0.001 | −0.011 | 0.024** | 0.033*** | −0.009 | −0.001 | 0.007 | −0.006 | −0.001 |

| βCAPM | 1.116*** | 1.120*** | 1.036*** | 1.09*** | 1.191*** | 1.042*** | 1.106*** | 1.179*** | 1.052*** | 0.954*** | 1.006*** | 1.087*** | 1.014*** | 1.162*** | 1.14*** | 0.966*** | 1.119*** | 1.169*** | 1.008*** | 0.889*** |

| l. quarter | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 |

| The Sharpe ratio | −0.982 | −0.811 | −1.083 | −0.819 | −0.746 | −1.002 | −0.89 | −0.735 | −0.939 | −0.945 | −0.982 | −0.811 | −1.083 | −0.819 | −0.746 | −1.002 | −0.89 | −0.735 | −0.939 | −0.945 |

Portfolios created for the fixed asset coverage ratio: models estimated with the least-squares method (left) and quantile regression (right)_

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| αCAPM | 0.001 | −0.006 | −0.007 | −0.021** | 0.009 | 0.005 | 0.01 | 0.009 | 0.020** | 0.019** | 0.0009 | −0.0060 | −0.0066 | −0.0146** | −0.0056 | 0.0076 | 0.0035 | 0.0068 | 0.0029 | 0.0226*** |

| αFF | 0.000 | −0.008 | −0.008 | −0.022** | 0.009 | 0.007 | 0.01 | 0.012 | 0.021** | 0.019** | 0.0060 | 0.0003 | −0.0062 | −0.0144 | −0.0032 | 0.0085 | −0.0061 | 0.0081 | 0.0017 | 0.0230* |

| αCarhart | −0.010 | 0.000 | −0.006 | −0.02* | 0.006 | 0.003 | 0.003 | 0.006 | 0.016* | 0.019** | 0.0017 | −0.0093 | −0.0036 | −0.0168 | −0.0003 | 0.0050 | 0.0039 | 0.0029 | 0.0020 | 0.0193* |

| βCAPM | 1.124*** | 1.222*** | 0.991*** | 0.79*** | 1.206*** | 1.115*** | 1.036*** | 1.178*** | 1.146*** | 1.140*** | 0.9565*** | 1.1808*** | 0.9423*** | 0.8546*** | 1.0591*** | 1.0635*** | 1.0244*** | 0.9384*** | 0.9605*** | 1.2871*** |

| l. quarter | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 68 | 68 | 68 | 68 | 68 | 68 | 68 | 68 | 68 | 68 |

| The Sharpe ratio | −0.804 | −0.964 | −1.176 | −1.078 | −0.934 | −0.943 | −0.857 | −0.874 | −0.749 | −0.751 | −0.7080 | −0.8980 | −1.0539 | −0.9753 | −0.8742 | −0.8429 | −0.7425 | −0.7612 | −0.6419 | −0.6570 |

Portfolios created for the debt ratio: models estimated with the least-squares method (left) and quantile regression (right)_

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| αCAPM | −0.0040 | −0.0062 | −0.0101 | −0.0014 | 0.0124 | 0.0028 | −0.0008 | 0.0186* | 0.0036 | 0.0035 | −0.0111 | −0.0148 | −0.0014 | −0.0045 | 0.0107 | 0.0021 | −0.0025 | 0.0091 | −0.0043 | −0.0049 |

| αFF | −0.0032 | −0.0046 | −0.0084 | −0.0038 | 0.0135 | 0.0023 | −0.0014 | 0.0200** | 0.0036 | 0.0029 | −0.0061 | −0.0090 | −0.0010 | −0.0080 | 0.0068 | 0.0036 | −0.0064 | 0.0082 | 0.0027 | 0.0134 |

| αCarhart | −0.0059 | −0.0072 | −0.0082 | −0.0022 | 0.0081 | 0.0104 | −0.0050 | 0.0129 | 0.0024 | 0.0012 | −0.0135 | −0.0090 | −0.0028 | −0.0111** | 0.0100 | 0.0030 | −0.0061 | 0.0005 | −0.0031 | 0.0174 |

| βCAPM | 1.0274*** | 0.9973*** | 0.9592*** | 1.1079*** | 1.2111*** | 0.8735*** | 0.9950*** | 1.2436*** | 1.1069*** | 1.0808*** | 0.9783*** | 0.9398*** | 0.9674*** | 1.0267*** | 1.0622*** | 0.9840*** | 0.9401*** | 1.1629*** | 1.0532*** | 0.9523*** |

| l. quarter | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 | 71 |

| The Sharpe ratio | −1.1344 | −0.8753 | −1.0406 | −0.8507 | −0.7772 | −0.8391 | −1.1745 | −0.7841 | −0.9350 | −0.7692 | −1.1344 | −0.8753 | −1.0406 | −0.8507 | −0.7772 | −0.8391 | −1.1745 | −0.7841 | −0.9350 | −0.7692 |